Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

The company also plans private debt-for-equity swaps for some holders of the Semler convertible notes that may shrink its offering size.

BitGo priced its IPO at $18 a share and expects NYSE trading to begin Thursday, with SEC filings showing major holdings by founders and early investors.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Tokenizing ETF shares could revolutionize asset management by enhancing efficiency and adaptability while ensuring regulatory compliance.

The post F/m Investments seeks SEC permission to tokenize ETF shares appeared first on Crypto Briefing.

Strive's strategic focus on Bitcoin investment and debt reduction could enhance its market position and influence in the crypto sector.

The post Vivek Ramaswamy’s Strive plans to raise $150M in preferred stock sale to buy Bitcoin and repay debt appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

A new report from CoinGate shows Bitcoin took back the crown in cryptocurrency payments during 2025. Here’s how the rest of the rankings looked.

Bitcoin Was The Most Used Cryptocurrency On CoinGate In 2025

In a new thread on X, digital asset payments processor CoinGate has shared insights from its latest report about transactions that occurred on the platform in 2025. In total, CoinGate processed 1.42 million cryptocurrency payments during the year, bringing its total lifetime payments beyond 7 million.

As the below pie chart shows, Bitcoin accounted for the largest share of these payments.

Back in 2024, Tether’s USDT ranked the highest in payments on the platform, beating Bitcoin. With a share of 22.10% in 2025, however, the original cryptocurrency managed to reclaim the top spot over the stablecoin, which ended the year with a payments dominance of 16.60%.

The third position was occupied by Litecoin, which was involved in 14.40% of CoinGate payments. In Summer 2025, LTC even briefly became the second-best coin in the metric. Litecoin being preferred over some other popular assets could be due to the fact that its blockchain offers cheap and fast transactions as core features.

Ethereum and Tron, the fifth and sixth most used coins, both observed growth in payments dominance during 2025. “TRX payment share grew from 9.1% to 11.5% and ETH from 8.9% to 10.6%,” noted CoinGate.

In terms of networks, the Bitcoin blockchain, including the Lightning Network, was the most widely used on the platform in 2025, symmetrical with the token’s payments share itself.

As displayed above, the second and third largest networks on CoinGate were Tron and Ethereum, occupying shares of 19.6% and 15.1%, respectively. These blockchains being above Litecoin despite their native tokens accounting for lower payment shares is because they also facilitate stablecoin transactions.

The United States led in country rankings on the platform, with 24.37% of payments on the platform taking place in the nation. Germany and Netherlands rounded out the top three with shares of 6.83% and 5.16%, respectively.

Cryptocurrencies saw significant usage on the platform in terms of being a payment mode, but that’s not all they were used for. According to the report, merchants also increasingly chose to settle in digital assets.

More specifically, cryptocurrency settlements rose from 27% in 2024 to 37.5% in 2025. Stablecoins were the preferred option for merchants, being involved in 25.2% of all settlements, while Bitcoin occupied a smaller, but still notable, 9.7% share.

Merchants also used cryptocurrencies to pay vendors, affiliates, partners, and contractors. “The most popular payouts were in USDC, Bitcoin, and Ethereum,” said CoinGate. Stablecoins once again dominated here, occupying a payouts share of 87.8%.

BTC Price

At the time of writing, Bitcoin is trading around $88,300, down more than 9% over the last week.

Bitcoin has slipped below the $90,000 psychological level, and bulls are now trying to defend the $88,000 mark to prevent a deeper correction. After days of heavy volatility across crypto markets, BTC is trading in a fragile zone where short-term sentiment can shift quickly, especially as traders react to macro uncertainty and weakening momentum. With price hovering near key on-chain levels, the next move could define whether this drop becomes a brief shakeout or the start of another leg lower.

Analyst Axel Adler highlighted that Bitcoin is currently testing one of its most important short-term “defense lines.” His Bitcoin Support and Resistance chart compares spot price with the realized cost basis of different short-term holder (STH) cohorts, turning these levels into dynamic support and resistance zones.

According to the data, BTC is trading right around the cost basis of the two freshest buyer groups: STH 0D-1D at roughly $89,800 and STH 1W-1M near $90,000. In other words, investors who entered the market over the past few weeks are sitting at breakeven, making this area highly sensitive.

Above current levels, resistance appears stacked. The 1M-3M cohort sits near $92,500 and is already underwater, meaning it may sell into rebounds, while the aggregated STH realized price around $99,300 remains a major ceiling.

