Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

The licensing move operationalizes Vietnam’s crypto pilot, though regulators have yet to confirm receiving or approving any exchange applications.

The initiative comes as enforcement actions and pending market structure legislation raise questions about how privacy tools and open-source developers are treated.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Tokenizing ETF shares could revolutionize asset management by enhancing efficiency and adaptability while ensuring regulatory compliance.

The post F/m Investments seeks SEC permission to tokenize ETF shares appeared first on Crypto Briefing.

Strive's strategic focus on Bitcoin investment and debt reduction could enhance its market position and influence in the crypto sector.

The post Vivek Ramaswamy’s Strive plans to raise $150M in preferred stock sale to buy Bitcoin and repay debt appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Ripple CEO Brad Garlinghouse used a Davos stage at the World Economic Forum’s 2026 annual meeting to make a pragmatic case for tokenization: stablecoins are already the lead use case, momentum has shifted sharply in the US, and the industry’s job now is to deliver measurable benefits rather than tokenize assets for novelty.

Why Ripple Is Building Bridges Between TradFi and DeFi

Garlinghouse’s remarks came on a panel titled “Is Tokenization the Future?” after the moderator cited Ripple-linked traction: tokenized assets on the XRP Ledger surged more than 2,200% last year. From there, Garlinghouse largely aligned with the panel’s theme that tokenization is moving from pilots toward mainstream financial plumbing, while drawing a clear boundary around monetary sovereignty.

“I do think the first poster child of tokenization is really stablecoins,” Garlinghouse said, arguing that usage growth has been decisive. He cited stablecoin transaction volumes rising from “$19 trillion of transactions on stablecoins in 2024” to “33 trillion in 2025,” describing that as “about 75% growth” and adding that “many in our industry would say that’s going to continue.”

Where the discussion turned to a “Bitcoin standard” framing, Garlinghouse emphasized the political reality of state money. “Sovereignty of fiat currencies, I believe, is for many countries sacrosanct,” he said, before invoking a line he attributed to Ben Bernanke from a prior Ripple event: “Governments will roll tanks into the street before giving up monetary supply, giving up the control of monetary supply, which stuck with me as yeah, that makes sense.”

That worldview shaped how Garlinghouse positioned Ripple’s strategy. “At Ripple, we very much focused on building the bridges between traditional finance and decentralized finance,” he said, describing work “with a lot of the banks around the world” as the practical path to scale rather than attempting to displace existing monetary regimes.

Garlinghouse also framed 2026 as a momentum year, not just a technology year. He argued that the political climate in the US has turned materially more constructive after a period he described as open hostility. “The US, the largest economy in the world, has been pretty openly hostile towards facets of crypto and blockchain technologies,” he said. “And that has shifted dramatically, you know, starting with the White House… [and] helped elect a much more pro-crypto pro-innovation Congress, and you’re seeing that play out.”

But the Ripple CEO repeatedly cautioned that narrative tailwinds are not enough. “Part of the tokenization topic […] is like we shouldn’t tokenize everything just to tokenize something,” Garlinghouse said. “There has to be a positive outcome of efficiency or transparency […] otherwise it’s just like okay it’s a nice science experiment.”

On regulation, Garlinghouse reiterated his pragmatic tone, arguing that the push for US crypto legislation should prioritize workable clarity over theoretical perfection. “What’s going on in the US right now is a classic dynamic of when you create new law, it’s never going to be perfect,” he said. “I subscribe to the idea that perfection is the enemy of good.”

He pointed to Ripple’s own history: “a five-year battle with the US government being sued because of the lack of clarity” to underline the stakes, adding: “We are very much an advocate of clarity is better than chaos.”

When pressed on whether stablecoins should pay rewards, one of the live fault lines in US policy debate, Garlinghouse positioned Ripple as less directly exposed than some peers, while still endorsing competitive symmetry. “Ripple doesn’t have as much of a dog in that fight as others in the industry,” he said, but added that a “level playing field goes two ways,” arguing that crypto firms and banks should face comparable standards when competing for the same activity.

Garlinghouse also addressed energy concerns around blockchain-based infrastructure, pushing back on a one-size-fits-all critique. “Not all layer 1 blockchains are created equal,” he said, contrasting proof-of-work systems with proof of stake and other consensus models, and arguing that stablecoin activity is already skewing toward “more power efficient blockchains.”

Spirited dialogue during today’s WEF session (to say the least), but one important point of agreement across the panelists was that innovation and regulation aren’t on opposite sides.

