Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

At Davos, Jeremy Allaire said Circle's stablecoin functions as shared infrastructure rather than a competitor to banks or card networks.

An actively managed fund blends Bitcoin, precious metals and mining stocks as asset managers expand crypto’s role in macro and capital-preservation strategies.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Gold rebounds to new highs near $4,900 after Trump halts tariffs as silver surges while Bitcoin lags and US stocks rally.

The post Gold hits new record above $4,900 as safe haven trade resumes after tariff pause appeared first on Crypto Briefing.

Kingsport's new ordinance could set a precedent for balancing technological advancement with community concerns in urban planning.

The post Kingsport City leaders advance Bitcoin mining and data center regulation appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

The idea of a cryptocurrency like XRP competing directly with global banks once sounded unrealistic, but that line is starting to blur. Ripple, the payments technology company behind XRP, has spent recent months pushing deeper into payments, liquidity, custody, and treasury infrastructure with acquisitions.

This has seen the role of XRP changing from a settlement token into something that increasingly mirrors core banking functions. The question is no longer whether Ripple can coexist with global banks, but what changes if it begins competing head-on with them.

A Strategic Challenge For Banks

Recent acquisitions and commentary across the global financial landscape have seen conversations about XRP’s role as a cross-border settlement token change into what might happen if Ripple starts competing with banks. Ripple has completed several high-profile acquisitions in recent months that extend its reach into treasury services, trading infrastructure, stablecoin rails, and custody, and each of these deals speaks to a broader strategy.

One of the most consequential moves was Ripple’s purchase of Hidden Road in April 2025. Hidden Road is a global prime broker that clears trillions annually and serves more than 300 institutional clients. With Hidden Road, which now operates as Ripple Prime, Ripple is now in charge of a multi-asset clearing, prime brokerage, and financing business.

Another significant acquisition was that of GTreasury, a treasury management platform bought for about $1 billion in October 2025. Ripple also agreed to acquire Rail, a stablecoin payments platform, for around $200 million in August 2025. Integrating Rail’s stablecoin-focused technology strengthens Ripple’s broader payments ecosystem and helps better position its stablecoin, Ripple USD (RLUSD).

That acquisition sits alongside other strategic deals completed in recent months, such as the purchases of Palisade and, most recently, Sydney-based fintech firm Solvexia on January 6, 2026 by GTreasury.

Can Ripple Start Competing With Major Banks?

Ripple has always been clear about its stance of competing with SWIFT as the leading global messaging network for financial institutions across the globe. Ripple’s CEO, Brad Garlinghouse, noted that the company plans to capture up to 14% of SWIFT’s current cross-border volume within the next five years.

Ripple’s partnerships with over 300 banks and financial institutions around the world already show how its blockchain rails are being used to speed cross-border settlement and manage liquidity efficiently. Many partners use RippleNet’s messaging for faster transfers, and those that use XRP often do so to tap into liquidity corridors that eliminate the need for massive prefunded accounts on both ends of a transaction.

Vincent Van Code, a popular crypto commentator on X, noted that Ripple is now encroaching on banks’ multi-trillion-dollar treasury, remittance, and custody revenue streams, areas that have historically been protected by legacy infrastructure. Ripple was held back for years by external constraints, but those barriers are now giving way and all the strategic pieces are beginning to fall into place.

Most banks are working on outdated systems and will soon be forced to rebuild their infrastructure from the ground up, a process that could cost between $3 billion and $4 billion per institution just to remain competitive.

Ethereum (ETH) has stabilized above the $3,000 mark after a sharp sell-off earlier this week, as large holders increased their exposure during the dip. The recovery follows a volatile period in which ETH briefly fell below key technical levels, triggering liquidations and renewed caution across the broader crypto market.

On January 22, Ethereum was trading around $3,003, up roughly 1.3% over 24 hours. The rebound came after ETH dropped nearly 13% between January 19 and 21, touching the $2,900 area for the first time in four weeks.

That decline coincided with heightened macro uncertainty, ETF outflows, and the liquidation of over $480 million in bullish leveraged positions.

Ethereum Accumulation Contrasts With Cautious Positioning

On-chain data shows that large Ethereum holders accumulated aggressively during the recent downturn. Whale balances increased by roughly 290,000 ETH over a two-day period, representing purchases worth close to $360 million at current prices.

