Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Collapsed Ethereum treasury demand and stiff overhead resistance between $3,100 and $3,200 stood in the way of Ether’s recovery to $4,000.

Strategy is urging MSCI to retain MSTR in its indexes, despite raising its Bitcoin holdings to 650,000 BTC as it has lowered its 2025 targets.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Polymarket's US app launch may drive institutional interest in crypto prediction markets, potentially reshaping event forecasting methods.

The post Polymarket launches US app after CFTC approval appeared first on Crypto Briefing.

The launch of Franklin Templeton's Solana ETF signifies growing institutional interest in blockchain technology, potentially boosting Solana's adoption.

The post Franklin Templeton’s Solana ETF begins trading on NYSE Arca appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

In a significant development, the bearish action of the Solana price is currently spilling into the SOL-backed Treasury reserves. A recent report shows that corporate treasury companies are experiencing a sharp decline in their SOL holdings in the shadow of broader market unease.

Corporate Solana Reserves Continue To Bleed

Solana is experiencing a notable development that is capable of shaping its next market direction. Ted Pillows, a market expert and investor, shared on the X platform that the corporate treasuries of Solana are sinking further as the price of SOL struggles to regain upward traction.

According to the expert, SOL treasury companies are making new lows that echo through the on-chain corridors of the network. This implied that the wallets previously renowned for their steady accumulation are now showing diminishing conviction as balances discreetly shrink in the current bearish market phase.

The trend shows how institutional Solana holders are adjusting in the face of tightened liquidity and increased volatility, but it’s not a sudden exodus. Rather, it may be a steady, calculated exhalation.

Pillows highlighted that this drop to new lows is a major reason why the price of SOL has been performing badly, as buying demand has faded among institutional investors. Until these companies recover, the expert is confident that a recovery in SOL will be difficult.

However, Solana has started throwing up a quiet flare, one that heralds a recovery. After examining the altcoin’s price action on the weekly time frame, Ali Martinez, a crypto analyst and trader, revealed that SOL is flashing a bullish signal that points to a potential upward move.

Martinez’s analysis hinges on the key Tom DeMark (TD) Sequential indicator. Since March 2023, the TD Sequential has proven to be very accurate when it comes to identifying SOL trend shifts on the weekly chart. During the ongoing bearish wave, the indicator is flashing a buy signal, suggesting that Solana is likely gearing up for a bounce.

SOL Activity Is On The Rise

Despite Solan’s price facing volatility, the leading network continues to wax strong as activity grows. In a post on X, Solana Daily disclosed that the network’s x402 activity is accelerating at a pace that feels more like an explosion this week. Currently, transactions are broadening, participation is expanding, and on-chain discussion is rising in the community.

The platform highlighted that the daily transaction volume on the protocol reached a new all-time high with approximately $380,000 processed on November 30 alone. This move to a new peak represents a 750% Week-over-Week (WoW) surge.

Furthermore, Solana has flipped the chart in dollar volume for the first time since its inception. With x402 transactions reaching new highs and a flip in dollar volume, the network is emerging as the most active in the cohort.

Il mercato delle criptovalute ha messo a segno un rimbalzo drammatico questa settimana, con il prezzo di Bitcoin che ha superato di slancio i 92.000$ ed Ethereum che si è arrampicato nuovamente sopra i 3.000$. Questa rapida ripresa (“V-shape recovery”) dei due principali asset digitali ha catturato l’attenzione del mercato, e gli analisti stanno ora condividendo la causa principale di questo “pump” inaspettato.

Perché i prezzi di Bitcoin ed Ethereum stanno rimbalzando

Attualmente Bitcoin scambia sopra i $93.000 dopo aver vissuto un periodo di vendite accelerate e pesanti liquidazioni delle posizioni Long che avevano brevemente spinto il prezzo al ribasso nelle ultime settimane. Ora che la vendita forzata si è attenuata, la criptovaluta ha recuperato in modo significativo, aggiungendo l’incredibile cifra di 75 miliardi di dollari alla sua capitalizzazione di mercato nel giro di sole 10 ore.

