Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Attackers have hijacked trusted Snap Store publishers via expired domains, allowing malicious wallet updates to reach long-time Linux users.

With Boomers controlling more than half of US household wealth, the coming generational transfer may funnel a portion of this capital into crypto markets, a new OKX survey shows.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Binance's addition of RLUSD and XRP pairs could enhance Ripple's market presence, potentially boosting stablecoin adoption and crypto liquidity.

The post Binance to open trading for Ripple’s stablecoin and XRP pairs appeared first on Crypto Briefing.

Finst's funding boost could accelerate its European expansion, enhancing crypto market transparency and accessibility for diverse investors.

The post Dutch crypto exchange Finst secures €8M in Series A round appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Ripple President Monica Long says 2026 will be the year institutional crypto usage shifts decisively from pilots to production, as regulated infrastructure and clearer rules pull banks, corporates, and market intermediaries deeper onchain. In a January 20 blog post, Long frames the next leg of adoption around four forces: stablecoins, tokenized assets, custody consolidation, and automation powered by AI.

#1 Stablecoins (Ripple USD) As The Settlement Layer

Long’s central prediction is that stablecoins will stop being treated as an “alternative rail” and become foundational to global settlement. “Within the next five years, stablecoins will become fully integrated into global payment systems—not as an alternative rail, but as the foundational one,” she wrote. “We’re seeing this shift not in theory, but in practice, as heavyweights like Visa and Stripe hard-wire these rails into incumbent flows.”

She ties that trajectory to US policy momentum, arguing the GENIUS Act “inaugurated the digital dollar era,” and positioning “highly compliant, US issued stablecoins, including Ripple USD (RLUSD)” as a standard for programmable, 24/7 payments and collateral use in markets. Long also points to “conditional approval from the OCC to charter the Ripple National Trust Bank” as part of Ripple’s compliance strategy.

The near-term demand driver, in her telling, is B2B, not retail. Long cites research claiming B2B payments became the largest real-world stablecoin use case last year, reaching an annualized $76 billion run-rate—up sharply from early 2023 levels. She argues stablecoins can unlock liquidity and reduce working-capital drag, citing “over $700 billion” of idle cash on S&P 1500 balance sheets and “more than €1.3 trillion across Europe.”

#2 Institutional Exposure And Tokenization

Long argues crypto is increasingly used as financial infrastructure rather than just a speculative asset. “Crypto has evolved from a speculative asset into the operating layer of modern finance,” she wrote. “By the end of 2026, balance sheets will hold over $1 trillion in digital assets, and roughly half of Fortune 500 companies will have formalized digital asset strategies.”

She points to a 2025 Coinbase survey she says found 60% of Fortune 500 companies are working on blockchain initiatives, and notes “more than 200 public companies” holding bitcoin in treasury. She also highlights the rise of “digital asset treasury” firms, claiming they grew from four in 2020 to more than 200 today, with nearly 100 formed in 2025 alone.

On market structure, Long forecasts “collateral mobility” as a key institutional use case, with custodians and clearing houses using tokenization to modernize settlement. Her stated expectation is that “5–10% of capital markets settlement” moves onchain in 2026, supported by regulatory momentum and stablecoin adoption by systemically important institutions.

#3 Custody Consolidation AcceleratesLong frames digital asset custody as the institutional on-ramp and predicts consolidation as custody offerings commoditize. “M&A activity in this space is a signal of maturity, not just momentum,” she wrote, citing $8.6 billion in crypto M&A in 2025. She argues regulation will push banks toward multi-custodian setups and predicts “more than half of the world’s top 50 banks” will add at least one new custody relationship in 2026.

She also points to convergence between crypto and traditional finance through deals such as Kraken’s purchase of NinjaTrader and Ripple’s acquisitions of GTreasury and Hidden Road, positioning them as steps toward safer, more integrated institutional workflows.

#4 Blockchain And AI ConvergeLong’s final theme is automation: smart contracts paired with AI models running treasury and asset-management processes continuously. “Stablecoins and smart contracts will enable treasuries to manage liquidity, execute margin calls and optimize yield across onchain repo agreements, all in real-time without manual intervention,” she wrote.

She argues privacy tech is critical for regulated deployment, pointing to zero-knowledge proofs as a way for AI to assess risk or creditworthiness without exposing sensitive data.

Long’s overarching claim is that 2026 marks a transition from experimentation to infrastructure: stablecoins as settlement and collateral, tokenization in core market plumbing, custody as a trust anchor, and AI-driven automation as the efficiency layer.

At press time, XRP traded at $1.905.