This behavior suggests that some long-term investors view the recent pullback as a buying opportunity. However, other indicators point to a more cautious stance among experienced traders.

The smart money index remains below its signal line, a level that has historically been crossed ahead of stronger upside moves. In previous instances, such confirmations preceded double-digit gains, but no such signal has emerged so far.

Derivatives data support this wait-and-see approach. ETH perpetual futures funding rates briefly turned negative, indicating reduced confidence among leveraged traders. Options markets have also shown increased demand for downside protection after repeated rejections near the $3,400 level over the past two months.

Technical Structure Highlights Tight Trading RangeFrom a technical perspective, Ethereum is trading within a symmetrical triangle on the daily chart.

Momentum indicators show a bullish divergence, the relative strength index has formed higher lows while the price made lower lows between November and mid-January. This pattern suggests that selling pressure may be weakening, though confirmation is still lacking.

The immediate level to watch on the upside is $3,050, a former support zone that ETH lost during the recent sell-off. A sustained daily close above this level would indicate short-term stabilization.

Above that, the $3,146–$3,164 range represents a dense supply zone, where approximately 3.4 million ETH have been accumulated. This area is expected to act as a strong resistance.

Related Reading: Bitcoin Took Top Spot In 2025 Crypto Payments, Litecoin Third-Most Used: CoinGate

On the downside, failure to hold the triangle’s lower boundary near $2,910 could open the door to a deeper move toward the $2,610 support area.

Cover image from ChatGPT, ETHUSD chart on Tradingview

https://cryptoslate.com/feed/

U.S. spot Bitcoin exchange-traded funds recorded three straight trading sessions of net outflows this week, totaling $1.58 billion.

The pullback follows a brief stretch of positive follow-through, sandwiched between another three-day outflow streak from Jan. 7 – 9 that totaled $1.134 billion, or about $378 million a day leaving the category.

Earlier in the month, flows flipped the other way, with more than $1 billion of net inflows over the first two trading days of January and $1.8 billion in inflows between Jan. 12 – 15, setting an early-month risk tone.

The swing from fast inflows to a multi-session drawdown has renewed focus on ETF flow prints as a near-term positioning read rather than a passive backdrop.

| Window (2026) | Flow regime | Days included | Net flow ($m) |

|---|---|---|---|

| Jan. 7 – Jan. 9 | Outflow | Jan. 7, Jan. 8, Jan. 9 | -1,134 |

| Jan. 12 – Jan. 15 | Inflow | Jan. 12, Jan. 13, Jan. 14, Jan. 15 | +1,811 |

| Jan. 16 – Jan. 21 | Outflow | Jan. 16, Jan. 20, Jan. 21 | -1,583 |

The feedback loop and concentration of selling pressure also matters

Large outflow days were led by the largest funds, including BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC), arguing against the move being driven by smaller products or idiosyncratic reallocations.

When the biggest vehicles lead redemptions, flows are easier to interpret as a broad pullback in real-money demand. They can also feed through to spot-market mechanics because creations and redemptions are ultimately serviced via the fund’s exposure to spot bitcoin, whether delivered in-kind or transacted via cash through the ETF plumbing.

That linkage is why multiple negative sessions can matter more than a single print.

In an inflow regime, ETFs can provide a steady marginal bid that helps rallies hold and reduces the amount of spot selling required to break key levels.

In an outflow regime, that marginal bid thins. Redemptions can add supply at moments when discretionary buyers are already stepping back.

The feedback loop becomes more visible when liquidity is lower because the same dollar of selling can move price more.

A recent CryptoSlate market note reported order-book depth about 30% below 2025 highs. That is a setup where flow-driven selling can carry more price impact than it would in a deeper book.

What this means for Bitcoin’s institutional adoption

The macro backdrop adds context for why ETF flows became a “watch this” input in early January.

The sharp repricing in Treasurys tied to tariff-related geopolitical uncertainty, with the 10-year yield referenced around the mid-4% range during the move. That mix has tended to pressure high-beta risk exposures when rates volatility rises.

Recent crypto drawdowns can be framed alongside a broader risk-off tape, linking Bitcoin’s direction to cross-asset sentiment rather than crypto-specific catalysts alone.