Ethereum ha seguito la stessa scia rialzista. I dati di CoinMarketCap mostrano che ETH ha guadagnato più del 9% nelle ultime 24 ore, con un accumulo costante che ha spinto il prezzo sopra i $3.050.

L’Analisi: Acquisti istituzionali coordinati o manipolazione?

L’analista di mercato Wimar.X ha spiegato il motivo dietro l’improvvisa impennata dei prezzi. Ha inquadrato la rinascita come un’ondata rapida di acquisti istituzionali coordinati ad alto volume. In parole povere, il mercato è “pompato” perché si è verificato un accumulo massiccio concentrato in una singola ora.

I dati di Arkham Intelligence confermano questa tesi, tracciando i movimenti delle “balene” e dei market maker poco prima del surge:

- Wintermute: Ha acquistato 8.577 BTC.

- Binance (il più grande exchange al mondo): Ha acquisito 7.658 BTC.

- Whale Wallet (portafoglio sconosciuto): Ha aggiunto 6.010 BTC al portafoglio.

- BitMEX (exchange co-fondato da Arthur Hayes): Ha accumulato 5.818 BTC.

- Bitfinex: Ha assorbito 5.778 BTC.

Secondo l’analisi di Wimar.X, questo accumulo improvviso e la sua tempistica appaiono coordinati. Ha descritto l’attività quasi come una forma di manipolazione, suggerendo che fosse intesa a influenzare la percezione del mercato e a spostare artificialmente i prezzi verso l’alto per innescare la FOMO.

Le previsioni degli analisti: Cosa succede ora?

Mentre il mercato mostra nuova forza e BTC recupera i $90.000, l’esperto crypto Michael van de Poppe ha sottolineato su X l’importanza di questo rimbalzo. Ha notato che il recente calo di Bitcoin all’inizio del mese appariva “insolito”, ma è stato seguito da una reazione forte. Secondo l’analista, il mantenimento sopra i $92.000 sarà critico per Bitcoin e potrebbe spianare la strada verso un nuovo massimo storico (ATH) e un potenziale test dei $100.000.

Dall’altra parte, l’analista identificato come ‘More Crypto Online’ si è concentrato su Ethereum. Ha dichiarato che ETH sta attualmente testando una zona di “micro supporto” tra $2.907 e $2.974. Mantenere quest’area è cruciale per sostenere il momentum rialzista iniziato questa settimana.

- Target ETH: La prossima finestra di rialzo si trova tra $3.165 e $3.210.

- Rischio: Una rottura sotto il livello di supporto inferiore potrebbe innescare un’onda correttiva più profonda. Tuttavia, i trend attuali suggeriscono che ETH punta principalmente verso l’alto.

https://cryptoslate.com/feed/

BlackRock, the largest asset management firm in the world, has described tokenization as the most critical market upgrade since the early internet.

On the other hand, the International Monetary Fund (IMF) describes it as a volatile, untested architecture that can amplify financial shocks at machine speed.

Both institutions are looking at the same innovation. Yet, the distance between their conclusions captures the most consequential debate in modern finance: whether tokenized markets will reinvent global infrastructure or reproduce its worst fragilities with new velocity.

The institutional divide on tokenization

In a Dec. 1 op-ed for The Economist, BlackRock CEO Larry Fink and COO Rob Goldstein argued that recording asset ownership on digital ledgers represents the next structural step in a decades-long modernization arc.

They framed tokenization as a financial leap comparable to the arrival of SWIFT in 1977 or the shift from paper certificates to electronic trading.

In contrast, the IMF warned in a recent explainer video that tokenized markets could be prone to flash crashes, liquidity fractures, and smart-contract domino cascades that turn local failures into systemic shocks.

The split over tokenization arises from the fact that the two institutions operate under very different mandates.

BlackRock, which has already rolled out tokenized funds and dominates the spot ETF market for digital assets, approaches tokenization as an infrastructure play. Its incentive is to expand global market access, compress settlement cycles to “T+0,” and broaden the investable universe.