I firmly believe this is THE moment to use crypto and blockchain technology to enable economic… https://t.co/4d3jNeNC4h

— Brad Garlinghouse (@bgarlinghouse) January 21, 2026

On tokenization’s social and market impact, Garlinghouse reframed a question about speculation as a question about access. He said he sees the opportunity in “the democratization of access to investment less so on the speculation side,” pointing to the idea that smaller investors could gain exposure to assets that are effectively inaccessible at modest ticket sizes today.

At press time, XRP traded at $1.9554.

A new report from CoinGate shows Bitcoin took back the crown in cryptocurrency payments during 2025. Here’s how the rest of the rankings looked.

Bitcoin Was The Most Used Cryptocurrency On CoinGate In 2025

In a new thread on X, digital asset payments processor CoinGate has shared insights from its latest report about transactions that occurred on the platform in 2025. In total, CoinGate processed 1.42 million cryptocurrency payments during the year, bringing its total lifetime payments beyond 7 million.

As the below pie chart shows, Bitcoin accounted for the largest share of these payments.

Back in 2024, Tether’s USDT ranked the highest in payments on the platform, beating Bitcoin. With a share of 22.10% in 2025, however, the original cryptocurrency managed to reclaim the top spot over the stablecoin, which ended the year with a payments dominance of 16.60%.

The third position was occupied by Litecoin, which was involved in 14.40% of CoinGate payments. In Summer 2025, LTC even briefly became the second-best coin in the metric. Litecoin being preferred over some other popular assets could be due to the fact that its blockchain offers cheap and fast transactions as core features.

Ethereum and Tron, the fifth and sixth most used coins, both observed growth in payments dominance during 2025. “TRX payment share grew from 9.1% to 11.5% and ETH from 8.9% to 10.6%,” noted CoinGate.

In terms of networks, the Bitcoin blockchain, including the Lightning Network, was the most widely used on the platform in 2025, symmetrical with the token’s payments share itself.

As displayed above, the second and third largest networks on CoinGate were Tron and Ethereum, occupying shares of 19.6% and 15.1%, respectively. These blockchains being above Litecoin despite their native tokens accounting for lower payment shares is because they also facilitate stablecoin transactions.

The United States led in country rankings on the platform, with 24.37% of payments on the platform taking place in the nation. Germany and Netherlands rounded out the top three with shares of 6.83% and 5.16%, respectively.

Cryptocurrencies saw significant usage on the platform in terms of being a payment mode, but that’s not all they were used for. According to the report, merchants also increasingly chose to settle in digital assets.

More specifically, cryptocurrency settlements rose from 27% in 2024 to 37.5% in 2025. Stablecoins were the preferred option for merchants, being involved in 25.2% of all settlements, while Bitcoin occupied a smaller, but still notable, 9.7% share.

Merchants also used cryptocurrencies to pay vendors, affiliates, partners, and contractors. “The most popular payouts were in USDC, Bitcoin, and Ethereum,” said CoinGate. Stablecoins once again dominated here, occupying a payouts share of 87.8%.

BTC Price

At the time of writing, Bitcoin is trading around $88,300, down more than 9% over the last week.

https://cryptoslate.com/feed/

Senate Agriculture Chair John Boozman has now released updated crypto market structure text, posting a full bill PDF last night.

The release locks in a near-term Senate Agriculture path to markup next week, but it also hardens a political split that could determine whether Senate Banking gets a negotiated bridge or a rival marker for later talks.

Politico's Jasper Goodman reported the draft “has not yet been shared with [Democrat] Sen. Cory Booker,” while independent crypto reporter Eleanor Terrett said the markup “is shaping up to be partisan,” with Senate Banking having been “hoping for a bipartisan deal to smooth its own markup.”

Boozman’s Jan. 21 rollout now reframes that dynamic: the committee has text in public view, but Boozman is also signaling the Boozman–Booker effort did not land as a unified bipartisan package.

Senate Agriculture sets the near-term calendar

Procedurally, Boozman set a firm Senate Agriculture calendar that markets can anchor to even before any text was posted. In a Jan. 13 press release, Boozman said legislative text was scheduled for release by close of business Wednesday, Jan. 21, and that deadline has now been met with a posted bill PDF.