In that environment, ETF redemptions become one of the cleaner observable footprints of de-risking. They show what investors are doing in a regulated wrapper that many allocators use for tactical exposure.

Positioning around late-January options levels provides another lens for how flows can interact with price.

Call open interest clustered around $100,000 into late-January expiries. That keeps attention on whether spot can hold above nearby levels or gets pulled back toward strikes where positioning is dense.

If spot hovers below a large call cluster while ETF flows remain negative, rallies can face two headwinds at once: fewer fresh ETF bids and a derivatives landscape where traders may monetize upside attempts rather than chase them.

If flows turn and spot holds firm, the same concentration can act as a magnet above price, particularly if dealers’ hedging needs shift as spot moves through strikes.

What investors should know as Bitcoin and BlackRock headlines collide

Using the Jan. 7–9 run rate as a simple scenario unit helps translate the story into forward-looking terms without treating flows as destiny.

- At roughly $378 million a day of net outflows, one additional week of similar prints would sum to about $1.9 billion leaving the category. That would be large enough to matter if market depth remains thinner than last year.

- A more benign path is a reversion toward flat daily prints, roughly plus or minus $0 to $100 million. That would reduce the mechanical seller and place more weight on organic spot demand and macro catalysts.

- A third path is a reset back to sustained inflows that resemble the first two trading days of January. That would restore a consistent marginal bid and make it easier for bitcoin to hold levels through U.S. macro data and rate moves.

What investors watch next is less about any single number and more about persistence and price reaction.

One check is whether redemptions stay concentrated in IBIT and FBTC or broaden across the complex, according to Barron’s coverage of the largest products’ role in major outflow sessions.

Another is whether Bitcoin begins to absorb negative flow days without sharp downside follow-through. That can imply sellers are being met with bids away from the ETF channel.

If the pattern becomes “outflows and fast declines,” that points to weak spot demand, with lower depth amplifying moves. That is consistent with the microstructure framing in the CryptoSlate note linked above.

Rates sensitivity remains a parallel check because yield spikes tied to macro headlines have coincided with risk reduction across assets, according to MarketWatch’s reporting on the Treasury selloff tied to tariff-related uncertainty.

There is also a practical caveat: ETF flows can be tactical and can reverse quickly. That includes rebalancing, tax positioning, or basis-driven strategies that do not reflect a long-term view.

The market is operating under macro-first constraints, which can push allocators to adjust exposure rapidly as rates move.

That is why streak length, the identity of the funds driving the moves, and the market’s ability to hold levels during negative prints tend to carry more information than any one day’s total.

The post Bitcoin liquidity just evaporated – and now this Wall Street feedback loop could wipe out gains appeared first on CryptoSlate.

Pierre Rochard's call for the Federal Reserve to integrate Bitcoin into its stress tests came at an unusual moment: the Fed is soliciting public comment on its 2026 scenarios while simultaneously proposing new transparency requirements for how it builds and updates those models.

The timing creates a natural question that has nothing to do with whether Rochard's specific claims hold up: can the Fed ever treat Bitcoin as a stress-test variable without “adopting” it as policy?

The answer isn't about ideology. It's about plumbing.

The Fed won't mainstream Bitcoin because a former strategy chief asks nicely. But if bank exposures to Bitcoin through custody, derivatives, ETF intermediation, or prime-brokerage-style services become large enough to move capital or liquidity metrics in a repeatable way, the Fed may eventually be forced to model BTC price shocks the same way it models equity drawdowns or credit spreads.

That shift wouldn't signal endorsement. It would signal that Bitcoin had become too embedded in regulated balance sheets to ignore.

What stress tests actually test

The Fed's supervisory stress tests feed directly into the Stress Capital Buffer, the amount of capital large banks must hold above regulatory minimums.

The tests project losses and revenues under adverse scenarios, then translate those projections into required capital. Scenario design matters because it determines comparability across firms: banks that face the same hypothetical shock are evaluated on the same terms.

For 2026, the Fed proposed scenarios that run from the first quarter of 2026 through the first quarter of 2029 and use 28 variables.

The set includes 16 US metrics: six activity indicators, four asset prices, and six interest rates.

