Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

The crypto industry in Japan is poised for a surge in growth among retail investors, observers say, as the government plans to introduce a moderate 20% tax.

Corporate Ether acquisitions continue to decline, leaving the world’s largest corporate ETH holder to scoop up billions in Ether, aiming to amass 5% of the total supply.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Firelight's XRP staking on Flare enhances DeFi risk management, potentially boosting institutional trust and expanding XRP's utility in DeFi.

The post Firelight unveils XRP staking on Flare for DeFi insurance appeared first on Crypto Briefing.

World Liberty Financial's move could significantly enhance the integration of decentralized finance with traditional financial markets.

The post World Liberty Financial to launch real-world asset products in January 2026 appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

The crypto market delivered a dramatic rebound this week, with the Bitcoin price vaulting above $92,000 and Ethereum climbing back over $3,000. The sharp recovery in both leading cryptocurrencies has caught the market’s attention, with analysts now sharing the major reason for the unexpected pump.

Why The Ethereum And Bitcoin Price Are Rebounding

Bitcoin is currently trading above $93,000 after experiencing a period of accelerated selling and heavy long liquidations that had briefly pushed its price down over the past few weeks. Now that forced selling has eased, the cryptocurrency has recovered significantly, adding an astonishing $75 billion to its market capitalization within 10 hours.

Ethereum has followed the same upward swing. Data from CoinMarketCap shows that ETH has gained more than 9% in the past 24 hours, with steady accumulation pushing its price above $3,050.

Crypto market analyst Wimar.X has explained the reason behind the sudden surge in both Bitcoin and Ethereum prices. He framed the resurgence as a rapid wave of high-volume coordinated institutional buying. In his words, the market pumped because a massive round of accumulation occurred within a single hour.

Data from Arkham Intelligence shows that Wintermute, a leading algorithmic trading firm, had bought 8,577 BTC ahead of the market surge. Binance, the world’s largest crypto exchange, also acquired 7,658 BTC, while a major whale wallet added 6,010 BTC to its portfolio. Finally, BitMEX, a crypto exchange co-founded by Arthur Hayes, reportedly accumulated 5,818 BTC, while Bitfinex absorbed 5,778 BTC.

According to Wimar.X analysis, the sudden accumulation and its timing appear coordinated. He described the activity as manipulation, implying that it was intended to influence market perception and artificially sway prices.

Analysts Share Outlook For Bitcoin And Ethereum Price After Pump

As the crypto market showed renewed strength and BTC recovered above $90,000, crypto expert Michael van de Poppe took to X to highlight the significance of the rebound. He noted that the recent dip in Bitcoin’s price at the start of the month appeared unusual but was followed by a strong bounce. According to the analyst, surpassing $92,000 will be critical for Bitcoin and could pave the way for a new all-time high and a potential test of $100,000.

On the other hand, a market analyst identified as ‘More Crypto Online’ on X has stated that Ethereum is currently testing the micro support zone between $2,907 and $2,974. He noted that holding this support area is crucial for sustaining the upward momentum that began earlier this week.

As a result, the analyst has predicted that Ethereum’s next upside window sits between $3,165 and $3,210. He cautioned that a breach below the lower support level could trigger a deeper corrective wave. However, current trends suggest that ETH is mainly aiming higher.

Quick Facts:

Analysts claim Bitcoin could rally to $100K once it holds the resistance point above $92K, while also suggesting a potential new ATH.

Analysts claim Bitcoin could rally to $100K once it holds the resistance point above $92K, while also suggesting a potential new ATH. As Bitcoin grinds higher, structural demand is building for infrastructure that delivers cheap, programmable, $BTC‑secured transactions instead of just speculative price exposure.

As Bitcoin grinds higher, structural demand is building for infrastructure that delivers cheap, programmable, $BTC‑secured transactions instead of just speculative price exposure. Bitcoin Hyper combines Bitcoin settlement with an SVM execution layer to attack Bitcoin’s speed, cost, and programmability limitations within a single modular architecture.

Bitcoin Hyper combines Bitcoin settlement with an SVM execution layer to attack Bitcoin’s speed, cost, and programmability limitations within a single modular architecture. $HYPER reached $28.9M in presale so far and shows potential for a 2026 ROI of 1,396%; 11,123% by 2030 once the project hits the mainstream.

$HYPER reached $28.9M in presale so far and shows potential for a 2026 ROI of 1,396%; 11,123% by 2030 once the project hits the mainstream.

Bitcoin’s rebound into a major resistance band has traders dusting off six-figure price targets, with several desks now openly talking about a push toward $100K if spot demand holds.

