Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

The new AI-powered crypto trading platforms are aimed at replacing traditional trading charts and order books with trading execution offered through natural language processing.

Galaxy plans to deploy a new hedge fund strategy that targets both crypto tokens and traditional financial stocks as the “up-only” phase fades.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Galaxy's hedge fund launch amid market volatility highlights confidence in digital assets and potential growth in regulatory and tech-driven sectors.

The post Galaxy plans to debut $100M hedge fund amid market pullback appeared first on Crypto Briefing.

The institutionalization of crypto by 2026 could revolutionize financial systems, enhancing liquidity, efficiency, and global settlement.

The post Ripple President Monica Long predicts half of Fortune 500 will adopt crypto strategies this year appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Bitcoin treasury company Strategy has unveiled a new $2.13 billion BTC acquisition, its largest spend since July 2025’s $2.46 billion purchase.

Strategy Has Expanded Its Bitcoin Reserves By 22,305 BTC

As announced by Strategy co-founder and chairman Michael Saylor in an X post, the company has completed another Bitcoin acquisition, this one involving 22,305 BTC.

According to the filing with the US Securities and Exchange Commission (SEC), the purchase occurred in the period between January 12th and 19th, and cost Strategy $95,284 per token or $2.13 billion in total. The firm sold shares of its STRK, STRC, and MSTR at-the-market (ATM) stock offerings to fund the buy.

Usually, Strategy reveals new acquisitions on Mondays, but this time the announcement has come on a Tuesday. The routine Sunday Saylor post foreshadowing the buy, however, did come on time.

This time, the Strategy chairman made the post with the caption “₿igger Orange.” Many in the community speculated that the caption was a hint at the next purchase from the company being bigger than the last, which already involved a significant sum of 13,627 BTC.

And indeed, not only has the buy been larger, it has in fact been the largest Bitcoin acquisition made by the firm since November 2024 in terms of the number of tokens involved. The larger purchase in that month expanded Strategy’s treasury by a whopping 55,500 BTC.

When considering the USD value, though, the latest acquisition falls short of a purchase from late July 2025, costing the company about $2.46 billion. BTC was trading at a higher value back then, so the larger USD sum got the company a lower amount of coins (21,021 BTC).

Following the latest purchase, Saylor’s firm has crossed the 700,000 BTC milestone, as its holdings have now risen to 709,715 BTC. Strategy spent a total of $53.92 billion on this stack and its current value stands at $63.55 billion, putting it in a profit of nearly 18%.

As Strategy continues to accumulate, it’s solidifying its already dominant position as by far the largest corporate holder of Bitcoin, as rankings from BitcoinTreasuries.net indicate.

Strategy’s closest digital asset treasury competitor isn’t a Bitcoin company, but rather an Ethereum one: Bitmine. Originally a mining-focused firm, Bitmine adopted an ETH treasury strategy in mid-2025 and has quickly established itself in the space, becoming the number one corporate holder of Ethereum and number two in overall rankings behind Strategy.

According to a Tuesday press release, Bitmine has also added to its reserves over the past week, purchasing 35,268 ETH. This has taken the company’s total holdings to 4,203,036 ETH, equivalent to nearly 3.5% of the cryptocurrency’s entire circulating supply.