Internationally, the Fed models 12 variables across four blocs: the euro area, the UK, developing Asia, and Japan. The models track real GDP, inflation, and exchange rates in each.

| Subhead | Variables | Count |

|---|---|---|

| Economic activity & prices | Real GDP growth; Nominal GDP growth; Real disposable personal income growth; Nominal disposable personal income growth; CPI inflation (CPI-U); Unemployment rate | 6 |

| Asset prices / financial conditions | House price index; Commercial real estate (CRE) price index; Equity prices (U.S. Dow Jones Total Stock Market Index); Stock market volatility (VIX) | 4 |

| Interest rates | 3-month Treasury rate; 5-year Treasury yield; 10-year Treasury yield; 10-year BBB-rated corporate yield; 30-year fixed mortgage rate; Prime rate | 6 |

The Fed explicitly noted that the 2026 set is identical to the 2025 set. Bitcoin isn't in it.

Banks with large trading operations face an additional global market shock component that stresses a broader set of risk factors, such as equity indices, credit spreads, commodity prices, foreign exchange, and volatility surfaces.

Banks with substantial trading or custody operations are also tested under a counterparty default scenario.

These components offer a natural entry point for Bitcoin: the Fed could fold a BTC shock into the global market shock framework without treating it as a core macroeconomic variable.

| Country / bloc | Real GDP (growth) | Inflation (CPI or local equivalent) | USD exchange rate (level) |

|---|---|---|---|

| Euro area | Euro area real GDP growth | Euro area inflation | USD/euro |

| United Kingdom | U.K. real GDP growth | U.K. inflation | USD/pound |

| Developing Asia | Developing Asia real GDP growth | Developing Asia inflation | F/USD (index) |

| Japan | Japan real GDP growth | Japan inflation | yen/USD |

What would make Bitcoin eligible

Four criteria would need to align before the Fed treats Bitcoin as a scenario input, and none of them requires the Fed to take a position on Bitcoin's long-term viability.

The first is materiality. Exposures must be large enough to move post-stress capital ratios meaningfully. The Fed's own transparency proposal discusses “material model changes” in terms of their impacts on projected Common Equity Tier 1 ratios, with thresholds ranging from 10 to 20 basis points.

That's not a Bitcoin-specific benchmark, but it's a realistic yardstick for “big enough to matter.” If a 50% Bitcoin drawdown paired with a volatility spike could push a bank's projected CET1 ratio down by 20 basis points, the Fed has a supervisory reason to model it.

The next criterion is repeatability. The shock must show up as a recurring driver of losses or liquidity stress, not a one-off headline.

Bitcoin's history of sharp drawdowns, often coinciding with equity selloffs and tighter funding conditions, provides the Fed with a benchmark to calibrate against. If Bitcoin behaves like a levered risk-on asset during stress episodes, it starts to look like other factors the Fed already models.

Then comes mapping into bank balance sheets. The Fed needs a clean transmission channel from a Bitcoin move to profit-and-loss or liquidity for regulated firms.

Plausible channels now include broker-dealer intermediation for ETFs, custody, riskless principal execution, and derivatives margining.

The last is data auditability. The Fed needs a defensible, monitorable series.

Bitcoin increasingly has institutional-grade reference points, such as BlackRock's IBIT, which references the CME CF Bitcoin Reference Rate. That makes Bitcoin easier to define in a stress scenario than many niche credit markets.

Why now feels different

Three developments in 2025 lowered the barriers to bank-adjacent Bitcoin activity and made future stress-test inclusion more plausible.

The Fed withdrew prior guidance on crypto-asset activities and shifted to “normal supervisory process” monitoring. The OCC issued guidance on crypto-asset safekeeping and, in Interpretive Letter 1188, confirmed that national banks may conduct riskless principal crypto-asset transactions.

The SEC rescinded Staff Accounting Bulletin 121 via SAB 122, removing an accounting treatment widely viewed as a custody roadblock for banks.

ETFs are now a bank-adjacent market structure. BlackRock's IBIT alone reported $70.24 billion in net assets as of Jan. 20.

The Banque de France noted that ETF authorized participants are often broker-dealer subsidiaries of US global systemically important banks, and that some US G-SIBs reported more than $2.7 billion in crypto-ETF investments by end-2024.

Authorized participants create and redeem ETF shares, hedge flows, and provide liquidity, which are activities that sit on regulated balance sheets and can transmit Bitcoin volatility into funding and margin pressures.

