Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Bhutan is adding to its growing list of blockchain initiatives. It already runs a Bitcoin mining operation and also launched a self-sovereign ID system powered by Ethereum.

Grayscale continued its pattern of trust-to-ETF conversions with the NEAR Trust despite declining fund performance.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

The institutionalization of crypto by 2026 could revolutionize financial systems, enhancing liquidity, efficiency, and global settlement.

The post Ripple President Monica Long predicts half of Fortune 500 will adopt crypto strategies this year appeared first on Crypto Briefing.

This partnership signifies a shift in retirement planning, integrating cryptocurrency exposure into traditional financial products, potentially broadening market appeal.

The post BlackRock partners with Delaware Life to bring Bitcoin into fixed index annuities appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

A year into his presidency, US President Donald Trump and his family have reportedly seen a notable shift in their wealth distribution, with a growing concentration of crypto ventures linked to the presidential family.

Trump Family’s Wealth Gets Crypto Boost

On Tuesday, Bloomberg reported that the Trump family’s wealth has remained relatively steady over the past year despite the plunging value of their social media company, Trump Media & Technology Group Corp, and the massive gains of their new crypto ventures.

According to the report, the family’s overall net worth has not grown significantly since President Trump’s inauguration, remaining at around $6.8 billion, as data from the Bloomberg Billionaires Index shows.

Notably, the gains from their new projects were offset by the losses of Trump Media, whose shares have declined by around 66% over the past 12 months, despite efforts to diversify into various endeavors.

Nonetheless, “the way the Trumps’ wealth is distributed now — particularly its concentration in virtual assets and public companies, some of which didn’t exist when he left office in 2021 — represents a sea change in how they’ll earn money for years to come,” the report highlighted.

Per Bloomberg, the family’s most notable change has been the growing concentration of their net worth in cryptocurrencies, with one-fifth of their fortune coming from crypto projects for the first time.

As a result, “cryptocurrency projects became the key driver of the Trump family’s wealth last year,” generating around $1.4 billion from the different digital asset-related ventures managed by the President’s eldest sons, Eric and Donald Trump Jr.

In a statement to the news media outlet, Eric Trump reaffirmed that his family’s crypto push was driven by their experience with banks after the President’s first term. “Having been canceled by banks, out of political malice, led us to many incredible opportunities, as we redefine the future of finance,” he asserted.

Digital Asset Fortune Breakdown

Over the past year, various news outlets have estimated the first family’s crypto fortune, with some reports calculating its value at around $1 billion. In October, Eric Trump shared that the real number was “probably more.”

While the Trump family dived into multiple crypto-related projects, Bloomberg analysis highlighted three of their main ventures: World Liberty Financial (WLFI), American Bitcoin Corp., and the official TRUMP and MELANIA memecoins.

World Liberty Financial reportedly sold $550 million worth of tokens, generating $390 million for the presidential family, according to the news media outlet’s calculations. In August, the company announced its partnership with Alt5 Sigma and became an investor in the technology firm, which sought to raise $1.5 billion for its crypto treasury strategy based on WLFI.

According to Bloomberg, “the Trumps netted more than $500 million” from the deal. The company also launched its USD1 stablecoin in March, which has grown to more than $3 billion since its debut. Bloomberg estimated that the business could be worth more than $300 million.

Meanwhile, the official TRUMP and MELANIA memecoins, which launched the weekend before President Trump’s second inauguration, generated gains worth roughly $280 million from the family’s holdings and associated proceeds.

In addition, Eric Trump owns about 7.4% of American Bitcoin, worth roughly $114 million despite the company’s shares declining 82% since their September peak. Donald Jr. reportedly owns a smaller, undisclosed amount.

The report also noted that the Trump family’s fortune could be worth billions more on paper, as they still own founder WLFI tokens, worth $3.8 billion at current prices. Nonetheless, these tokens were not included in the calculations as they remain locked.

A recent report from CNBC reveals that Binance’s co-CEO, Richard Teng, is contemplating a return to the US market after exiting in 2023 as part of a regulatory agreement that also resulted in the departure of the exchange’s former CEO, Changpeng Zhao (CZ).

Ripple CEO Predicts Positive Impact From Binance’s Return

During an interview at the World Economic Forum in Davos on Tuesday, Teng emphasized that Binance is taking a “wait-and-see” stance regarding its reentry into the US, a market he considers “very important.”

In tandem with Teng’s comments, Brad Garlinghouse, Ripple’s CEO, shared his optimistic outlook for the world’s leading exchange comeback in a separate interview with CNBC.

Garlinghouse remarked that the US market is significant and suggested that Binance had previously been a major player within it. “I think they’ll come back because they’re a capitalistic, innovative company that wants to solve larger market challenges and continue to grow,” he stated.

Not only that, but Garlinghouse also believes that Binance’s entry into the country’s cryptocurrency market could increase competition and ultimately attract more users. He noted:

I think it will actually have the positive impact of bringing more people into the market, in part because it’ll reduce pricing. Today their pricing is lower on a global basis than what we see here in the U.S.

Teng, Garlinghouse Call For Support Of Key Crypto Bills

The discussion of Binance’s future in the US comes amidst a turbulent regulatory environment for cryptocurrencies. The recent cancellation of the crucial markup for the crypto market structure bill, known as the CLARITY Act, reflects ongoing challenges.

Teng, a former regulator himself, weighed in on the state of US crypto regulations, asserting that “any regulation will be better than no regulation.” He explained that having regulatory clarity allows companies to navigate the framework effectively.