STH MVRV Near a Statistical Extreme

Adler adds that another key metric reinforcing this fragile setup is Short-Term Holder MVRV (STH MVRV), which measures the ratio between Bitcoin’s market price and the cost basis of short-term holders. In simple terms, when STH MVRV drops below 1.0, it signals that this cohort is, on average, holding unrealized losses and is increasingly vulnerable to panic-driven selling.

According to Adler, current STH MVRV stands at 0.897, meaning short-term holders are clearly underwater. More importantly, the metric is approaching the lower boundary of its 155-day statistical range, where the Mean minus one standard deviation sits near 0.875. With only around 2.5% remaining before reaching that statistical minimum, Bitcoin is entering a zone that historically aligns with market exhaustion and local bottom formation.

Adler notes that in many past observations, price stabilization occurred when the metric touched or approached this lower band, as buyers stepped in and selling pressure weakened. However, the market remains at a critical decision point. A clean break below 0.875 would signal extreme oversold conditions and raise the risk of short-term holder capitulation.

Together, both charts frame the same battlefield. The $89.8K–$90K region is the key defense zone for fresh buyers, while $92.5K now acts as resistance. With MVRV pressing toward a statistical extreme, Bitcoin is approaching a make-or-break moment between stabilization and deeper downside.

Bitcoin Bears Pressure Key Support Zones

Bitcoin (BTC) is facing renewed downside pressure after failing to reclaim the $90,000 region, with the latest pullback pushing price toward the $88,600 area. The 3-day chart shows BTC slipping back into the lower part of its recent range, reflecting a fragile market structure where rallies are being sold and buyers remain hesitant to step in aggressively.

From a trend perspective, BTC is trading below its key moving averages, with the faster lines curling downward and acting as dynamic resistance. The most notable barrier sits around the $100,000–$105,000 zone, where the broader trend indicators remain overhead and signal that the market is still in recovery mode rather than a confirmed uptrend. Even the recent bounce attempts have struggled to sustain momentum, highlighting that demand has not returned with enough force to absorb selling pressure.

At the same time, BTC continues to hold above the red long-term moving average, which is still rising and represents the broader bull market foundation. This keeps the larger structure intact, but the price action suggests that bulls must defend the $88,000–$90,000 area to prevent further weakness.

If BTC stabilizes and reclaims $90K, it could open the door for a push back into the mid-$90K range. However, if selling accelerates below $88K, the market risks revisiting deeper support levels from the late-2025 consolidation.

Featured image from ChatGPT, chart from TradingView.com

https://cryptoslate.com/feed/

Bitcoin is struggling to build momentum around the $90,000 level, yet at least one headline-grabbing buyer appears to be leaning in the opposite direction.

Adam Back, the CEO of Blockstream, said on X (formerly Twitter) that a “Bitfinex whale” is purchasing roughly 450 Bitcoin per day at current price levels, a pace that would translate into about $40.6 million of daily demand with Bitcoin trading around $90,233 at the time of writing.

According to Back:

“The Bitfinex whale [was] initially [buying] 300 BTC/day, but now ramped to 450 BTC around the $90k mark. [This is] same as the [total] number of Bitcoins mined per day. Around $470/second all-day-long.”

On paper, a persistent buyer of that size can, in principle, offset incremental new supply, even if only at the margin and only for as long as the flow persists.

However, the bigger question is whether these large buyers can change the character of a market that has recently struggled to sustain rallies, with participants repeatedly taking profits quickly or cutting losses into rebounds.

A whale-sized bid meets whale-sized skepticism

Notably, the Bitfinex whale buying narrative is not occurring in isolation.

Data from Santiment showed that Bitcoin “whales and sharks” continued accumulating despite weak sentiment, with wallets holding between 10 and 10,000 Bitcoin adding 36,322 BTC over the past nine days. This represents a 0.27% increase in their collective holdings.

That kind of absorption can matter in a market where marginal flows often set the tone, especially when price is pinned near a widely watched strike level.

However, accumulation data can be deceptively comforting because it does not automatically reveal the price levels at which holders become sellers, nor whether the broader market has enough depth to carry prices through overhead supply.

This is why the Bitfinex bid, if real and persistent, may be more interesting as a stabilizing force than as a directional prophecy.

This is because a steady buyer can slow panic and reduce the odds of disorderly dips, without necessarily creating the kind of demand surge that breaks a market into a new trend.

Bitcoin's ‘Failed Breakout' map shows the problem

In its latest Week On-Chain report, analytics firm Glassnode argued that Bitcoin remains in a moderate bear phase bounded by specific levels tied to cost basis behavior.