He also said the committee markup is scheduled for Tuesday, Jan. 27, at 3 p.m. Boozman previously said the committee needed more time “to finalize the remaining details and ensure the broad support this legislation requires” when he postponed an earlier markup and pointed to action during the last week of January, an arc that now ends in a published text heading into next week’s vote.

| Committee | Item | Date/time | Status in primary sources |

|---|---|---|---|

| Senate Agriculture | Text release deadline | Jan. 21, 2026 (COB) | Deadline was scheduled, according to Boozman (timeline), and text has since been posted publicly |

| Senate Agriculture | Committee markup | Jan. 27, 2026, 3 p.m. | Scheduled, according to Boozman (timeline) |

| Senate Banking | Executive session for H.R. 3633 | Jan. 15, 2026 | Postponed, according to the committee hearing page (status page) |

The last full text: Boozman-Booker discussion draft

What the Agriculture Committee is aiming to ship is now captured by two documents: the earlier bipartisan discussion draft released Nov. 10 by Boozman and Booker, and the newly posted Jan. 21 bill text.

That package described a framework for new CFTC authority over “digital commodities” in spot markets, plus consumer protections and a funding stream.

The Jan. 21 update keeps the CFTC-centered architecture but adds more politically sensitive definitional and operational hooks, including an explicit inclusion of “meme coins” within the “digital commodity” definition unless excluded by rule.

The text lays out definitions, rulemaking, and registration requirements for “digital commodity intermediaries” at the CFTC.

That includes registration sections for exchanges and for brokers and dealers, and the updated text adds a concrete on-ramp: expedited registration and a provisional-status operating regime that would compress the gap between enactment and functional compliance planning.

The same draft includes explicit headings for decentralized finance and anti-money laundering.

In the updated Jan. 21 text, those standalone TOC items are no longer carried in the same way; instead, DeFi concepts are pushed into hardened definitions and a new “software developer protections” section that aims to keep certain builders, interfaces, and non-custodial tooling from being treated as regulated intermediaries solely because of development, publication, or maintenance activities.

Booker’s office framed the Nov. 10 document as a discussion draft after months of negotiation. That posture now reads less like a glide path and more like a dividing line: Boozman’s rollout acknowledges Booker’s participation while still landing on text that appears positioned to move through Senate Agriculture even without a jointly branded agreement.

The emerging political split matters for markets less as a whip count and more as a parameter for timelines.

With text now posted, the next inflection is whether the Jan. 27 markup produces a committee-approved vehicle that can be reconciled with Senate Banking’s delayed H.R. 3633 track, or whether it forces Banking to wait for a cross-committee bargain that may now be harder to reach.

Scott had originally aimed to move that process via a Jan. 15 markup before it was postponed. If Agriculture moves ahead on Jan. 27 without Booker’s sign-off in the manner described on X, the committee vote can still produce a negotiating vehicle, but it would likely do so as a sharper partisan marker rather than a pre-negotiated bridge.

That outcome would also increase the odds that Banking stays staggered until a cross-committee compromise emerges. In the provided materials, Banking’s only recorded update is the “POSTPONED” status for its executive session.

Compliance timelines and market sensitivity

A staggered approach keeps compliance planning focused on what firms can prepare for without final statutory boundaries.

That is especially true for registration mechanics and operational controls that resemble existing CFTC market intermediaries, and the updated text attempts to narrow uncertainty by specifying an expedited registration pathway and interim operating conditions rather than leaving the entire ramp to later rulemaking.

The Agriculture discussion draft’s emphasis on definitions, rulemaking, and registration implies that even after enactment, the first binding constraints would be the pace of CFTC rulemakings and supervisory throughput for new registrants.

The updated text adds more explicit timing mechanics: it directs the CFTC to stand up an expedited registration process within 180 days, then ties continued operations to registration within a 90-day window once that expedited process is in place, with provisional status persisting until later effective dates land.

That capacity question sits against a baseline where the CFTC reported more than $17.1 billion in monetary relief and 58 new enforcement actions in FY2024.

Those figures show enforcement scale that is not the same thing as standing up routine spot-market examinations and ongoing supervision for a larger set of registered entities, and the new build-out of expedited registration raises the stakes on whether resourcing and throughput can match the bill’s compressed ramp.

In parallel, the SEC de-emphasized high-profile “registration/status” fights with major crypto venues (often dismissing legacy cases) while continuing to pursue retail-harm / fraud matters. In 2024, the SEC brought 33 crypto-related enforcement actions, down 30% from 2023. Last year (2025), that number fell even further, with only a handful of SEC releases related to crypto.

That keeps an enforcement backdrop for tokens that remain in dispute over whether they fall under securities laws, even as the Agriculture text pushes toward a commodity-like spot framework that now explicitly sweeps in meme coins unless later excluded.

