Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Strategy is urging MSCI to retain MSTR in its indexes, despite raising its Bitcoin holdings to 650,000 BTC as it has lowered its 2025 targets.

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

BitMine's strategic ETH movements signal a proactive stance in leveraging upcoming network upgrades to maintain its crypto treasury dominance.

The post BitMine-linked wallet withdraws 30,278 ETH from Kraken ahead of Fusaka upgrade appeared first on Crypto Briefing.

Ostium's funding boost could accelerate the integration of traditional commodities with decentralized finance, enhancing market accessibility.

The post Arbitrum-based DEX Ostium secures $20M funding to scale its crypto and real-world asset trading appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Il mercato delle criptovalute ha messo a segno un rimbalzo drammatico questa settimana, con il prezzo di Bitcoin che ha superato di slancio i 92.000$ ed Ethereum che si è arrampicato nuovamente sopra i 3.000$. Questa rapida ripresa (“V-shape recovery”) dei due principali asset digitali ha catturato l’attenzione del mercato, e gli analisti stanno ora condividendo la causa principale di questo “pump” inaspettato.

Perché i prezzi di Bitcoin ed Ethereum stanno rimbalzando

Attualmente Bitcoin scambia sopra i $93.000 dopo aver vissuto un periodo di vendite accelerate e pesanti liquidazioni delle posizioni Long che avevano brevemente spinto il prezzo al ribasso nelle ultime settimane. Ora che la vendita forzata si è attenuata, la criptovaluta ha recuperato in modo significativo, aggiungendo l’incredibile cifra di 75 miliardi di dollari alla sua capitalizzazione di mercato nel giro di sole 10 ore.

Ethereum ha seguito la stessa scia rialzista. I dati di CoinMarketCap mostrano che ETH ha guadagnato più del 9% nelle ultime 24 ore, con un accumulo costante che ha spinto il prezzo sopra i $3.050.

L’Analisi: Acquisti istituzionali coordinati o manipolazione?

L’analista di mercato Wimar.X ha spiegato il motivo dietro l’improvvisa impennata dei prezzi. Ha inquadrato la rinascita come un’ondata rapida di acquisti istituzionali coordinati ad alto volume. In parole povere, il mercato è “pompato” perché si è verificato un accumulo massiccio concentrato in una singola ora.

I dati di Arkham Intelligence confermano questa tesi, tracciando i movimenti delle “balene” e dei market maker poco prima del surge:

- Wintermute: Ha acquistato 8.577 BTC.

- Binance (il più grande exchange al mondo): Ha acquisito 7.658 BTC.

- Whale Wallet (portafoglio sconosciuto): Ha aggiunto 6.010 BTC al portafoglio.

- BitMEX (exchange co-fondato da Arthur Hayes): Ha accumulato 5.818 BTC.

- Bitfinex: Ha assorbito 5.778 BTC.

Secondo l’analisi di Wimar.X, questo accumulo improvviso e la sua tempistica appaiono coordinati. Ha descritto l’attività quasi come una forma di manipolazione, suggerendo che fosse intesa a influenzare la percezione del mercato e a spostare artificialmente i prezzi verso l’alto per innescare la FOMO.

Le previsioni degli analisti: Cosa succede ora?

Mentre il mercato mostra nuova forza e BTC recupera i $90.000, l’esperto crypto Michael van de Poppe ha sottolineato su X l’importanza di questo rimbalzo. Ha notato che il recente calo di Bitcoin all’inizio del mese appariva “insolito”, ma è stato seguito da una reazione forte. Secondo l’analista, il mantenimento sopra i $92.000 sarà critico per Bitcoin e potrebbe spianare la strada verso un nuovo massimo storico (ATH) e un potenziale test dei $100.000.

Dall’altra parte, l’analista identificato come ‘More Crypto Online’ si è concentrato su Ethereum. Ha dichiarato che ETH sta attualmente testando una zona di “micro supporto” tra $2.907 e $2.974. Mantenere quest’area è cruciale per sostenere il momentum rialzista iniziato questa settimana.

