Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

The lawsuit was filed days after the president threatened on social media to sue the banking giant for debanking him weeks after his supporters attacked the US Capitol in 2021.

Institutional compliance costs and higher Treasury yields are reshaping stablecoin issuance as growth shifts from rapid expansion to balance-sheet discipline.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

BitGo debuted on NYSE ending up near 13% as Ondo tokenized the stock on their RWA platform across Solana, Ethereum, and BNB Chain.

The post BitGo stock jumps on NYSE debut as Ondo brings the stock onchain appeared first on Crypto Briefing.

Gold rebounds to new highs near $4,900 after Trump halts tariffs as silver surges while Bitcoin lags and US stocks rally.

The post Gold hits new record above $4,900 as safe haven trade resumes after tariff pause appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

On Thursday, Senator Craig Bowser introduced a new piece of legislation aimed at creating a Strategic Bitcoin and cryptocurrency reserve for Kansas state.

The proposal, filed as Bill 352, would permit the Kansas Public Employees Retirement System (KPERS) to allocate up to 10% of its total funds into Bitcoin exchange-traded funds (ETFs).

Kansas Bitcoin Bill

Under the bill’s framework, KPERS would not be obligated to sell its Bitcoin ETF holdings if their value grows beyond the 10% allocation threshold, unless the board determines that doing so would better serve the interests of beneficiaries.

If enacted, the legislation would also require the KPERS board to conduct an annual review of the investment program, with the results formally submitted to the governor for oversight and evaluation.

Kansas’ move follows a growing trend among US states exploring BTC as a strategic asset as the regulatory environment surrounding crypto has significantly shifted under President Donald Trump’s administration.

US States Move Toward Crypto Reserves

Texas set an early benchmark last November when it became the first state to formally incorporate cryptocurrency into its treasury strategy by purchasing $10 million worth of Bitcoin.

In North Dakota, lawmakers are considering BTC investments as a potential hedge against inflation. Oklahoma has also entered the conversation, with Senator Dusty Deevers introducing the Bitcoin Freedom Act.

Meanwhile, Tennessee introduced a new bill last week—HB1695—designed to establish its own Strategic Bitcoin Reserve. West Virginia has put forward Senate Bill 143, which proposes allocating 10% of certain state funds toward a cryptocurrency reserve.

Missouri has made notable progress as well, advancing House Bill 2080 to create a Strategic Bitcoin Reserve Fund. That measure has already passed its second reading and is now moving forward for further consideration in the state House.

Featured image from DALL-E, chart from TradingView.com

Now hanging in uncertainty, a big US cryptocurrency bill meant to set firmer ground for trading platforms, digital tokens and stablecoins lost its urgent status among Congress leaders. Attention shifting elsewhere, several influential senators paused work on it this week. Talks continue behind the scenes, aiming to fix unresolved parts before moving forward.

Lawmakers Focus On Housing

A handful of senators shift attention toward affordable housing plans linked to US President Donald Trump’s priorities. This move shrinks the chance for quick approval of the cryptocurrency legislation. Time runs short as political energy flows elsewhere.

Now the Banking Committee changed its timeline because of that move, so the expected vote on the bill got delayed for now. This puts a pause on efforts to build one clear system.

Big Industry Pushback

Out of nowhere, Coinbase stopped backing the plan. Its executives said the proposal might limit how stablecoins work, affecting services people rely on. That shift made them step away quietly. Right after, the group in charge paused things as well.

That shift laid bare growing tensions. Not every bank welcomed the rise of stablecoins. Rivalry looms when digital coin returns gain wider reach. Some financial players see threat in that growth.

Fear spread through trading floors. When talks got delayed, digital currencies started falling because people began questioning how much longer the arguing could last – alongside what kind of outcome might finally emerge.

Useful, perhaps, if waiting brings sharper rules. Still, dragging too long risks confusing banks more, leaving them unsure when to act.

Separate Tracks EmergeAhead of the curve, some lawmakers are eyeing a fresh approach where certain digital tokens fall under commodity rules. This version, quietly shared by the Senate Agriculture team, might follow its own path forward – timing unclear.

While others debate classification, this draft sidesteps the main gridlock and suggests an alternate route through regulatory terrain.

One path might still move forward, even if the Banking Committee’s proposal gets stuck. Still, running two versions at once brings up concerns – how will they merge them should both make it to debate?