Market positioning has also shown sensitivity to policy and macro repricing, which can amplify the impact of committee calendar risk even before statutory language is finalized.

CoinShares reported $454 million in weekly outflows in its Jan. 12 report, tying the shift mainly to fading expectations of a March Federal Reserve rate cut after macro data.

One week later, CoinShares reported $2.17 billion in weekly inflows, its largest since October 2025. It noted sentiment weakened late in the week amid geopolitical tensions, tariff threats, and policy uncertainty, with $1.55 billion into bitcoin products and $496 million into ether products.

| CoinShares weekly flows | Total | BTC | ETH | Context noted by CoinShares |

|---|---|---|---|---|

| Jan. 12, 2026 report | -$454M | -$404M | -$116M | Shift tied mainly to fading expectations of a March Fed cut (report) |

| Jan. 19, 2026 report | +$2.17B | +$1.55B | +$496M | Late-week sentiment softening amid geopolitical tensions, tariff threats, and policy uncertainty (report) |

Stablecoins, AML, and the next marker

For lawmakers, stablecoin-linked liquidity and AML integrity remain pressure points that can influence where trading, custody, and settlement concentrate once federal rules move from draft text to compliance programs.

The Agriculture effort’s earlier discussion-draft approach included explicit DeFi and AML headings, but the updated text’s higher-signal additions are elsewhere, most notably the expanded definitional architecture (including meme coins) and software developer protections, leaving AML pressure to be fought over through other supervisory and statutory levers.

Those outcomes depend on whether obligations are written directly into statute or delegated to later rulemaking. International policy framing continues to push in the direction of tighter guardrails.

The Bank for International Settlements has argued stablecoins “fall short” as sound money and can pose risks without regulation. It has also promoted a “tokenised unified ledger” concept for settlement and tokenization, implying more formal integration with regulated financial infrastructure over time.

With Senate Agriculture’s text release deadline now passed and its markup scheduled for Jan. 27, the next formal marker for US crypto market structure is whether the posted bill can clear committee and reopen a workable bipartisan lane, or whether the break with Booker’s earlier bipartisan posture leaves the software developer protections and interim registration mechanics as bargaining chips in a longer cross-committee negotiation.

The market’s next read-through will also depend on how any released text is positioned relative to Booker’s earlier bipartisan draft release.

The post Bipartisan Senate crypto alliance just imploded, leaving these high-stakes software developer protections in limbo appeared first on CryptoSlate.

Bitcoin is struggling to build momentum around the $90,000 level, yet at least one headline-grabbing buyer appears to be leaning in the opposite direction.

Adam Back, the CEO of Blockstream, said on X (formerly Twitter) that a “Bitfinex whale” is purchasing roughly 450 Bitcoin per day at current price levels, a pace that would translate into about $40.6 million of daily demand with Bitcoin trading around $90,233 at the time of writing.

According to Back:

The Bitfinex whale [was] initially [buying] 300 BTC/day, but now ramped to 450 BTC around the $90k mark. [This is] same as the [total] number of Bitcoins mined per day. Around $470/second all-day-long.

On paper, a persistent buyer of that size can, in principle, offset incremental new supply, even if only at the margin and only for as long as the flow persists.

However, the bigger question is whether these large buyers can change the character of a market that has recently struggled to sustain rallies, with participants repeatedly taking profits quickly or cutting losses into rebounds.

A whale-sized bid meets whale-sized skepticism

Notably, the Bitfinex whale buying narrative is not occurring in isolation.

Data from Santiment showed that Bitcoin “whales and sharks” continued accumulating despite weak sentiment, with wallets holding between 10 and 10,000 Bitcoin adding 36,322 BTC over the past nine days. This represents a 0.27% increase in their collective holdings.

That kind of absorption can matter in a market where marginal flows often set the tone, especially when price is pinned near a widely watched strike level.

However, accumulation data can be deceptively comforting because it does not automatically reveal the price levels at which holders become sellers, nor whether the broader market has enough depth to carry prices through overhead supply.

This is why the Bitfinex bid, if real and persistent, may be more interesting as a stabilizing force than as a directional prophecy.

This is because a steady buyer can slow panic and reduce the odds of disorderly dips, without necessarily creating the kind of demand surge that breaks a market into a new trend.

Bitcoin's ‘Failed Breakout' map shows the problem

In its latest Week On-Chain report, analytics firm Glassnode argued that Bitcoin remains in a moderate bear phase bounded by specific levels tied to cost basis behavior.

The firm identified the True Market Mean around $81,100 as downside support and the Short-Term Holder cost basis around $98,400 as upside resistance.