“Once you have clarity, you can then start working around those rules,” Teng added, acknowledging that initial regulations may not be perfect but can be refined over time.

This backdrop of regulatory uncertainty is further complicated by recent developments in the industry. The CEO of Coinbase, Brian Armstrong, stepped back from supporting the crypto market structure bill just 24 hours before its markup, leading to its eventual suspension.

Garlinghouse, who continues to support the bill in its latest form, was surprised by Armstrong’s “vehemence” against the CLARITY Act. He noted that “the rest of the industry, including exchanges that compete with Coinbase, were still supporting it.”

Looking ahead, Garlinghouse is hopeful that industry leaders will find a way to overcome the current impasse. “If we want the industry to continue to grow, we need things like the Genius Act and the Clarity Act,” he affirmed.

At the time of writing, Binance’s native token, Binance Coin (BNB), had dropped to $893.65, marking a 3.7% decline over the previous 24 hours. Ripple’s associated XRP token retraced towards $1.90, suffering even greater losses of 5.5% in the same time frame.

Featured image from OpenArt, chart from TradingView.com

https://cryptoslate.com/feed/

NYSE said it is developing a platform for trading and on-chain settlement of tokenized securities, and will seek regulatory approvals for a proposed new NYSE venue powered by that infrastructure.

According to the owners, ICE, the system is designed to support 24/7 operations, instant settlement, orders sized in dollar amounts, and stablecoin-based funding. It combines NYSE’s Pillar matching engine with blockchain-based post-trade systems that have the capability to support multiple chains for settlement and custody.

ICE did not name which blockchains would be used. The company also framed the venue and its features as contingent on regulatory approvals.

The scope ICE described is U.S.-listed equities and ETFs, including fractional share trading. It said tokenized shares could be fungible with traditionally issued securities or natively issued as digital securities.

ICE said tokenized shareholders would retain traditional dividends and governance rights. It also said distribution is intended to follow “non-discriminatory access” for qualified broker-dealers.

The forward-looking market-structure implication sits less in the token wrapper and more in the decision to pair continuous trading with immediate settlement.

Under that design, the binding constraint shifts from matching orders during a session to moving money and collateral across time zones and outside banking hours (inference based on settlement and operating-hour constraints described by regulators and ICE).

U.S. markets only fairly recently completed the move from T+2 to T+1 settlement, effective May 28, 2024, a project the SEC tied to updated rules for clearing agencies and broker-dealers. FINRA has also issued reminders that even a one-day compression requires coordinated changes in trade reporting and post-trade workflows.

Always-on trading raises settlement and funding demands

Pressure for longer trading windows is also building in listed equities, with Nasdaq publicly described as seeking SEC approval for a 23-hour, five-day trading schedule. ICE’s proposal extends the concept by pairing always-available trading with a settlement posture it labeled “instant.”

That approach would require market participants to pre-position cash, credit lines, or eligible on-chain funding at all times (inference grounded in the “instant settlement” and 24/7 features, and the post-trade funding constraints reflected in the T+1 migration).

For broader context on how quickly tokenization is spreading in finance, see CryptoSlate’s coverage of tokenized assets.

ICE made the funding and collateral angle explicit, describing the tokenized securities platform as one component of a broader digital strategy. That strategy also includes preparing clearing infrastructure for 24/7 trading and potential integration of tokenized collateral.

ICE said it is working with banks including BNY and Citi to support tokenized deposits across ICE’s clearinghouses. It said the goal is to help clearing members transfer and manage money outside traditional banking hours, meet margin obligations, and accommodate funding requirements across jurisdictions and time zones.

That framing aligns with DTCC’s push around tokenized collateral. DTCC has described collateral mobility as the “killer app” for institutional blockchain use, according to its announcement of a tokenized real-time collateral management platform.

A near-term data point for how quickly tokenized cash-equivalents can scale sits in tokenized U.S. Treasuries. RWA.xyz displays the total value of $9.33 billion as of press time.

ICE’s emphasis on tokenized deposits and collateral integration creates a path where similar assets become operational inputs for brokerage margin and clearinghouse workflows. That scenario is an inference grounded in ICE’s stated clearing strategy and DTCC’s collateral thesis, including the focus on mobility.

| Plumbing shift | Metric | Value | Source |

|---|---|---|---|

| U.S. equities settlement cycle | Compliance date | May 28, 2024 (T+1) | SEC, FINRA |

| Tokenized Treasuries | Total value (displayed) | $8.86B (as of 01/06/2026) | RWA.xyz |

Stablecoins, tokenized deposits, and collateral mobility

For crypto markets, the bridge is the settlement asset and the collateral workflow. ICE explicitly referenced stablecoin-based funding for orders and separately referenced tokenized bank deposits for clearinghouse money movement.

One base-case scenario is a settlement-asset race where stablecoins and bank-issued tokenized deposits compete for acceptance in brokerage and clearing operations. That could push more institutional treasury activity into on-chain rails while keeping the compliance perimeter centered on broker-dealers and clearing members.

A second scenario is collateral mobility spillover, where tokenized collateral becomes a primary tool for intraday and overnight margining in a 24/7 environment. That shift could increase demand for tokenized cash-equivalents such as Treasury tokens that can move in real time under defined eligibility rules.

In that design, the operational question becomes which chains, custody arrangements, and permissioning models satisfy broker-dealer requirements. ICE said only that the post-trade system has the capability to support multiple chains and did not identify any specific network.