After experiencing a slight upward push a few days ago, the price of XRP has pulled back as volatility slowly takes over the broader cryptocurrency market. However, on-chain data reveals an interesting story about investors, who appear to have entered an accumulation phase, scooping up the altcoin at a rapid rate that rivals past cycles.

A Cycle Déjà Vu For XRP

Buying activity is starting to heat up for XRP, but investors and traders seem to be entering a familiar phase. While these investors continue to accumulate the leading altcoin, their buying patterns on the network closely resemble those seen in the past.

Glassnode, a popular on-chain data analytics platform, disclosed this pattern after examining the XRP Realized Price by Age (7-day Moving Average) metric. Specifically, the XRP Realized Price by Age is a key metric that determines the average price at which various cohorts of holders, divided by the length of time they have owned their tokens and last moved them.

As the price of XRP fluctuates, the chart shows that short-term holders are steadily building positions. This type of silent accumulation has been seen in the past when conviction-driven capital absorbs supplies before wider market notice, making it a critical period for the altcoin.

According to the data analytics platform, the current market structure for XRP is showing a striking resemblance to that of February 2022. A clear look into the chart reveals that active investors over the weekly to monthly timeframe window are now accumulating strongly, suggesting that bullish sentiment is returning toward the token.

One interesting thing about this accumulation is that it is happening below the cost basis of wallet addresses holding the altcoin between 6 months and 12 months. In the meantime, top purchasers continue to face increased psychological strain as long as this structure remains in place.

Why You Should Be A Patient Holder Of The Asset

Should this accumulation persist, the action is likely to lay the groundwork for another push higher. However, some investors remain skeptical about another upward move, especially to a new all-time high.

Crypto expert Bird has outlined the potential for XRP to experience a rally to a new all-time high, attributing it to the token’s design and growing role in the financial sector. The analyst stated that XRP is emerging as the foundation of the new financial system, not just another speculative asset.

Currently, the token has become a means for liquidity, payments, tokenization, and real-world use. “You don’t accidentally end up with something like this. Ripple has created something special and world-changing,” the expert added.

Bird stated that these kinds of assets only occur once in a lifetime, while encouraging investors to seek more insights about the token. This is because most people only become aware of them after the shift has already taken place.

https://cryptoslate.com/feed/

Bermuda wants to become the world's first “fully on-chain national economy.”

The announcement, delivered jointly by the island's government, Circle, and Coinbase on Jan. 19, frames the initiative as the deployment of digital asset infrastructure across government agencies, local banks, insurers, small businesses, and consumers, with USDC positioned as the primary payment rail.

The pitch: fast, low-cost, dollar-denominated settlement replacing expensive legacy systems.

However, strip away the marketing gloss, and what's actually on the table is something narrower and more instructive: a pilot-driven modernization of payment rails in a small, high-cost economy where traditional card networks extract hefty fees and where experimentation carries limited systemic risk.

Bermuda isn't mandating that every resident transact on a blockchain, but it is testing whether stablecoins can function as an everyday settlement infrastructure without forcing consumers to change how they pay.

That distinction matters because the real story here isn't Bermuda's crypto ambitions. It's the quiet, grinding work of making dollars-on-chain a practical financial layer, and the gap between what that requires and what most “on-chain economy” headlines imply.

What “fully on-chain” actually describes

The official releases outline three concrete near-term actions: government agencies piloting stablecoin-based payments, financial institutions integrating tokenization tools, and residents participating in digital literacy programs.

The government characterizes this as a continuation of a multi-year arc that began with the Digital Asset Business Act in 2018, included a USDC airdrop at the Bermuda Digital Finance Forum in 2025, and will scale further at the 2026 forum in May.

But “fully on-chain” functions as a spectrum, not a binary.

At the low end, it's marketing with an announcement with minimal change to actual payment flows. At the high end, it's an integrated national infrastructure where banks, insurers, and government agencies have built stablecoin settlement into core systems, consumer wallets arecommon, and measurable cost and time savings appear in the data.

Bermuda's current position sits somewhere between allowing on-chain payments and making them a default settlement rail for key flows.

The language supports Level 1 to early Level 2: pilots exist, “multiple live examples” are claimed, but no adoption statistics, timelines, or mandates have been disclosed.