That upper band matters because it is where “breakeven supply” from recent buyers becomes increasingly active. In practice, that means rallies into the area can invite selling pressure rather than unlock trend upward momentum, as holders who bought near the highs use strength to exit closer to flat.

This is further exacerbated by the fact that the market has not fully recovered from prior distribution.

According to the firm, the recent rally “partially filled” what it called an “air gap” between approximately $93,000 and $98,000. This was a sign that the supply previously held by BTC top buyers had been redistributed to newer participants.

However, above the $100,000 mark, Glassnode still saw a “wide and dense” supply zone that has been gradually maturing into the long-term holder cohort.

That unresolved overhang is likely to cap attempts above both $98,400 and $100,000 unless demand accelerates meaningfully and sustainably.

Meanwhile, this same friction shows up in Bitcoin holders' profit and loss realized behavior.

Glassnode highlighted that realized losses have been dominated by the 3–6 month cohort, with additional contributions from 6–12 month holders. The pattern is linked to “pain-driven” selling by investors who accumulated above $110,000 and are now exiting as the price revisits their entry range.

On the profit side, the firm saw a rise in realizations from the 0% to 20% profit margin cohort, consistent with breakeven sellers and swing traders taking thin gains rather than holding for expansion.

In sum, the on-chain picture explains why Bitcoin rebounds feel heavy even when spot conditions improve.

Derivatives treat $90,000 as a fault line

This is where the Bitfinex whale narrative intersects with microstructure.

Glassnode noted that dealer gamma positioning has skewed lower, with takers bidding for downside protection, leaving dealers short gamma below $90,000 and long gamma above that strike.

The implication is asymmetric. Under $90,000, hedging flows can amplify downside moves. Above $90,000, dealer positioning can dampen follow-through, turning the level into a friction point rather than a launchpad.

If a large, steady spot buyer is indeed ramping activity around $90,000, it could matter disproportionately, not because it guarantees upside, but because it may reduce the chance of slipping into the “short gamma” zone where moves can accelerate.

Outside of whale watching, Glassnode described a derivatives market that looks disengaged. It called futures participation a “ghost town,” noting that seven-day futures volume has contracted and that price moves have occurred without meaningful volume expansion.

The firm also flagged open interest adjustments without corresponding traded volume, a pattern consistent with churn and risk recycling rather than fresh leverage entering the system.

Options markets, meanwhile, are pricing risk primarily at the front end. Glassnode said one-week implied volatility rose by more than 13 volatility points after a macro and geopolitical headline-driven sell-off, while three-month volatility rose only approximately 2 points, and six-month volatility barely moved.

On Bitfinex itself, leverage positioning offers another lens.

According to Tradingview data, the number of bullish Bitcoin bets made with borrowed funds on the exchange, known as margin long positions, has been declining. On a year-to-date basis, the tally dropped to roughly 70,639 Bitcoin from a peak of 72,000.

It then increased slightly to around 71,000 Bitcoin as of press time, signaling renewed dip buying during the slide. However, the broader trend during the past month remains downward.

That matters because these margin long positions have historically acted as a contrary indicator in past cycles, typically peaking when the market is struggling and then drying up as a new uptrend begins.

What a persistent whale bid can, and cannot, do

Considering all of the above, the most disciplined way to think about the whale bid is in regimes rather than narratives.

In a base case, Bitcoin continues oscillating inside Glassnode’s cost-basis range, supported above roughly $81,100, but struggling to sustain bids through roughly $98,400 and into the $100,000-plus supply overhang.

In that environment, a persistent whale bid can help keep dips orderly, yet it will not automatically break the market out unless spot participation broadens beyond selective absorption.

In a bull case, demand accelerates enough to reclaim and hold $98,400, forcing the market to absorb the dense supply zone above $100,000 rather than repeatedly distributing into it.

For that to happen, the Bitcoin market would likely need to see more sustained accumulation, and the derivatives volume would need to re-enter the sector in a way that supports trend formation rather than thin-liquidity pops.

In a bear case, BTC price falls under $90,000 and cannot quickly recover, pushing the market into a zone where dealers are short gamma, and hedging flows can intensify the downside.

In that scenario, the whale’s presence becomes a key variable. If the bid persists, it could blunt the move. If it fades, the market risks sliding back toward deeper cost-basis support.

The post How one Bitcoin whale is absorbing the world’s entire daily mining supply as Bitcoin price faces $90,000 friction appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Altcoins emerge as the unexpected winners as capital rotates away from Bitcoin and Ethereum.