The Fed is also in an unusual transparency and comment cycle heading into 2026. It published proposed scenarios and explicitly asked for public comment. It issued a separate proposal on stress-test transparency and public accountability, outlining new documentation requirements and a cadence for reviewing material model changes.

This posture makes exploratory scenario components, such as testing emerging risks without embedding them in binding capital requirements, more institutionally plausible than they were before.

What changes if Bitcoin gets included

Including Bitcoin in stress tests wouldn't constitute endorsement. It would standardize how banks model crypto-related risks and eliminate the current patchwork of ad hoc proxies, such as equity volatility plus tech drawdowns.

Additionally, banks would get a common path to compare against, improving comparability across firms.

It would also implicitly mainstream Bitcoin as a modeled risk factor. Once the Fed treats Bitcoin like interest rates or equity indices, something that can transmit stress and must be projected under adverse conditions, it becomes harder to dismiss crypto exposures as fringe activities.

That shift could tighten controls and compliance around crypto-facing business lines.

Banks would treat those activities more like other capital-sensitive businesses: tighter limits, governance, model validation, documented hedging assumptions, and more granular data collection.

The Fed already has the latitude to add scenario components based on a bank's activities and risk profile. Bitcoin could arrive first as a targeted component for banks with meaningful crypto intermediation rather than as a universal macro variable.

That tier structure offers a natural path forward.

How Bitcoin could enter the stress-test framework

Three implementation tiers seem plausible over time, each triggered by growing bank exposure.

Tier 1 is a trading-book Bitcoin shock inside the global market shock, and is the most likely first step.

Crypto-linked trading, hedging, and ETF facilitation at G-SIB broker-dealers would trigger a Bitcoin spot shock, a volatility shock, and a basis/liquidity shock that feed margin and counterparty exposures. This is exactly the kind of component stress test that stress tests already use for other asset classes.

Historically consistent ranges might include a 50% to 80% Bitcoin drawdown over a short horizon, implied volatility doubling or tripling, and liquidity demand spikes tied to price gaps and margin calls.

Tier 2 is treating Bitcoin as a supervisory variable. This is harder and requires broad bank mapping.

Multiple banks would need to show material, measurable Bitcoin-linked profit-and-loss sensitivity across quarters, like custody, lending to ecosystem participants, derivatives, and prime-like financing.

The Fed would need to build and validate supervisory models that, in a repeatable way, translate Bitcoin paths into losses, fee income, and liquidity stress.

Tier 3 is an exploratory Bitcoin scenario. This becomes possible during a transparency era like the current one. The Fed could publish an exploratory sensitivity analysis alongside the main test, exploring crypto-TradFi spillovers without embedding Bitcoin in binding capital requirements.

The current 2026 transparency posture makes this more institutionally feasible than it used to be.

The governance counterweight

Bank trade groups generally argue the Fed should preserve discretion in scenario design and ensure transparency requirements don't create distortions or mechanical capital impacts divorced from real risk.

The Fed itself has noted that adding “salient risks” via scenarios can reduce the ability to test other emerging risks and increase the burden.

That's the sober institutional reason Bitcoin won't appear in stress tests until exposures justify it: not because the Fed opposes Bitcoin, but because scenario design is a capital-allocation tool with real consequences for bank behavior.

The question isn't whether the Fed will “adopt Bitcoin.” The question is whether Bitcoin exposures at regulated banks will grow large enough and become embedded enough in trading, custody, and intermediation activities that the Fed can no longer model bank resilience without modeling Bitcoin shocks.

If that happens, Bitcoin won't enter stress tests as a policy statement. It will enter because the Fed ran out of ways to ignore it.

The post Bitcoin is about to hit the Federal Reserve’s 2026 stress tests, creating a massive capital risk for regulated banks appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Privacy coins have come under renewed pressure over the past week, with major tokens including Monero, Dash and Decred posting double-digit losses.

Privacy coins have come under renewed pressure over the past week, with major tokens including Monero, Dash and Decred posting double-digit losses. From foreign exchange market control to safe-haven, crypto has several use cases in Iran.

From foreign exchange market control to safe-haven, crypto has several use cases in Iran.https://beincrypto.com/feed/

XRP continues to trade under pressure as broader crypto market weakness weighs on sentiment. The token remains in a short-term downtrend, driven partly by macro bearishness and partly by lingering investor skepticism.

