Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Technical charts highlight improving fundamentals in Bitcoin and select altcoins, but bears selling the range highs and softening investor sentiment threaten to snuff out the recovery.

The US president said he supported the GENIUS Act because it was "politically popular,” but added the main reason was in response to China.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Iran's central bank amassed $507M in USDT to dodge sanctions, using crypto tactics to access offshore liquidity.

The post Iran’s central bank used $500M in Tether to fight FX collapse and evade sanctions appeared first on Crypto Briefing.

Ethereum and Solana are expected to solidify their positions as leading blockchain platforms by 2026. General-purpose blockchain networks will find it challenging to compete with the established network effects of Ethereum and Solana. Solana is gaining favor among developers and consumers, positi...

The post Arnav Pagidyala: Ethereum and Solana will dominate by 2026, Solana’s community culture enhances its ecosystem, and Robinhood is set to surpass Coinbase | Bankless appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Fundstrat’s head of research, Tom Lee, has told investors to prepare for a rough opening to 2026 before conditions improve later in the year. He warned that political friction and tariff talk could trigger meaningful setbacks for both stocks and Bitcoin, even as blockchain and AI remain long-term strengths.

Tom Lee’s Call And The Near-Term Picture

Lee said a more dovish stance from the US Federal Reserve and the end of quantitative tightening set the stage for gains later on.

He put a possible market correction in the mid-teens range, estimating a pullback of about 15% to 20% at one stage.

He pointed to geopolitics — including renewed tariff threats — and rising political divides as brakes on an immediate, broad rally. Reports note he still expects a late-year rebound if policy eases and liquidity returns.

Reports say the White House’s selective support for certain industries could tilt which sectors lead the recovery.

2026 is shaping up to be similar to 2025:

– good fundamentals

– tariff escalations and White House picking “winners and losers” – political divisiveness – tailwinds from AI and blockchain BUT: dovish Fed now and QT over

And so a painful decline may lie ahead but we would… https://t.co/7Mp3rcOcP1

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) January 20, 2026

Deleveraging Still Hitting Crypto Liquidity

Lee argued that recent squeezes have left crypto markets fragile. Market makers have been weakened by repeated forced exits, and that has made price moves jumpier.

He also noted that a fresh Bitcoin all-time high would be an important signal that the market has worked through those stresses, though he didn’t repeat earlier extreme price targets in his latest remarks.

Reports stress the difference between a technical bounce and a move backed by wider adoption and deeper institutional flows.

Despite warnings that a painful decline may still unfold, some investors are not backing away entirely. Reports say parts of the market continue to view sharp pullbacks as buying chances rather than exit signals.

Even with uncertainty around tariffs and global politics, Lee and his camp believes disciplined dip buying — spread out over time — offers better odds than trying to time a perfect bottom while fear dominates headlines.

“And so a painful decline may lie ahead but we would ‘buy the dip'”, Lee said in an X post.

Reports indicate that more than $1.8 billion was liquidated over a 48-hour stretch as bitcoin lost ground.

Bitcoin sank to roughly $88,500 during the slide, and Coinglass data showed the bulk of wiped positions were longs — a sign that traders had been positioned for higher prices.

The selloff erased gains made earlier in the year and pulled crypto capitalization sharply lower, in one of the biggest drops since mid-November.

Featured image from Allrecipes, chart from TradingView

A decade-old report from the World Economic Forum (WEF) is resurfacing in the crypto space, highlighting early recognition of Ripple and XRP’s potential in the banking sector. Analysts say the document illustrates how decentralized networks like Ripple may allow institutions to settle payments faster and more directly in the future.

WEF Spotlights Ripple For Settlement Case Study

A crypto market analyst identified as ‘SMQKE’ on X recently revived a 2015 WEF report, sparking fresh discussions in the crypto community. The document explores how traditional banks could interact with emerging payment technologies, and it specifically mentions the company as a system capable of transforming interbank settlement.

The WEF report revealed that, as alternative payment methods, such as decentralized networks, grow in popularity worldwide, banks have the opportunity to integrate them into their services. By adopting these technologies, institutions can make it easier for customers to move value in and out of non-traditional networks while also exploring new financial products. Ripple is cited as an example of a protocol that could serve as one of these alternative rails.

Beyond customer use, these networks can also improve how banks operate internally. By leveraging non-traditional networks, banks could streamline processes and offer smoother, faster products and services. Ripple’s protocol, for instance, enhances this process by enabling real-time settlement between banks, eliminating the need for traditional clearinghouses or correspondent banks.

A case study in the WEF report focuses on German-based Fidor Bank, an online full-service bank that implemented the payment firm for its internal settlement operations in 2014. According to the World Economic Forum, broader adoption of Ripple could enable other banks to settle payments instantly with one another. This early example demonstrates how the crypto payments company was already seen as a practical tool for improving banking efficiency.