In that context, blockchain-based ledgers look like the next logical step in the evolution of financial plumbing. This means the technology offers a way to strip out costs and latency in the traditional financial world.

However, the IMF operates from the opposite direction.

As the stabilizer of the global monetary system, it focuses on the hard-to-predict feedback loops that arise when markets operate at extremely high speed. Traditional finance relies on settlement delays to net transactions and conserve liquidity.

Tokenization introduces instantaneous settlement and composability across smart contracts. That structure is efficient in calm periods but can propagate shocks far faster than human intermediaries can respond.

These perspectives do not contradict each other so much as they reflect different layers of responsibility.

BlackRock is tasked with building the next generation of investment products. The IMF is tasked with identifying the fault lines before they spread. Tokenization sits at the intersection of that tension.

A technology with two futures

Fink and Goldstein describe tokenization as a bridge “built from both sides of a river,” connecting traditional institutions with digital-first innovators.

They argue that shared digital ledgers can eliminate slow, manual processes and replace disparate settlement pipelines with standardized rails that participants across jurisdictions can verify instantly.

This view is not theoretical, though the data requires careful parsing.

According to Token Terminal, the broader tokenized ecosystem is approaching $300 billion, a figure heavily anchored by dollar-pegged stablecoins like USDT and USDC.

However, the actual test lies in the roughly $30 billion wedge of regulated real-world assets (RWAs), such as tokenized Treasuries, private credit, and bonds.

Indeed, these regulated assets are no longer restricted to pilot programs.

Tokenized government bond funds such as BlackRock’s BUIDL and Ondo’s products are now live. At the same time, precious metals have moved on-chain as well, with significant volumes in digital gold.

The market has also seen fractionalized real estate shares and tokenized private credit instruments expand the investable universe beyond listed bonds and equities.

In light of this, forecasts for this sector range from the optimistic to the astronomical. Reports from firms such as RedStone Finance project a “blue sky” scenario in which on-chain RWAs could reach $30 trillion by 2034.

Meanwhile, more conservative estimates from McKinsey & Co. suggest the market could double as funds and treasuries migrate to blockchain rails.

For BlackRock, even the conservative case represents a multi-trillion-dollar restructuring of financial infrastructure.

Yet the IMF sees a parallel, less stable future. Its concern centers on the mechanics of atomic settlement.

In today’s markets, trades are often “netted” at the end of the day, meaning banks only need to move the difference between what they bought and sold. Atomic settlement requires every trade to be fully funded instantly.

In stressed conditions, this demand for pre-funded liquidity can spike, potentially causing liquidity to evaporate exactly when it is needed most.

If automated contracts then trigger liquidations “like falling dominoes,” a localized problem could become a systemic cascade before regulators even receive the alert.

The liquidity paradox

Part of the enthusiasm around tokenization stems from the question of where the next cycle of market growth may originate.

The last crypto cycle was characterized by memecoin-driven speculation, which generated high activity but drained liquidity without expanding long-term adoption.

Advocates of tokenization argue that the next expansion will be driven not by retail speculation but by institutional yield strategies, including tokenized private credit, real-world debt instruments, and enterprise-grade vaults delivering predictable returns.

Tokenization, in this framing, is not merely a technical upgrade but a new liquidity channel. Institutional allocators facing a constrained traditional yield environment may migrate to tokenized credit markets, where automated strategies and programmable settlement can yield higher, more efficient returns.

However, this future remains unrealized because large banks, insurers, and pension funds face regulatory constraints.

The Basel III Endgame rules, for example, assign punitive capital treatment to certain digital assets classified as “Group 2,” discouraging exposure to tokenized instruments unless regulators clarify the distinctions between volatile cryptocurrencies and regulated tokenized securities.

Until that boundary is defined, the “wall of money” remains more potential than reality.

Furthermore, the IMF argues that even if the funds arrive, they carry hidden leverage.

A complex stack of automated contracts, collateralized debt positions, and tokenized credit instruments may create recursive dependencies.