Despite this, Ripple’s operational progress continues, offering potential long-term support for XRP price stability and recovery.

RLUSD Listed On Binance

Ripple recently confirmed that its U.S. dollar-backed stablecoin, RLUSD, has been listed on Binance. The listing expands RLUSD’s visibility and accessibility, which is critical as stablecoin adoption accelerates across global markets. Increased usage typically strengthens the issuing ecosystem’s relevance within digital payments and settlement infrastructure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Although RLUSD currently operates on the Ethereum network, future expansion to the XRP Ledger could be significant. Integration with XRPL would increase on-chain utility, transaction demand, and network activity. This development positions Ripple to benefit from tokenization and cross-border settlement growth, indirectly supporting XRP’s fundamental outlook.

XRP Holders Are Selling

Despite these advances, XRP holders remain cautious. On-chain data shows net realized profit and loss turning negative in recent sessions. Investors are selling XRP below their acquisition price, a behavior often linked to fear of further downside rather than confidence in near-term recovery.

This loss realization reflects hesitation among retail participants. Persistent selling into weakness can slow momentum shifts, even when fundamentals improve. Until investor confidence stabilizes, XRP may struggle to translate Ripple’s ecosystem progress into immediate price appreciation.

Large Wallets Are Still Bullish On XRP

Institutional behavior offers a contrasting signal. For the week ending January 16, XRP recorded $69.5 million in institutional inflows. Month-to-date inflows reached $108.1 million, despite XRP remaining in a downtrend. Such consistency suggests larger investors maintain long-term conviction.

Institutional flows often precede trend reversals, as these participants tend to accumulate during periods of pessimism. Continued inflows provide liquidity support and reduce downside risk. This divergence between retail caution and institutional confidence may help XRP establish a recovery base.

XRP Price Needs To Escape Downtrend

XRP trades near $1.96 at the time of writing, remaining below a downtrend line active for more than two weeks. Technical pressure persists, yet improving fundamentals and institutional demand increase the probability of a breakout. Escaping the downtrend would mark a key shift in short-term momentum.

A confirmed move above the downtrend line would likely push XRP past the $2.00 psychological level. Clearing $2.03 could open the path toward $2.10. If momentum builds, the recovery target near $2.35 becomes achievable in the near term.

The bullish scenario weakens if XRP fails to reclaim $2.00. Rejection at this level could renew selling pressure. Under that outcome, XRP price may slide toward $1.86 or lower, invalidating the bullish thesis and extending the existing downtrend.

The post XRP Struggles Below $2 as Loss-Driven Selling Spikes Across the Network appeared first on BeInCrypto.

Flipper has released an upgraded version of its AI-driven DEX aggregator, designed to simplify token swaps and order management on Solana. The protocol aggregates liquidity from Raydium, Whirlpool (Orca), and Meteora, with plans to expand to additional exchanges.

Smart swaps are now live: the system analyzes pools and selects the most efficient route, including multi-hop paths through intermediate tokens, to ensure the best rates. All this happens within a single transaction, with built-in slippage protection and WSOL support.

Limit orders include take profit (to lock in gains up to 1000%) and stop loss (to minimize losses during price drops). Orders can be combined with swaps, canceled, or set to expire, with support for Token 2022 and xstocks for confidential transactions.

The AI assistant provides market forecasts — analyzing trends, liquidity, volatility, and risk — and suggests optimal entry and exit points. Funds are stored in automated vaults, never held by the platform itself. Security is reinforced through route validation, audits, and event monitoring.

The protocol is deployed on mainnet at: fLpRcgQSJxKeeUOgbb6M7bWe1iyYQbahjoGXGWwr4HgHit

Testing has covered swaps, orders, and routing performance.

What’s Next for Flipper?

Future updates will connect additional liquidity sources, including Saber, Orca TokenSwap, OpenBook, Phoenix, and Raydium CLMM. Planned improvements include automatic order execution via oracles, enhanced AI sentiment analysis, gas optimization, and API integrations for developers.