Though the WEF report is over a decade old, its insights remain relevant as financial institutions continue exploring blockchain-based payment solutions. Notably, this is not the first time the World Economic Forum has mentioned Ripple in its reports. In its May 2025 report, the international organization highlighted Ripple and the XRP Ledger (XRPL) as key technologies in the future of asset tokenization.

How XRP Fits In The Bank Settlement Scheme

As the native token of the XRP Ledger (XRPL), XRP is designed to serve as a digital bridge for fast, low-cost cross-border payments between financial institutions. By leveraging XRPL, Ripple enables banks and payment providers to settle transactions in seconds rather than days.

Due to its high throughput and ability to handle large transaction volumes with minimal effort, the XRP Ledger appears well-suited for the demands of modern banking. Its efficiency and speed have led many to compare Ripple to SWIFT, the long-standing messaging network used by banks worldwide for international transfers.

https://cryptoslate.com/feed/

Canada's Prime Minister, Mark Carney, walked onto the World Economic Forum's Davos stage yesterday and said the quiet part out loud.

The rules-based order, the thing leaders love to invoke when they want the world to behave, is fading.

Carney called it a “pleasant fiction.”

He said we are living through a “rupture.”

He said great powers are using integration as a weapon, tariffs as leverage, finance as coercion, and supply chains as vulnerabilities to be exploited.

Then he reached for Václav Havel’s famous “greengrocer” from The Power of the Powerless, the shopkeeper who hangs a sign reading “Workers of the world, unite!” not because he believes it, but because he knows the ritual matters more than the words. It’s Havel’s shorthand for life under a system where everyone performs loyalty in public, even as they quietly recognize the lie.

He told the room, “It is time for companies and countries to take their signs down.”

The Davos audience cheered and clapped in response.

Perhaps, one can argue that they are trained to nod along. This week, they have extra reasons.

The talk around town has been about tariffs and coercion, and whether allies are about to be treated like revenue lines.

The mood is tied to President Trump escalating pressure around Greenland and tariff threats against European partners, a story that keeps resurfacing across conference chatter and the news cycle.

Carney’s slot was listed as a “Special Address” in the WEF run-up. His message landed in a room already primed for it.

Here is the part crypto people should not miss: when geopolitics becomes transactional in public, money stops being background infrastructure and starts feeling like a border.

That shift changes what people pay for.

It changes what investors store value in. It changes what counts as a safe option.

Bitcoin sits right in the middle of that feeling.

Not because it suddenly becomes a global settlement rail for trade invoices. It probably does not.

Not because it replaces the dollar in a clean, straight line. It almost certainly does not.

Bitcoin matters because it offers an option: a credible outside asset that is hard to block, hard to rewrite, and hard to gate behind somebody else’s permission.

In a stable world, that sounds ideological. In a rupture world, it starts to sound like risk management.

Carney even used the language of risk management. He said this room knows it. He said insurance costs money, and the cost can be shared.

Collective investments in resilience are cheaper than everyone building their own fortresses.

That is the Davos version of a truth every investor learns early: concentration risk feels fine until the day it does not.

The human part of this story, the moment you realize access can be conditional

Most people do not wake up wanting a new monetary system.

They wake up wanting their salary to clear, their bank transfer to arrive, their business to keep trading, and their savings to keep meaning something next year.

They also have a moment, sometimes it is a headline, sometimes it is a blocked payment, sometimes it is a currency shock, when they realize access can be conditional.

Carney’s speech is basically a map of how those moments multiply.

He talked about tariffs used as leverage.

He talked about financial infrastructure as coercion.

He talked about supply chains exploited as vulnerabilities.

“Over the past two decades, a series of crises in finance, health, energy and geopolitics have laid bare the risks of extreme global integration. But more recently, great powers have begun using economic integration as weapons, tariffs as leverage, financial infrastructure as coercion, supply chains as vulnerabilities to be exploited.

You cannot live within the lie of mutual benefit through integration, when integration becomes the source of your subordination.”

That is what a “rupture” feels like in everyday terms. Your costs move because of a speech in another capital. Your suppliers disappear because of a sanctions package. Your payment route gets slower because a bank somewhere decides your jurisdiction is riskier this month.

Even if you never touch crypto, that environment changes the way you value optionality.

Bitcoin is optionality with teeth.

It is not magic.

It does not make geopolitics disappear.

It does not exempt anyone from laws.

It does not stop volatility.

It does one simple thing: it exists outside most of the chokepoints that make modern finance such an effective tool of state power.

That is why this moment matters more than a single Davos speech.

Two Bitcoins show up in markets, the insurance one, and the liquidity one

If you want to talk about Bitcoin under a changing world order without slipping into slogans, you have to admit something that makes true believers uncomfortable.

Bitcoin has two personalities in markets.

- One is the insurance asset. People buy it because they worry about the rails, the long term, the shape of the world, and the rules. They want something that can move across borders as information.

- The other is the liquidity asset. In sudden shocks, Bitcoin trades like the thing that gets sold when people need dollars now.