Crypto Bill: What Might Happen NextFew believe it’s dead, though time slips fast. Elections loom; attention wanders. Agreement must come soon, or nothing sticks.

Some members of Congress quietly say pushing into late February could kill chances, yet backers still meet out of view to adjust the proposal and pull in more votes.

Featured image from Unsplash, chart from TradingView

https://cryptoslate.com/feed/

BlackRock’s 2026 Thematic Outlook put Ethereum at the center of its tokenization thesis, asking whether the network could serve as a “toll road.”

BlackRock stated that “of tokenized assets 65%+ are on Ethereum.”

The framing pushes Ethereum into an infrastructure role rather than a directional call on ETH. A “toll road” model depends on where issuance, settlement and fee payment occur when real-world assets and tokenized cash move onchain.

BlackRock noted stablecoin transaction volume is adjusted to “strip out inorganic activity (e.g., bots),” citing Coin Metrics and Allium via the Visa Onchain Analytics dashboard.

That caveat narrows the metrics investors may rely on when translating tokenization “activity” into economic throughput.

Ethereum’s share is a moving target

A late-January market check shows why the “65%+” figure should be treated as point-in-time.

RWA.xyz’s directory view put Ethereum’s tokenized RWA market share at 59.84%, with total value around $12.8 billion at retrieval on Jan. 22.

RWA.xyz’s networks view also shows Ethereum leading by value, including a total value (excluding stablecoins) of $13,433,002,447, with the table time-stamped around Jan. 21.

The spread between those readings and BlackRock’s Jan. 5 figure leaves room for share drift.

That drift can come as issuance expands to other chains and as reporting windows change.

| Data point | Ethereum value / share | Timestamp in source | Source |

|---|---|---|---|

| BlackRock tokenization slide snapshot | “65%+” of tokenized assets on Ethereum | As of 1/5/2026 | BlackRock PDF (p. 17) |

| RWA.xyz directory overview | ~$12.8B total value, 59.84% market share | Retrieved 1/22/2026 | RWA.xyz Directory |

| RWA.xyz networks table | $13,433,002,447 (excl. stablecoins) | Table shows “as of” 01/22/2026, pack records as-of 01/21/2026 | RWA.xyz Networks |

For ETH holders, the forward-looking issue is less whether institutions tokenize assets and more whether tokenization routes fee-paying settlement through ETH-bearing paths.

BlackRock’s thesis leans toward Ethereum as a base layer for tokenized assets. Yet a base-layer role can be diluted if execution shifts to rollups or if tokenized funds are distributed across multiple L1s where users do not touch ETH.

Rollups and fee paths complicate the “toll road” thesis

L2BEAT’s rollup summary shows large pools of value already “secured” by leading Ethereum rollups.

Arbitrum One is listed at $17.52 billion, Base at $12.94 billion, and OP Mainnet at $2.33 billion, each labeled Stage 1.

That architecture can preserve Ethereum’s settlement role while shifting where users pay fees day to day.

Rollup execution economics and fee assets vary by design, and that difference matters for fee capture even if Ethereum remains the underlying security layer.

Tokenized cash may become a major throughput driver in tokenization portfolios, and it comes with clearer scenario math.

Citi’s stablecoin report modeled 2030 issuance at $1.9 trillion in a base case and $4.0 trillion in a bull case.

It paired those balances with a 50x velocity assumption to model roughly $100 trillion and $200 trillion in transaction activity, respectively.

The mechanical implication is that even modest market-share changes in settlement networks can matter if activity scales to those levels.

Measurement methodology becomes central if investors try to infer fee generation from raw on-chain flows.

Stablecoin “noise,” multi-chain products and the single-ledger debate

Visa has argued stablecoin transfer volumes contain “noise.”

In an example, Visa said last-30-days stablecoin volume falls from $3.9 trillion to $817.5 billion after removing inorganic activity.

BlackRock’s tokenization slide references the same concept of stripping bots, tying its narrative to a narrower definition of economic use.

If the “toll road” is meant to be monetized through settlement, the investable variable is organic settlement demand that cannot be cheaply replicated elsewhere, not headline transfer counts.

Multi-chain distribution already appears in institutional product design, which complicates any linear “tokenization equals ETH demand” argument.

BlackRock’s tokenized fund BUIDL is available on seven blockchains, with cross-chain interoperability enabled by Wormhole.