The protocol is designed for:

• Users seeking the best exchange rates without manual searching

• Traders who rely on automated orders and AI analytics

• Developers integrating flexible adapters into DeFi systems

About the Project

Flipper is an AI-powered DEX aggregator built on the Solana blockchain to simplify DeFi trading. The platform unites liquidity from multiple exchanges, offering smart routing, limit orders (take profit & stop loss), an AI assistant for market analysis and forecasts, and support for xstocks confidential tokens via Token 2022.

All operations are non-custodial — funds remain in the user’s wallet. The system focuses on security, slippage protection, and MEV-attack mitigation.

The project is evolving iteratively, guided by community feedback, with plans for expanded integrations and new features.

Join the community on Telegram: @flipper_dex_chat

Start trading: https://app.flpp.io/

The post Flipper Launches Updated Trading Protocol on Solana appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Bitcoin’s April 2025 swing low around $73,000 has become the make-or-break line for 2026, according to veteran professional trader and commentator Nik Patel, who argues that a higher-timeframe break below that level would likely open the door to a prolonged grind in the mid-$50,000s.

In Part Three of his “2026 Outlook” published Jan. 21, Patel laid out a high-conviction call that Bitcoin prints fresh all-time highs in the first half of 2026, framing it as further evidence the market has shifted away from the clean, narrative-driven four-year cycle. “Bitcoin trades new all-time highs in H1 — the 4-year cycle is dead,” he wrote, summarizing his regime view as “higher for longer,” potentially stretching into 2027.

Why Bitcoin Must Hold $73,000 Or Risk A Slide

Patel’s core technical claim is simple: as long as Bitcoin does not close key higher timeframes below the April 2025 low, the broader structure remains intact and the base case is continuation higher. He acknowledged that he expected a sharper reversal earlier: “Timing-wise, I was wrong on my expectations for a more immediate reversal,” but stressed that price has continued to hold above the April lows “despite having every reason to break and close below.”

That resilience, in his view, matters more than moving averages or anchored references. “Since 2022, we have not made fresh lows on a weekly timeframe below the bottoms that preceded the next highs (or, more plainly, weekly structure in the most technical sense has remained bullish with higher-highs and higher-lows),” Patel wrote. “This has not changed and I place less weight on MAs, VWAPs etc. than I do on price itself, and whilst the $73k April lows that preceded the $126k all-time highs are protected, weekly structure is still bullish.”

His forecast leans heavily on a macro and positioning backdrop he describes as inconsistent with a deep-cycle crypto bear market. Patel cited “Goldilocks into reflation,” rising inflation breakevens, falling real rates, midterm dynamics, and bearish sentiment and positioning as part of the setup that makes a 2018- or 2022-style unwind less likely in his framework.

Patel’s downside map is unusually explicit for a discretionary macro-technical thesis. “If I’m wrong — and we close the higher timeframes below $73k — we likely trade mid-$50ks this year, consolidate there for many months and produce no new highs in 2026,” he wrote, outlining a scenario where a structural failure forces a wholesale reassessment.

He reiterated that the trigger is not an intraday wick but timeframe closes. In his year-ahead playbook, he described being “invalidated on a weekly close below $73k but with a view to re-entering on an immediate reclaim,” while “fully” cutting exposure if Bitcoin prints a monthly close below $73,000, in which case he would “prepare for mid-$50ks.”

Patel also pushed back on the idea that the drawdown from the highs represents a new, uniquely bearish regime. “Where many view the most recent move off the highs into $80k as a ‘structural shift unlike prior corrections’, I disagree and continue to view this as a ‘higher for longer’ regime within which we have these 30-40% corrections, range-bound price-action chewing through supply and subsequently continue higher,” he wrote.

He added that the correction “felt different” in part because it coincided with what he called “the largest liquidation event in crypto history,” alongside forced selling dynamics and long-term holder supply, yet it has still only produced a drawdown modestly larger than prior pullbacks in the broader uptrend.

Even so, Patel allowed for near-term turbulence. He said there is “a decent chance we sweep the November low in early Q1,” but maintained he “categorically” does not expect a higher-timeframe close below the April lows in the first half of the year. His base case remains new highs in H1 2026—“perhaps in late Q1 but likely in early Q2.”

At press time, BTC traded at $90,060.

Bitwise’s take on the final months of 2025 reads like a careful, hopeful note rather than a loud market call. Momentum on the chains rose even as prices stalled, and that gap is exactly what has traders talking. Some think it marks a bottom. Others say it’s too soon to be sure.