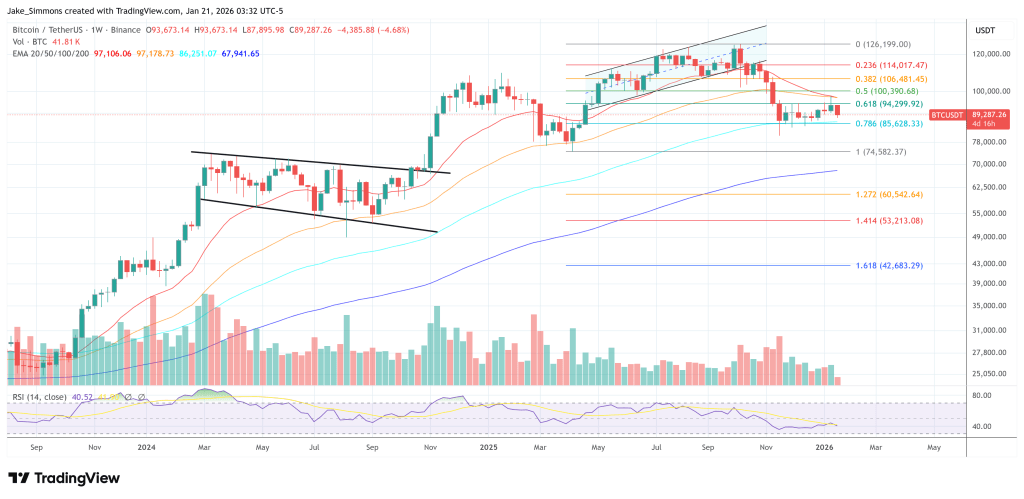

BTC Price

Bitcoin has been showing bearish momentum recently as its price has declined to the $89,300 level.

A year into his presidency, US President Donald Trump and his family have reportedly seen a notable shift in their wealth distribution, with a growing concentration of crypto ventures linked to the presidential family.

Trump Family’s Wealth Gets Crypto Boost

On Tuesday, Bloomberg reported that the Trump family’s wealth has remained relatively steady over the past year despite the plunging value of their social media company, Trump Media & Technology Group Corp, and the massive gains of their new crypto ventures.

According to the report, the family’s overall net worth has not grown significantly since President Trump’s inauguration, remaining at around $6.8 billion, as data from the Bloomberg Billionaires Index shows.

Notably, the gains from their new projects were offset by the losses of Trump Media, whose shares have declined by around 66% over the past 12 months, despite efforts to diversify into various endeavors.

Nonetheless, “the way the Trumps’ wealth is distributed now — particularly its concentration in virtual assets and public companies, some of which didn’t exist when he left office in 2021 — represents a sea change in how they’ll earn money for years to come,” the report highlighted.

Per Bloomberg, the family’s most notable change has been the growing concentration of their net worth in cryptocurrencies, with one-fifth of their fortune coming from crypto projects for the first time.

As a result, “cryptocurrency projects became the key driver of the Trump family’s wealth last year,” generating around $1.4 billion from the different digital asset-related ventures managed by the President’s eldest sons, Eric and Donald Trump Jr.

In a statement to the news media outlet, Eric Trump reaffirmed that his family’s crypto push was driven by their experience with banks after the President’s first term. “Having been canceled by banks, out of political malice, led us to many incredible opportunities, as we redefine the future of finance,” he asserted.

Digital Asset Fortune Breakdown

Over the past year, various news outlets have estimated the first family’s crypto fortune, with some reports calculating its value at around $1 billion. In October, Eric Trump shared that the real number was “probably more.”

While the Trump family dived into multiple crypto-related projects, Bloomberg analysis highlighted three of their main ventures: World Liberty Financial (WLFI), American Bitcoin Corp., and the official TRUMP and MELANIA memecoins.

World Liberty Financial reportedly sold $550 million worth of tokens, generating $390 million for the presidential family, according to the news media outlet’s calculations. In August, the company announced its partnership with Alt5 Sigma and became an investor in the technology firm, which sought to raise $1.5 billion for its crypto treasury strategy based on WLFI.

According to Bloomberg, “the Trumps netted more than $500 million” from the deal. The company also launched its USD1 stablecoin in March, which has grown to more than $3 billion since its debut. Bloomberg estimated that the business could be worth more than $300 million.

Meanwhile, the official TRUMP and MELANIA memecoins, which launched the weekend before President Trump’s second inauguration, generated gains worth roughly $280 million from the family’s holdings and associated proceeds.

In addition, Eric Trump owns about 7.4% of American Bitcoin, worth roughly $114 million despite the company’s shares declining 82% since their September peak. Donald Jr. reportedly owns a smaller, undisclosed amount.