That second personality is why “rupture” headlines can produce weird price action. The macro story gets scarier, and Bitcoin drops anyway.

The immediate response is a dollar grab: credit tightens, leverage unwinds, risk gets sold first, and questions get asked later.

There's a sequence: squeeze first, repricing later.

Tariffs as leverage, why the first wave can hurt Bitcoin, then help its story

Tariffs are more than a tax; they are a signal.

They tell markets the temperature of international relationships, they tell companies how stable their cost base will be, and they tell central banks how messy inflation might get.

This is where Carney’s argument about weaponized integration connects directly to Bitcoin’s near-term and long-term path.

If the latest tariff threats escalate into real measures, companies reprice supply chains, consumers see price pressure, and policymakers face uglier trade-offs.

The JPMorgan framing around tariffs is a reminder that they are not just politics. They are a macro variable that shows up in growth, inflation, and confidence.

In the first phase, markets often do what markets do. They go defensive, they prefer cash, they prefer the most liquid collateral, and they chase dollars.

Bitcoin can get dragged lower with everything else.

Then the second phase arrives.

Businesses and households realize this is not a one-off. They start paying for resilience. They diversify, build redundancy, and look for assets that sit outside the obvious pressure points.

That is where Bitcoin’s insurance narrative gains weight. Not everyone becomes a Bitcoin maximalist because they read the Bitcoin Whitepaper, but because a larger share of capital starts treating optionality as worth paying for.

Financial infrastructure as coercion, stablecoins live on the rails, Bitcoin sits outside them

Carney’s line about financial infrastructure matters because it points to the part of the crypto stack most people misunderstand.

Stablecoins are crypto, and stablecoins are also the dollar’s long arm.

They move fast, they settle cheaply, and they make cross-border value transfer easier. They also live inside an ecosystem of issuers, compliance, blacklists, and regulatory chokepoints.

That is beyond a moral judgment. It is the design, and it is also why stablecoins can scale.

In a world where financial infrastructure becomes more openly coercive, stablecoins can feel like a superhighway with more toll booths.

Bitcoin feels like a dirt road that still gets you out. That distinction becomes more important as countries and blocs start building their own resilience stacks.

Carney called it variable geometry: different coalitions for different issues. He talked about buyers’ clubs for critical minerals, bridging trade blocs, and AI governance among like-minded democracies.

You can see the same logic in the policy world around defense procurement, including Europe’s SAFE push.

It is about capacity, coordination, and optionality. Crypto will get pulled into that same orbit.

Some blocs will prefer regulated, surveilled rails. Some will build their own. Some will restrict foreign dependencies. Some will quietly keep a foot in every camp.

Bitcoin’s role in that environment is leveraged through existence.

If you can exit, even imperfectly, coercion becomes costlier to apply.

Middle powers, “third paths,” and why Bitcoin’s biggest impact might be psychological

Carney’s speech is a manifesto for middle powers: countries that cannot dictate terms alone, and that get squeezed when great powers turn the world into a bilateral negotiation.

He said negotiating alone with a hegemon means negotiating from weakness. He said middle powers have a choice: compete for favor, or combine to create a third path.

That is a geopolitical argument.

It also rhymes with what Bitcoin represents in finance.

Bitcoin is a third-path asset.

It is not the hegemon’s money. It is not a rival’s money. It is not a corporate ledger. It is not a treaty.

That matters most when trust is thin and alignment is messy, when alliances feel conditional, and when sovereignty sounds less like a principle and more like something you have to finance.

Carney stood with Greenland and Denmark in his remarks.

He opposed tariffs over Greenland, and called for focused talks on Arctic security and prosperity.

You do not have to take a view on Greenland to see the pattern. Trade tools are being discussed as leverage among allies in public.

When that happens, every CFO, every pension committee, every sovereign fund, and every household with savings gets a little more serious about tail risks.

That is what matters for us, the slow shift in what feels safe.

US President Donald Trump, speaking today, asserted that he “would not use force” to take Greenland but reiterated that he does still want to purchase the “big block of ice.” He reaffirmed that he expects Europe to support the purchase for world security reasons, but if it refuses, “the US will remember.”

Three forward scenarios for Bitcoin by 2030, “managed fragmentation,” “tariff spiral,” “rails fracture”

Carney called this a rupture.

He also warned against a world of fortresses and argued for shared resilience. Those are two different futures, and Bitcoin’s path looks different in each.

1) Managed fragmentation

Blocs form, standards diverge, and trade routes adjust. Coercion exists, but it stays bounded because everyone realizes escalation is expensive.

Bitcoin in this world trends upward as a portfolio's final insurance policy. Volatility remains.

Correlation to liquidity cycles remains. The structural bid grows because the world keeps paying for optionality.

2) Tariff spiral and dollar squeeze

Tariffs escalate, and retaliation follows.