During periods of volatility, these chains can unwind faster than risk engines are designed to handle. The very features that make tokenization attractive, such as the instant settlement, composability, and global access, create feedback mechanisms that could amplify stress.

The tokenization question

The debate between BlackRock and the IMF is not about whether tokenization will integrate into global markets; it already has.

It is about the trajectory of that integration. One path envisions a more efficient, accessible, globally synchronized market structure. The other anticipates a landscape where speed and connectivity create new forms of systemic vulnerability.

However, in that future, the outcome will depend on whether global institutions can converge on coherent standards for interoperability, disclosure, and automated risk controls.

The post BlackRock bets on tokenization, but IMF warns of uncontrollable ‘atomic’ domino effect appeared first on CryptoSlate.

Payout speed in crypto casinos is often described in minutes or hours. However, the real drivers live beneath those numbers. Transaction confirmation policy, liquidity staging, internal queue logic, and wallet routing can all influence whether a withdrawal feels instant or drawn out. Many people looking into this are really trying to answer one question: Is the delay blockchain-related, or platform-related? The answer is almost always a mix of both, with platform infrastructure carrying more influence than most users realize.

Bitcoin transactions typically require multiple confirmations before they are considered final. Industry practice varies, but custody-based services commonly use a window between 3 and 6 confirmations, depending on risk tolerance, network congestion, and transaction size. Confirmation requirements alone do not determine payout speed. The bigger variable is liquidity architecture, which dictates whether funds are sitting in a ready-to-release wallet, moving through a conversion buffer, or waiting in an internal queue for scheduling.

Most platforms operate with three liquidity layers. Hot wallets pay small, frequent withdrawals quickly. Warm buffers aggregate batched outgoing transfers during peak hours. Cold reserves cover wide swings and large outflows. A well-tuned platform continuously rebalances these layers through automated triggers, while less optimized systems refill on fixed schedules. The difference creates a noticeable gap in perceived payout speed.

Promo mechanics, wallet routing, and visible payout design

A concrete place to test these mechanics is Joe Fortune Bitcoin Casino, where deposit options, bonus terms, and withdrawal help pages are public and can be inspected to see how wallet choice interacts with routing and timing. When a user selects Bitcoin as the deposit path, the system determines whether the same rail will serve payouts, or pass through an internal conversion layer first. That routing decision shapes latency more than confirmation counts alone.

Next, the processing language in the UI offers hints about what stage a withdrawal is in, such as whether it is pending blockchain settlement or queued for internal scheduling. Joe Fortune Bitcoin Casino also states that Bitcoin payouts are processed within a 24-hour approval window on its support pages, reinforcing that processing time includes platform orchestration, not only network confirmations.

When a site advertises frequent deposit boosts, those incentives can cluster transactions at similar hours, which places predictable pressure on liquidity buffers and queue timing, giving observant users a way to compare behavior across peak and low windows.

Promotional cycles also influence liquidity rhythms. Here is an example of a daily-boost campaign that could produce clustered deposit windows, a factor that influences payout pacing during concentrated activity periods:

Watching how payout timing shifts across these cycles reveals whether liquidity buffers scale elastically or refill in static intervals.

What actually determines payout speed

There are five components that matter when it comes to payout speed.

1. Confirmation policy design

Rigid confirmation settings create unnecessary waiting when the network is quiet. Smarter policies adjust dynamically with congestion and risk scoring.

2. Hot wallet refill strategy

Fixed refills can strand withdrawals in queues until the next cycle. Threshold-based refills respond in real time and shorten wait perception.

3. Liquidity buffering logic

Buffer pools smooth volatility. The best setups move liquidity proactively, not reactively, reducing payout bottlenecks during traffic surges.

4. Fee calibration strategy

Underpricing transaction fees during congestion extends settlement delays. Overpricing them raises operational costs without improving the experience. Efficient routing balances both against mempool conditions.

5. UI state transparency

Generic labels like processing hide context and increase uncertainty. Clear labels, such as awaiting confirmations or queued for payout scheduling, improve perceived speed without exposing backend logic.