The government hasn't published merchant counts, transaction volumes, cost comparisons, or wallet penetration rates, and these metrics distinguish experimentation from transformation.

| Level | Operational meaning | What you’d need to see | What Bermuda has actually disclosed |

|---|---|---|---|

| 0 | “On-chain economy” is primarily a branding line, with little to no change in real payment flows. | No meaningful new payment options in production; no measurable change in costs, settlement times, or adoption; no public roadmap beyond general ambition. | High-level ambition language + partnership framing; no KPIs, timelines, or adoption figures published. (Easy to over-interpret without data.) |

| 1 | On-chain payments are permitted and usable in pockets: early merchant acceptance and limited government/payment experiments. | Named payment categories in scope (e.g., specific fees/taxes); baseline counts (# merchants, # wallets); early volumes (monthly txn count/$$); basic user journeys (cash-in/out availability). | Releases describe pilots and claim “multiple live examples,” with USDC positioned centrally, plus education/onboarding plans — but provide no merchant counts, wallet penetration, volumes, or cost comps. |

| 2 | Stablecoins become a default (or common) settlement option for key flows, while legacy rails still exist. | Penetration rates by sector (% of merchant sales in stablecoins); cost delta vs cards/wires; settlement speed metrics; reliable on/off-ramps; named bank/insurer integrations with go-live dates; compliance framework in production. | Language supports “allowing on-chain payments” moving toward “default rails” in aspiration, but there’s no disclosed timetable, no named integrating institutions, and no measured adoption/cost outcomes yet. |

| 3 | On-chain is integrated into the national financial stack: government + financial institutions + broad consumer usage with measurable macro impact. | Government collections + disbursements materially on-chain (taxes/fees + benefits/payroll/rebates); broad merchant coverage; high wallet penetration; audited cost/time savings; resiliency/uptime stats; clear governance and success metrics. | Not established by the announcement: no mandate, no claim that “all GDP” settles on-chain, no replacement of fiat system, and no published success metrics showing system-level transformation. |

The island as a laboratory

Bermuda's small scale makes it an ideal testing ground. With a population of roughly 64,600 and a GDP of $9.23 billion, the economy is highly open and services-oriented.

Consumer spending hit $841 million in the second quarter of 2025, providing a useful anchor for estimating potential savings.

Traditional card networks charge merchants a blended fee of 2.5% to 3.5%. Stablecoin rails, depending on the on-ramp and compliance infrastructure, can reduce that to 0.5% 1.5%.

If 10% of Bermuda's consumer spending shifted to stablecoins, annual merchant savings could range from $3.4 million to $10.1 million. At 30% penetration, that climbs to $10.1 million to $30.3 million.

Those numbers are illustrative models that assume functional cash-in/cash-out infrastructure, merchant tooling, and regulatory clarity.

But they show why even modest adoption could be meaningful for a small economy.

The island has been experimenting with digital payments for years. In 2019, Circle announced Bermuda would accept USDC for tax payments. In 2020, the government partnered with Stablehouse on a “digital stimulus token” pilot for in-person merchant transactions.

The current initiative builds on that history, but it's still unclear which government payment categories, such as taxes, licenses, customs, benefits, or payroll, will be included in the pilots, or when.

The Visa proof point

The cleaner signal that stablecoins are becoming a practical settlement infrastructure doesn't come from Bermuda. It comes from Visa.

On Dec. 16, Visa announced USDC settlement for US issuer and acquirer partners, with initial banks including Cross River and Lead Bank.

Settlement runs over Solana, and broader US availability is planned through 2026. By late November, Visa's stablecoin settlement program had reached $3.5 billion in annualized volume.

By mid-January 2026, that figure had grown to $4.5 billion.

Visa's pitch mirrors Bermuda's: modernize the rails without changing the consumer experience. Cardholders swipe the same way, and merchants receive dollars the same way.

The difference is in backend settlement speed and cost. Yet, Visa's own crypto head acknowledged in January that stablecoins still lack “merchant acceptance at scale” for direct spending.

The $4.5 billion annualized run rate is real traction, but it's a rounding error next to Visa's $14.2 trillion in total payment volume.

That contrast of growing institutional adoption alongside limited consumer-facing utility defines stablecoins as payment infrastructure. They're effective as settlement rails inside existing networks. They're not yet replacing cards at checkout.

What the numbers hide

Stablecoin transaction volume headlines are misled by design.

Bloomberg reported $33 trillion in total stablecoin transaction value for 2025, a 72% year-over-year increase.

Meanwhile, Visa's on-chain analytics paint a different picture: $47 trillion in gross stablecoin volume, but only $10.4 trillion when adjusted for high-frequency trading, arbitrage, and non-payment activity.

That gap matters. It's the difference between treating stablecoins as speculative instruments cycling through wash trades and treating them as genuine payment infrastructure.

Bermuda's bet assumes the latter use case will dominate, but the data shows the former still drives most volume.

Circulating stablecoin supply now exceeds $310 billion, with USDT accounting for roughly $187 billion. That's real liquidity, but it doesn't automatically translate into grocery store checkouts or payroll disbursements.