The report also noted that the Trump family’s fortune could be worth billions more on paper, as they still own founder WLFI tokens, worth $3.8 billion at current prices. Nonetheless, these tokens were not included in the calculations as they remain locked.

https://cryptoslate.com/feed/

NYSE said it is developing a platform for trading and on-chain settlement of tokenized securities, and will seek regulatory approvals for a proposed new NYSE venue powered by that infrastructure.

According to the owners, ICE, the system is designed to support 24/7 operations, instant settlement, orders sized in dollar amounts, and stablecoin-based funding. It combines NYSE’s Pillar matching engine with blockchain-based post-trade systems that have the capability to support multiple chains for settlement and custody.

ICE did not name which blockchains would be used. The company also framed the venue and its features as contingent on regulatory approvals.

The scope ICE described is U.S.-listed equities and ETFs, including fractional share trading. It said tokenized shares could be fungible with traditionally issued securities or natively issued as digital securities.

ICE said tokenized shareholders would retain traditional dividends and governance rights. It also said distribution is intended to follow “non-discriminatory access” for qualified broker-dealers.

The forward-looking market-structure implication sits less in the token wrapper and more in the decision to pair continuous trading with immediate settlement.

Under that design, the binding constraint shifts from matching orders during a session to moving money and collateral across time zones and outside banking hours (inference based on settlement and operating-hour constraints described by regulators and ICE).

U.S. markets only fairly recently completed the move from T+2 to T+1 settlement, effective May 28, 2024, a project the SEC tied to updated rules for clearing agencies and broker-dealers. FINRA has also issued reminders that even a one-day compression requires coordinated changes in trade reporting and post-trade workflows.

Always-on trading raises settlement and funding demands

Pressure for longer trading windows is also building in listed equities, with Nasdaq publicly described as seeking SEC approval for a 23-hour, five-day trading schedule. ICE’s proposal extends the concept by pairing always-available trading with a settlement posture it labeled “instant.”

That approach would require market participants to pre-position cash, credit lines, or eligible on-chain funding at all times (inference grounded in the “instant settlement” and 24/7 features, and the post-trade funding constraints reflected in the T+1 migration).

For broader context on how quickly tokenization is spreading in finance, see CryptoSlate’s coverage of tokenized assets.

ICE made the funding and collateral angle explicit, describing the tokenized securities platform as one component of a broader digital strategy. That strategy also includes preparing clearing infrastructure for 24/7 trading and potential integration of tokenized collateral.

ICE said it is working with banks including BNY and Citi to support tokenized deposits across ICE’s clearinghouses. It said the goal is to help clearing members transfer and manage money outside traditional banking hours, meet margin obligations, and accommodate funding requirements across jurisdictions and time zones.

That framing aligns with DTCC’s push around tokenized collateral. DTCC has described collateral mobility as the “killer app” for institutional blockchain use, according to its announcement of a tokenized real-time collateral management platform.

A near-term data point for how quickly tokenized cash-equivalents can scale sits in tokenized U.S. Treasuries. RWA.xyz displays the total value of $9.33 billion as of press time.

ICE’s emphasis on tokenized deposits and collateral integration creates a path where similar assets become operational inputs for brokerage margin and clearinghouse workflows. That scenario is an inference grounded in ICE’s stated clearing strategy and DTCC’s collateral thesis, including the focus on mobility.

| Plumbing shift | Metric | Value | Source |

|---|---|---|---|

| U.S. equities settlement cycle | Compliance date | May 28, 2024 (T+1) | SEC, FINRA |

| Tokenized Treasuries | Total value (displayed) | $8.86B (as of 01/06/2026) | RWA.xyz |

Stablecoins, tokenized deposits, and collateral mobility

For crypto markets, the bridge is the settlement asset and the collateral workflow. ICE explicitly referenced stablecoin-based funding for orders and separately referenced tokenized bank deposits for clearinghouse money movement.

One base-case scenario is a settlement-asset race where stablecoins and bank-issued tokenized deposits compete for acceptance in brokerage and clearing operations. That could push more institutional treasury activity into on-chain rails while keeping the compliance perimeter centered on broker-dealers and clearing members.