A third scenario reaches Bitcoin through cross-asset liquidity. Always-available equities and ETFs, paired with faster settlement expectations, could compress the boundary between “market hours” and “crypto hours,” making funding conditions a more continuous input into BTC positioning (scenario inference anchored to ICE’s 24/7 equities and ETF scope and the mechanics of TradFi access via ETF wrappers).

Farside data shows large daily net flows into U.S. spot Bitcoin ETFs on several early-January sessions, including +$697.2 million on Jan. 5, 2026, +$753.8 million on Jan. 13, 2026, and +$840.6 million on Jan. 14, 2026.

That channel transmits equity-like allocation decisions into BTC exposure, alongside other flow drivers covered in CryptoSlate’s ETF inflows reporting.

Why macro and regulation will shape the rollout

Macro conditions set the incentive gradient for these plumbing changes because collateral efficiency matters more when rate policy and balance-sheet costs shift. The OECD’s baseline projects the federal funds rate will remain unchanged through 2025 and then be lowered to 3.25–3.5% by the end of 2026.

That path can reduce carry costs while leaving institutions focused on liquidity buffers and margin funding as trading windows lengthen (analysis tied to OECD rates and ICE’s 24/7 clearing focus). Under a 24/7 regime with instant settlement as a design goal, margin operations can become more continuous.

That dynamic can pull attention toward programmable cash movement, tokenized deposits, and tokenized collateral as tools for meeting obligations outside bank cutoffs.

For more on one of the key collateral-like building blocks, see CryptoSlate’s deep dive on tokenized Treasuries.

For crypto-native venues, the nearer-term implication is less about NYSE listing tokens and more about whether regulated intermediaries normalize on-chain cash legs for funding and collateral management. That can affect demand for stablecoin liquidity and short-duration tokenized instruments even if the trading venue remains permissioned (scenario inference based on ICE’s stated objectives).

DTCC’s positioning of collateral mobility as an institutional blockchain use case offers a parallel track where post-trade modernization proceeds through constrained implementations rather than open-access markets. That approach can shape where on-chain liquidity forms and which standards become acceptable for settlement and custody.

ICE did not provide a timeline, did not specify eligible stablecoins, and did not identify which chains would be used. The next concrete milestones are likely to center on filings, approval processes, and published eligibility criteria for funding and custody.

NYSE said it will seek regulatory approvals for the platform and the proposed venue.

The post Wall Street’s secret blockchain platform is coming for your dividends and it’s using stablecoins to do it appeared first on CryptoSlate.

Strategy (formerly MicroStrategy) acquired an additional 22,305 Bitcoin for approximately $2.13 billion between Jan. 12 and Jan. 19, continuing an aggressive accumulation campaign that has absorbed 3.38% of the top crypto's total supply.

That works out to 3.55% of the circulating supply of 19.97 million coins.

The purchases were executed at an average price of $95,284 per bitcoin, according to a Jan. 20 8-K filing with the Securities and Exchange Commission (SEC).

The latest acquisition brings Strategy’s total Bitcoin holdings to 709,715 BTC, a hoard worth roughly $64 billion. The company’s cost basis for the total stack is approximately $53.92 billion, or an average of $75,979 per bitcoin, implying around $10.5 billion in paper gains at current prices.

How Strategy is funding its Bitcoin purchases

While the headline number highlights the company’s relentless buying, the mechanics behind the purchase reveal a significant shift in how Strategy funds its operations.

These latest acquisitions were funded using proceeds from the firm's at-the-market sales of its Class A common stock (MSTR), its perpetual Stretch preferred stock (STRC), and the Series A Perpetual Strike Preferred Stock (STRK).

According to the SEC filing, the Michael Saylor-led Strategy sold 10,399,650 MSTR shares for approximately $1.8 billion last week. It still has about $8.4 billion worth of shares to fund future BTC purchases.

According to the SEC filing, the Michael Saylor-led Strategy sold 10,399,650 MSTR shares for approximately $1.8 billion last week. It still has about $8.4 billion worth of shares to fund future BTC purchases.

However, the preferred channel is seeing increased activity.

The filing showed Strategy sold 2,945,371 STRC shares for around $294.3 million (with $3.6 billion shares remaining) and 38,796 STRK shares for $3.4 million (with $20.3 billion shares remaining).

This increased bet shows that the company's attempt to turn its bitcoin treasury strategy into a repeatable “yield SKU” that can sit quietly in brokerage accounts and income portfolios is yielding significant interest.

Notably, this financial engineering has produced four distinct exposure tiers that trade on the Nasdaq exchange. This means investors do not need any BTC know-how to invest, as they can simply buy them through a regular brokerage account.

The product lineup is segmented by risk appetite, offering four distinct ways to play the Strategy trade.

The headline act is the Variable Rate Series A Perpetual Stretch Preferred Stock, or STRC. Marketed explicitly as “short duration high yield credit,” this security currently pays an 11.00% annual dividend in monthly cash installments.

Unlike a standard bond where market forces dictate the yield, STRC is an issuer-managed product. Strategy retains the policy power to adjust the dividend rate to ensure the stock trades near its $100 par value.

Data from STRC.live shows that the firm has accumulated 27,000 BTC from the STRC fundraiser.

Below STRC sits a tiered structure of fixed-rate perpetuals.

For the investor who wants a piece of the equity upside, there is STRK (“Strike”). It pays an 8% annual dividend and is non-cumulative (meaning missed payments are lost forever).