The connectors, such as on-ramps, off-ramps, merchant tooling, and compliance frameworks, remain the hard part.

What Bermuda's announcement doesn't establish

The official releases don't mandate that residents or merchants use stablecoins. They don't claim that all GDP will settle on public blockchains. They don't replace Bermuda's fiat system with a sovereign token.

More importantly, they don't solve the banking problem: stablecoins still need the same connectors that enable traditional payments.

Bermuda's Digital Asset Business Act, passed in 2018, established a licensing regime for private-sector digital asset businesses and explicitly states it “shall not apply to any entity owned by the Bermuda Government.”

That means the government's move on-chain doesn't automatically subject it to the same regulatory framework as Circle or Coinbase.

The announcement also leaves critical questions unanswered. Which agencies will pilot stablecoin payments, and for which services? Which banks and insurers have integrated tokenization tools? What percentage of merchants accept USDC today, and what's the average transaction size?

Officials claim “multiple live examples” but provide no metrics. That's the gap between rhetoric and reality.

The real stakes

The question isn't whether Bermuda will wake up tomorrow with every transaction on a blockchain. It won't.

The question is whether a small, high-cost economy can build enough on-chain infrastructure to make stablecoins a default option for a meaningful share of economic activity.

If it works, Bermuda becomes a reference case for other jurisdictions evaluating stablecoin adoption. If it doesn't, the island joins the long list of crypto-friendly jurisdictions that announced ambitious plans but struggled with execution.

The outcome depends less on blockchain technology than on operational discipline: onboarding merchants, training consumers, integrating compliance, and ensuring the cost savings are real and measurable.

The post One country is moving its economy “fully on-chain” with USDC, but the data reveals a massive hidden catch appeared first on CryptoSlate.

When the Ethereum Foundation dropped a thread on Jan. 19 claiming “Ethereum is the #1 choice for global financial institutions” and backing it with 35 cited examples, it moved past the standard protocol update or developer announcement.

It read like institutional marketing: a ranked claim, a curated evidence stack, and a call-to-action funnel pointing readers to an owned landing page where financial institutions can browse live metrics and click “Get In Touch.”

That shift in tone and structure matters because it signals something more strategic than routine developer communications.

The Foundation is documenting what's happening on Ethereum while also actively fighting for control of the narrative about which blockchain institutions will choose as their settlement layer.

And it's doing so at a moment when competing rails, particularly Solana, have been gaining mainstream credibility in institutional tokenization stories, while Ethereum itself has been painted as slowing down.

The question isn't whether the 35 stories are real. The question is why the Foundation chose this moment to package them into a public-facing narrative weapon, and what changed inside and outside the organization to make that move legible.

Is Ethereum comms centralized?

The clearest internal explanation is structural. In 2025, the Ethereum Foundation formalized “Comms & marketing” as an explicit management focus area, assigning it to Josh Stark as part of a broader effort to strengthen execution.

That's a shift from the Foundation's historically decentralized, developer-centric communications posture. Making narrative work someone's formal responsibility means the organization can now mount coordinated, institution-facing campaigns rather than relying on ad-hoc community evangelism.

The institutions portal, institutions.ethereum.org, wasn't thrown together for the January thread. It's a fully built funnel with a Data Hub that displays real-time network metrics, including ETH staked, stablecoin TVL, tokenized real-world assets, DeFi TVL, and layer-2 counts.

Additionally, the funnel includes a Library that explicitly references the Foundation's Enterprise Acceleration team's thought leadership and updates.

The Jan. 19 post functions as top-of-funnel distribution for an already-live institutional landing page, not as a standalone announcement. That's marketing infrastructure, not developer relations.

The story being told about Ethereum changed

Two external pressures made staying quiet costly.

First, competing institutional tokenization narratives have increasingly been attached to non-Ethereum rails. R3, the enterprise blockchain consortium whose clients include major banks, announced a collaboration with Solana in late 2024, framing it as bringing “big bank” tokenization efforts onto Solana's infrastructure.

R3 followed up with plans for a Solana-native “Corda protocol” yield vault slated for the first half of 2026, adding more oxygen to the “institutions-on-Solana” storyline.

That's a direct challenge to Ethereum's positioning as the default institutional settlement layer.

Additionally, data from rwa.xyz shows that Ethereum grew by 3.72% in the tokenized real-world asset (RWA) market over the past 30 days. However, Solana, BNB Chain, and Stellar registered growth of 15.9%, 20.4%, and 35.3%, respectively, in the same period.

Although these three blockchains account for just 33% of Ethereum's total market share, the accelerated growth rate raises an alert.