This supports a survival path for non-Ethereum chains as distribution and venue-specific utility layers, even if Ethereum retains a lead in issuance value or settlement credibility.

A separate strand of the debate has focused on whether institutional tokenization ends in one common ledger.

During Davos week, that theme circulated on social media through posts featuring remarks from BlackRock CEO Larry Fink.

World Economic Forum materials published this month support broader claims about tokenization benefits, including fractionalization and faster settlement themes.

However, the WEF stops short of validating that verbatim “single blockchain” language in its digital assets outlook for 2026 and tokenization explainer video.

For Ethereum’s decentralization thesis, the investable tension is whether a base layer can remain neutral as tokenization becomes tied to large issuers and regulated venues.

“Transparency” claims depend on credible resistance to unilateral change and on settlement finality that downstream layers inherit.

Today, L2BEAT’s stage framework and value-secured data show rollups scaling under Ethereum’s security umbrella, while BUIDL’s multi-chain rollout shows major issuers also reducing platform concentration risk.

BlackRock’s “toll road” slide set a dated market-share marker at 65%+.

Late-January RWA dashboards and multi-chain product releases showed the near-term battlefield is share, settlement location, and measurement of organic usage across the RWA sector.

That same dynamic is likely to shape how investors interpret growth in tokenized Treasuries and other on-chain issuance categories.

The post BlackRock backs Ethereum gatekeeping tokenization even though its market share is under threat appeared first on CryptoSlate.

U.S. spot Bitcoin exchange-traded funds recorded three straight trading sessions of net outflows this week, totaling $1.58 billion.

The pullback follows a brief stretch of positive follow-through, sandwiched between another three-day outflow streak from Jan. 7 – 9 that totaled $1.134 billion, or about $378 million a day leaving the category.

Earlier in the month, flows flipped the other way, with more than $1 billion of net inflows over the first two trading days of January and $1.8 billion in inflows between Jan. 12 – 15, setting an early-month risk tone.

The swing from fast inflows to a multi-session drawdown has renewed focus on ETF flow prints as a near-term positioning read rather than a passive backdrop.

| Window (2026) | Flow regime | Days included | Net flow ($m) |

|---|---|---|---|

| Jan. 7 – Jan. 9 | Outflow | Jan. 7, Jan. 8, Jan. 9 | -1,134 |

| Jan. 12 – Jan. 15 | Inflow | Jan. 12, Jan. 13, Jan. 14, Jan. 15 | +1,811 |

| Jan. 16 – Jan. 21 | Outflow | Jan. 16, Jan. 20, Jan. 21 | -1,583 |

The feedback loop and concentration of selling pressure also matters

Large outflow days were led by the largest funds, including BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC), arguing against the move being driven by smaller products or idiosyncratic reallocations.

When the biggest vehicles lead redemptions, flows are easier to interpret as a broad pullback in real-money demand. They can also feed through to spot-market mechanics because creations and redemptions are ultimately serviced via the fund’s exposure to spot bitcoin, whether delivered in-kind or transacted via cash through the ETF plumbing.

That linkage is why multiple negative sessions can matter more than a single print.

In an inflow regime, ETFs can provide a steady marginal bid that helps rallies hold and reduces the amount of spot selling required to break key levels.

In an outflow regime, that marginal bid thins. Redemptions can add supply at moments when discretionary buyers are already stepping back.

The feedback loop becomes more visible when liquidity is lower because the same dollar of selling can move price more.

A recent CryptoSlate market note reported order-book depth about 30% below 2025 highs. That is a setup where flow-driven selling can carry more price impact than it would in a deeper book.

What this means for Bitcoin’s institutional adoption

The macro backdrop adds context for why ETF flows became a “watch this” input in early January.

The sharp repricing in Treasurys tied to tariff-related geopolitical uncertainty, with the 10-year yield referenced around the mid-4% range during the move. That mix has tended to pressure high-beta risk exposures when rates volatility rises.

Recent crypto drawdowns can be framed alongside a broader risk-off tape, linking Bitcoin’s direction to cross-asset sentiment rather than crypto-specific catalysts alone.

In that environment, ETF redemptions become one of the cleaner observable footprints of de-risking. They show what investors are doing in a regulated wrapper that many allocators use for tactical exposure.

Positioning around late-January options levels provides another lens for how flows can interact with price.

Call open interest clustered around $100,000 into late-January expiries. That keeps attention on whether spot can hold above nearby levels or gets pulled back toward strikes where positioning is dense.