Altcoins emerge as the unexpected winners as capital rotates away from Bitcoin and Ethereum. How President Trump’s economic comments are shaping market sentiment.

How President Trump’s economic comments are shaping market sentiment.https://beincrypto.com/feed/

Bitget, the world’s largest Universal Exchange (UEX), is turning global markets into an arena with the launch of its first-ever Global Stock Futures Championship, unveiling a headline prize pool of 1,551,000 USDT. Kicking off on January 23, 2026 at 00:00 (UTC+8) and running till February 11, 2026 (UTC+8), the championship is Bitget’s boldest competitive event yet. Built to unite elite traders, rising stars, and global communities in a single, high-stakes battleground.

The centerpiece is the Team Battle, where collaboration meets competition for 940,000 USDT in rewards. A main pool of 700,000 USDT will be shared among the top 30 teams ranked by profit and loss, while 200,000 USDT in Early Bird Perks rewards the first 10,000 participants who join teams and complete qualifying trades between January 26 and 28. Leadership takes the spotlight through 40,000 USDT in Team Captain Awards, honoring those who rally and guide winning squads.

For traders who thrive solo, the Individual PnL Challenge offers 300,000 USDT to the top 100 performers worldwide, leaving an open stage for precision, timing, and confidence under pressure.

Influence enters the arena through the Star Trader Challenge, where global crypto creators compete for 101,000 USDT. The top three will claim a 100,000 USDT pool, while a 1,000 USDT community voting fund lets users predict and back the ultimate champion, turning spectators into participants.

The Challenge Center completes the championship ecosystem, distributing 100,000 USDT through daily and full-period missions. By completing tasks, traders unlock Mystery Boxes containing tokenized stocks, vouchers, merchandise, and premium rewards, making every trade part of a larger game.

For first timers, Bitget introduces a welcome airdrop totaling 110,000 USDT. All participants receive a 50,000 USDT welcome gift upon registration, while new users who complete signup and achieve at least 100 USDT in stock futures trading volume qualify for an additional 60,000 USDT airdrop with guaranteed tokenized stock rewards.

The championship launches alongside peak earnings season, transforming market volatility into a proving ground for skill. More than a competition, it marks a new chapter in how traders engage global equities through a crypto-native lens. With this debut, Bitget brings stock markets into the rhythm of real-time, borderless trading. Where teams form, reputations rise, and every move counts.

To be part of the championship, visit here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

The post Bitget Ignites Global Stock Futures Championship with $1.55 Million Prize Pool appeared first on BeInCrypto.

The XRP price surged nearly 3% on Thursday, bringing the psychologically significant $2 level within striking distance.

The move comes amid Ripple’s aggressive expansion of its digital asset ecosystem, highlighted by a strategic partnership with DXC Technology (DXC).

XRP Price Eyes the $2 Mark As Ripple Expands Banking Reach

As of this writing, the XRP price was trading for $1.96, just shy of the $2 threshold after a 2.95% climb in the last 24 hours.

The surge comes barely a day after Ripple President Monica Long highlighted strong forecasts for 2026. It also follows Ripple CEO Brad Garlinghouse’s appearance at the World Economic Forum (WEF) in Davos, Switzerland.

However, the latest gains for the Ripple token follow the network’s collaboration with DXC Technology, which aims to bridge traditional banking infrastructure with enterprise blockchain solutions.

DXC announced that it will integrate Ripple’s digital asset custody and payment solutions into its Hogan core banking platform. Reportedly, the platform manages over 300 million deposit accounts with a total value exceeding $5 trillion globally.

The integration aims to enable financial institutions to offer digital asset custody, tokenization, and cross-border payment services without disrupting existing core banking systems.

“For digital assets to move into the financial mainstream, institutions need secure custody and seamless payment capabilities,” read an excerpt in the announcement, citing Sandeep Bhanote, Global Head and General Manager of Financial Services at DXC.

According to Bhanote, DXC Technology’s work with Ripple brings those capabilities together in a way that allows banks to engage in the digital asset ecosystem without changing their core systems.

Through this collaboration, Ripple Payments, a licensed end-to-end cross-border solution, and Ripple Custody, designed for institutional digital asset management, will be embedded into DXC’s enterprise banking infrastructure.

This integration allows banks and fintechs to adopt digital asset capabilities while maintaining regulatory compliance and operational continuity.