- Target ETH: La prossima finestra di rialzo si trova tra $3.165 e $3.210.

- Rischio: Una rottura sotto il livello di supporto inferiore potrebbe innescare un’onda correttiva più profonda. Tuttavia, i trend attuali suggeriscono che ETH punta principalmente verso l’alto.

The crypto market delivered a dramatic rebound this week, with the Bitcoin price vaulting above $92,000 and Ethereum climbing back over $3,000. The sharp recovery in both leading cryptocurrencies has caught the market’s attention, with analysts now sharing the major reason for the unexpected pump.

Why The Ethereum And Bitcoin Price Are Rebounding

Bitcoin is currently trading above $93,000 after experiencing a period of accelerated selling and heavy long liquidations that had briefly pushed its price down over the past few weeks. Now that forced selling has eased, the cryptocurrency has recovered significantly, adding an astonishing $75 billion to its market capitalization within 10 hours.

Ethereum has followed the same upward swing. Data from CoinMarketCap shows that ETH has gained more than 9% in the past 24 hours, with steady accumulation pushing its price above $3,050.

Crypto market analyst Wimar.X has explained the reason behind the sudden surge in both Bitcoin and Ethereum prices. He framed the resurgence as a rapid wave of high-volume coordinated institutional buying. In his words, the market pumped because a massive round of accumulation occurred within a single hour.

Data from Arkham Intelligence shows that Wintermute, a leading algorithmic trading firm, had bought 8,577 BTC ahead of the market surge. Binance, the world’s largest crypto exchange, also acquired 7,658 BTC, while a major whale wallet added 6,010 BTC to its portfolio. Finally, BitMEX, a crypto exchange co-founded by Arthur Hayes, reportedly accumulated 5,818 BTC, while Bitfinex absorbed 5,778 BTC.

According to Wimar.X analysis, the sudden accumulation and its timing appear coordinated. He described the activity as manipulation, implying that it was intended to influence market perception and artificially sway prices.

Analysts Share Outlook For Bitcoin And Ethereum Price After Pump

As the crypto market showed renewed strength and BTC recovered above $90,000, crypto expert Michael van de Poppe took to X to highlight the significance of the rebound. He noted that the recent dip in Bitcoin’s price at the start of the month appeared unusual but was followed by a strong bounce. According to the analyst, surpassing $92,000 will be critical for Bitcoin and could pave the way for a new all-time high and a potential test of $100,000.

On the other hand, a market analyst identified as ‘More Crypto Online’ on X has stated that Ethereum is currently testing the micro support zone between $2,907 and $2,974. He noted that holding this support area is crucial for sustaining the upward momentum that began earlier this week.

As a result, the analyst has predicted that Ethereum’s next upside window sits between $3,165 and $3,210. He cautioned that a breach below the lower support level could trigger a deeper corrective wave. However, current trends suggest that ETH is mainly aiming higher.

https://cryptoslate.com/feed/

Payout speed in crypto casinos is often described in minutes or hours. However, the real drivers live beneath those numbers. Transaction confirmation policy, liquidity staging, internal queue logic, and wallet routing can all influence whether a withdrawal feels instant or drawn out. Many people looking into this are really trying to answer one question: Is the delay blockchain-related, or platform-related? The answer is almost always a mix of both, with platform infrastructure carrying more influence than most users realize.

Bitcoin transactions typically require multiple confirmations before they are considered final. Industry practice varies, but custody-based services commonly use a window between 3 and 6 confirmations, depending on risk tolerance, network congestion, and transaction size. Confirmation requirements alone do not determine payout speed. The bigger variable is liquidity architecture, which dictates whether funds are sitting in a ready-to-release wallet, moving through a conversion buffer, or waiting in an internal queue for scheduling.