If spot hovers below a large call cluster while ETF flows remain negative, rallies can face two headwinds at once: fewer fresh ETF bids and a derivatives landscape where traders may monetize upside attempts rather than chase them.

If flows turn and spot holds firm, the same concentration can act as a magnet above price, particularly if dealers’ hedging needs shift as spot moves through strikes.

What investors should know as Bitcoin and BlackRock headlines collide

Using the Jan. 7–9 run rate as a simple scenario unit helps translate the story into forward-looking terms without treating flows as destiny.

- At roughly $378 million a day of net outflows, one additional week of similar prints would sum to about $1.9 billion leaving the category. That would be large enough to matter if market depth remains thinner than last year.

- A more benign path is a reversion toward flat daily prints, roughly plus or minus $0 to $100 million. That would reduce the mechanical seller and place more weight on organic spot demand and macro catalysts.

- A third path is a reset back to sustained inflows that resemble the first two trading days of January. That would restore a consistent marginal bid and make it easier for bitcoin to hold levels through U.S. macro data and rate moves.

What investors watch next is less about any single number and more about persistence and price reaction.

One check is whether redemptions stay concentrated in IBIT and FBTC or broaden across the complex, according to Barron’s coverage of the largest products’ role in major outflow sessions.

Another is whether Bitcoin begins to absorb negative flow days without sharp downside follow-through. That can imply sellers are being met with bids away from the ETF channel.

If the pattern becomes “outflows and fast declines,” that points to weak spot demand, with lower depth amplifying moves. That is consistent with the microstructure framing in the CryptoSlate note linked above.

Rates sensitivity remains a parallel check because yield spikes tied to macro headlines have coincided with risk reduction across assets, according to MarketWatch’s reporting on the Treasury selloff tied to tariff-related uncertainty.

There is also a practical caveat: ETF flows can be tactical and can reverse quickly. That includes rebalancing, tax positioning, or basis-driven strategies that do not reflect a long-term view.

The market is operating under macro-first constraints, which can push allocators to adjust exposure rapidly as rates move.

That is why streak length, the identity of the funds driving the moves, and the market’s ability to hold levels during negative prints tend to carry more information than any one day’s total.

The post Over $1B in Bitcoin liquidity evaporated as the Wall Street feedback loop looks to wipe out gains appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Coordinated U.S. Treasury sell-offs are fueling macro stress, triggering an underlying “risk-off” sentiment.

Coordinated U.S. Treasury sell-offs are fueling macro stress, triggering an underlying “risk-off” sentiment. Canton’s rally strengthens as bullish structure, leverage positioning, and liquidity dynamics favor upside momentum.

Canton’s rally strengthens as bullish structure, leverage positioning, and liquidity dynamics favor upside momentum.https://beincrypto.com/feed/

Caroline Ellison was released from prison on Wednesday after serving roughly 60% of her two-year sentence. The former co-CEO of Alameda Research played a key role in the events that led to the collapse of the FTX cryptocurrency exchange.

In anticipation of Ellison’s release, the US Securities and Exchange Commission (SEC) banned her from holding any executive positions for 10 years.

An Early Release

According to the US Federal Bureau of Prisons, the 31-year-old is now housed at a halfway facility in New York. She will remain there as part of her transition back into civilian life. Such centers help former inmates reenter society by providing support with employment and daily reintegration.

Ellison was transferred to the facility in October 2025. She was previously held at a federal prison in Connecticut, where she began serving her two-year sentence in November 2024.

Her release came around ten months earlier than originally expected. It followed sentence reductions tied to Ellison’s cooperation with prosecutors and compliance with prison requirements.

In a litigation release issued last month, the SEC barred Ellison for ten years from serving as an officer or director of any publicly traded company.

The regulator cited earlier complaints alleging that Ellison played a central role in misleading investors. These actions helped FTX raise more than $1.8 billion by presenting the exchange as a safe platform for trading crypto assets.

The SEC also pursued comparable bans against other former FTX executives who cooperated with investigators, including former CTO Gary Wang and former head of engineering Nishad Singh. Both individuals avoided prison sentences despite their involvement.

Reactions to Ellison’s early release across Crypto Twitter varied.

Divided Reactions To Ellison Sentence

Some observers questioned what they viewed as a relatively lenient outcome given the scale of Ellison’s wrongdoing and the broader damage to the crypto industry’s credibility.