The firm identified the True Market Mean around $81,100 as downside support and the Short-Term Holder cost basis around $98,400 as upside resistance.

That upper band matters because it is where “breakeven supply” from recent buyers becomes increasingly active. In practice, that means rallies into the area can invite selling pressure rather than unlock trend upward momentum, as holders who bought near the highs use strength to exit closer to flat.

This is further exacerbated by the fact that the market has not fully recovered from prior distribution.

According to the firm, the recent rally “partially filled” what it called an “air gap” between approximately $93,000 and $98,000. This was a sign that the supply previously held by BTC top buyers had been redistributed to newer participants.

However, above the $100,000 mark, Glassnode still saw a “wide and dense” supply zone that has been gradually maturing into the long-term holder cohort.

That unresolved overhang is likely to cap attempts above both $98,400 and $100,000 unless demand accelerates meaningfully and sustainably.

Meanwhile, this same friction shows up in Bitcoin holders' profit and loss realized behavior.

Glassnode highlighted that realized losses have been dominated by the 3–6 month cohort, with additional contributions from 6–12 month holders. The pattern is linked to “pain-driven” selling by investors who accumulated above $110,000 and are now exiting as the price revisits their entry range.

On the profit side, the firm saw a rise in realizations from the 0% to 20% profit margin cohort, consistent with breakeven sellers and swing traders taking thin gains rather than holding for expansion.

In sum, the on-chain picture explains why Bitcoin rebounds feel heavy even when spot conditions improve.

Derivatives treat $90,000 as a fault line

This is where the Bitfinex whale narrative intersects with microstructure.

Glassnode noted that dealer gamma positioning has skewed lower, with takers bidding for downside protection, leaving dealers short gamma below $90,000 and long gamma above that strike.

The implication is asymmetric. Under $90,000, hedging flows can amplify downside moves. Above $90,000, dealer positioning can dampen follow-through, turning the level into a friction point rather than a launchpad.

If a large, steady spot buyer is indeed ramping activity around $90,000, it could matter disproportionately, not because it guarantees upside, but because it may reduce the chance of slipping into the “short gamma” zone where moves can accelerate.

Outside of whale watching, Glassnode described a derivatives market that looks disengaged. It called futures participation a “ghost town,” noting that seven-day futures volume has contracted and that price moves have occurred without meaningful volume expansion.

The firm also flagged open interest adjustments without corresponding traded volume, a pattern consistent with churn and risk recycling rather than fresh leverage entering the system.

Options markets, meanwhile, are pricing risk primarily at the front end. Glassnode said one-week implied volatility rose by more than 13 volatility points after a macro and geopolitical headline-driven sell-off, while three-month volatility rose only approximately 2 points, and six-month volatility barely moved.

On Bitfinex itself, leverage positioning offers another lens.

According to Tradingview data, the number of bullish Bitcoin bets made with borrowed funds on the exchange, known as margin long positions, has been declining. On a year-to-date basis, the tally dropped to roughly 70,639 Bitcoin from a peak of 72,000.

It then increased slightly to around 71,000 Bitcoin as of press time, signaling renewed dip buying during the slide. However, the broader trend during the past month remains downward.

That matters because these margin long positions have historically acted as a contrary indicator in past cycles, typically peaking when the market is struggling and then drying up as a new uptrend begins.

What a persistent whale bid can, and cannot, do

Considering all of the above, the most disciplined way to think about the whale bid is in regimes rather than narratives.

In a base case, Bitcoin continues oscillating inside Glassnode’s cost-basis range, supported above roughly $81,100, but struggling to sustain bids through roughly $98,400 and into the $100,000-plus supply overhang.

In that environment, a persistent whale bid can help keep dips orderly, yet it will not automatically break the market out unless spot participation broadens beyond selective absorption.

In a bull case, demand accelerates enough to reclaim and hold $98,400, forcing the market to absorb the dense supply zone above $100,000 rather than repeatedly distributing into it.

For that to happen, the Bitcoin market would likely need to see more sustained accumulation, and the derivatives volume would need to re-enter the sector in a way that supports trend formation rather than thin-liquidity pops.

In a bear case, BTC price falls under $90,000 and cannot quickly recover, pushing the market into a zone where dealers are short gamma, and hedging flows can intensify the downside.

In that scenario, the whale’s presence becomes a key variable. If the bid persists, it could blunt the move. If it fades, the market risks sliding back toward deeper cost-basis support.

The post How one Bitcoin whale is absorbing the world’s entire daily mining supply as Bitcoin price faces $90,000 friction appeared first on CryptoSlate.