Most platforms operate with three liquidity layers. Hot wallets pay small, frequent withdrawals quickly. Warm buffers aggregate batched outgoing transfers during peak hours. Cold reserves cover wide swings and large outflows. A well-tuned platform continuously rebalances these layers through automated triggers, while less optimized systems refill on fixed schedules. The difference creates a noticeable gap in perceived payout speed.

Promo mechanics, wallet routing, and visible payout design

A concrete place to test these mechanics is Joe Fortune Bitcoin Casino, where deposit options, bonus terms, and withdrawal help pages are public and can be inspected to see how wallet choice interacts with routing and timing. When a user selects Bitcoin as the deposit path, the system determines whether the same rail will serve payouts, or pass through an internal conversion layer first. That routing decision shapes latency more than confirmation counts alone.

Next, the processing language in the UI offers hints about what stage a withdrawal is in, such as whether it is pending blockchain settlement or queued for internal scheduling. Joe Fortune Bitcoin Casino also states that Bitcoin payouts are processed within a 24-hour approval window on its support pages, reinforcing that processing time includes platform orchestration, not only network confirmations.

When a site advertises frequent deposit boosts, those incentives can cluster transactions at similar hours, which places predictable pressure on liquidity buffers and queue timing, giving observant users a way to compare behavior across peak and low windows.

Promotional cycles also influence liquidity rhythms. Here is an example of a daily-boost campaign that could produce clustered deposit windows, a factor that influences payout pacing during concentrated activity periods:

Watching how payout timing shifts across these cycles reveals whether liquidity buffers scale elastically or refill in static intervals.

What actually determines payout speed

There are five components that matter when it comes to payout speed.

1. Confirmation policy design

Rigid confirmation settings create unnecessary waiting when the network is quiet. Smarter policies adjust dynamically with congestion and risk scoring.

2. Hot wallet refill strategy

Fixed refills can strand withdrawals in queues until the next cycle. Threshold-based refills respond in real time and shorten wait perception.

3. Liquidity buffering logic

Buffer pools smooth volatility. The best setups move liquidity proactively, not reactively, reducing payout bottlenecks during traffic surges.

4. Fee calibration strategy

Underpricing transaction fees during congestion extends settlement delays. Overpricing them raises operational costs without improving the experience. Efficient routing balances both against mempool conditions.

5. UI state transparency

Generic labels like processing hide context and increase uncertainty. Clear labels, such as awaiting confirmations or queued for payout scheduling, improve perceived speed without exposing backend logic.

A 90-second payout UX audit anyone can run

You can map a platform’s payout maturity without backend access by observing behavior patterns.

- Make a small test deposit via the wallet you plan to use.

- Note the confirmation messaging and whether thresholds are fixed or conditional.

- Observe state changes after initiating a withdrawal to check if messaging evolves or remains static.

- Cross-check timing against mempool conditions through a public explorer to see whether fee choices reflect network pressure.

- Repeat at different hours to measure queue elasticity during peak and quiet periods.

- Review help pages for timing language to distinguish platform processing windows from blockchain settlement expectations.

This workflow reveals structural performance faster than any marketing claim.

An experiment design for data-driven sites

A strong analysis would measure 25 controlled withdrawals across three conditions:

| Condition | Data logged |

|---|---|

| Low congestion | Confirmation count, fee level, queue duration, UI state cadence |

| Moderate congestion | Wallet refill behavior, fee response, processing state clarity |

| High congestion | Scheduling delay patterns, fee scaling, settlement variance |

Results could correlate fee strategy and liquidity scheduling with perceived payout speed, generating an evergreen reference piece for UX-driven audiences.

Clarity is created through infrastructure

Payment infrastructure moves funds. Interface infrastructure creates confidence. A fast payout that feels opaque loses to a slightly slower payout that communicates status accurately at each stage. When users understand whether they are waiting for confirmations, liquidity provisioning, or scheduling cadence, friction drops and trust rises.