By contrast, Ellison’s sentence was significantly lighter. FTX founder and former CEO Sam Bankman-Fried remains behind bars and is serving a 25-year prison term.

Though both were central figures in the FTX collapse, Ellison and Bankman-Fried followed different legal paths.

Bankman-Fried pleaded not guilty and went to trial. A jury later convicted him on multiple felony charges, including wire fraud and fraud-related conspiracies connected to the misuse of customer funds.

Ellison, by contrast, pleaded guilty to several fraud and conspiracy charges and cooperated with prosecutors. This decision contributed to a significantly reduced sentence.

As part of her testimony, Ellison testified that Alameda Research and FTX improperly commingled customer assets, concealed escalating losses, and relied on an open-ended credit arrangement that allowed Alameda direct access to FTX customer deposits.

Ellison’s release effectively closed the legal chapter involving senior executives at FTX and Alameda Research, whose actions helped set the stage for the 2022 crypto winter.

For Bankman-Fried, prospects for early release appear remote.

In a recent interview, US President Donald Trump stated that he did not intend to grant Bankman-Fried a pardon. Although Bankman-Fried is appealing his sentence, the likelihood of a retrial remains low.

The post What’s Next For FTX Culprit Caroline Ellison After Her Prison Release appeared first on BeInCrypto.

XRP continues to trade under pressure as broader crypto market weakness weighs on sentiment. The token remains in a short-term downtrend, driven partly by macro bearishness and partly by lingering investor skepticism.

Despite this, Ripple’s operational progress continues, offering potential long-term support for XRP price stability and recovery.

RLUSD Listed On Binance

Ripple recently confirmed that its U.S. dollar-backed stablecoin, RLUSD, has been listed on Binance. The listing expands RLUSD’s visibility and accessibility, which is critical as stablecoin adoption accelerates across global markets. Increased usage typically strengthens the issuing ecosystem’s relevance within digital payments and settlement infrastructure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Although RLUSD currently operates on the Ethereum network, future expansion to the XRP Ledger could be significant. Integration with XRPL would increase on-chain utility, transaction demand, and network activity. This development positions Ripple to benefit from tokenization and cross-border settlement growth, indirectly supporting XRP’s fundamental outlook.

XRP Holders Are Selling

Despite these advances, XRP holders remain cautious. On-chain data shows net realized profit and loss turning negative in recent sessions. Investors are selling XRP below their acquisition price, a behavior often linked to fear of further downside rather than confidence in near-term recovery.

This loss realization reflects hesitation among retail participants. Persistent selling into weakness can slow momentum shifts, even when fundamentals improve. Until investor confidence stabilizes, XRP may struggle to translate Ripple’s ecosystem progress into immediate price appreciation.