Crypto: On-Chain Activity Surges

According to Bitwise, Ethereum activity and layer-two transactions climbed to new highs, and decentralized trading grew markedly. Stablecoin supplies also swelled, with the total market cap passing the $300 billion mark in Q4.

Reports note that decentralized exchange volumes at times matched or exceeded those of major centralized venues. These are hard numbers. They are signs that real use and liquidity are expanding under the surface.

The latest Bitwise Crypto Market Review just dropped—and it’s the most important one we’ve ever published.

Why? Because it shows a tension in crypto markets that has historically signaled a bear-market bottom (see Q1 2023).

Receipts: During Q4 2025…

– ETH’s price fell 29% ……

— Bitwise (@BitwiseInvest) January 21, 2026

Why Prices Have Lagged

Bitwise’s chief investment officer, Matt Hougan, compared this setup to early 2023 when prices trailed rising fundamentals before a significant rebound took hold over the following two years.

The comparison makes sense on paper. Price can be stubborn. Market psychology often lags behind on-chain realities, and traders sometimes wait for a clearer macro story before committing capital.

Fundstrat’s Tom Lee offers a counterpoint, saying the year could be bumpy until late, with tariffs and political tensions weighing on risk appetite. That view keeps many investors cautious.

According to market data, flows into stablecoins accelerated, and fund inflows to crypto firms outpaced several other sectors in the stock market. DeFi use was no longer a niche metric; it was central to the Q4 narrative.

“That’s the type of divergence you get at the bottom of bear markets, when sentiment is down but fundamentals are up,” Hougan said.

Some infrastructure firms reported rising revenues. At the same time, trading volumes remained muted compared with the peaks seen earlier, which helps explain the mismatch between on-chain strength and sideways price action.

Why This Might Matter For 2026Bitwise highlighted 10 broad indicators it sees as health signs for the market, ranging from transaction counts to custody and fee trends. Progress on regulatory clarity was also flagged.

Reports say the Clarity Act could change how stablecoins are treated in the US, and a new US Federal Reserve chair could shift policy in ways that matter for risk assets.

Bitwise sees Q4 as a quiet period where things were improving behind the scenes, even if prices didn’t show it. The firm says this kind of gap between price and activity has happened before big rebounds. It doesn’t mean a rally will happen right away, but the market could be setting itself up for a stronger year ahead.

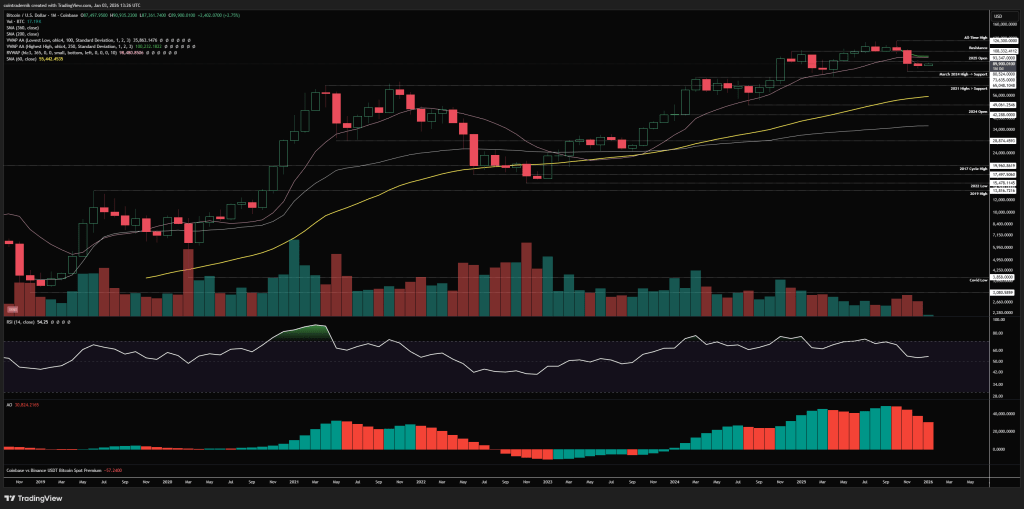

Featured image from Unsplash, chart from TradingView