Inflation uncertainty rises, central banks stay tight longer, and risk assets get hit. A dollar squeeze shows up.

Bitcoin here can look disappointing in the moment.

Price falls with leverage unwinds, narratives get mocked, then policy eventually shifts, liquidity returns, and the underlying reason people want an exit option becomes stronger.

3) Rails fracture

Financial coercion expands. Secondary sanctions and controls become more common. Cross-border payments get more politicized.

Some countries build parallel settlement stacks, some companies reroute exposure, and everyone pays more for friction.

Bitcoin’s insurance value is highest in this world because the cost of conditional access is highest.

Stablecoins still matter for commerce. Bitcoin matters for reserve optionality, for portability, and for the ability to move value when doors close.

This is also where regulation gets harsher. A fractured world tends to be a more suspicious world, and the easiest thing for states to tighten is anything that looks like capital flight.

Bitcoin’s upside here exists alongside higher enforcement pressure. That tension becomes part of the story.

The quiet tell, even Davos is arguing about resilience, not efficiency

The old globalization story was efficiency: just-in-time supply chains, single-point optimization, and frictionless capital.

Carney’s speech is about resilience, redundancy, shared standards, and variable coalitions.

And it is happening at Davos, the temple of integration. That is the tell. Even the “rules-based order” language is changing in public.

The WEF theme is still cooperation. The framing is still dialogue. And the agenda is full of resilience talk because the room knows the bargain Carney described is under strain.

Outside Davos, the news cycle reinforces the point.

The UN Security Council is still extending reporting around Red Sea attacks, reminding everyone that shipping lanes are strategic terrain. The UN record captures how persistent that risk remains.

The Venezuela tanker seizures covered by AP show hard power and economic control blending in the Western Hemisphere, too.

Le Monde’s report on a US-Taiwan deal around advanced chips and tariffs shows how industrial policy and trade are merging, even in sectors that used to be treated as pure economics.

Bitcoin does not cause any of this.

And it does not solve it.

It becomes more relevant because the world is changing around it.

What to watch next, five signals that the rupture thesis is becoming investable

A watchlist to remain alert:

- Tariff implementation dates, and whether threats turn into policy. The Greenland-linked tariff reporting is one real-time test.

- Signs of allies building redundancy stacks: defense procurement coordination, trade bridges, critical-minerals buyers’ clubs, and the policy plumbing that makes “shared resilience” real.

- Cross-border payments politics. Any move that makes access more conditional increases demand for outside options, and also increases pressure on crypto on-ramps.

- Energy and shipping risk. The Red Sea remains a live variable.

- Bitcoin’s behavior during stress. If it sells off first and rebounds when policy shifts, that fits the two-personality model. If it starts holding up during shocks, that signals the insurance bid is getting deeper.

The point Carney made, applied to Bitcoin

Carney’s speech was a warning about pretending, about “living within a lie,” about acting like the old system still works as advertised.

For Bitcoin, the parallel is simpler. People have treated money as plumbing for decades. They are starting to treat it like a geopolitical instrument again.

In that world, Bitcoin becomes easier to understand.

Not as a promise. Not as a religion. And not as a straight-line trade.

It becomes what it has always been underneath the hype: a volatile, imperfect, stubborn form of financial optionality.

A way to keep one window open when more doors start coming with terms and conditions.

The post Bitcoin is now your only lifeboat as Canada says the current world order is merely a “pleasant fiction” appeared first on CryptoSlate.

Ethereum is currently reporting the highest daily network growth in its history, a statistical surge that ostensibly signals a massive return of user activity.

Over the past week, the Ethereum mainnet processed 2.9 million transactions, a new all-time high according to Token Terminal data.

This activity was accompanied by a sharp jump in daily active addresses, which rose to approximately 1.3 million from roughly 0.6 million in late December.

Critically, this explosion in throughput has occurred while transaction costs have remained negligible. Average transaction fees have stayed in the “pennies” range of $0.10 to $0.20 despite the record demand.

For a network that historically saw fees spike between $50 and $200 during the 2021-2022 NFT boom, this represented a fundamental shift in economic accessibility.

However, forensic analysis suggests this growth is not entirely organic. While surface metrics indicate a bull-market revival, security researchers warn that a significant portion of this traffic is driven by malicious actors.

These attackers are exploiting the network's newly lowered fees to launch industrial-scale “address poisoning” campaigns, targeting users with automated scams disguised as legitimate activity.

The scaling context

To understand the sudden spike in volume, one must look at the recent structural changes to the Ethereum protocol. For years, the network was powerful but economically unusable for most people.

Leon Waidmann, head of research at the Onchain Foundation, pointed out that since he entered crypto, Ethereum mainnet fees were simply too high for the average user.

He noted the network was too expensive for retail, too expensive for frequent usage, and too expensive to build consumer-scale apps.

However, that changed about one year ago when Ethereum developers methodically scaled the network while attempting to protect decentralization and security.