Large Wallets Are Still Bullish On XRP

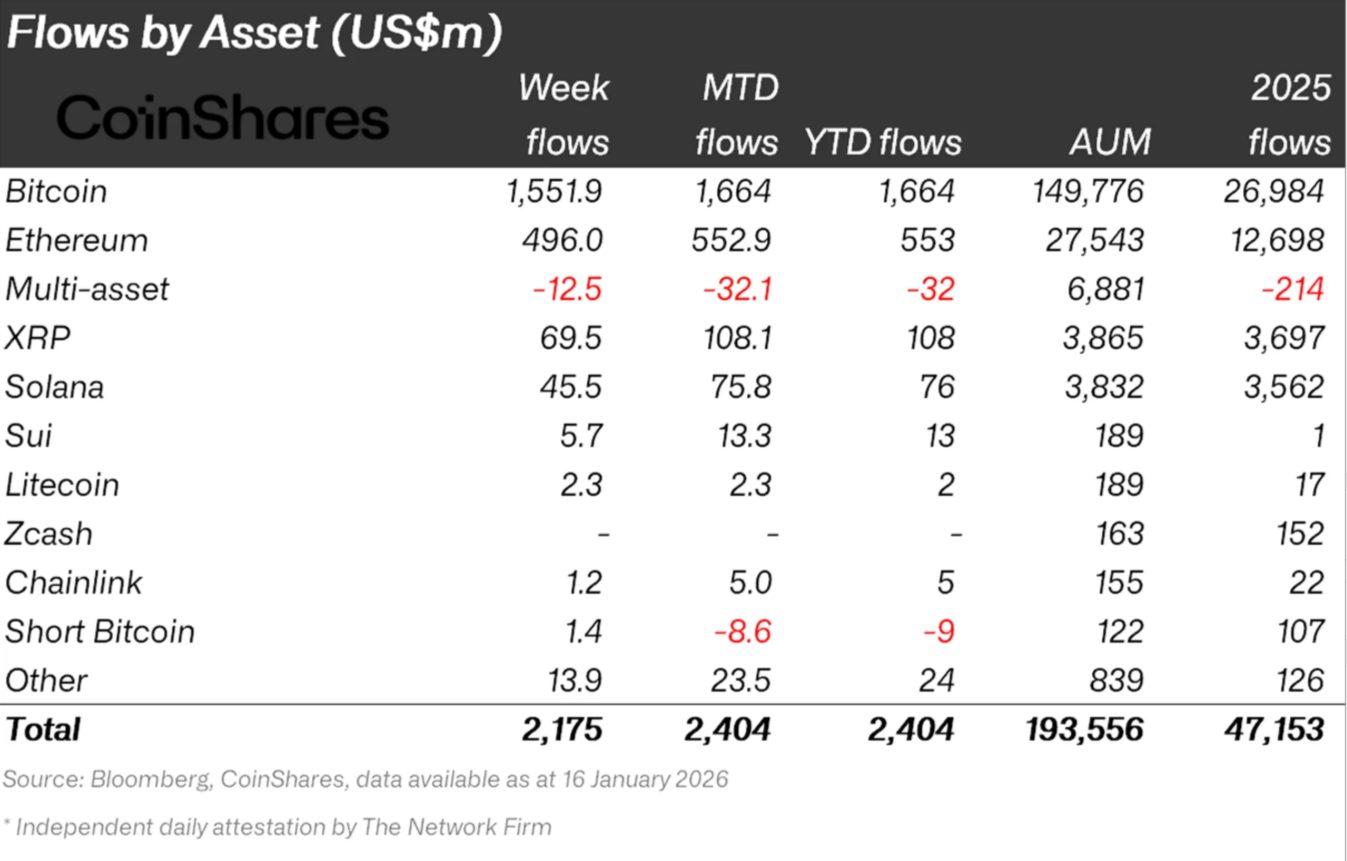

Institutional behavior offers a contrasting signal. For the week ending January 16, XRP recorded $69.5 million in institutional inflows. Month-to-date inflows reached $108.1 million, despite XRP remaining in a downtrend. Such consistency suggests larger investors maintain long-term conviction.

Institutional flows often precede trend reversals, as these participants tend to accumulate during periods of pessimism. Continued inflows provide liquidity support and reduce downside risk. This divergence between retail caution and institutional confidence may help XRP establish a recovery base.

XRP Price Needs To Escape Downtrend

XRP trades near $1.96 at the time of writing, remaining below a downtrend line active for more than two weeks. Technical pressure persists, yet improving fundamentals and institutional demand increase the probability of a breakout. Escaping the downtrend would mark a key shift in short-term momentum.

A confirmed move above the downtrend line would likely push XRP past the $2.00 psychological level. Clearing $2.03 could open the path toward $2.10. If momentum builds, the recovery target near $2.35 becomes achievable in the near term.

The bullish scenario weakens if XRP fails to reclaim $2.00. Rejection at this level could renew selling pressure. Under that outcome, XRP price may slide toward $1.86 or lower, invalidating the bullish thesis and extending the existing downtrend.

The post XRP Struggles Below $2 as Loss-Driven Selling Spikes Across the Network appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Dogecoin (DOGE) is once again testing investors’ patience as it trades near the $0.12 level, a zone that has become a focal point after weeks of volatility.

The meme coin has shed more than 20% from its recent highs near $0.15, but recent price action suggests selling pressure may be easing. At the same time, on-chain data and new developments around token usage are adding fresh context to DOGE’s short-term outlook.

As of January 22, Dogecoin is hovering between $0.12 and $0.13, with daily trading volumes still elevated compared to earlier this month. Market participants are closely watching whether this consolidation marks the start of a recovery or merely a pause before another leg lower.

DOGE Accumulation Signals Emerge Around Key Support

On-chain liquidity data indicates gradual accumulation near the $0.12–$0.127 range. Analysts note that DOGEhas repeatedly defended this support zone, suggesting buyers are stepping in incrementally rather than aggressively.