Second, mainstream outlets began framing Ethereum as losing momentum. The Financial Times explicitly used “midlife crisis” language, contrasting Ethereum with faster, cheaper rivals and questioning whether the network could maintain its dominance amid intensifying competition.

That kind of framing, published in an outlet read by the exact institutional decision-makers Ethereum wants to attract, raises the reputational cost of silence.

Put together, the Foundation faced both competitive narrative pressure and reputational framing pressure. A proactive “here are the receipts” post becomes legible as a response to the story being told about Ethereum, not a reaction to any single new development.

What the 35 stories actually prove and why it matters now

Not all of the 35 items carry equal weight, and treating the thread as a truth table rather than a press release reveals useful nuance.

Several claims are verifiably live with measurable activity. Kraken launched xStocks on Ethereum. Fidelity issued its FDIT tokenized money market fund on the network. Amundi tokenized a share class of its CASH EUR money market fund.

JPMorgan issued its deposit token on Base, an Ethereum layer-2. Société Générale's SG-FORGE deployed its EURCV and USDCV stablecoins on DeFi protocols like Morpho and Uniswap. Stripe built stablecoin-based recurring billing into its payments stack.

These are real products with issuer announcements, on-chain contracts, and in some cases disclosed volume or assets under management.

The timing reflects a genuine shift in the competitive landscape for institutional adoption.

The global stablecoin market capitalization sits around $311 billion, with roughly $188 billion issued on the Ethereum ecosystem, whether on the mainnet or layer-2 blockchains.

Tokenized real-world assets tracked by RWA.xyz total roughly $21.66 billion in distributed value.

Those numbers are large enough that the “which chain wins institutions” question is no longer niche, but contested terrain with real economic stakes.

Ethereum retains structural advantages: the deepest liquidity, the most established DeFi protocols, the broadest developer ecosystem, and a multi-year head start in institutional experimentation.

However, advantages erode if the narrative shifts.

If decision-makers at banks, asset managers, and fintechs begin internalizing the story that Solana is faster, cheaper, and more aligned with institutional needs, those perceptions can become self-fulfilling as liquidity and developer attention migrate.

The same happens if these institutions believe that Ethereum is slowing down under its own weight.

The Foundation's response appears to contest that narrative directly by arguing that Ethereum already serves as the institutional liquidity layer, backed by a curated stack of proof points and a self-service portal where institutions can verify claims and make contact.

That's a deliberate attempt to win narrative share before the perception gap becomes an adoption gap.

The real signal

The Jan. 19 post isn't important because it reveals new institutional deals. It's important because it reveals that the Ethereum Foundation now treats narrative control as a formal organizational capability rather than a byproduct of developer evangelism.

The publication, the institutions' portal, the formalized comms structure, and the explicit funding of narrative-focused initiatives like Etherealize all point in the same direction: the Foundation has decided that winning the institutional adoption story requires more than building good infrastructure.

Tapping institutional interest also requires actively shaping how that infrastructure is perceived by the institutions it wants to attract.

Whether that strategy works depends less on the quality of the 35 stories than on whether the underlying claim, that Ethereum is the default institutional settlement layer, remains true as competitors build competing rails and mainstream outlets question Ethereum's momentum.

The Foundation is betting that proactive narrative work can prevent perception from drifting away from reality. The risk is that reality itself shifts while the Foundation is busy defending its story.

The post Ethereum is facing a brutal institutional “midlife crisis,” and the Foundation’s 35-point response reveals a shocking new reality appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Dogecoin's sell-off almost wiped out its 2026 gains. What caused this drop?

Dogecoin's sell-off almost wiped out its 2026 gains. What caused this drop? ONDO shows quiet accumulation signs as downside pressure weakens beneath resistance.

ONDO shows quiet accumulation signs as downside pressure weakens beneath resistance.https://beincrypto.com/feed/

Coinbase CEO Brian Armstrong thrust Bitcoin into the heart of the World Economic Forum’s (WEF) policy debate on Wednesday.

His comments come as markets anticipate US President Donald Trump’s appearance at the event in Davos, given his history of unscripted remarks on trade, tariffs, and geopolitics.

Bitcoin’s Independence Collides With Central Banking at Davos

The Coinbase executive directly challenged Banque de France Governor François Villeroy de Galhau over monetary independence.

“I trust more independent central banks with a democratic mandate than private issuers of Bitcoin,” Gareth Jenkinson reported, citing Villeroy de Galhau during a Davos discussion.

This remark echoes a long-standing view among central bankers that sovereign institutions are inherently more legitimate than decentralized alternatives.