The real lever of payout experience

Payout speed is not one metric. It is a system outcome shaped by liquidity topology, queue logic, wallet staging, confirmation policies, fee calibration, and interface transparency. The best platforms make these systems invisible by making their results predictable. For users evaluating crypto casinos, the most reliable signal is not a time estimate. It is consistency under different conditions, observable routing behavior, and UI feedback that accurately mirrors system states.

Those are the mechanics that shape payout speed, and the ones worth measuring.

Disclaimer: This is a sponsored post. CryptoSlate does not endorse any of the projects mentioned in this article. Investors are encouraged to perform necessary due diligence.

The post Crypto Casino Payout Speed Explained with On-Chain Liquidity and Bitcoin Settlement UX appeared first on CryptoSlate.

Bitcoin (BTC) jumped 11% from its Dec. 1 lows at $83,822.76 to over $93,000 overnight, driven by a convergence of macro and micro developments.

The Federal Reserve formally ended quantitative tightening (QT) on Dec. 1, coinciding with the New York Fed conducting approximately $25 billion in morning repo operations and another $13.5 billion overnight, the largest such injections since 2020.

The liquidity pump eased funding stress and propelled BTC higher as traders responded to the abrupt shift in monetary plumbing.

The combination of QT’s termination and direct liquidity provision typically supports high-beta assets by reducing borrowing costs and expanding the dollar supply in the financial system.

Rate-cut probabilities shifted back in Bitcoin’s favor after weak US manufacturing data reinforced the case for an economic slowdown.

The ISM manufacturing PMI printed at 48.2, marking a ninth consecutive month of contraction and pushing CME FedWatch odds for a 25 basis point cut at the Dec. 10 FOMC meeting into the high-80% range.

As a result of rising odds of a rate cut, risk assets stabilized following the Dec. 1 selloff, which traders attributed to speculation about the Bank of Japan tightening and shallow crypto liquidity.

Distribution catalyst meets flow reversal

Vanguard, managing roughly $9 trillion to $10 trillion in assets, opened its brokerage platform to third-party crypto ETFs and mutual funds tied to BTC, ETH, XRP, and SOL for the first time, creating immediate demand pressure.

Bloomberg senior ETF analyst Eric Balchunas described a “Vanguard effect,” noting Bitcoin rose about 6% around the US market open on the first day clients could access these products, with BlackRock’s IBIT alone recording approximately $1 billion in volume during the first 30 minutes of trading.

That distribution milestone arrived as US spot Bitcoin ETF flows turned modestly positive after four weeks of outflows totaling more than $4.3 billion.

Market structure amplified the rally after Bitcoin broke through the resistance level.

After November delivered the worst monthly performance in more than four years, and the 7.3% drop on Dec. 1 pushed BTC below $84,000, positioning skewed bearish, and sentiment gauges registered “extreme fear.”

Bitcoin remains down more than 30% from its October peak near $126,000, with November alone erasing roughly 17% amid over $3.5 billion in ETF redemptions and stress around large corporate holders like Strategy.

The rebound reflects macro-driven relief from QT by the Fed and liquidity injections, structural tailwinds from Vanguard’s platform opening and slowing ETF outflows, and short-covering off a closely watched support level rather than a reversal of the broader downtrend.

The post Bitcoin just ripped 11% after the Fed quietly restarted a $38 billion money printer mechanism appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Crypto Fight Night (CFN) has confirmed a partnership with BC.GAME, which will serve as the […]

Crypto Fight Night (CFN) has confirmed a partnership with BC.GAME, which will serve as the […] PENGU eyes $0.015 if demand holds, but whale selling risks drop below $0.01 support.

PENGU eyes $0.015 if demand holds, but whale selling risks drop below $0.01 support.https://beincrypto.com/feed/

PENGU rallied over 30% in early December 2025 following news of a major collaboration between Pudgy Penguins and the National Hockey League (NHL) for the 2026 Discover NHL Winter Classic.