This pattern often appears during early accumulation phases, where larger players avoid driving prices sharply higher.

Technical indicators present a mixed picture. Dogecoin is trading slightly above its 50-day moving average, while the Relative Strength Index sits near neutral levels, leaving room for movement in either direction.

Trading volume has increased over the past week, pointing to renewed interest, but resistance remains firm around $0.13 to $0.14. A confirmed break above this range could open the door to a move toward $0.14, while a loss of $0.12 may expose downside levels near $0.115 or lower.

Broader Market and Sentiment Factors

Market sentiment continues to weigh on Dogecoin’s trajectory. The Crypto Fear & Greed Index remains in “fear” territory, reflecting cautious positioning across digital assets. Bitcoin’s dominance is another variable to watch.

Historically, periods of declining Bitcoin dominance have coincided with capital rotation into altcoins like DOGE.

Macroeconomic signals and regulatory developments also remain relevant. Any shift toward a clearer or more favorable regulatory stance in the U.S. or Europe could improve risk appetite, while renewed uncertainty may pressure speculative tokens.

Token Utility Expands With Payment App Plans

Beyond price action, Dogecoin’s fundamentals are evolving. The House of Doge has confirmed plans to launch a Dogecoin payment app, “Such,” in the first half of 2026. The app is designed to support wallets, DOGE purchases, and direct payments, with a focus on small businesses and peer-to-peer commerce.

While the announcement has not yet translated into price momentum, it highlights ongoing efforts to expand Dogecoin’s real-world use. Over time, increased utility could help DOGE move beyond short-term trading narratives. Currently, Dogecoin remains largely driven by sentiment, technical levels, and broader market trends.

Cover image from ChatGPT, DOGEUSD chart on Tradingview

According to a recent technical analysis by market expert Egrag Crypto, XRP has formed a “Super Guppy Compression” against Bitcoin, signaling the potential for a major structural shift. The analyst has revealed what could come next for the XRP/BTC pair following this development, indicating a higher probability of a bullish breakout within the next few months.

XRP Bitcoin Pair Forms Super Guppy Compression

In his X post, Egrag Crypto provided a detailed breakdown of the XRP/BTC price structure and the recent patterns emerging within its chart. He suggested that the trading pair recently entered a transition phase after a multi-year decline, with price action tightening as the market moved through a period of compression.

Egrag Crypto revealed that XRP/BTC has completed a Super Guppy Compression pattern, which shows full ribbon compression across both short- and long-term Moving Averages (MA). According to the analyst, this compression signals an upcoming volatility expansion, indicates exhausted selling pressure, and highlights a clear transition phase in the market.

Color dynamics within the Guppy system on the chart also suggest a shift in market behavior. Egrag Crypto notes that the short-term Moving Averages, or “ribbons” as he calls them, are turning green, signaling early bullish momentum. At the same time, long-term ribbons remain red but are flattening, indicating that the downward trend on XRP/BTC is easing. These developments also show that the market has exited its bearish phase; however, a clear uptrend has yet to emerge, leaving the trading pair in a base-building stage.

From a price-structure perspective, Egrag Crypto notes that XRP/BTC is forming a bullish rectangular pattern. The analyst revealed that the trading pair had repeatedly bounced off support while facing rejection at resistance, indicating that supply is being absorbed rather than aggressively sold off. According to him, this behavior aligns with textbook reaccumulation patterns observed after extended downtrends, signaling a potential upward move ahead.

Egrag Crypto has shared key targets for where he believes XRP/BTC could go next, depending on its current market structure. He noted that the structure matters more than the underlying emotion, suggesting that although the market may seem quiet, it is actively positioning for a decisive move.

Analyst Sets Bullish And Bearish Targets For XRP/BTC

Continuing his analysis, Egrag Crypto predicted that over the next three to six months, the XRP/BTC price has a 60-70% chance of a bullish breakout. He added that there is also a 30-40% possibility of an extended consolidation, but only if the market structure breaks—a scenario he considers unlikely.

Looking at the chart, the analyst has identified two key upside targets and one downside scenario. If XRP/BTC crosses the red resistance line at approximately $0.0000338, Egrag Crypto predicts an initial surge to a “conservative” target of $0.000091, followed by a rise to a “normal” target of $0.00014. Conversely, if a structure break occurs, XRP/BTC could plunge from $0.0000193 to $0.00000668.