This led to three major protocol upgrades that advanced the roadmap.

The first was the May 2025 “Pectra” upgrade, which increased blob capacity by raising the target blobs per block from 3 to 6 and the max from 6 to 9. This effectively doubled expected blob throughput.

Then, the network's “Fusaka” upgrade followed in December 2025, shipping Peer Data Availability Sampling (PeerDAS). This allowed validators to verify blob availability via sampling rather than downloading the entire dataset, enabling higher throughput while keeping node requirements reasonable.

Most recently, the Blob Parameter-Only (BPO) fork in January 2026 raised the blob target from 10 to 14 and the max to 21. These pragmatic updates were designed to unlock significant capacity for the blockchain network.

The economic effects of these upgrades became apparent quickly as the network's mainnet fees dropped sharply, and simple transactions became cheap again.

Waidmann pointed out that building directly on Layer 1 became viable at scale, prompting prediction markets, real-world assets, and payments to move back to the mainnet.

At the same time, stablecoin transfers on the network reached approximately $8 trillion in the fourth quarter.

Ethereum's record activity is not adding value

While the record activity shows signs of a blockchain in the ascendancy, on-chain data suggest that these activities have not added real value to the network.

Data from Alhpractal shows that the Metcalfe Ratio, which compares market capitalization to the square of the number of active users, is declining. This indicates that valuation is not keeping pace with real network adoption.

Additionally, Ethereum's Adoption Score is currently at level 1, the lowest tier in its historical range. This reflects a cold market, with valuation relative to on-chain activity low.

Considering this, Matthias Seidl, the co-founder of GrowThePie, suggested that the network's activity increase might not be organic.

He cited the example of a single address receiving 190,000 native ETH transfers from 190,000 unique wallets in a single day.

Seidl noted the number of wallets receiving native transfers is relatively stable, but the number of wallets sending native transfers increased a lot (2x). He highlighted that many native transfers (sending vanilla ETH) use only 21,000 gas, the cheapest form of EVM transaction.

These are currently accounting for almost 50% of all transactions. In comparison, sending an ERC20 token costs roughly 65,000 gas, and one stablecoin transfer needs as much gas as three native ETH transfers.

Address poisoning?

Meanwhile, Ethereum’s latest burst of on-chain activity is being traced to an old scam, repackaged for a cheaper-fee era.

Security researcher Andrey Sergeenkov noted that a wave of address-poisoning campaigns has been exploiting low gas costs since December, inflating network metrics while seeding transaction histories with lookalike addresses designed to trick users into sending real funds to attackers.

The mechanics of these attacks are simple: scammers generate “poisoning” addresses that resemble a target’s legitimate wallet address by matching the first and last characters. After a victim completes a normal transfer, the attacker sends a small “dust” transaction to the victim so the spoofed address appears in their recent history.

The bet is that, at some later point, the user will copy the familiar-looking address from their activity feed without verifying the full string.

Considering this, Sergeenkov ties the surge in new Ethereum addresses to that playbook. He estimates new address creation ran about 2.7 times the 2025 average, with the week of Jan. 12 peaking at roughly 2.7 million new addresses.

When he decomposed the flows behind the growth, he concluded that roughly 80% was driven by stablecoin activity rather than organic user demand.

To test whether this looked like poisoning, Sergeenkov looked for a telltale signature: addresses that received a sub-$1 stablecoin transfer as their first interaction.

By his count, 67% of the new addresses fit that pattern. In absolute terms, he found 3.86 million out of 5.78 million addresses received “dust” as their first stablecoin transaction.

He then narrowed the search to the senders: accounts moving less than $1 of USDT and USDC between Dec. 15, 2025, and Jan. 18, 2026.

Sergeenkov counted unique recipients for each sender and filtered for those distributing to at least 10,000 addresses. What surfaced, he says, were smart contracts designed to industrialize the campaign. These are codes that can bankroll and coordinate hundreds of poisoning addresses in a single transaction.

One contract he reviewed included a function labeled `fundPoisoners`, which, in his description, disperses stablecoin dust and a small amount of ETH for gas to a large batch of poisoning addresses at once.

Those addresses then fan out, sending dust to millions of potential targets to manufacture misleading entries in wallet transaction histories.

The model relies on scale as most recipients will never fall for it, but the economics work if a tiny fraction do.

Sergeenkov pegs the effective conversion rate at around 0.01%, implying the business is built to tolerate extreme failure rates. In the dataset he analyzed, 116 victims collectively lost about $740,000, with one loss accounting for $509,000 of that total.

The gating factor has historically been cost. Address poisoning demands millions of on-chain transactions that do not directly generate revenue unless a victim mis-sends funds.

Sergeenkov argues that, until late 2025, Ethereum network fees made the mass-send strategy harder to justify. However, with transaction costs roughly six-fold lower, the risk-reward calculus shifted sharply in favor of the attacker.