Armstrong pushed back, reframing the debate in terms of control and issuance rather than political mandate.

“Bitcoin is a decentralized protocol. There’s actually no issuer of it. So, in the sense that central banks have independence, Bitcoin is even more independent. No country, company, or individual controls it in the world,” Armstrong articulated.

The exchange marked one of the rare moments at the WEF where Bitcoin itself, not merely blockchain technology or tokenized finance, was debated head-on.

For years, WEF panels have largely focused on permissioned ledgers, institutional adoption, and central bank digital currencies. They often sidestep Bitcoin’s challenge to monetary sovereignty altogether.

That dynamic began to shift at WEF 2026, in part due to persistent questioning from journalists on the ground.

Gareth Jenkinson pressed Armstrong during the “Crypto at a Crossroads” session, asking whether the US would follow through on discussions around establishing a strategic Bitcoin reserve.

Armstrong’s response framed Bitcoin less as a speculative asset and more as a neutral, global monetary network, one that governments are increasingly forced to acknowledge rather than dismiss.

Banks Push Back as Bitcoin Enters the Strategic and Macro Debate

Outside Davos, Armstrong continued to sharpen his critique of the TradFi system. In a separate interview with CNBC, he accused the US banking lobby of attempting to stifle competition through regulatory pressure, particularly around stablecoin legislation.

Referencing the stalled CLARITY Act, Armstrong argued that banks were pushing to block crypto platforms from offering yields, not because of systemic risk, but because of competitive threat.

“Their lobbying groups and their trade arms are coming in and trying to ban the competition,” Armstrong said, adding that crypto firms should be allowed to compete on a level regulatory playing field rather than being walled off by legacy incumbents.

The timing of these debates coincides with growing macroeconomic unease about the global financial system.

Hedge fund veteran Ray Dalio, also speaking to CNBC during the Davos week, warned that the current monetary order is under strain.

“The monetary order is breaking down,” Dalio said, pointing to rising debt levels and shifting reserve strategies among central banks and sovereign wealth funds.

He noted that gold’s renewed prominence reflects deepening concerns about the stability of fiat currency. These concerns are increasingly extending to digital alternatives such as Bitcoin.

Policy signals from Washington suggest that Bitcoin is no longer entirely outside the state’s strategic calculus.

US Treasury Secretary Scott Bessent confirmed in 2025 that any Bitcoin seized through law enforcement actions would be added to America’s strategic reserve.

While not an outright endorsement, the move signals a quiet acknowledgment of Bitcoin’s durability as a monetary asset.

Taken together, the Davos exchanges reflect a subtle but meaningful shift. Bitcoin is no longer just an external disruptor critiqued from afar.

It is increasingly being debated, sometimes uncomfortably, inside the very institutions that once sought to ignore it.

The post Coinbase CEO Brian Armstrong Confronts France’s Central Bank Chief on Bitcoin at Davos appeared first on BeInCrypto.

Ethereum price slipped nearly 6% over the past 24 hours and almost 13% in two days, extending a choppy January pullback. Price briefly dipped below key levels, raising fresh doubts about whether buyers can regain control.

Yet beneath the surface, large holders stepped in aggressively. Roughly $360 million worth of ETH was accumulated by whales near the dip. The rebound case looks tempting, but Smart money (informed traders) is not fully convinced yet.

Triangle Pattern And Bullish Divergence Face Off Against Heavy Supply Cluster

Ethereum is trading inside a symmetrical triangle on the daily chart. Sellers rejected the price near the upper trendline earlier, around January 14. Now price is testing the lower boundary. But can buyers save the breakdown now?

Momentum throws an important hint. Between November 4 and January 20, Ethereum printed a lower low while RSI formed a higher low. RSI measures momentum by comparing recent gains and losses. This bullish divergence suggests selling pressure is weakening, even as the price tests support.

This kind of signal mattered before. In early January, a bearish RSI divergence preceded the recent drop. Now the opposite setup is forming, hinting at a potential reversal rather than continuation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The possible bounce, however, faces a clear obstacle. Cost basis data shows a dense supply cluster between roughly $3,146 and $3,164. About 3.44 million ETH was accumulated in this zone.

Many holders are near breakeven. That often turns the area into strong resistance. Any rebound must clear this cluster to prove strength and turn into a reversal, as the RSI hints.

Whales Buy the Dip, but Smart Money Waits

Whales are acting with conviction. As Ethereum fell from around 13% (between January 19 and January 21), whale holdings rose from roughly 103.42 million ETH to about 103.71 million ETH. That increase represents close to $360 million in accumulation near current prices. This is not new behavior.