Despite the price jump, on-chain data shows persistent transfers of PENGU from the project’s deployment address to centralized exchanges. This trend has sparked debate about the sustainability of PENGU’s recovery.

NHL Partnership Sparks PENGU Rally

PENGU, the Pudgy Penguins community token, experienced a notable surge during the first week of December. It has increased by almost 30% in the last 24 hours, trading at $0.01246 as of this writing.

This price increase aligned with Pudgy Penguins’ announcement of an NHL partnership lasting from December to January.

The collaboration launched at Art Week Miami, highlighted by activations, giveaways, and live appearances at NHL events.

The partnership spans December through January, beginning with activations at Art Week Miami. The campaign, supported by an animated video of cartoon penguins skating across an ice rink, reflects the brand’s broader push into mainstream entertainment.

Once known primarily as an NFT collection, Pudgy Penguins has expanded into toys, physical events, and global licensing, now aiming to “own winter” through sports tie-ins.

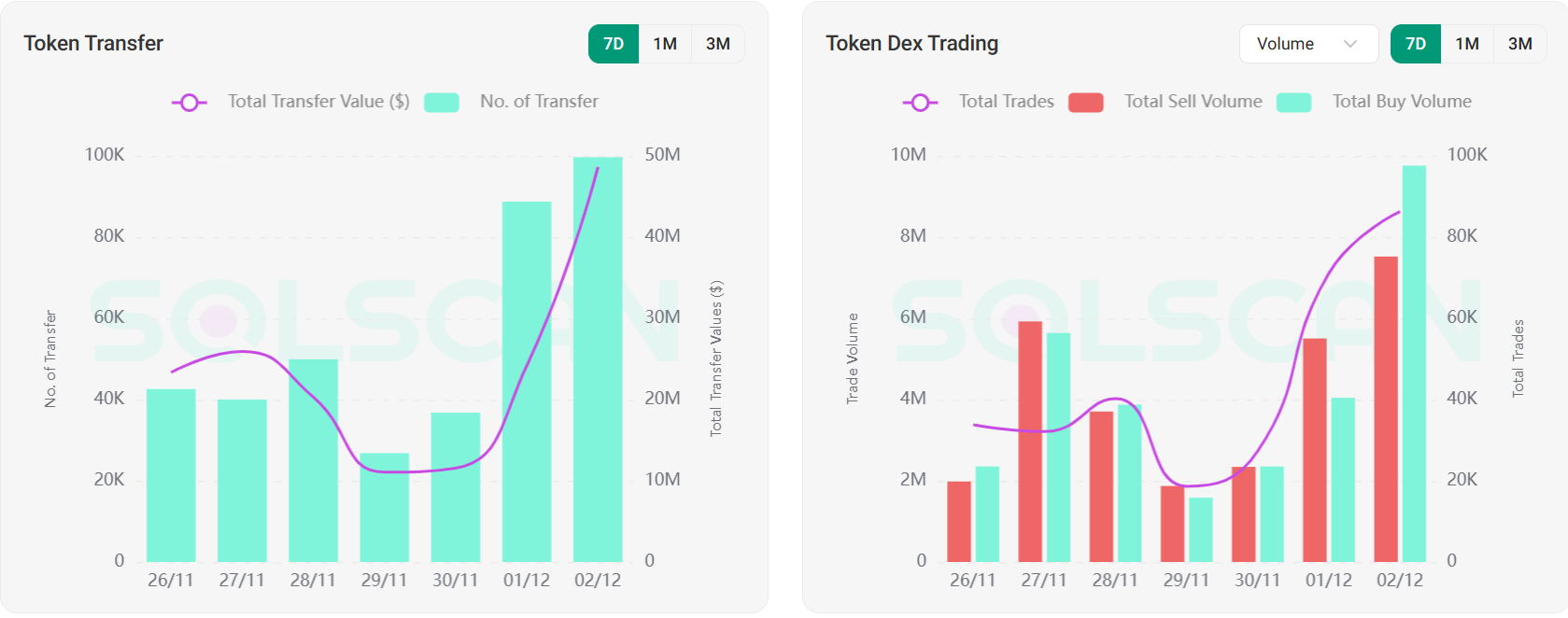

The partnership reignited enthusiasm in the token. DEX trading volume for PENGU reached its monthly high in early December, as noted by Solscan. This surge reflected increased activity from traders responding to the partnership news.