Considering this, Sergeenkov argued that scaling Ethereum throughput without hardening its user-facing safety has created an environment where “record” activity can be indistinguishable from automated abuse.

In his view, the industry’s obsession with headline network metrics risks masking a darker reality in which cheaper blockspace can easily subsidize mass-targeted scams as legitimate adoption, leaving retail users to bear the loss.

The post How an industrial-scale scam is driving Ethereum transactions to record highs because of cheap gas fees appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Solana Mobile, Trump Media and Pump.fun have also announced new projects and milestones.

Solana Mobile, Trump Media and Pump.fun have also announced new projects and milestones. What's next for USOR after a 98% crash?

What's next for USOR after a 98% crash?https://beincrypto.com/feed/

Zcash has officially confirmed a bearish breakdown. The price lost a major long-term trendline and activated a technical pattern that points to a potential 34% downside move. Under normal conditions, that kind of confirmation attracts aggressive sellers. Instead, the opposite happened. Large holders stepped in, exchange balances dropped sharply, all while the leverage positioning became heavily skewed to the short side, with bears expecting more downside.

That combination rarely appears during clean breakdown moves. It usually appears when the market is setting up to punish one side of the trade.

A Confirmed Breakdown After Losing a Critical Trend Level

From a technical perspective, the breakdown is real.

Zcash is still down roughly 55% from its early November peak near $745. More importantly, the ZEC price has now lost the 100-day exponential moving average (EMA). An EMA is a trend indicator that gives more weight to recent prices, making it useful for spotting shifts in market direction.

This level mattered before. In early December, Zcash briefly dipped below the 100-day EMA, then reclaimed it the next day. That reclaim triggered a sharp 71% rally. This time, the level has not been reclaimed yet, keeping the broader trend pressure bearish.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On the 12-hour chart, Zcash also confirmed a head-and-shoulders breakdown on January 20. This is a reversal pattern that forms after an uptrend and typically signals a deeper move lower once the neckline breaks. The measured downside from this structure points to a roughly 34% decline, which is now supposedly active.

Technically, bears have what they want. The reaction afterward is what makes this setup unusual.

Buying Appears After Weakness, Not Before It — But Why

On-chain data explains why the breakdown response matters.

Exchange balance tracks how many coins are held on trading platforms. Rising balances usually suggest selling pressure, while falling balances suggest coins are being moved into private wallets for holding.

During the breakdown itself, exchange balances rose, showing active selling. That fits the bearish narrative.

Then the behavior flipped.

Over the next 24 hours, exchange balances dropped by roughly 17%. At the same time, large holders increased exposure. Whale wallets added about 2.44% to their holdings, while the top 100 addresses (mega whales) expanded their positions by nearly 4%.

This is accumulation after confirmation, not speculative dip buying ahead of it.

When large holders buy into confirmed weakness, they are usually positioning for either a fast reclaim of key levels or a volatility event driven by forced liquidations. Derivatives data strongly supports the second scenario.