A second scenario is collateral mobility spillover, where tokenized collateral becomes a primary tool for intraday and overnight margining in a 24/7 environment. That shift could increase demand for tokenized cash-equivalents such as Treasury tokens that can move in real time under defined eligibility rules.

In that design, the operational question becomes which chains, custody arrangements, and permissioning models satisfy broker-dealer requirements. ICE said only that the post-trade system has the capability to support multiple chains and did not identify any specific network.

A third scenario reaches Bitcoin through cross-asset liquidity. Always-available equities and ETFs, paired with faster settlement expectations, could compress the boundary between “market hours” and “crypto hours,” making funding conditions a more continuous input into BTC positioning (scenario inference anchored to ICE’s 24/7 equities and ETF scope and the mechanics of TradFi access via ETF wrappers).

Farside data shows large daily net flows into U.S. spot Bitcoin ETFs on several early-January sessions, including +$697.2 million on Jan. 5, 2026, +$753.8 million on Jan. 13, 2026, and +$840.6 million on Jan. 14, 2026.

That channel transmits equity-like allocation decisions into BTC exposure, alongside other flow drivers covered in CryptoSlate’s ETF inflows reporting.

Why macro and regulation will shape the rollout

Macro conditions set the incentive gradient for these plumbing changes because collateral efficiency matters more when rate policy and balance-sheet costs shift. The OECD’s baseline projects the federal funds rate will remain unchanged through 2025 and then be lowered to 3.25–3.5% by the end of 2026.

That path can reduce carry costs while leaving institutions focused on liquidity buffers and margin funding as trading windows lengthen (analysis tied to OECD rates and ICE’s 24/7 clearing focus). Under a 24/7 regime with instant settlement as a design goal, margin operations can become more continuous.

That dynamic can pull attention toward programmable cash movement, tokenized deposits, and tokenized collateral as tools for meeting obligations outside bank cutoffs.

For more on one of the key collateral-like building blocks, see CryptoSlate’s deep dive on tokenized Treasuries.

For crypto-native venues, the nearer-term implication is less about NYSE listing tokens and more about whether regulated intermediaries normalize on-chain cash legs for funding and collateral management. That can affect demand for stablecoin liquidity and short-duration tokenized instruments even if the trading venue remains permissioned (scenario inference based on ICE’s stated objectives).

DTCC’s positioning of collateral mobility as an institutional blockchain use case offers a parallel track where post-trade modernization proceeds through constrained implementations rather than open-access markets. That approach can shape where on-chain liquidity forms and which standards become acceptable for settlement and custody.

ICE did not provide a timeline, did not specify eligible stablecoins, and did not identify which chains would be used. The next concrete milestones are likely to center on filings, approval processes, and published eligibility criteria for funding and custody.

NYSE said it will seek regulatory approvals for the platform and the proposed venue.

The post Wall Street’s secret blockchain platform is coming for your dividends and it’s using stablecoins to do it appeared first on CryptoSlate.

Strategy (formerly MicroStrategy) acquired an additional 22,305 Bitcoin for approximately $2.13 billion between Jan. 12 and Jan. 19, continuing an aggressive accumulation campaign that has absorbed 3.38% of the top crypto's total supply.

That works out to 3.55% of the circulating supply of 19.97 million coins.

The purchases were executed at an average price of $95,284 per bitcoin, according to a Jan. 20 8-K filing with the Securities and Exchange Commission (SEC).

The latest acquisition brings Strategy’s total Bitcoin holdings to 709,715 BTC, a hoard worth roughly $64 billion. The company’s cost basis for the total stack is approximately $53.92 billion, or an average of $75,979 per bitcoin, implying around $10.5 billion in paper gains at current prices.

How Strategy is funding its Bitcoin purchases

While the headline number highlights the company’s relentless buying, the mechanics behind the purchase reveal a significant shift in how Strategy funds its operations.

These latest acquisitions were funded using proceeds from the firm's at-the-market sales of its Class A common stock (MSTR), its perpetual Stretch preferred stock (STRC), and the Series A Perpetual Strike Preferred Stock (STRK).