However, it functions as a hybrid, offering convertibility to stock that captures about 40% of the gains if Strategy’s common shares rally.

For the risk-averse income seeker, the company offers STRF (“Strife”). This 10% perpetual preferred cannot be converted to stock, but it sits higher in the capital structure.

It is cumulative, meaning the company must make up any missed dividend payments later. With $1.6 billion remaining in capacity, it represents the most conservative tier.

There is also the STRD (“Stride”) instrument, which matches the 10% yield of STRF but removes the safety net. It is non-cumulative and non-convertible.

If Strategy skips a payment, the investor has no recourse, giving STRD the sharpest risk-reward profile among the fixed-rate options. It has $1.4 billion remaining.

Meanwhile, the company has even opened a European front. Last November, Strategy introduced the Series A Perpetual Stream Preferred (STRE), a euro-denominated security that carries a 10% annual dividend paid quarterly.

This instrument carries sharp teeth regarding non-payment. The dividend is cumulative and increases by 100 basis points per missed period, up to a maximum of 18%.

Institutional investors turn to Strategy's preferred

Strategy's financial engineering product list has successfully courted a demographic that typically shuns crypto: the income tourist.

Data from several institutional filings show that high-income and preferred-focused funds are populating the STRC holders list. The roster includes the Fidelity Capital & Income Fund (FAGIX), Fidelity Advisor Floating Rate High Income (FFRAX), and the Virtus InfraCap U.S. Preferred Stock ETF (PFFA).

Meanwhile, the most striking validation comes from BlackRock. The BlackRock iShares Preferred and Income Securities ETF (PFF) is a massive fund that tracks an index usually dominated by sleepy bank and utility preferreds.

As of Jan. 16, the fund held $14.25 billion in net assets. Inside that conservative portfolio, Strategy’s Bitcoin-linked paper has established a beachhead.

The ETF disclosed a position of approximately $210 million in Strategy’s STRC. It holds another ~$260 million across STRF, STRK, and STRD. In total, BlackRock’s ETF exposure to Strategy preferreds sits at roughly $470 million (or 3.3% of the total fund).

Valentin Kosanovic, a deputy director at Capital B, views this as a watershed moment for digital credit.

According to him:

“This is another clear, factual, unquestionable demonstration of the materialization of the wave of institutionalized legacy BTC-pegged financial products.”

Risks?

The machinery required to sustain these dividends creates a unique set of risks. Strategy is not paying these yields from operating profits in the traditional sense. It is funding them through the capital markets.

The company’s prospectus for STRC states that cash dividends are expected to be funded primarily through additional capital raising, including at-the-market stock offerings.

This creates a circular dependency: Strategy sells securities to buy Bitcoin and then pays dividends on those securities.

Considering this, Michael Fanelli, a partner at RSM US, highlighted several risks associated with this model, including Bitcoin price crashes, the lack of insurance coverage, and the fact that the products are unproven in recessions. He also noted that the perpetual products have no maturity date.

However, Bitcoin analyst Adam Livingston countered that the products are a “mind-bender” for traditional analysts. He argued that “STRC is quietly turning Strategy into a private central bank for the yield-starved world.”

According to him:

“STRC is a coupon-bearing ‘credit rail’ that can absorb fixed-income demand, convert it into BTC at scale, then feed the equity premium that makes the next raise easier, cheaper, and faster. That is a flywheel with a bid inside it.”

The post Strategy just crossed 700k BTC but its “circular” Bitcoin funding loop risks a massive high-yield credit disaster appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Seventeen years of untouched Bitcoin outweighs any single week of tariffs, sell-offs, or headline-driven volatility.

Seventeen years of untouched Bitcoin outweighs any single week of tariffs, sell-offs, or headline-driven volatility. It's an interesting time for M traders everywhere right now.

It's an interesting time for M traders everywhere right now. https://beincrypto.com/feed/

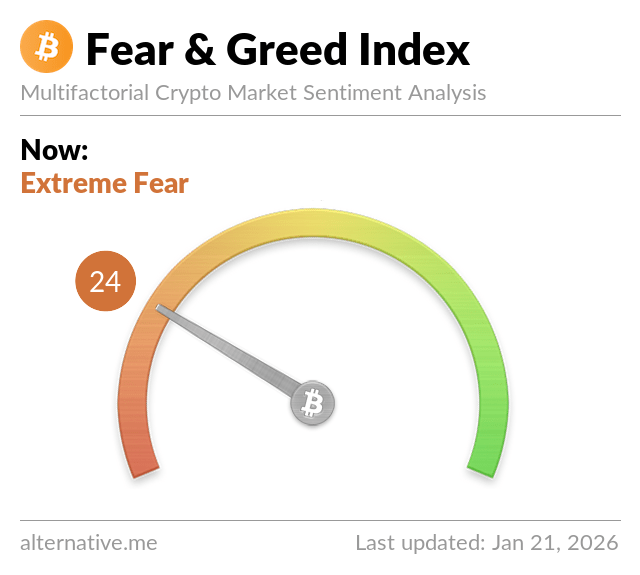

The Crypto Fear and Greed Index fell to 24 on January 21, 2026, signaling a sharp return to extreme fear after briefly entering greed territory last week.

Market sentiment has deteriorated sharply as cryptocurrencies face another major drawdown amid escalating geopolitical tensions.