“Banks are under increasing pressure to modernize while continuing to operate on complex infrastructure,” added Joanie Xie, VP and Managing Director, North America at Ripple. “Our partnership with DXC brings digital asset custody, RLUSD, and payments directly into the core banking environments institutions already trust.

Together, they are enabling banks to deliver secure, compliant digital asset use cases at enterprise scale without disruption.

Institutional Adoption Gains Momentum as Ripple Scales Globally

The initiative represents a significant step in Ripple’s ongoing effort to drive adoption of its digital assets across mainstream financial institutions.

While the stablecoin RLUSD has experienced record highs following institutional interest in markets like the UAE, its market capitalization remains modest at $1.4 billion, a tiny fraction of the $309 billion global stablecoin market.

XRP, meanwhile, continues to inspire optimism as the broader Ripple ecosystem expands and adoption narratives strengthen.

The DXC–Ripple partnership signals growing institutional acceptance of blockchain-enabled solutions in core banking systems.

By providing “last-mile connectivity” between TradFi and on-chain assets, the collaboration reduces the friction banks face in experimenting with digital currencies. This could enable real-world deployment at scale.

Ripple’s strategic enterprise push, combined with XRP’s recent price momentum, could encourage further interest from both institutional and retail participants.

The post XRP Price Nears $2 as Ripple Expands Enterprise Reach to 300 Million Accounts in New Deal appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

With the market still weak and uncertainty lingering, concerns of another XRP price crash are growing. This comes as selling pressure increases and market dynamics show no clear indications of an upcoming bullish reversal. Notably, XRP’s ongoing downtrend also coincides with a decline in both retail and institutional activity, underscoring weakened confidence across the broader market.

XRP Price Stays Weak Amid Retail And Institutional Decline

After jumping above $2 earlier this year, the XRP price stayed stuck around that level for weeks, repeatedly attempting to break to the upside but failing. Following last week’s unexpected price increase, the cryptocurrency crashed down toward $1.95, where it has since stabilized and continued to consolidate for several days. This unexpected downturn suggests that XRP remains just as weak as it was last year despite the brief rally.

This weakness and price volatility appear to be driven by a slowdown in institutional participation. As selling pressure continues to mount, Spot XRP ETFs have recently recorded their second outflow since launching in November 2025. This latest outflow marks the largest ever recorded by XRP ETFs.

According to SoSoValue, the first XRP ETF outflow occurred earlier this year, on January 7, when $40,80 million exited the investment products. The most recent data shows that XRP ETFs recorded another outflow of approximately $53.32 million on Tuesday, January 20.

Grayscale was the only issuer to post outflows that day, with more than $55.39 million leaving its GXRP ETF, while products issued by Canary, Bitwise, and 21 Shares saw zero flows. Meanwhile, Franklin Templeton’s XRPZ recorded inflows of $2.07 million, which only slightly offset the losses, bringing the net daily outflow to $53.32 million.

If more outflows occur, the continued drop in institutional activity, combined with XRP’s weakened price, could push the cryptocurrency lower. At present, XRP is trying to recover from recent losses, with its price rising approximately 1.62% over the past 24 hours, according to CoinMarketCap.

XRP Open Interest Crash Adds To Weakness

In addition to the decline in ETF inflows, XRP’s Open Interest (OI) has reportedly crashed to new lows, signaling a sharp reduction in trading activity and retail market participation. Data from Coinglass shows that XRP’s derivatives market saw its futures Open Interest fall to $3.35 billion this Wednesday. This marks the lowest level recorded since January 1, 2026, when OI declined to $3.33 billion.

A drop in Open Interest often indicates that traders may be losing interest in XRP’s upside potential. This waning optimism and confidence may be further fueled by growing geopolitical and regulatory uncertainty. Investors appear to be adopting a more risk-off approach, reflected in the crypto Fear and Greed Index, which has entered extreme fear territory.