A 90-second payout UX audit anyone can run

You can map a platform’s payout maturity without backend access by observing behavior patterns.

- Make a small test deposit via the wallet you plan to use.

- Note the confirmation messaging and whether thresholds are fixed or conditional.

- Observe state changes after initiating a withdrawal to check if messaging evolves or remains static.

- Cross-check timing against mempool conditions through a public explorer to see whether fee choices reflect network pressure.

- Repeat at different hours to measure queue elasticity during peak and quiet periods.

- Review help pages for timing language to distinguish platform processing windows from blockchain settlement expectations.

This workflow reveals structural performance faster than any marketing claim.

An experiment design for data-driven sites

A strong analysis would measure 25 controlled withdrawals across three conditions:

| Condition | Data logged |

|---|---|

| Low congestion | Confirmation count, fee level, queue duration, UI state cadence |

| Moderate congestion | Wallet refill behavior, fee response, processing state clarity |

| High congestion | Scheduling delay patterns, fee scaling, settlement variance |

Results could correlate fee strategy and liquidity scheduling with perceived payout speed, generating an evergreen reference piece for UX-driven audiences.

Clarity is created through infrastructure

Payment infrastructure moves funds. Interface infrastructure creates confidence. A fast payout that feels opaque loses to a slightly slower payout that communicates status accurately at each stage. When users understand whether they are waiting for confirmations, liquidity provisioning, or scheduling cadence, friction drops and trust rises.

The real lever of payout experience

Payout speed is not one metric. It is a system outcome shaped by liquidity topology, queue logic, wallet staging, confirmation policies, fee calibration, and interface transparency. The best platforms make these systems invisible by making their results predictable. For users evaluating crypto casinos, the most reliable signal is not a time estimate. It is consistency under different conditions, observable routing behavior, and UI feedback that accurately mirrors system states.

Those are the mechanics that shape payout speed, and the ones worth measuring.

Disclaimer: This is a sponsored post. CryptoSlate does not endorse any of the projects mentioned in this article. Investors are encouraged to perform necessary due diligence.

The post Crypto Casino Payout Speed Explained with On-Chain Liquidity and Bitcoin Settlement UX appeared first on CryptoSlate.

https://ambcrypto.com/feed/

PEPE still faces a bullish threat despite strong momentum.

PEPE still faces a bullish threat despite strong momentum. Recent comments from the Bank of Japan have further destabilized Bitcoin’s price. Despite hitting the […]

Recent comments from the Bank of Japan have further destabilized Bitcoin’s price. Despite hitting the […]https://beincrypto.com/feed/

XRP is attempting a strong recovery after last week’s decline, with the altcoin posting an 8% rise in the past 24 hours.

The broader market’s positive shift is helping XRP regain momentum, but the real catalyst appears to be renewed confidence from large investors. This surge in whale activity could position XRP for a retest of multi-week highs.

XRP Whales Rescue The Altcoin

Whale buying has intensified as XRP approached the $2.00 psychological level earlier this week. On-chain data shows that wallets holding between 100 million and 1 billion XRP collectively accumulated 620 million XRP in just a few days. At current prices, this accumulation is worth more than $1.36 billion.

Such aggressive buying at discounted levels indicates that whales are positioning for a potential rebound and view the recent dip as a buying opportunity rather than a trend reversal. Their renewed confidence signals that the upside potential outweighs the short-term volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The macro backdrop for XRP is also showing marked improvement. The HODLer Net Position Change — an indicator tracking movements among long-term holders — is flashing bullish for the first time since mid-October. The metric has shifted back into positive territory, signaling that LTHs have stopped selling and are once again accumulating.

Support from long-term holders is critical for maintaining price floors during periods of market uncertainty. Their return provides XRP with a more stable base and reduces the likelihood of major downside moves, priming the asset for sustained recovery should broader market conditions remain favorable.