Crypto Market Sentiment Collapses Into Extreme Fear

BeInCrypto reported earlier this week that President Trump’s tariff threats against the European Union sparked a wider market sell-off, weighing heavily on risk assets. The pressure intensified on Tuesday.

Speaking at Davos, US Treasury Secretary Scott Bessent reaffirmed the Trump administration’s readiness to deploy tariffs as a primary geopolitical tool, a stance that further unsettled global markets.

BeInCrypto Markets data showed that Bitcoin (BTC) fell below the $90,000 level, even briefly dipping under $88,000. Ethereum (ETH) also dropped under $3,000.

The overall sell-off erased more than $120 billion from the total cryptocurrency market capitalization over the past 24 hours.

Derivatives markets reflected the severity of the move, with widespread forced liquidations. More than 182,000 traders were liquidated in the past day, pushing total liquidations to $1.08 billion. Long positions accounted for $989.9 million of the losses.

The sharp sell-off has also weighed heavily on investor sentiment. The Crypto Fear and Greed Index dropped to 24 today. This marks a return to extreme fear after the market reached greed territory at 61 just last week, on January 15.

“Risk-off is back. Capital is running for safety,” a market watcher wrote.

The index provides a broad snapshot of crypto market psychology. It aggregates data from multiple factors, including volatility, market volume and momentum, social media activity, Bitcoin dominance, and Google Trends.

Analysts Weigh In as Crypto Confidence Weakens

In a post on X (formerly Twitter), analyst Rex said investor interest in the sector has deteriorated to the point of widespread apathy. The current mood seems even more worrying because it’s driven not only by price but by growing disillusionment with crypto’s long-term narratives.

The analyst noted that even long-time crypto participants are increasingly shifting their focus to stocks and commodities. This indicates a loss of confidence rather than just a temporary lull.

“No one wants to make angel investments in this space, no one believes any of the bullshit narratives.. No one cares anymore. It literally can’t get any worse for sentiment than right now.. Bottom of the COVID crash people still believed in this industry, what we have now is worse,” the post read.

Nonetheless, some investors remain confident about a comeback. Analyst Doc suggested that sentiment at Bitcoin’s actual bottom will likely be worse than after the FTX collapse, even if the current drawdown is smaller.

This conviction is based on the belief that cryptocurrency remains a powerful asymmetric investment, with long-term upside outweighing downside risk despite prevailing pessimism.

“I’m not a big predictions guy, but if I had to pick one- sentiment at the actual BTC bottom will be worse than post-FTX despite the bitcoin drawdown not even coming close to 2022 and crypto will once again be the best asymmetric bet in capital markets. That’s why I’m staying,” he noted.

Looking ahead, market direction will likely hinge on how macroeconomic and geopolitical developments evolve in the coming weeks. Until clarity emerges, volatility may remain elevated and sentiment fragile.

The post Extreme Fear Replaces Greed in Crypto Market After $120 Billion Drawdown appeared first on BeInCrypto.