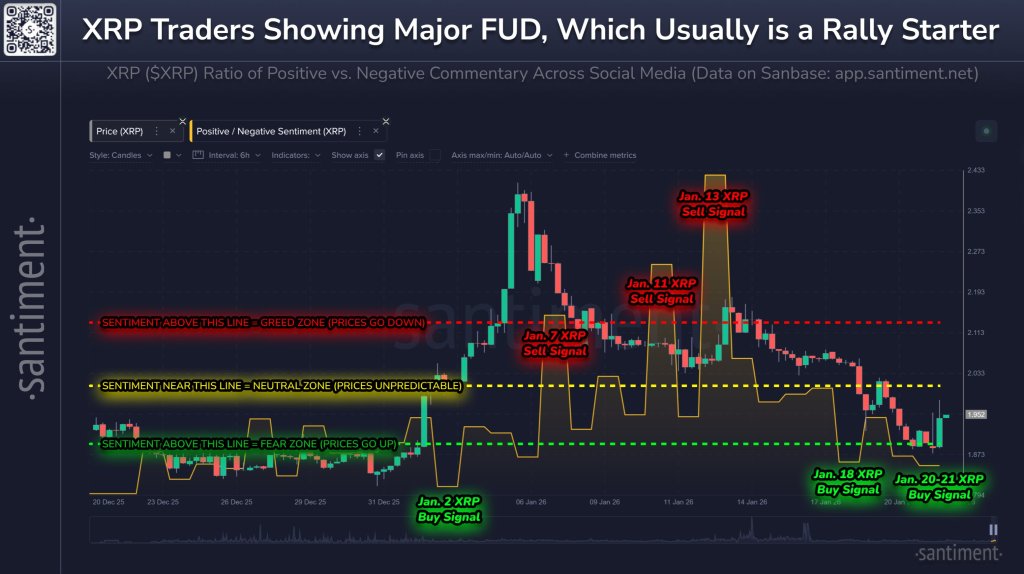

XRP is back in a familiar spot: social chatter has turned sharply bearish even as the market probes support after an early-January surge. Analytics firm Santiment said its social data shows XRP slipping into “Extreme Fear” after a roughly 19% pullback from its early-month high, a setup it argues has historically preceded rallies.

Santiment wrote on Jan. 22 via X: “According to our social data, XRP has fallen into ‘Extreme Fear’ territory. Small retail traders have become pessimistic toward the #5 market cap cryptocurrency after a -19% drop since the high back on January 5th. Historically, this high level of bearish commentary leads to rallies. Prices move the opposite to retails’ expectations more often than not.”

The chart Santiment shared pairs XRP’s 6-hour candles with a social ratio measuring positive versus negative commentary, and overlays three “buy” and three “sell” markers tied to sentiment bands. Those bands are explicitly labeled as a “fear zone” (where prices “go up”), a neutral zone, and a “greed zone” (where prices “go down”).

How Reliable Is The XRP Social Sentiment Signal?

To check the timing, daily XRP spot data for the same late-December-to-January window broadly supports the chart’s claim that extreme sentiment readings often show up near inflection points, with an important caveat: not every signal front-runs a turn cleanly, and some arrive early.

The first “buy” marker on the chart is dated Jan. 2. On that day, XRP closed around $2.01 after trading as low as roughly $1.87, and the market proceeded to accelerate into the week’s blow-off move: by Jan. 5 XRP closed near $2.35, and the Jan. 6 session printed a high around $2.42. In other words, the Jan. 2 “buy” call landed ahead of the sharp leg higher that set the period’s high.

The first “sell” marker is dated Jan. 7, immediately after the peak. XRP closed around $2.16 that day and then bled lower across the next sessions, sliding toward the low-$2.00s by Jan. 12. On sequence alone, that sell signal aligns with the market shifting from post-spike distribution into a steadier downtrend.

The second “sell” marker, Jan. 11, is less straightforward. XRP closed near $2.07 on Jan. 11 and dipped again on Jan. 12, but then logged a sharp rebound on Jan. 13, closing around $2.17. Traders treating the Jan. 11 marker as an immediate top signal would have faced a short-term whipsaw before downside resumed.

That brings the chart’s third “sell” marker (Jan. 13) which appears to target that rebound itself. From Jan. 13’s close near $2.17, XRP rolled back over: it faded through mid-month and ultimately slid into the Jan. 20 low around $1.87 (intraday), which maps cleanly to the chart’s contention that “greed-zone” sentiment can coincide with local exhaustion.

On the “buy” side late in the window, Santiment flags Jan. 18 and Jan. 20–21. The Jan. 18 marker arrived early: XRP closed around $1.99 on Jan. 18 but continued lower into Jan. 20 before rebounding. The current Jan. 20–21 marker fits better in the short term, with XRP bouncing from the Jan. 20 close near $1.89 to roughly $1.95 by today. Even so, that rebound has so far been modest relative to the broader drawdown from the $2.4 area peak.

Santiment’s broader point is contrarian: when social feeds tip into one-sided pessimism, marginal selling pressure may already be exhausted, setting up mean reversion. The recent signal history partially supports that while also showing the practical risk: entries can be early, and “extreme fear” can persist if trend conditions remain heavy.

At press time, XRP traded at $1.9498.