Bullish sentiment received further support from whale accumulation. In late November, large investors acquired about $273,000 in PENGU, buying at nearly three times their average volume. Smart money inflows tracked $1.3 million from new addresses in early November.

At the same time, Bitso Exchange, the leading Latin American crypto exchange, announced a Q1 2026 launch of a perpetuals aggregator, featuring PENGU as a primary asset. This move targets the region’s $1.37 trillion remittance market.

However, with hype building around Pudgy Penguins’ new NHL partnership, traders now face a sharp contrast between bullish momentum and uneasy sell-pressure signals.

On-Chain Analysis: Selling Pressure Persists

Although price action turned positive, blockchain data identified ongoing token transfers. The PENGU deployment address has routinely moved about $3 million in tokens to centralized exchanges every few days.

On-chain analyst EmberCN reported that these transfers have continued, with the latest seen in early December.

“The most recent transfer was in the early hours of this morning,” they wrote.

Since mid-July, the address moved 3.881 billion PENGU tokens, worth $108 million, to centralized exchanges. This activity tracked directly with the decline in PENGU’s price, which fell from its $0.04 second peak to roughly $0.01.

Regular outflows from the project’s core wallet suggest ongoing selling or strategic distribution, challenging recent price gains.

Such token movements often prepare for sales or liquidity. In the PENGU ecosystem, however, the scale and sustained pace suggests ongoing distribution rather than routine liquidity management.

This dynamic creates tension between positive news, such as the NHL partnership, and continued selling from unlocked team or ecosystem tokens.

The post PENGU Token Jumps 30% on NHL Deal, But $108 Million Sell-Off Sparks Fear appeared first on BeInCrypto.

The newly launched Firelight Protocol introduces staking rewards for XRP through a novel on-chain economic security primitive designed to protect DeFi assets from exploits.

Enabling New Use Cases for XRP

XRP, while being one of the largest crypto assets by market cap, does not have any native staking or yield opportunities. Firelight aims to add a new layer of value for XRP by providing a staking layer that utilizes the staked XRP for providing on-chain cover. This cover can be contracted by DeFi protocols in order to safeguard asset value in case of hacks and exploits.

Bridging the Gap to Institutional-Grade DeFi

DeFi has just come through one of its strongest growth periods ever, surpassing $170 billion in TVL in October, driven largely by institutional demand. At the same time, more than $1 billion is lost to DeFi exploits every year, and recent high-profile incidents like the Balancer exploit have sharpened concerns around asset safety. In traditional finance, insurance is embedded into every market, but DeFi still largely lacks this critical layer of protection, creating a major bottleneck for the next wave of institutional adoption. Firelight is designed to close this gap by providing robust DeFi cover, and the real, growing demand for this protection will help drive value back to XRP holders.

Security-First Approach

Firelight, incubated by Sentora and backed by Flare, utilizes Flare’s FAssets to bring XRP into the protocol. Unlike many generic bridges, FAssets is fully decentralized, and extensively audited, providing a robust on/off-ramp for XRP into DeFi.

At launch, Firelight has completed three audits—one by OpenZeppelin and one by Coinspect and a bug bounty program supported by Immunifi to help ensure maximum protocol security.

How Firelight Enables XRP to Enter DeFi

Firelight will launch across two phases. In the launch phase, XRP holders can deposit XRP and receive stXRP, a 1:1 fully backed, ERC-20 compliant liquid vault token.

stXRP serves as a transferable receipt for users’ deposits and can be freely used across the Flare DeFi ecosystem, from swapping on DEXs, to serving as collateral in lending protocols, or contributing to liquidity pools. Participants in the launch vault will also be eligible to earn Firelight Points.