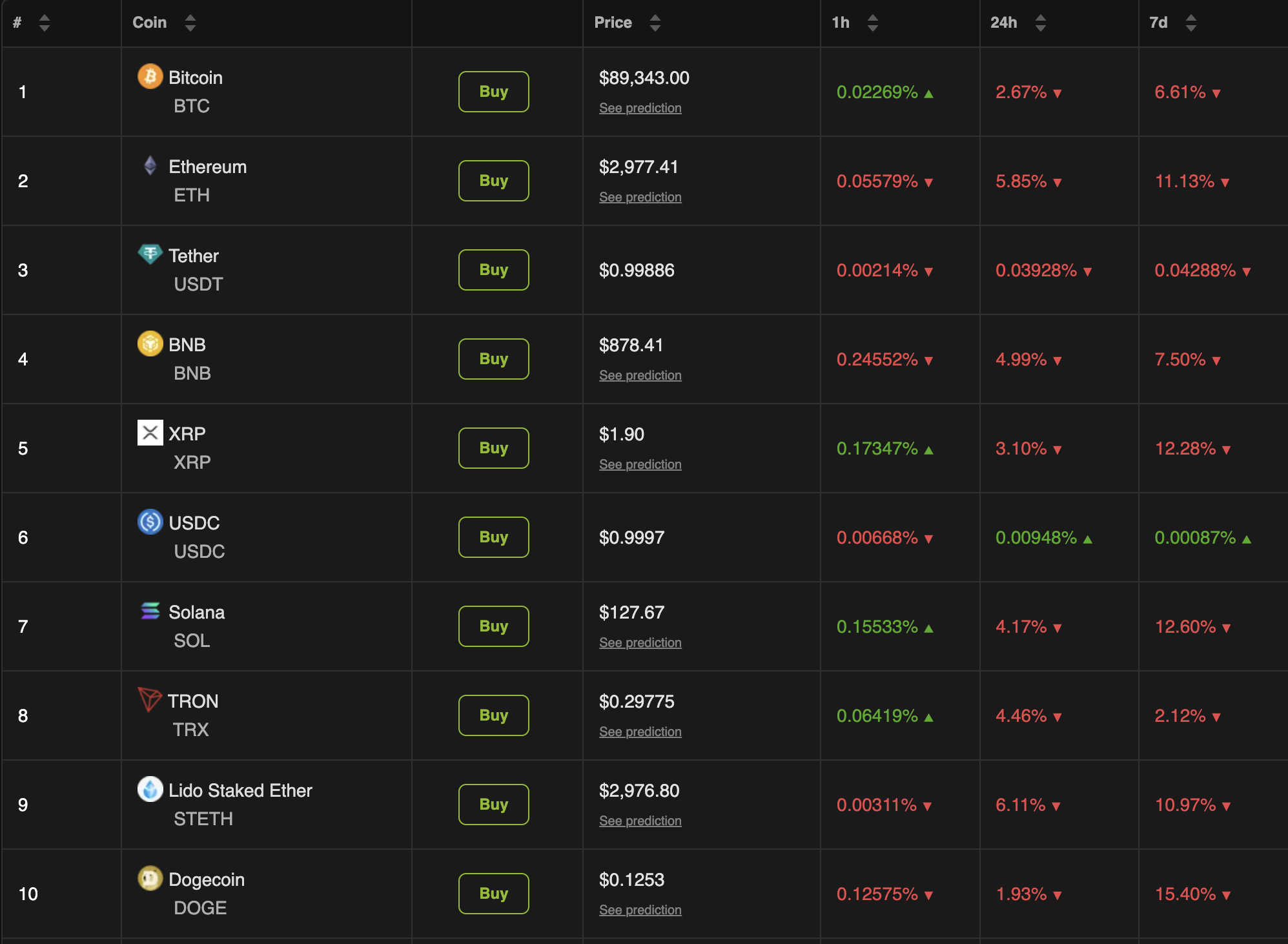

The Bitcoin price has extended its pullback. BTC is down roughly 3% over the past 24 hours and about 6.6% over seven days, slipping below $90,000 and pushing the $100,000 target further away.

Still, this drop is not breaking new ground. Similar pullbacks have appeared before, and in those cases, Bitcoin rebounded once key technical conditions aligned. This time, the setup again hinges on momentum exhaustion and a reclaim of critical moving averages.

Hidden Divergence and EMA Reclaim Define the Rebound Setup

The rebound thesis starts with momentum.

On the 12-hour chart, Bitcoin is showing a hidden bullish divergence. Between mid-December and late January, the BTC price formed a higher low while the Relative Strength Index, or RSI, made a lower low. RSI measures momentum by comparing recent gains and losses. When RSI weakens, but price holds structure, it often signals that selling pressure is slowing.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That momentum shift matters because it sets the stage for the next technical trigger: the exponential moving averages.

On the daily chart, Bitcoin recently lost both the 20-day and 50-day exponential moving averages. An EMA is a moving average that gives more weight to recent prices, making it useful for spotting early trend changes.

Since June 2025, Bitcoin has followed clear fractals. Each time price reclaimed and held the 20-day and 50-day EMAs after a pullback, it rallied sharply.

Late June saw a 16.9% move.

Late September produced 11.7%.

Early January delivered 10%.

If the RSI stabilization leads to a rebound that reclaims the 20-day and 50-day EMAs, the same historical expansion range still applies. From current levels, that keeps a move toward $100,000 mathematically intact. But are on-chain metrics supporting the technicals?