According to the SEC filing, the Michael Saylor-led Strategy sold 10,399,650 MSTR shares for approximately $1.8 billion last week. It still has about $8.4 billion worth of shares to fund future BTC purchases.

According to the SEC filing, the Michael Saylor-led Strategy sold 10,399,650 MSTR shares for approximately $1.8 billion last week. It still has about $8.4 billion worth of shares to fund future BTC purchases.

However, the preferred channel is seeing increased activity.

The filing showed Strategy sold 2,945,371 STRC shares for around $294.3 million (with $3.6 billion shares remaining) and 38,796 STRK shares for $3.4 million (with $20.3 billion shares remaining).

This increased bet shows that the company's attempt to turn its bitcoin treasury strategy into a repeatable “yield SKU” that can sit quietly in brokerage accounts and income portfolios is yielding significant interest.

Notably, this financial engineering has produced four distinct exposure tiers that trade on the Nasdaq exchange. This means investors do not need any BTC know-how to invest, as they can simply buy them through a regular brokerage account.

The product lineup is segmented by risk appetite, offering four distinct ways to play the Strategy trade.

The headline act is the Variable Rate Series A Perpetual Stretch Preferred Stock, or STRC. Marketed explicitly as “short duration high yield credit,” this security currently pays an 11.00% annual dividend in monthly cash installments.

Unlike a standard bond where market forces dictate the yield, STRC is an issuer-managed product. Strategy retains the policy power to adjust the dividend rate to ensure the stock trades near its $100 par value.

Data from STRC.live shows that the firm has accumulated 27,000 BTC from the STRC fundraiser.

Below STRC sits a tiered structure of fixed-rate perpetuals.

For the investor who wants a piece of the equity upside, there is STRK (“Strike”). It pays an 8% annual dividend and is non-cumulative (meaning missed payments are lost forever).

However, it functions as a hybrid, offering convertibility to stock that captures about 40% of the gains if Strategy’s common shares rally.

For the risk-averse income seeker, the company offers STRF (“Strife”). This 10% perpetual preferred cannot be converted to stock, but it sits higher in the capital structure.

It is cumulative, meaning the company must make up any missed dividend payments later. With $1.6 billion remaining in capacity, it represents the most conservative tier.

There is also the STRD (“Stride”) instrument, which matches the 10% yield of STRF but removes the safety net. It is non-cumulative and non-convertible.

If Strategy skips a payment, the investor has no recourse, giving STRD the sharpest risk-reward profile among the fixed-rate options. It has $1.4 billion remaining.

Meanwhile, the company has even opened a European front. Last November, Strategy introduced the Series A Perpetual Stream Preferred (STRE), a euro-denominated security that carries a 10% annual dividend paid quarterly.

This instrument carries sharp teeth regarding non-payment. The dividend is cumulative and increases by 100 basis points per missed period, up to a maximum of 18%.

Institutional investors turn to Strategy's preferred

Strategy's financial engineering product list has successfully courted a demographic that typically shuns crypto: the income tourist.

Data from several institutional filings show that high-income and preferred-focused funds are populating the STRC holders list. The roster includes the Fidelity Capital & Income Fund (FAGIX), Fidelity Advisor Floating Rate High Income (FFRAX), and the Virtus InfraCap U.S. Preferred Stock ETF (PFFA).

Meanwhile, the most striking validation comes from BlackRock. The BlackRock iShares Preferred and Income Securities ETF (PFF) is a massive fund that tracks an index usually dominated by sleepy bank and utility preferreds.

As of Jan. 16, the fund held $14.25 billion in net assets. Inside that conservative portfolio, Strategy’s Bitcoin-linked paper has established a beachhead.

The ETF disclosed a position of approximately $210 million in Strategy’s STRC. It holds another ~$260 million across STRF, STRK, and STRD. In total, BlackRock’s ETF exposure to Strategy preferreds sits at roughly $470 million (or 3.3% of the total fund).

Valentin Kosanovic, a deputy director at Capital B, views this as a watershed moment for digital credit.

According to him:

“This is another clear, factual, unquestionable demonstration of the materialization of the wave of institutionalized legacy BTC-pegged financial products.”