European leaders facing a Greenland-linked dispute with Washington could treat U.S. Treasurys as a leverage point.

That would test not just the headline size of foreign holdings, but the market’s capacity to absorb speed, and how quickly higher yields would filter into the dollar, U.S. credit conditions, and crypto liquidity.

The Financial Times has framed Greenland as a plausible flashpoint for U.S.-Europe tensions and argued that Treasurys could sit on the menu of countermeasures.

That framing places the focus on execution mechanics and timing rather than a single “EU sells X” headline.

According to the U.S. Treasury’s Treasury International Capital (TIC) Table 5, foreign investors held $9.355 trillion in U.S. Treasurys at end-November 2025.

Of that total, $3.922 trillion was attributed to foreign official holders, a pool large enough that even partial portfolio shifts, especially if coordinated or fast, can register in rates.

The first constraint is measurement.

TIC country lines track securities reported by U.S.-based custodians and broker-dealers, and Treasury notes that holdings in overseas custody accounts “may not be attributed to the actual owners.”

That means the table “may not provide a precise accounting of individual country ownership,” a caveat that complicates any claim that “the EU” could dump a defined amount on command.

A portion of European beneficial ownership can appear in non-EU country lines, and European custody hubs can hold Treasurys for non-European owners. The practical implication is that “sell capacity” is not identical to “European-attributed holdings,” and policymakers have clearer influence over official portfolios than over private custody flows.

A defensible reference set exists inside the TIC data if it is described as custody attribution rather than EU ownership.

At end-November 2025, Treasurys attributed to Belgium ($481.0 billion), Luxembourg ($425.6 billion), France ($376.1 billion), Ireland ($340.3 billion), and Germany ($109.8 billion) totaled about $1.733 trillion.

Presented properly, that $1.73 trillion number is an upper-bound reference for identified major EU reporting and custody jurisdictions, not a verified EU-27 beneficial-owner total.

Custody data vs. “EU ownership” and why it matters

Official-sector positioning adds another layer because “official” can mean a classification in TIC reporting, while Fed custody data describes a location-based subset held in custody at Federal Reserve Banks.

The Federal Reserve’s international summary data show foreign official U.S. Treasury securities held in custody at Federal Reserve Banks at $2.74589 trillion in November 2025 (preliminary).

That location-based subset sits below the TIC “foreign official” total of $3.922 trillion at end-November.

How the Greenland dispute translates into selling would probably run through a sequence of policy signaling and portfolio mechanics rather than a single announcement of forced liquidation.

A preconditioning phase could unfold over weeks or months in which rhetoric hardens, and European policymakers discuss financial countermeasures in risk-management terms, consistent with the Financial Times framing that Treasurys could serve as leverage.

A second phase, spanning days to weeks, would center on a policy signal such as a coordinated call to shorten duration, reduce exposure, or adjust reserve-management guidelines.

Those steps can be executed without formally labeling the move as weaponization, and without requiring a centralized “EU” sale order.

The execution phase would then determine market impact, with two channels that can overlap.

One is official runoff through non-reinvestment at maturity, which can play out over quarters or years.

The other is active secondary-market sales by public and private holders, which can compress into weeks if hedging constraints, risk limits, or volatility targeting bind.

Even if the political intent is gradual diversification, volatility can turn it into a de facto flow shock if private hedgers and leveraged Treasury holders de-risk at the same time.

The liquidation timeline matters because research has linked month-scale changes in foreign official flows to rate moves.

A 2012 Federal Reserve International Finance Discussion Papers study estimated that if foreign official inflows into Treasurys drop by $100 billion in a month, 5-year Treasury rates rise about 40–60 basis points in the short run.

It also estimated long-run effects near 20 basis points after private investors respond.

The paper is dated, so the figures function as order-of-magnitude bounds for speed risk rather than a point estimate for today’s market structure.

Even so, the core implication remains: a faster “dump” (or a faster stop in marginal buying) has a different rate profile than a maturity runoff.