Similar whale buying appeared around January 14, shortly before a sharp bounce. Plus, the Ethereum whales started picking up supply again over the past few hours.

This steady accumulation signals confidence that the downside is limited near current levels. Whales are willing to absorb supply during weakness.

Smart money tells a different story.

The smart money index, which tracks informed positioning, remains below its signal line. Smart money typically moves early and aggressively before sustained rallies. In December, when this indicator surged above the signal line, Ethereum rallied about 26% in ten days. A similar move at the end of December preceded a 16% advance into mid-January.

That kind of confirmation is missing now. Smart money appears to be waiting for proof that resistance is cleared. The heavy cost basis cluster above the ETH price likely explains the hesitation. Until supply is absorbed, patience makes sense.

Ethereum Price Levels Reveal The Key Zone

Everything now funnels into a narrow range of levels.

The first level to reclaim is $3,050. Ethereum lost this multi-touchpoint support during the latest selloff. A daily close back above it would signal initial stabilization.

Above that, all eyes turn to the $3,160 area. This level has multiple touchpoints and aligns with the cost basis supply cluster. A clean daily close above it would represent roughly a 6% move from current prices. More importantly, it would break heavy resistance and could invite smart money back in. Post that, the reversal setup can take form.

If that happens, momentum could accelerate quickly. A confirmed breakout opens the path toward $3,390, where a broader bullish reversal would take shape.

On the downside, losing the lower triangle support near $2,910 weakens the rebound thesis. A sustained break there exposes $2,610 as the next major support.

Ethereum’s sellers may have won the recent battle, but the war is still on. Whales are already positioning for a bounce. Smart money is waiting for proof. If Ethereum can clear the $3,160 supply wall, hesitation may turn into momentum fast.

The post Ethereum’s 13% Dip Draws $360 Million in Whale Buying — But Why Is Smart Money Hesitating? appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Crypto analyst Dom has commented on the current XRP price action, revealing what the triple tap at $1.80 means for the altcoin. This comes as XRP sheds most of its gains from the start of the year amid the recent crypto market crash.

XRP Price Reaches Major Support With Triple Tap At $1.80

In an X post, Dom stated that there is a triple tap in the $1.80 zone, which is the last possible expression of a bottoming structure for the XRP price. The analyst warned that any further moves to the downside are likely to trigger a breakdown for the altcoin. He added that regaining $2.05 is the goal for bulls to put the chart back in a “safe zone.”

This analyst comes amid the XRP price crash below the psychological $2 level. The altcoin has crashed alongside the broader crypto market, losing most of its yearly gains in the process. This comes on the back of the latest Trump tariffs on eight European nations, which have sparked bearish sentiment in the market.

Commenting on the 30% rally for the XRP price earlier in the month, Dom reiterated that it was a weak move. He noted that the order flow analysis showed no strong buyer support and that the push was possible due to low liquidity. On-chain analytics platform Glassnode also recently commented on the current price action, noting that the current market structure for XRP closely resembles that of February 2022.

Glassnode stated that investors active over the 1-week to 1-month window are now accumulating below the cost basis of the 6-month to 12-month cohort. They added that as this structure persists, psychological pressure on top buyers continues to build over time.

XRP’s Structure Still Intact

In an X post, crypto analyst Egrag Crypto stated that the XRP price structure remains intact, with the upper resistance at between $3.40 and $3.60. Meanwhile, the lower support is between $1.85 and $1.95, and the price is currently near the range lows. The analyst also noted that the 21 EMA is sloping down and acting as resistance, with the price still below it, suggesting weak short-term momentum.

As for what could happen next, Egrag Crypto predicted a liquidity sweep rather than a confirmed breakdown in the XRP price. He explained that a wick below $1.85 is a normal liquidity behavior within a range. However, a weekly close below this level could signal structural failure and increase cycle risk.

Until that happens, Egrag Crypto noted that the XRP price is still ranging, holding structure, not broken, and not in macro failure. He added that his stance remains unchanged as he is still bullish and holding as long as the structure remains valid.

At the time of writing, the XRP price is trading at around $1.90, down over 3% in the last 24 hours, according to data from CoinMarketCap.

Fundstrat’s Tom Lee reiterated his $250,000 Bitcoin target while cautioning that 2026 could be a “jagged” year for crypto adoption and a turbulent one for broader risk assets, framing any major pullback as a buying window rather than a signal to de-risk.

Speaking on The Master Investor Podcast with Wilfred Frost in an interview released Jan. 20, Lee said he expects 2026 to ultimately “look like a continuation of the bull market that started in 2022,” but argued markets must first digest several transitions that could deliver a drawdown large enough to “feel like a bear market.”