Risks?

The machinery required to sustain these dividends creates a unique set of risks. Strategy is not paying these yields from operating profits in the traditional sense. It is funding them through the capital markets.

The company’s prospectus for STRC states that cash dividends are expected to be funded primarily through additional capital raising, including at-the-market stock offerings.

This creates a circular dependency: Strategy sells securities to buy Bitcoin and then pays dividends on those securities.

Considering this, Michael Fanelli, a partner at RSM US, highlighted several risks associated with this model, including Bitcoin price crashes, the lack of insurance coverage, and the fact that the products are unproven in recessions. He also noted that the perpetual products have no maturity date.

However, Bitcoin analyst Adam Livingston countered that the products are a “mind-bender” for traditional analysts. He argued that “STRC is quietly turning Strategy into a private central bank for the yield-starved world.”

According to him:

“STRC is a coupon-bearing ‘credit rail’ that can absorb fixed-income demand, convert it into BTC at scale, then feed the equity premium that makes the next raise easier, cheaper, and faster. That is a flywheel with a bid inside it.”

The post Strategy just crossed 700k BTC but its “circular” Bitcoin funding loop risks a massive high-yield credit disaster appeared first on CryptoSlate.

https://ambcrypto.com/feed/

LINK showed bullish signs as whales accumulated below $13. Is a breakout brewing?

LINK showed bullish signs as whales accumulated below $13. Is a breakout brewing? Seventeen years of untouched Bitcoin outweighs any single week of tariffs, sell-offs, or headline-driven volatility.

Seventeen years of untouched Bitcoin outweighs any single week of tariffs, sell-offs, or headline-driven volatility.https://beincrypto.com/feed/

Solana’s latest price action killed any near-term shot at a run toward and through the $150 handle. SOL sold off hard in line with broader risk assets as macro uncertainty picked up.

Even with that drawdown, holder behavior suggests conviction hasn’t cracked. SOL investors largely kept a bullish bias, signaling confidence that goes beyond short-term price noise.

Solana Sees Relatively Strong Investor Interest

Solana spot ETFs printed a surprise $3.08 million in net inflows during a period of heavy market stress. Those flows came in as global equities were getting hit, and the broader crypto market saw more than $120 billion wiped off total capitalization. That divergence highlights SOL’s ability to pull capital even in risk-off conditions.

The contrast with other crypto products was clear. Bitcoin ETFs saw $483 million in net outflows on Monday as investors de-risked. Most major assets followed the same exit trend. Solana, however, bucked the flow, reinforcing a bullish narrative that could support a rebound.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain data tells a similar story. New address growth on Solana stayed relatively steady despite negative sentiment across markets. The network added roughly 8.6 million new addresses on Monday, followed by 8.4 million on Tuesday — just a 2.38% drop.

That level of consistency suggests demand hasn’t materially rolled over. New address creation tends to reflect real usage and incoming interest rather than short-term speculation. Holding up through a drawdown points to underlying support that could help fuel a recovery once conditions improve.

Will SOL Price Heal Its Wounds?

SOL is trading around $127 at the time of writing, down 12.8% on the week. Price defended the $125 support zone, preventing a deeper flush. That area is shaping up as a key near-term floor, with buyers stepping in to absorb supply.

Relative strength still favors SOL versus other large caps. ETF inflows and steady network activity argue for a quicker bounce. A reclaim of $132 as support would open the door for a push through $136 and a partial retrace of recent losses.

The setup flips bearish if momentum stalls. A clean break below $125 would invalidate current support and shift sentiment lower. In that case, SOL could slide toward $119, extending the correction and sidelining the bullish case.

The post Solana ETFs Outperform Bitcoin and Ethereum Amid Market Crash appeared first on BeInCrypto.

Asset manager Grayscale is seeking regulatory approval to convert its Grayscale Near Trust into a spot exchange-traded fund (ETF).

The firm filed a Form S-1 registration statement with the US Securities and Exchange Commission on January 20, marking a move to expand its crypto ETF product lineup.