Important: The table below lays out editorial scenario constructs using an execution-speed lens. Sale sizes are illustrative except the $1.73 trillion line, which is a TIC custody-attribution reference for major EU reporting and custody jurisdictions and explicitly not a verified EU beneficial-owner amount. The rate language is framed as regime risk (orderly vs disorderly) rather than a linear “bps per $X” extrapolation.

| Scenario (sale amount) | One-month execution (flow shock framing) | One-quarter execution (absorption window) | 1–3 years (runoff framing) |

|---|---|---|---|

| $250B | Heuristic short-run +100–150 bps on 5-year rates if concentrated in a month; long-run effects nearer +50 bps after private response (2012 elasticity) | Lower peak move if distributed, with repricing tied to hedging and risk appetite | Often resembles reduced reinvestment, with term-premium drift more than a single shock |

| $500B | Heuristic short-run +200–300 bps; long-run effects nearer +100 bps (2012 elasticity) | Greater chance of persistent term-premium repricing if sustained alongside wider “sell America” flows | Functions as diversification, with market impact spread across cycles |

| $1.0T | Tail-risk short-run +400–600 bps; long-run effects nearer +200 bps (2012 elasticity) | Would test dealer balance sheets and risk-bearing capacity even with time to adjust | Hard to distinguish from structural reallocation without clearer attribution data |

| $1.73T (TIC custody-attribution reference) | Tail-risk framing if treated as a one-shot sale, while noting the $1.73T is not EU beneficial ownership | Could transmit as a multi-quarter tightening impulse if sales coincide with heavier hedging demand | Resembles a multi-year reserve and portfolio shift if done mainly through runoff |

Execution speed, yield shock risk, and broader market spillovers

Any sustained yield backup would land on a U.S. economy carrying a large debt stock.

U.S. gross national debt stands at $38.6 trillion as of press time.

That scale increases sensitivity to marginal funding-cost shifts even when refinancing occurs over time.

Higher Treasury yields typically tighten financial conditions through benchmark effects on mortgages, investment-grade issuance, and leveraged credit.

Equity valuations can also re-rate as the risk-free discount rate changes, channels that become more acute if the term premium reprices rather than only the policy path.

The spillover is broader than Treasurys because foreign investors hold a large footprint across U.S. markets.

The Treasury’s annual survey reported $31.288 trillion in foreign holdings of U.S. securities, including $12.982 trillion in long-term debt and $16.988 trillion in equities.

In crypto-adjacent markets, stablecoin issuers are also material Treasury buyers; see CryptoSlate’s breakdown of stablecoin issuers’ Treasury demand.

Dollar outcomes split into two regimes that can coexist across horizons.

In acute stress, a geopolitical shock can push investors toward dollar liquidity and U.S. collateral even as one bloc sells, a setup where yields move higher while the dollar holds up, or even strengthens.

Over longer horizons, sustained politicization can pull the other direction if allies treat U.S. government paper as a policy variable, nudging incremental diversification in official portfolios and gradually weakening structural dollar demand.

The International Monetary Fund’s COFER data show the dollar at 56.92% of disclosed global reserves in Q3 2025, with the euro at 20.33%.

That structure tends to change in steps rather than a single break.

The IMF has also described prior quarterly moves as sometimes valuation-driven, noting that the Q2 2025 decline in the dollar share was “largely valuation-driven” through exchange-rate effects.

That dynamic can blur interpretation of quarter-to-quarter shifts during volatility.

Crypto transmission: liquidity, discount rates, and narrative reflexivity

For crypto markets, the near-term linkage would run through rates and dollar liquidity rather than reserve shares alone.

A fast Treasury liquidation that lifts intermediate yields would raise the global discount rate and can tighten leverage conditions that feed into BTC and ETH positioning.

A slower runoff would transmit more through term-premium drift and portfolio rebalancing across equities and credit.

The narrative channel can cut the other way.

A high-profile episode where allied blocs discuss Treasurys as a policy tool can reinforce the “neutral settlement” framing that parts of the market apply to crypto, even if the first-order move is risk reduction under higher yields.

Tokenized Treasury products sit at the intersection of TradFi collateral and crypto rails; see CryptoSlate’s coverage as tokenized U.S. Treasurys reached a $7.45 billion all-time high.

What traders and policymakers would watch for is not a single “EU sells X” headline, because custody-based data can misstate beneficial ownership.

Instead, they would likely track a sequence of observable proxies, including shifts in foreign official custody holdings at the Fed and changes in TIC-reported totals over subsequent months.

If Greenland becomes the trigger for sustained U.S.-EU financial brinkmanship, the market variable that matters first is whether any Treasury reduction is executed as a one-month flow shock or a multi-year runoff.

The post US Treasurys face a $1.7 trillion EU “dump” over Greenland, forcing shift to Bitcoin if dollar safety vanishes appeared first on CryptoSlate.

https://ambcrypto.com/feed/

How President Trump’s economic comments are shaping market sentiment.

How President Trump’s economic comments are shaping market sentiment. White House urged a 'compromise' on yield to pass the CLARITY Act

White House urged a 'compromise' on yield to pass the CLARITY Acthttps://beincrypto.com/feed/

The market has not seen issuers mint billions of dollars in stablecoins daily in recent months. In January 2026, stablecoin growth showed clear signs of slowing. This signal raises questions about what the market may be facing next.