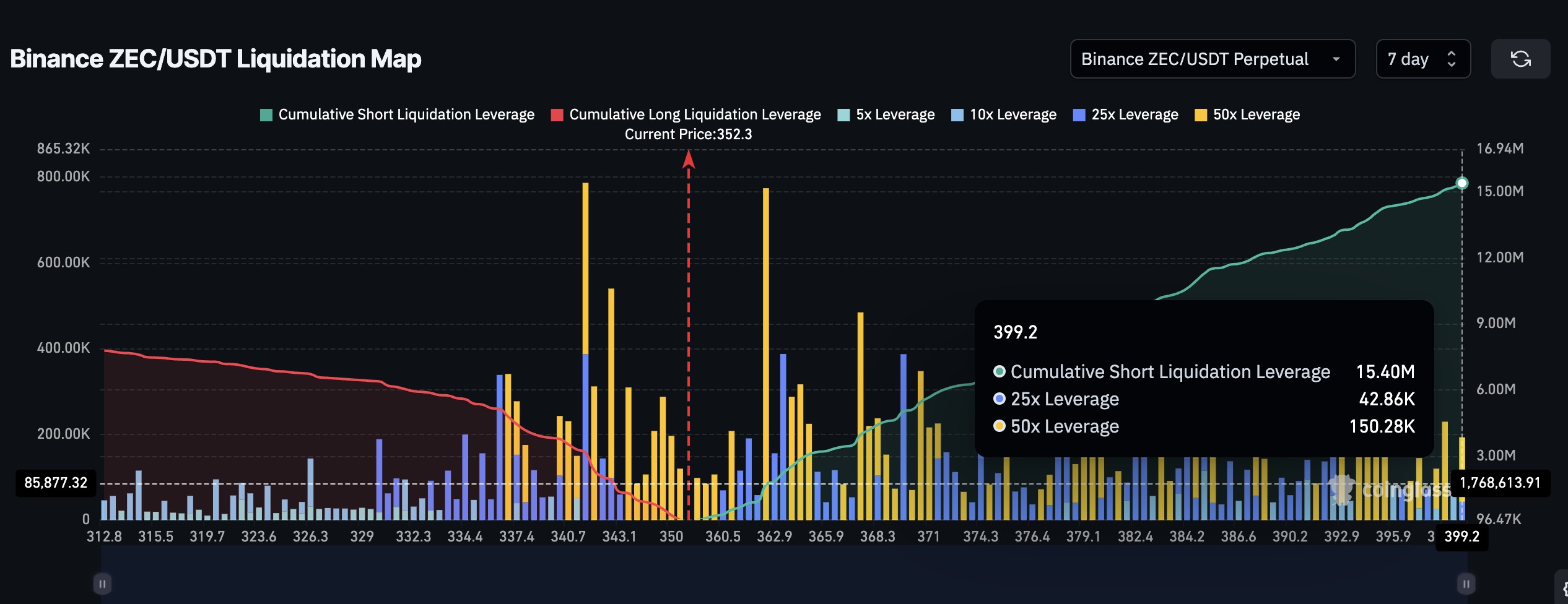

Short Positioning Creates the Conditions for a Squeeze With Key Zcash Price Levels In Focus

The liquidation map shows where leveraged traders would be lose out if the price moves against them.

Liquidation levels represent price zones where traders using leverage would be automatically closed by exchanges. When many positions cluster on one side, price moves toward those levels can accelerate quickly.

For Zcash, short liquidation exposure over the coming days sits near $15.4 million, while long liquidation exposure is closer to $7.8 million. That means the market is heavily tilted toward short bets, nearly a 2:1 short bias.

This imbalance matters. Zcash does not need a trend reversal to cause damage. Even a moderate bounce can begin liquidating short positions, forcing buy orders that push the price higher.

A move into the $375 to $400 range would trigger most short positions, trapping the bearish side of the market. A push above $450 materially weakens the bearish structure. Also, if the ZEC price manages to reclaim the 100-day EMA, history shows upside can expand rapidly rather than stabilize slowly.

The trap theory fails if the price continues lower. A sustained break below $329 on the 12-hour timeframe keeps the 34% downside path intact and opens the door toward $255 and even lower.

The post Zcash’s 34% Breakdown Triggered — Why It Could All Be A Setup To Trap The Bears appeared first on BeInCrypto.

Following the introduction of HMRC’s new Cryptoasset Reporting Framework (CARF) on January 1st, global financial institutions, policymakers, and financial leaders will gather at the 3rd annual London Digital Assets Forum (DAF3) to assess how regulatory clarity is accelerating institutional adoption of digital assets in the UK.

“In 2025, London maintained its position as a financial hub, closing the gap with first-place New York to just one point in the Global Financial Centres Index,” said Victoria Gago, Co-Founder of DAF.

“With its history as a centre of financial innovation, and evolving regulatory environment, London is creating a fertile ground for blockchain to thrive within traditional finance. DAF3 will serve as a premier venue to foster cross-sector partnerships that will propel blockchain integration forward in 2026.”

This year, to account for the rapid expansion of institutional interest in blockchain, DAF3 will run over two days, featuring sessions on policy and regulation, tokenisation, DeFi, and how institutions are moving in the digital assets space as industry experts come to London to discuss the outlook for the year ahead.

Speakers at the event include: Nikhil Sharma of BlackRock; Emma Lovett of J.P. Morgan; Paul Worthington of Stripe; Dorothea Ysenburg of Mastercard; Tim Grant of Deus X Capital, and Stani Kulechov of Aave.

London’s renewed momentum extends beyond traditional markets into digital assets. In 2025, the FTSE outperformed the S&P, while the UK consolidated its position as Europe’s leading digital asset hub, accounting for more than a third of the region’s blockchain talent and reaching crypto adoption rates of over 24% of adults.

A recent report by Barclays Bank referred to 2026 as the “year of great regulation” as digital assets come under the purview of mainstream finance, with UK tax residents having to declare their crypto returns as capital gains starting January 1st of this year. This standardisation paves the way for increased institutional support for digital assets, with the FCA stating its intention to open a regulatory sandbox for the testing of stablecoin payments.

Deals focused on enterprise and institutional models account for over 70% of the UK’s digital asset investments. This is a trend that will continue with institutional investors poised to take advantage of regulatory certainty and a fintech-style regulatory sandbox. The Transatlantic Taskforce for Markets of the Future is also promising deeper integration between US and UK capital markets, with its first round of policy recommendations due in March.

Beyond content, Digital Assets Forum is designed as an executive-level forum focused on practical outcomes. In addition to main-stage discussions, the event features dedicated breakout rooms for smaller, focused sessions, two private rooms reserved for one-to-one meetings, and a separate space for press briefings and media interviews.

The agenda, audience curation, and meeting formats are structured to enable senior leaders to compare strategies, advance partnerships, and move initiatives forward in a trusted, institution-first environment.