Grayscale Moves to Convert Near Trust Into ETF With New SEC Filing

For context, the Grayscale Near Trust currently manages about $900,000 in assets and has a net asset value of $2.19 per share. The product trades on the OTCQB market under the ticker GSNR.

Under the proposed conversion, the ETF would be listed on NYSE Arca. According to the filing,

“The Shares are currently quoted on OTCQB under the ticker symbol ‘GSNR’ and following the effectiveness of the registration statement of which this prospectus forms a part, the Trust intends to list the Shares on NYSE Arca, Inc. (“NYSE Arca”) under the symbol ‘GSNR.'”

Furthermore, Grayscale named Coinbase Custody Trust Company as custodian for the NEAR holdings. Meanwhile, Coinbase would act as the prime broker. The Bank of New York Mellon would serve as administrator and transfer agent.

The filing states that the ETF is designed to offer investors a straightforward and efficient way to access NEAR through a regulated investment vehicle. Grayscale noted that the fund would not employ leverage, derivatives, or other similar financial instruments as part of its investment strategy.

The asset manager now joins Bitwise, which also filed a Form S-1 for a Near ETF in May 2025. The latest filing reflects Grayscale’s ongoing strategic expansion within the crypto ETF market.

In 2025, the company converted several products into ETFs, including its Digital Large Cap Fund, Chainlink Trust, and XRP Trust. Grayscale now offers 9 live ETFs.

Moreover, earlier this month, Grayscale formed new Delaware statutory trusts for proposed BNB and Hyperliquid ETFs. These Delaware trust registrations are early steps before submitting full SEC ETF applications. In addition, Grayscale is seeking approval for ETFs on Hedera, Avalanche, and Bittensor.

Nevertheless, the announcement failed to generate any immediate upside for NEAR’s price. BeInCrypto Markets data shows that the altcoin declined 1.76% over the past 24 hours, broadly mirroring the wider market downturn. At the time of writing, NEAR was trading at $1.54.

NEAR’s losses are more pronounced on a weekly basis. Over the past seven days, the token has shed approximately 14.3% of its value, reflecting sustained selling pressure and cautious investor sentiment amid ongoing macro and geopolitical uncertainty.

The post Grayscale’s Near ETF Plan Progresses While Token Faces Selling Pressure appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Fundstrat’s Tom Lee reiterated his $250,000 Bitcoin target while cautioning that 2026 could be a “jagged” year for crypto adoption and a turbulent one for broader risk assets, framing any major pullback as a buying window rather than a signal to de-risk.

Speaking on The Master Investor Podcast with Wilfred Frost in an interview released Jan. 20, Lee said he expects 2026 to ultimately “look like a continuation of the bull market that started in 2022,” but argued markets must first digest several transitions that could deliver a drawdown large enough to “feel like a bear market.”

$250,000 Bitcoin Call Comes With A 2026 Warning

Lee pointed to what he described as a “new Fed” dynamic, arguing markets tend to “test” a new chair and that the sequencing of identification, confirmation, and reaction can catalyze a correction. He also warned that the White House could become “more deliberate in picking winners and losers,” expanding the set of sectors, industries, and even countries “in the bullseye,” which he said is already visible in gold’s strength.

A third friction point, in his telling, is AI positioning: the market is still calibrating “how much is priced into AI,” from energy needs to data-center capacity, and that uncertainty could linger until other narratives take the baton.

Pressed on magnitude, Lee said with regards to the S&P 500, the drawdown “could be 10%,” but also “could be 15% or 20%,” potentially producing a “round trip from the start of the year,” before finishing 2026 strong. He added that his institutional clients did not appear aggressively positioned yet, and flagged leverage as a tell: margin debt is at an all-time high, he said, but up 39% year-over-year—below the 60% pace he associates with local market peaks.

For crypto, Lee leaned on a market-structure explanation for why gold outperformed: he said crypto tracked gold until Oct. 10, when the market suffered what he called “the single largest deleveraging event in the history of crypto,” “bigger than what happened in November 2022 around FTX.”