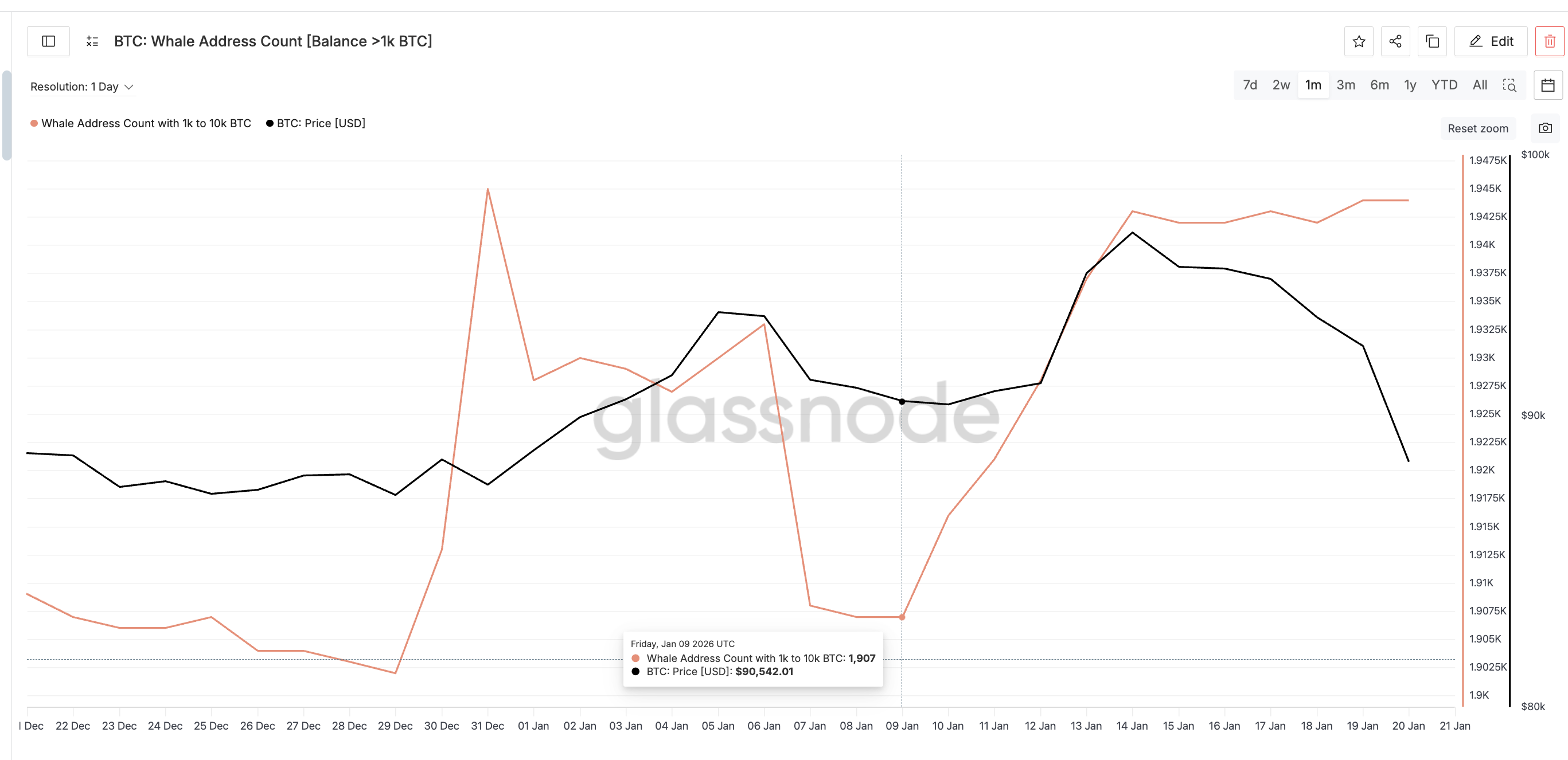

Whales Hold Steady While Long-Term Holders Cap the Price

On-chain data explains why the rebound has not started yet.

Whale behavior remains constructive. Addresses holding between 1,000 and 10,000 BTC have not declined since January 14. Even as prices pulled back, whale counts stayed flat to slightly higher, suggesting large players are not driving the sell-off. Hence, conviction remains.

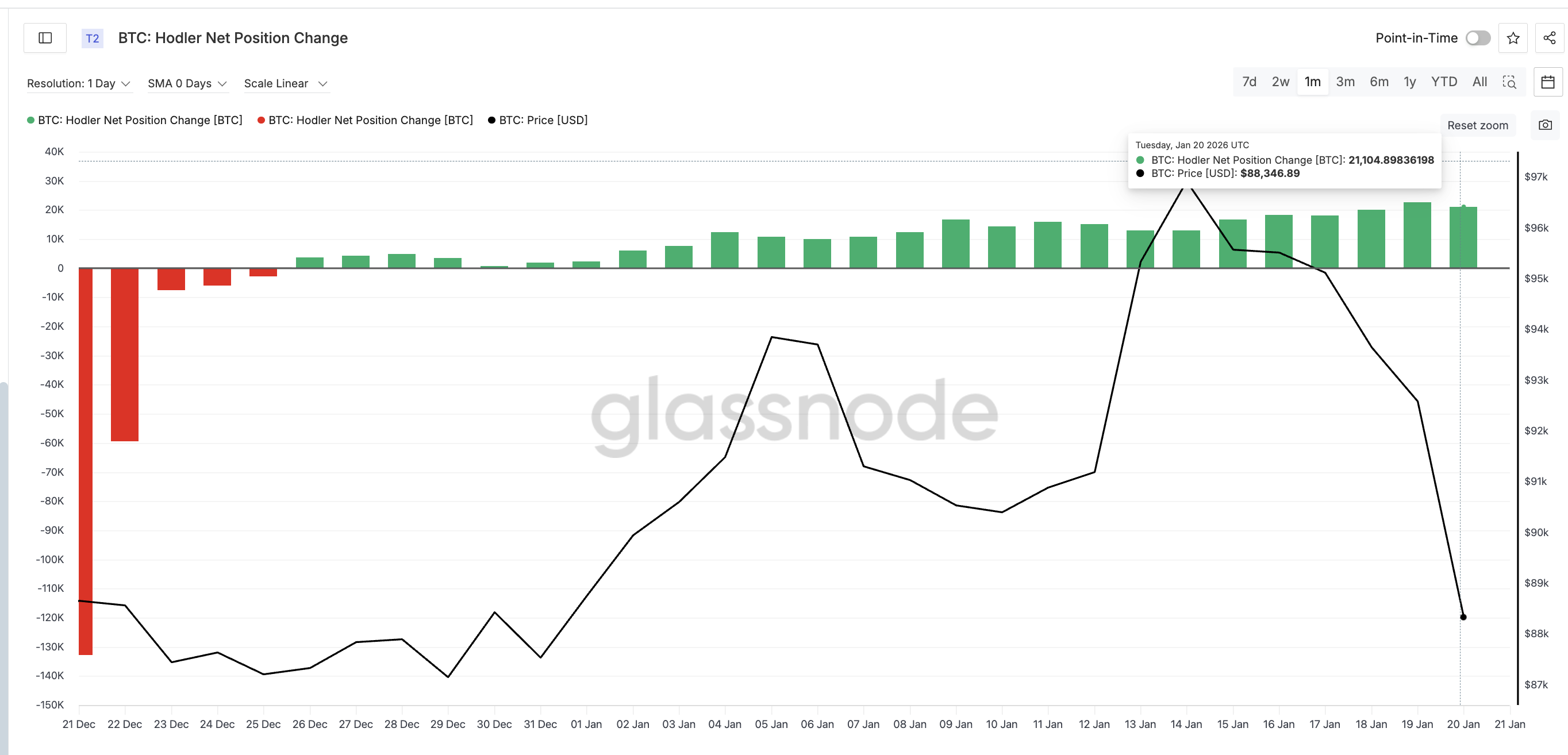

Hodlers are also absorbing supply. Wallets holding Bitcoin for more than 155 days have continued adding coins. Despite the recent drop between January 14 and January 20, this group increased inflows by 62%.