By comparing stablecoin trends with Bitcoin price movements and similar historical periods, several potential scenarios emerge. These comparisons help investors gain a more comprehensive view of possible risks ahead.

USDT Market Capitalization Stalls, Raising Concerns About Continued Correction

Data from the USDT Market Cap Change by CryptoQuant tracks daily changes in the market capitalization of the leading stablecoin.

The 60-day average (60-day market cap change – SMA30) shows that the pace of USDT market cap growth has declined sharply since late November last year. Growth fell from around $15 billion to approximately $3.3 billion.

When compared side by side with Bitcoin’s price, a strong correlation becomes apparent. In previous cycles, rising liquidity—reflected by rapid increases in USDT market cap—often moved in parallel with Bitcoin rallies.

Conversely, when liquidity growth slowed, Bitcoin typically entered a period of stagnation. In worse scenarios, the market shifted into a downtrend.

Although the 60-day market cap change – SMA30 has not yet turned negative, the latest signals from the 2026 market environment are sending warnings.

First, the market capitalization of USDT (ERC-20)—which accounts for more than 50% of the total USDT supply—has declined over the past month. At the same time, USDT has traded consistently below $1 during this period.

This does not indicate a USDT depeg. However, a declining market cap, combined with sub-$1 pricing, reflects capital outflows. Stablecoin holders appear less interested in seeking new opportunities and more inclined to cash out.

Second, Tether Treasury recently burned 3 billion USDT. This marked the first burn since May last year. CryptoQuant data shows this was also the largest USDT burn in the past three years.

Some observers interpret this move as a sign of caution from large players amid macroeconomic uncertainty and rising geopolitical tensions. This process typically occurs when investors redeem USDT for USD, prompting Tether to remove the corresponding USDT from circulation.

“Someone big just completely exited the market,” investor Ted commented.

These signals remain early and are not yet strong enough to confirm a definitive trend. However, if they intensify, the stablecoin market’s two-month stagnation at around $308 billion in total capitalization could end and shift into a corrective phase.

In that scenario, Bitcoin and altcoins may face an increased risk of entering a bear market—an outcome most investors would prefer to avoid.

The post USDT Demand Stalls in January, Signaling Capital Outflows from the Market appeared first on BeInCrypto.

Monero has been one of the strongest movers this month. XMR is still up roughly 57% over the past three months and around 17% in January so far. But that strength has started to unwind fast. Since topping near $799, the Monero price has already corrected about 36% in the past seven days.

This pullback is not happening in isolation. A bearish chart structure is forming at the same time Monero nears a month that has historically been hostile to price strength. Together, they raise a serious question: is this just a pause, or is Monero setting up for a deeper February sell-off?

Bearish Structure Emerges as February History Turns Against Price

Monero is currently trading inside a rising wedge. A rising wedge is a bearish pattern where the price continues making higher highs, but the trend narrows, signaling exhaustion rather than strength. When this pattern breaks, it often resolves sharply lower.

The measured move from this structure implies a 44% downside risk if the lower boundary fails.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

What makes this setup more concerning is how closely it aligns with Monero’s recent February history.

Since February 2023, XMR has been consistently negative.

Across these three Februarys, Monero posted an average monthly decline of roughly 8–16%, with weakness often accelerating after strong January performance.

That context matters. Monero is once again coming off a strong January, and the XMR price is now rolling over as February approaches. The wedge does not guarantee a breakdown, but it does mean history and structure are pointing in the same direction.

That risk becomes clearer once momentum indicators are added.

Momentum and Capital Flows Confirm Selling Pressure Is Building

Momentum is no longer supporting the uptrend.

Between November 9 and January 19, the Monero price printed a higher high. Over the same period, the Relative Strength Index (RSI) formed a lower high. RSI measures momentum by comparing recent gains to recent losses. When price rises, but RSI weakens, it signals bearish divergence, often seen before trend reversals.

At the same time, Monero has slipped below the 20-day exponential moving average (EMA). An EMA gives more weight to recent prices and is used to track short-term trend strength. Losing the 20-day EMA shows buyers are losing control of momentum.

Attention now shifts to the 50-day EMA, which sits close to the lower boundary of the rising wedge. A loss of this level would mean both momentum and trend support have failed together.

Capital flow data adds another warning.

The Chaikin Money Flow (CMF) indicator has moved below zero, showing that money is flowing out of Monero rather than into it. CMF is now pressing against its rising trendline that has held since early December. A clean break below that line would confirm sustained capital outflows.