$250,000 Bitcoin Call Comes With A 2026 Warning

Lee pointed to what he described as a “new Fed” dynamic, arguing markets tend to “test” a new chair and that the sequencing of identification, confirmation, and reaction can catalyze a correction. He also warned that the White House could become “more deliberate in picking winners and losers,” expanding the set of sectors, industries, and even countries “in the bullseye,” which he said is already visible in gold’s strength.

A third friction point, in his telling, is AI positioning: the market is still calibrating “how much is priced into AI,” from energy needs to data-center capacity, and that uncertainty could linger until other narratives take the baton.

Pressed on magnitude, Lee said with regards to the S&P 500, the drawdown “could be 10%,” but also “could be 15% or 20%,” potentially producing a “round trip from the start of the year,” before finishing 2026 strong. He added that his institutional clients did not appear aggressively positioned yet, and flagged leverage as a tell: margin debt is at an all-time high, he said, but up 39% year-over-year—below the 60% pace he associates with local market peaks.

For crypto, Lee leaned on a market-structure explanation for why gold outperformed: he said crypto tracked gold until Oct. 10, when the market suffered what he called “the single largest deleveraging event in the history of crypto,” “bigger than what happened in November 2022 around FTX.”

After that, he said, Bitcoin fell more than 35% and Ethereum almost 50%, breaking the linkage. “Crypto has periodic deleveraging events,” Lee said. “It really impairs the market makers and the market makers are essentially the central bank of crypto. So many of the market makers I would say maybe half got wiped out on October 10th.”

That fragility, he argued, doesn’t negate the “digital gold” framing so much as it limits who treats it that way today. “Bitcoin is digital gold,” Lee said, but added that the set of investors who buy that thesis “is not the same universe that owns gold.”

Over time, Lee expects the ownership base to broaden, though not smoothly. “Crypto still has a, I think, future adoption curve that’s higher than gold because more people own gold than own crypto,” he said. “But the path to getting that adoption rate higher is going to be very jagged. And I think 2026 will be a really important test because if Bitcoin makes a new all-time high, we know that that deleveraging event is behind us.”

Within that framework, Lee reiterated his high-conviction upside call: “We think Bitcoin will make a new high this year,” he said, confirming a $250,000 target. He tied the thesis to rising “usefulness” of crypto, banks recognizing blockchain settlement and finality, and the emergence of natively crypto-scaled financial models.

Lee cited Tether as a proof point, claiming it is expected to generate nearly $20 billion in 2026 earnings with roughly 300 employees, and argued that the profit profile illustrates why blockchain-based finance can look structurally different from legacy banking.

Lee closed with advice that intentionally cuts against short-horizon reflexes. “Trying to time the market makes you an enemy of your future performance,” he said. “As much as I’m warning about 2026 and the possibility of a lot of turbulence, they should view the pullback as a chance to buy, not the pullback as a chance to sell.”

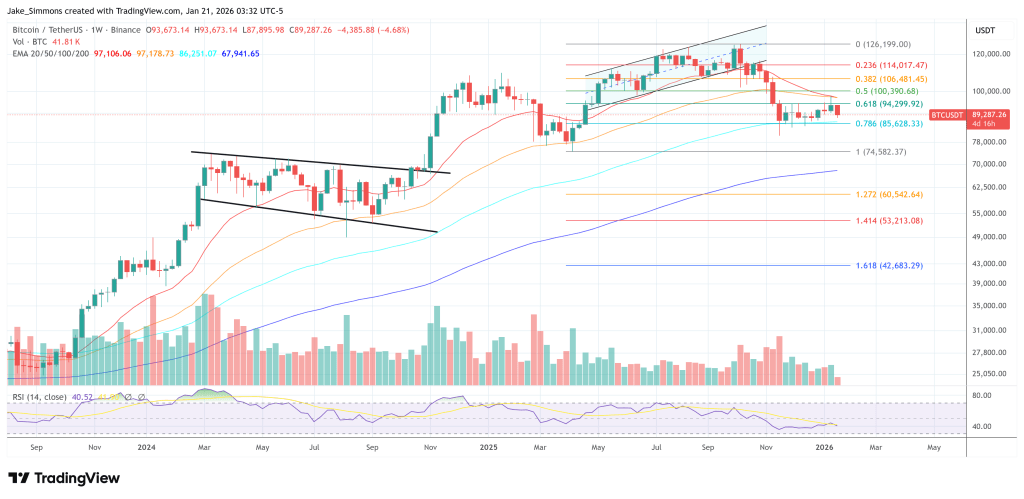

At press time, Bitcoin traded at $89,287.