XRP Price Has A Shot At Recovery

XRP is trading at $2.20 at the time of writing, up 8% in 24 hours after bouncing cleanly from the $2.00 intra-day low. The rebound from this key psychological level reinforces bullish sentiment and aligns with heavy whale accumulation.

Holding $2.20 as support places XRP in a strong position to target $2.36 next. If XRP manages to break this resistance, the altcoin could climb toward $2.50 and log its highest price in three weeks. Whale buying and LTH support make this scenario increasingly realistic.

However, failure to maintain investor confidence could still introduce downside risk. If selling pressure increases, XRP may slip back to the $2.02 support level. This would invalidate the bullish setup and erase recent gains.

The post XRP Jumps 8% as Crypto Whales Scoop Up $1.3 Billion appeared first on BeInCrypto.

PENGU rallied over 30% in early December 2025 following news of a major collaboration between Pudgy Penguins and the National Hockey League (NHL) for the 2026 Discover NHL Winter Classic.

Despite the price jump, on-chain data shows persistent transfers of PENGU from the project’s deployment address to centralized exchanges. This trend has sparked debate about the sustainability of PENGU’s recovery.

NHL Partnership Sparks PENGU Rally

PENGU, the Pudgy Penguins community token, experienced a notable surge during the first week of December. It has increased by almost 30% in the last 24 hours, trading at $0.01246 as of this writing.

This price increase aligned with Pudgy Penguins’ announcement of an NHL partnership lasting from December to January.

The collaboration launched at Art Week Miami, highlighted by activations, giveaways, and live appearances at NHL events.

The partnership spans December through January, beginning with activations at Art Week Miami. The campaign, supported by an animated video of cartoon penguins skating across an ice rink, reflects the brand’s broader push into mainstream entertainment.

Once known primarily as an NFT collection, Pudgy Penguins has expanded into toys, physical events, and global licensing, now aiming to “own winter” through sports tie-ins.