In simple terms, momentum is fading, trend support is weakening, and capital is starting to leave. That combination rarely resolves upward without a decisive reclaim.

The Monero (XMR) Price Levels That Decide The Next Leg

The bearish scenario activates if Monero loses $479 on a daily close. That level is close to the lower boundary of the rising wedge, which again stands just 10% away. A confirmed break opens the path toward $360, followed by $318, starting the projected 44% move.

The bullish invalidation is equally clear.

Monero must reclaim the 20-day EMA and hold above it. The last clean reclaim of this level on January 6 triggered an 84% rally. A sustained move back above $591 would weaken the bearish divergence and significantly reduce the breakdown risk.

Until that happens, Monero remains vulnerable.

January strength has not fully disappeared, but the structure supporting it is cracking. With February historically unfriendly and momentum rolling over, the next 6–10% move will likely decide whether this is a temporary pullback or the start of a deeper “red February” unwind.

The post Monero’s 44% Breakdown Risk Aligns With Its Historically Red February — Possible Repeat? appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

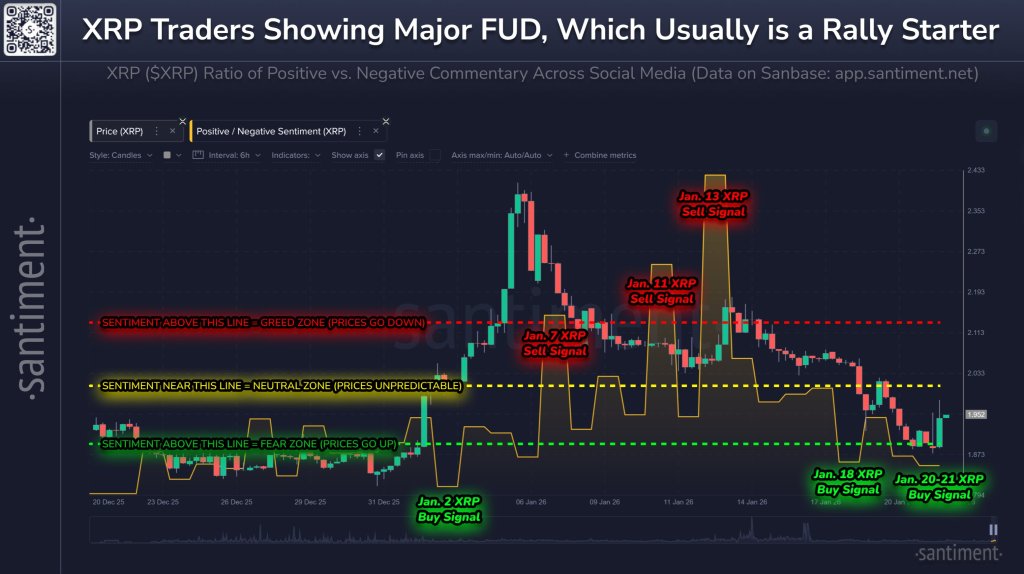

XRP is back in a familiar spot: social chatter has turned sharply bearish even as the market probes support after an early-January surge. Analytics firm Santiment said its social data shows XRP slipping into “Extreme Fear” after a roughly 19% pullback from its early-month high, a setup it argues has historically preceded rallies.

Santiment wrote on Jan. 22 via X: “According to our social data, XRP has fallen into ‘Extreme Fear’ territory. Small retail traders have become pessimistic toward the #5 market cap cryptocurrency after a -19% drop since the high back on January 5th. Historically, this high level of bearish commentary leads to rallies. Prices move the opposite to retails’ expectations more often than not.”

The chart Santiment shared pairs XRP’s 6-hour candles with a social ratio measuring positive versus negative commentary, and overlays three “buy” and three “sell” markers tied to sentiment bands. Those bands are explicitly labeled as a “fear zone” (where prices “go up”), a neutral zone, and a “greed zone” (where prices “go down”).

How Reliable Is The XRP Social Sentiment Signal?

To check the timing, daily XRP spot data for the same late-December-to-January window broadly supports the chart’s claim that extreme sentiment readings often show up near inflection points, with an important caveat: not every signal front-runs a turn cleanly, and some arrive early.

The first “buy” marker on the chart is dated Jan. 2. On that day, XRP closed around $2.01 after trading as low as roughly $1.87, and the market proceeded to accelerate into the week’s blow-off move: by Jan. 5 XRP closed near $2.35, and the Jan. 6 session printed a high around $2.42. In other words, the Jan. 2 “buy” call landed ahead of the sharp leg higher that set the period’s high.