In Phase 2, staking will back DeFi cover. ensuring a high-impact use-case with real demand to provide rewards for stakers. This will be the sole purpose of the protocol; capital deployed on Firelight will be allocated to this DeFi cover mechanism.

Backed by Industry Leaders

Sentora, as the technical service provider, and Flare Network, as the protocol enabling the creation of FAssets (e.g., FXRP), are the primary contributors to Firelight. Both organizations are backed by Ripple and share a mission to expand XRP’s role in DeFi. Their combined expertise in secure interoperability, protocol design, and network operations provides Firelight with deep technical support and a clear path for long-term ecosystem growth—so XRP holders and developers can build, secure, and scale real-world applications with confidence.

The post XRP Staking Arrives with the Launch of Firelight Protocol appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Crypto analyst Tony Severino has revealed a historical bearish pattern that could send the Bitcoin price to as low as $42,000. This bearish outlook for BTC comes amid a rebound for the flagship crypto, with a recent surge above the psychological $90,000 level.

Bitcoin Price Risks 50% Drop To $42,000 Based On This Pattern

In an X post, Severino stated that the Bitcoin price likes to retrace to subwave 3/4 of wave 3/4 of its impulse. Based on this, the analyst indicated that BTC could crash to as low as $42,000 on wave C of this move to the downside. His accompanying chart showed that this decline could happen sometime at the start of next year.

This bearish Bitcoin price prediction comes amid BTC’s rebound above $90,000 following the end of quantitative tightening (QT) by the U.S. Federal Reserve. The flagship crypto has also rebounded amid optimism of another rate cut at this month’s FOMC meeting. CME FedWatch data shows there is almost a 90% chance that the Fed will lower rates again this month.

However, despite these macro positives for the Bitcoin price, analysts such as Tony Severino have suggested that BTC is in a bear market and is likely to trend lower in the coming months. In an X post, he highlighted the BTC monthly chart, suggesting it showed a subtle volume breakout that confirmed a “not-so-subtle” trendline breakdown.

Meanwhile, market technician JT described statements that the QT ending is bullish for the Bitcoin price as being a “fallacy.” He alluded to the possibility that the Bank of Japan (BOJ) may hike rates this month as one of the stressors to liquidity beyond QT.

Peter Brandt Predicts Drop To Mid $40ks

In an X post, veteran trader and analyst Peter Brandt predicted that the Bitcoin price could drop to mid $40,000. He stated that the upper boundary of the lower green zone starts below $70,000 and that the lower support boundary is in the mid $40,000. Notably, Brandt had previously predicted that BTC could drop to around $50,000 before it then rallies to around $200,000 in the next bull market.

The veteran analyst noted that there have been five major bull market cycles for the Bitcoin price since its inception. He further stated that in all previous cycles, the violation of the dominant parabolic advance has been followed by a 75% plus correction with no exception. As such, he expects BTC to undergo another significant correction in this cycle, potentially dropping below $50,000.

At the time of writing, the Bitcoin price is trading at around $93,000, up almost 7% in the last 24 hours, according to data from CoinMarketCap.

What to Know:

- Even as Bitcoin holds around $93K, Bitcoin’s base layer remains secure but slow, with high fees and no native smart contract environment, limiting real on-chain activity for everyday users.

- As demand for scalable on-chain applications grows, the lack of a high-speed execution layer around Bitcoin creates a structural gap for DeFi, gaming, and payments.

- Bitcoin Hyper introduces the first Bitcoin Layer 2 with SVM integration, targeting faster-than-Solana performance while leveraging Bitcoin as the settlement backbone.

- By delivering extremely low-latency execution, fast smart contracts, and Rust-based tooling, Bitcoin Hyper aims to make wrapped $BTC usable across DeFi, NFTs, and gaming.