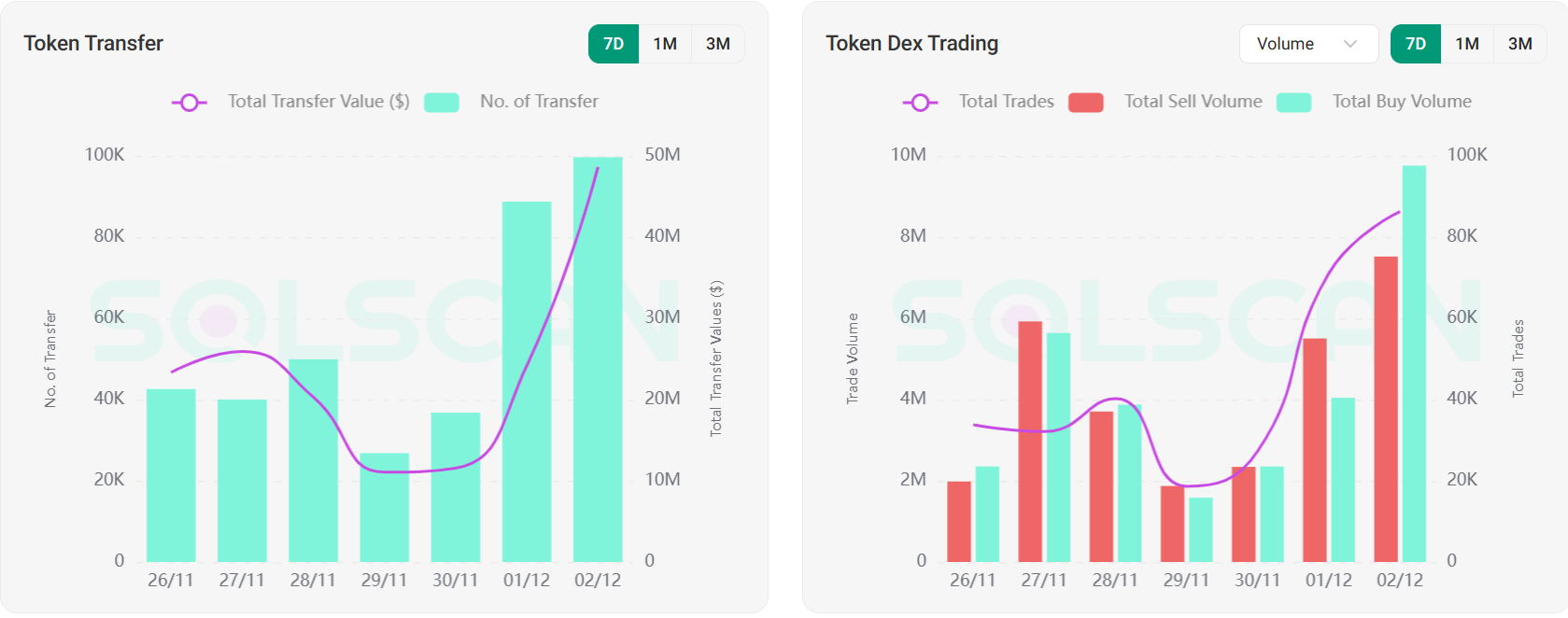

The partnership reignited enthusiasm in the token. DEX trading volume for PENGU reached its monthly high in early December, as noted by Solscan. This surge reflected increased activity from traders responding to the partnership news.

Bullish sentiment received further support from whale accumulation. In late November, large investors acquired about $273,000 in PENGU, buying at nearly three times their average volume. Smart money inflows tracked $1.3 million from new addresses in early November.

At the same time, Bitso Exchange, the leading Latin American crypto exchange, announced a Q1 2026 launch of a perpetuals aggregator, featuring PENGU as a primary asset. This move targets the region’s $1.37 trillion remittance market.

However, with hype building around Pudgy Penguins’ new NHL partnership, traders now face a sharp contrast between bullish momentum and uneasy sell-pressure signals.

On-Chain Analysis: Selling Pressure Persists

Although price action turned positive, blockchain data identified ongoing token transfers. The PENGU deployment address has routinely moved about $3 million in tokens to centralized exchanges every few days.

On-chain analyst EmberCN reported that these transfers have continued, with the latest seen in early December.

“The most recent transfer was in the early hours of this morning,” they wrote.

Since mid-July, the address moved 3.881 billion PENGU tokens, worth $108 million, to centralized exchanges. This activity tracked directly with the decline in PENGU’s price, which fell from its $0.04 second peak to roughly $0.01.

Regular outflows from the project’s core wallet suggest ongoing selling or strategic distribution, challenging recent price gains.

Such token movements often prepare for sales or liquidity. In the PENGU ecosystem, however, the scale and sustained pace suggests ongoing distribution rather than routine liquidity management.

This dynamic creates tension between positive news, such as the NHL partnership, and continued selling from unlocked team or ecosystem tokens.

The post PENGU Token Jumps 30% on NHL Deal, But $108 Million Sell-Off Sparks Fear appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

XRP’s price pullback deepened this week, but a high-timeframe technical view keeps some traders hopeful. Based on reports from analyst Egrag Crypto, the monthly chart remains above the key 21-EMA, and that is being treated as the main guide for the coin’s long-term direction.

Monthly Chart Holds The Stronger Signal

According to Egrag’s multi-timeframe review, seven key charts were checked and six trade below the 21-day Exponential Moving Average. The weaker frames include the four-hour, one-day, three-day, five-day, one-week, and two-week charts.

XRP is trading at $2.18, up 8.5% over the last 24 hours, but shed a measly 0.8% on the weekly frame. That short-term fall explains the current mood among traders.

Big Upside Targets On The Table

Reports have disclosed that the analyst’s longer-term model keeps XRP inside a rising channel on the monthly chart.

The model points to a target band between $9 and $13, and the analyst gives this outcome a 55–65% probability within three to six months if the monthly candle holds above its support.