The pressure comes from very long-term holders.

Wallets holding Bitcoin for more than one year have accelerated selling into weakness. On January 14, their net outflows were around 25,700 BTC. By January 20, that figure had expanded to roughly 68,650 BTC. That 167% increase in distribution is the main force preventing the price from lifting cleanly.

In short, whales and hodlers are supporting the price, while very long-term holders are supplying BTC.

The Bitcoin Price Levels That Decide Whether $100,000 Remains in Play

This conflict now gets solved through price action.

On the upside, Bitcoin needs to reclaim $94,390 and $96,420. A daily close above these levels would signal a successful EMA recovery and confirm the rebound structure. If that happens, a move toward $100,000 ($100,240 line) would represent an advance of roughly 12% from the current levels, well within the historical EMA-driven range discussed earlier.

On the downside, $87,830 is critical. A sustained break below this level would weaken the RSI divergence and expose deeper support near $84,350. That outcome would invalidate the rebound thesis and confirm that long-term holder selling remains dominant.

Bitcoin does not need a miracle. It needs momentum confirmation and an EMA reclaim. And it might also need support from the very long-term holders. The EMA reclaim gig might get delayed if they keep selling.

If those align, the same fractal that has worked repeatedly since mid-2025 may still point the way back toward $100,000.

The post $100,000 Still Possible for Bitcoin? Not Miracle, But Historical Fractals Say So appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

On-chain data shows the largest of Chainlink whales have been accumulating recently even as the cryptocurrency’s price has slipped below $13.00.

Top 100 Chainlink Whales Have Been Expanding Their Supply

In a new post on X, on-chain analytics firm Santiment has talked about the latest trend in the holdings of the 100 largest addresses present on the Chainlink network.

This category of holders naturally includes the large whales, investors who carry sums significant enough to have some influence on the blockchain. As such, their combined supply can be worth keeping an eye on.

Below is the chart shared by Santiment that shows the trend in the supply of the 100 largest Chainlink addresses over the last few months.

As displayed in the graph, the Chainlink supply held by the top 100 addresses went up in November as the cryptocurrency’s price plummeted, a possible sign that big-money investors were loading up.

These whales shed some of their holdings in December and the first week of January, but recently, they have showed signs of renewed accumulation as LINK’s price has plunged below the $13.00 level. Compared to the start of November, the cohort’s holdings are up 16.1 million tokens.

“As retail sells off due to impatience & FUD, it’s common to see smart money gather up more $LINK to prepare for (or cause) the next pump,” explained the analytics firm. It now remains to be seen whether this accumulation will have any effect on the cryptocurrency.

Chainlink isn’t the only asset that has seen movements from large investors recently. As Santiment has highlighted in another X post, Bitcoin sharks and whales have participated in net buying over the last nine days.

In the context of BTC, sharks and whales are defined as investors holding between 10 to 10,000 tokens. Below is a chart that shows how the supply of these investors has changed since late July.

As is visible in the graph, the Bitcoin sharks and whales have increased their combined supply by 36,322 BTC in the last nine days, equivalent to an increase of 0.27%. Interestingly, the large investors have held on despite the fact that the asset’s price has gone through a retrace over the past few days.

However, the same hasn’t been true for the opposite end of the market, the retail entities. These investors, corresponding to addresses holding less than 0.01 BTC, have shed 132 BTC (0.28%) in the same window.

LINK Price

At the time of writing, Chainlink is floating around $12.33, down more than 10% in the last seven days.

Dogecoin started a fresh decline below the $0.1280 zone against the US Dollar. DOGE is now consolidating losses and might face hurdles near $0.130.

- DOGE price started a fresh decline below the $0.120 level.

- The price is trading below the $0.1280 level and the 100-hourly simple moving average.

- There is a key bearish trend line forming with resistance at $0.130 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it stays below $0.1300 and $0.1320.

Dogecoin Price Dives Below Support

Dogecoin price started a fresh decline after it closed below $0.1320, like Bitcoin and Ethereum. DOGE declined below the $0.1280 and $0.1220 support levels.

The price even traded below $0.1180. A low was formed near $0.1155, and the price is now showing bearish signs. There was a recovery wave above $0.120. The price climbed above the 23.6% Fib retracement level of the downward move from the $0.1512 swing high to the $0.1155 low.

Dogecoin price is now trading below the $0.1280 level and the 100-hourly simple moving average. If there is a recovery wave, immediate resistance on the upside is near the $0.1280 level.

The first major resistance for the bulls could be near the $0.130 level and the trend line. The next major resistance is near the $0.1330 level or the 50% Fib retracement level of the downward move from the $0.1512 swing high to the $0.1155 low.

A close above the $0.1330 resistance might send the price toward the $0.1375 resistance. Any more gains might send the price toward the $0.140 level. The next major stop for the bulls might be $0.1420.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.1300 level, it could continue to move down. Initial support on the downside is near the $0.1215 level. The next major support is near the $0.120 level.

The main support sits at $0.1150. If there is a downside break below the $0.1150 support, the price could decline further. In the stated case, the price might slide toward the $0.1120 level or even $0.1050 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.1215 and $0.1200.

Major Resistance Levels – $0.1300 and $0.1330.