Click here for tickets and information

About Digital Assets Forum

For more information and to register for DAF, visit the official website at Digital Assets Forum.

Launched in 2018 in Barcelona, the European Blockchain Convention – organiser of Digital Assets Forum – has quickly become the premier blockchain event in Europe. It connects industry professionals, innovative startups, and leading technology experts. The event provides a platform for sharing insights, fostering collaborations, and exploring the immense potential of blockchain, crypto, and digital assets.

The post Global Financial Institutions Gather in London as UK Crypto Reporting Rules Take Effect appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

XRP is taking a decisive step toward institutional relevance as Flare Networks unveils new infrastructure designed to support enterprise-grade financial use cases. For years, XRP has been recognized for its speed and efficiency in cross-border payments, and XRP has often been discussed as a liquidity asset, but with limited programmability and on-chain utility. Flare’s latest move changes that equation, unlocking new layers of functionality that position XRP as more than just a settlement token.

How Flare Expands XRP Smart Contract Capabilities

Flare Networks is taking concrete steps to activate XRP for institutional-grade financial infrastructure. In a recent Genfinity interview that was revealed on X, the Flare Networks team breaks down how its infrastructure is enabling traditionally idle digital assets, starting with XRP, to participate in a programmable financial system.

The conversation focuses on execution rather than theory. This includes bringing FXRP live, integrating directly with wallets, custodians, exchanges, and removing technical friction so that participation won’t require users to manage on-chain technical complexity. Flare’s strategy is not about an isolated pilot experiment, but about building durable infrastructure that can scale across different users, assets, and environments.

A core design principle is risk abstraction at the protocol level, through platforms like Firelightfi, where exposure is structured, collateralized, allowing larger participants to engage with clearer parameters, predictable outcomes, and stronger operational safeguards.

This approach shifts participation from speculative usage toward structured financial activity. The discussion makes it clear that XRP is the first implementation, not the final destination. However, the Flare broader objective is to activate multiple digital assets within a unified framework that prioritizes usability, security, and seamless integration into existing financial workflows. As highlighted in the Genfinity interview, this approach reflects the current stage of digital asset infrastructure, transitioning from experimentation toward real-world execution.

What This Means For The Future Of XRP And Tokenized Media

Crypto analyst Skipper_xrp has mentioned that SBI Group President Yoshitaka Kitao emphasized that Ripple is no longer just building products; it is creating a full-stack financial ecosystem with XRP and RLUSD integrated into every layer of its infrastructure.

The vision is already moving into execution as Ripple Labs has confirmed its collaboration with major Japanese financial institutions to launch a high-profile innovation program aimed at professionalizing the XRP Ledger ecosystem.

Meanwhile, BXE Token is preparing to debut on a US-regulated exchange with more than 12 million users and over $900 billion in annual trading volume, alongside compliance coverage across 49 countries. At the same time, decentralized media platforms are preparing for the US market.

Bitcoin tumbled sharply this week and erased the gains it had made in 2026. Reports from CoinGlass show that over the past 24 hours, 167,513 traders were forced out of their positions, with total liquidations reaching $857 million, with most of those losses coming from long bets. The price slid below the key $88,000 area on major exchanges as traders were forced out of leveraged positions.

Liquidations And Quick Drop

According to CoinGlass and market trackers, the liquidations were concentrated in long positions, which amplified the fall and made the move faster than a simple sell-off would have been. Crypto market value fell by hundreds of millions over the same short span.

Markets Turned Risk-Averse As Tariff Threats Spread

Reports note that renewed tariff threats from US President Donald Trump toward some European countries set off a fresh “Sell America” trade, which pushed investors away from US assets and toward safer bets.

Stocks fell and the dollar weakened. At the same time, traders were watching big moves in Japan’s bond market, where yields jumped sharply, increasing pressure on global liquidity. Those bond moves are important because they can force carry trades to unwind, pulling money out of risk assets — including crypto.

The sell-off did not happen for only one reason. Reports point to a mix of political shocks, bond-market stress, and a wave of forced liquidations as the main drivers. As cash flowed into safe havens, gold surged to fresh highs while crypto lost ground. Many investors treated Bitcoin like a risky asset in this episode, selling it to cover losses or margin calls elsewhere.

Different trackers gave slightly different figures on total market losses and exact liquidations over 24 and 48 hours. That is normal when markets move fast and data is pulled from different exchanges and windows. Still, the broad picture was clear: a fast, leveraged unwind sent prices lower and erased the year’s gains for Bitcoin.

Markets Will Watch Liquidity And DiplomacyLooking ahead, investors will likely watch three things closely: moves in global bond markets, any escalation or de-escalation around the tariff threats tied to Greenland, and whether forced selling slows. If liquidity conditions calm, risk assets can recover more easily. If they keep tightening, the pressure on crypto and stocks could persist.

Featured image from Pexels, chart from TradingView