#XRP – The Chasm ( $13) – 7 Time Frames (

1/8):

There is 1 Signal Matters Most. Right now, 6 time frames are bearish below the 21 EMA:

4H

1D

3D

5D

1W

2W

But there’s 1 KING timeframe still bullish: 1M (Monthly)

Above the 21 EMA

General Note: In TA,… pic.twitter.com/788Mk5u5Ng

— EGRAG CRYPTO (@egragcrypto) December 1, 2025

From today’s price, reaching $9 would require roughly an over 4x rise, while $13 would mean close to 7-fold jump. Those are large moves and would likely need strong momentum to happen quickly.

Other Analysts Offer Lower Near-Term EstimatesOther analysts recently projected a $4 price in about four months or by the end of 2026, citing Ripple’s plan to launch RLUSD in Japan by Q1 2026 as one possible driver.

Based on reports, spot XRP ETFs have bought over $756 million worth of the token in the weeks after their launch, a flow that some see as support for future gains.

Meanwhile, on-chain data shows Ripple’s escrow unlocked 1 billion XRP for December in two equal transactions of 500 million each.

The first transfer went to the Ripple (9) address on Tuesday. At the time of reporting, the Ripple (9) wallet held 500,000,204 XRP from that release.

One of the 500 million batches was valued at about $1.08 billion at the moment it moved. These monthly unlocks are routine, but they are watched closely by markets because of the extra supply that can enter circulation.

What Traders Should Watch NextShort-term charts remain under pressure, and momentum indicators on lower timeframes are weak. Yet higher-timeframe momentum can shift quickly when buyers step in, and a single monthly close below or above the 21-EMA would change how analysts read the situation.

Based on reports, holders who follow the monthly structure are being urged to stay patient, while others warn that short-term selling could extend before any sustained recovery.

Featured image from Gemini, chart from TradingView

Crypto analyst Tony Severino has revealed a historical bearish pattern that could send the Bitcoin price to as low as $42,000. This bearish outlook for BTC comes amid a rebound for the flagship crypto, with a recent surge above the psychological $90,000 level.

Bitcoin Price Risks 50% Drop To $42,000 Based On This Pattern

In an X post, Severino stated that the Bitcoin price likes to retrace to subwave 3/4 of wave 3/4 of its impulse. Based on this, the analyst indicated that BTC could crash to as low as $42,000 on wave C of this move to the downside. His accompanying chart showed that this decline could happen sometime at the start of next year.

This bearish Bitcoin price prediction comes amid BTC’s rebound above $90,000 following the end of quantitative tightening (QT) by the U.S. Federal Reserve. The flagship crypto has also rebounded amid optimism of another rate cut at this month’s FOMC meeting. CME FedWatch data shows there is almost a 90% chance that the Fed will lower rates again this month.

However, despite these macro positives for the Bitcoin price, analysts such as Tony Severino have suggested that BTC is in a bear market and is likely to trend lower in the coming months. In an X post, he highlighted the BTC monthly chart, suggesting it showed a subtle volume breakout that confirmed a “not-so-subtle” trendline breakdown.

Meanwhile, market technician JT described statements that the QT ending is bullish for the Bitcoin price as being a “fallacy.” He alluded to the possibility that the Bank of Japan (BOJ) may hike rates this month as one of the stressors to liquidity beyond QT.

Peter Brandt Predicts Drop To Mid $40ks

In an X post, veteran trader and analyst Peter Brandt predicted that the Bitcoin price could drop to mid $40,000. He stated that the upper boundary of the lower green zone starts below $70,000 and that the lower support boundary is in the mid $40,000. Notably, Brandt had previously predicted that BTC could drop to around $50,000 before it then rallies to around $200,000 in the next bull market.

The veteran analyst noted that there have been five major bull market cycles for the Bitcoin price since its inception. He further stated that in all previous cycles, the violation of the dominant parabolic advance has been followed by a 75% plus correction with no exception. As such, he expects BTC to undergo another significant correction in this cycle, potentially dropping below $50,000.

At the time of writing, the Bitcoin price is trading at around $93,000, up almost 7% in the last 24 hours, according to data from CoinMarketCap.