If you’re convinced Bitcoin is marching toward six figures, the bigger question is where the next asymmetric upside comes from. Right now, the world’s leading crypto is holding near $93K.

History suggests the highest multiples don’t usually come from the base asset itself, but from the infrastructure built on top of it; think ERC-20 DeFi blue chips riding Ethereum’s 2020 breakout.

Bitcoin’s problem is that it never had its own native DeFi and application stack to the same extent.Slow confirmation times, high fees during peak cycles, and the absence of native smart contracts have kept most real on-chain activity on other networks, even as Bitcoin dominates as a store of value and brand.

That’s the gap Bitcoin Hyper ($HYPER) is going after: a high-speed Bitcoin Layer 2 that brings Solana-style throughput directly to $BTC’s settlement layer.

Instead of asking you to rotate out of Bitcoin into a ‘fast L1,’ Bitcoin Hyper is betting the next 1000x upside comes from plugging DeFi, gaming, and payments into Bitcoin’s existing liquidity.

With a presale already into eight figures and early whales circling, Bitcoin Hyper is positioning itself as a bet not against Bitcoin, but on Bitcoin finally getting the performance layer it has been missing.For $BTC holders who want more than passive ‘number go up,’ that’s a compelling narrative to examine seriously.

Bitcoin Hyper Turns BTC Into a High-Speed Application Layer

Bitcoin Hyper is built for one simple outcome: letting you use Bitcoin like a modern, high-throughput network without abandoning Bitcoin’s security and brand.

It introduces a dedicated Layer 2 that runs smart contracts using the Solana Virtual Machine (SVM) tooling, tuned to deliver faster performance than Solana itself for real-world transactions.For users, this translates into sub-second confirmation experiences and low fees on wrapped $BTC transfers, swaps, and dApps, rather than waiting on congested Bitcoin blocks.

DeFi traders can move into pools, lending markets, and staking strategies at speed, while still ultimately settling back to Bitcoin as the base layer they trust via a Canonical Bridge. If you’re considering getting exposure, here’s a guide on how to buy Bitcoin Hyper.

Developers get a Rust-based SDK and API to ship NFT platforms, gaming dApps, and high-frequency applications without fighting Bitcoin’s base-layer limitations.

Bitcoin Hyper explicitly targets Solana-level speed while anchoring to Bitcoin, aiming to keep latency low enough for gaming and real-time apps.The presale has already pulled in $28.8M, a clear signal of early conviction behind the project’s thesis

You can explore the Bitcoin Hyper presale now.

Can $HYPER Be a 1000x for Bitcoin Maxis?

If Bitcoin Hyper captures even a small portion of the broader Bitcoin DeFi and Layer 2 narrative market, our prediction suggests that $HYPER could reach $0.08625, delivering roughly 545% returns from the current presale price of $0.013365.

That kind of upside depends on real usage, but the thesis is clear: bring Solana-like performance to where the Bitcoin liquidity already sits. You can read a Bitcoin Hyper price prediction breakdown for more scenario modeling.

Momentum is already building around that idea. Whale buys include $500K, $379K, and $274K, all feeding into the $HYPER momentum.If Bitcoin does grind toward six figures over the next cycle, the infrastructure that lets $BTC behave like a modern programmable asset stands to benefit most.

What is Bitcoin Hyper? The execution layer for crypto’s flagship: fast, cheap, and plugged directly into the world’s best-known crypto brand.

The core opportunity here is simple: Bitcoin retains its role as pristine collateral and base money, while Bitcoin Hyper turns that collateral into something you can actually deploy across DeFi, gaming, and payments at high speed.If the market agrees that the next 1000x comes from building on Bitcoin rather than competing with it, $HYPER sits directly in that slipstream.

Join the $HYPER presale now.

This article is informational only and does not constitute financial, investment, or trading advice; always do your own research.

Authored by Aaron Walker for NewsBTC — https://www.newsbtc.com/bitcoin-hyper-presale-next-1000x-bitcoin-layer-2