After that, he said, Bitcoin fell more than 35% and Ethereum almost 50%, breaking the linkage. “Crypto has periodic deleveraging events,” Lee said. “It really impairs the market makers and the market makers are essentially the central bank of crypto. So many of the market makers I would say maybe half got wiped out on October 10th.”

That fragility, he argued, doesn’t negate the “digital gold” framing so much as it limits who treats it that way today. “Bitcoin is digital gold,” Lee said, but added that the set of investors who buy that thesis “is not the same universe that owns gold.”

Over time, Lee expects the ownership base to broaden, though not smoothly. “Crypto still has a, I think, future adoption curve that’s higher than gold because more people own gold than own crypto,” he said. “But the path to getting that adoption rate higher is going to be very jagged. And I think 2026 will be a really important test because if Bitcoin makes a new all-time high, we know that that deleveraging event is behind us.”

Within that framework, Lee reiterated his high-conviction upside call: “We think Bitcoin will make a new high this year,” he said, confirming a $250,000 target. He tied the thesis to rising “usefulness” of crypto, banks recognizing blockchain settlement and finality, and the emergence of natively crypto-scaled financial models.

Lee cited Tether as a proof point, claiming it is expected to generate nearly $20 billion in 2026 earnings with roughly 300 employees, and argued that the profit profile illustrates why blockchain-based finance can look structurally different from legacy banking.

Lee closed with advice that intentionally cuts against short-horizon reflexes. “Trying to time the market makes you an enemy of your future performance,” he said. “As much as I’m warning about 2026 and the possibility of a lot of turbulence, they should view the pullback as a chance to buy, not the pullback as a chance to sell.”

At press time, Bitcoin traded at $89,287.

Trove Markets’ new token collapsed almost immediately after trading began, wiping out the vast majority of early gains and leaving many backers angry and confused. The drop was brutal. Traders who bought early watched their holdings shrink by about 95% in a matter of hours.

Token Price Plunges After Launch

Initial prices implied a market value near $20 million. Based on reports, the token fell to roughly $0.0008 per unit, trimming the market cap to below $1–2 million.

Some wallets unloaded huge chunks of coins right after the token generation event. That selling pressure coincided with a flood of posts on social platforms calling the launch a rug pull.

Trove Had Raised Millions Before The Fall

According to reports, the project raised roughly $11.5 million in its public sale. The Trove team announced it would keep about $9.4 million to fund further work and pay for a switch of blockchains.

Refunds totaling about $2.44 million were returned to some investors, and another $100,000 was earmarked for additional reimbursements. The numbers left many buyers feeling shortchanged and asking why a large share of the money stayed with the team.

Team Keeps Majority Of FundsOn-chain analysts and tracing tools flagged unusual transfers tied to a handful of new accounts. Reports note that a meaningful slice of the token supply moved into one cluster of wallets, and some transfers were routed through services like ChangeHero.

That activity raised questions about whether all token allocations were handled openly. Legal calls and demands for public audits followed soon after.

Investors reacted quickly. Some demanded full refunds. Others threatened legal steps. Community moderators and influencers amplified complaints and demanded clear timelines for fixes.

We’re pivoting Trove to Solana.

After recent sentiment around Trove, the liquidity partner that had been supporting our Hyperliquid path chose to unwind their 500k $HYPE position. That was their decision and we fully respect it.

This changes our constraints: we’re no longer…

— unwise (@unwisecap) January 18, 2026

Trove posted updates, saying a partner had pulled out and that the pivot to Solana was necessary to keep the project alive.

The team promised to continue building and to be more open about their choices, while pledging to deliver a working platform that might justify holding the funds.

Trust Hinges On Delivery And Transparencyhttps://t.co/sc8b59sjYE

— TROVE (@TroveMarkets) January 19, 2026

What happens next will matter more than the words now being exchanged. If the team can show tangible progress on the exchange and create real trading depth, some anger may fade.

If not, the episode could be used as a warning: token sales that change terms late in the process can trigger swift market punishment and reputational damage. Regulatory scrutiny could also increase if large sums are held after a collapse like this.

Featured image from Unsplash, chart from TradingView