The first “sell” marker is dated Jan. 7, immediately after the peak. XRP closed around $2.16 that day and then bled lower across the next sessions, sliding toward the low-$2.00s by Jan. 12. On sequence alone, that sell signal aligns with the market shifting from post-spike distribution into a steadier downtrend.

The second “sell” marker, Jan. 11, is less straightforward. XRP closed near $2.07 on Jan. 11 and dipped again on Jan. 12, but then logged a sharp rebound on Jan. 13, closing around $2.17. Traders treating the Jan. 11 marker as an immediate top signal would have faced a short-term whipsaw before downside resumed.

That brings the chart’s third “sell” marker (Jan. 13) which appears to target that rebound itself. From Jan. 13’s close near $2.17, XRP rolled back over: it faded through mid-month and ultimately slid into the Jan. 20 low around $1.87 (intraday), which maps cleanly to the chart’s contention that “greed-zone” sentiment can coincide with local exhaustion.

On the “buy” side late in the window, Santiment flags Jan. 18 and Jan. 20–21. The Jan. 18 marker arrived early: XRP closed around $1.99 on Jan. 18 but continued lower into Jan. 20 before rebounding. The current Jan. 20–21 marker fits better in the short term, with XRP bouncing from the Jan. 20 close near $1.89 to roughly $1.95 by today. Even so, that rebound has so far been modest relative to the broader drawdown from the $2.4 area peak.

Santiment’s broader point is contrarian: when social feeds tip into one-sided pessimism, marginal selling pressure may already be exhausted, setting up mean reversion. The recent signal history partially supports that while also showing the practical risk: entries can be early, and “extreme fear” can persist if trend conditions remain heavy.

At press time, XRP traded at $1.9498.

As the market erases its 2026 gains, Bitcoin (BTC) has fallen to its lowest level in weeks and is attempting to reclaim a crucial level. Some market observers have warned that a retest of the November lows is likely if volatility continues.

Bitcoin Breaks Down From Key Support

On Wednesday, Bitcoin continued to pullback and hit a three-week low of $87,263. The cryptocurrency had been trading between the $90,000-$96,000 range since its start-of-the-year breakout, reaching a two-month high of $97,924 a week ago.

However, the crypto market has experienced significant volatility over the past few days, fueled by renewed geopolitical tensions. As a result, BTC has retraced 10% in the past week, falling to the mid-zone of its $84,000-$94,000 range.

Amid this performance, trader Wealthmanager noted that the flagship crypto had retraced all its 2026 gains, briefly falling below its yearly opening and POC. He added that this is a critical level to hold in the coming days, as losing this area could send the price back to the $80,000 mark.

Analyst Crypto Jelle highlighted a two-month bear flag structure on BTC’s daily chart, suggesting a high chance of a breakdown. “Lose the current lows again, and bears will be fully back in the driver’s seat,” he asserted.

Similarly, Market observer Lyvo Crypto pointed out the same formation, detailing that Bitcoin broke down from the pattern’s ascending support after the recent price action and lost its two-month uptrend.

To the trader, this signals that “momentum is fully in the bears’ control” and “if it [bearish momentum] sustains, we could see a free fall” that could likely result in a retest of the $78,000 area.

In the case of a breakdown to the November lows, he advised that “from there, we’ll wait for confirmation of a double bottom and look for a relief rally.”

BTC To Repeat Its 2020 Price Action?

Crypto Bullet drew a parallel between BTC’s current price action and its performance in early 2022. The analyst affirmed that the current price action closely mirrors its 2022 fractal, which could signal that a major correction is ahead.

At the time, Bitcoin retraced over 40% from its late 2021 cycle top, followed by a “dead cat bounce” at the start of 2022 and a second major correction toward new lows.

Now, the flagship crypto displays a similar performance as it has retraced 30% from the October highs and is currently attempting to reclaim the lost ground. However, Crypto Bullet noted that there are two significant differences from its 2022 correction.

First, Bitcoin has yet to retest the 50-week and 200-week Moving Averages (MAs). Second, the timing hints that the final breakdown is not due until later in Q1.

“If we match the 2022 fractal’s top and the October 2025 top, we’ll see there’s still about 1 month of PA to make that final leg up and test the 50-Week MA or the 200-Day MA,” he explained.

He concluded that one more pump above the $100,000 is likely, but advised caution as the key supports are being tested.

As of this writing, Bitcoin is trading at $89,890, a 1.2% increase in the daily timeframe.