Instead of feeling like a dead-cat bounce, this looks and trades more like the early stages of a new leg in the cycle.

Michael van de Poppe thinks that resistance at the $92K price point is critical for a potential $100K-and-beyond run, going so far as to suggest another ATH.

The good news is that Bitcoin is already trading at $93K at the time of writing. The even better news is that this doesn’t seem like a temporary bump; the 7% push over the last week suggests sustained momentum.

You’re also seeing the usual pattern that defined previous bull extensions: Bitcoin moves first, then high‑beta plays tied to its infrastructure start to outperform. In 2020–21 that meant exchanges, DeFi blue chips, and smart-contract platforms. This time, the rotation narrative is increasingly pointing at Bitcoin layer 2s.The logic is straightforward. If Bitcoin takes out resistance and grinds higher, demand for cheaper, faster, more programmable Bitcoin exposure typically explodes. Users want $BTC-secured assets that can actually do things: trade, lend, borrow, game, and settle payments at scale.

That’s the gap next‑gen Bitcoin L2s are racing to fill.

This is where Bitcoin Hyper ($HYPER) slots in as a higher‑beta ecosystem play on sustained $BTC strength.

By combining a Bitcoin settlement layer with Solana‑style performance through an integrated SVM execution layer, it positions itself as a leveraged way to express a utility thesis, not just a ‘number go up’ bet.

You can read more about what Bitcoin Hyper is right here.

Why Bitcoin’s Next Leg Is About Programmability, Not Just Price

Each major Bitcoin breakout has exposed the same structural issue: the base layer was never designed for thousands of transactions per second, sub‑second finality, or complex smart contracts.

Fees spike, blocks clog, and developers are forced to build elsewhere while trying to bolt on synthetic $BTC exposure.

That’s why you’re seeing a wave of infrastructure plays focused on scaling and programmability.

Lightning targets peer‑to‑peer payments, while projects like Stacks and Rootstock push EVM‑style programmability anchored to Bitcoin. Others experiment with rollups and sidechains, each making a different trade‑off between speed, security, and composability.

In that crowd, Bitcoin Hyper ($HYPER) is one of several emerging contenders, but with a different starting point: it leans into Solana’s Virtual Machine and high‑throughput design while treating Bitcoin as the settlement and trust anchor.The trademark Canonical Bridge produces the wrapped $BTC on Bitcoin Hyper’s Layer 2 ecosystem with near-instant finality, cutting down waiting times and consequently lowering transaction costs considerably.

For traders thinking about the ‘higher‑beta to $BTC’ trade, that kind of architecture is where a lot of speculative and real activity is likely to converge.

Buy your $HYPER on the official presale page today.

How Bitcoin Hyper Turns Bitcoin Into a High-Speed DeFi Base

Zooming in, Bitcoin Hyper ($HYPER) pitches itself as the first Bitcoin layer 2 to integrate the Solana Virtual Machine directly on top of a Bitcoin settlement layer. In plain terms, you get Solana‑style parallel execution and low‑latency processing while final state roots regularly anchor back to Bitcoin for security and credibility.

The L2 uses a modular setup: Bitcoin L1 for settlement and a real‑time SVM L2 for execution, with a single sequencer batching and posting state to mainnet.

That enables extremely low‑latency transaction processing and high‑throughput smart contracts that, according to the team, can even surpass Solana’s effective performance for specific workloads, while using modified SPL‑compatible tokens tailored to the L2 environment.The presale has already raised over $28.9M with $HYPER priced at $0.013365, which shows a lot of long-term potential.

Based on the project’s utility and presale performance, our price prediction for $HYPER considers a 2026 price target of $0.20. Based on the current presale price of $0.013365, this represents a 1,396% potential ROI.

With sufficient market support, we could see a $1.50 $HYPER by 2030, delivering a wealth-building 11,123% ROI. It all comes down to the team checking the project’s developmental milestones and $HYPER managing to rally the market behind it.If these numbers check, $HYPER could become the next crypto to explode in 2026.

Bitcoin Hyper targets a release window of Q4 2025-Q1 2026, so the time is not on your side. If you decide to invest, make sure you read our guide on how to buy $HYPER first.

Buy $HYPER today before the presale ends.

This isn’t financial advice. DYOR and invest wisely.

Authored by Bogdan Patru, Bitcoinist: https://bitcoinist.com/bitcoin-hyper-next-crypto-to-explode-100k-btc-thesis

https://cryptoslate.com/feed/

Bitcoin (BTC) jumped 11% from its Dec. 1 lows at $83,822.76 to over $93,000 overnight, driven by a convergence of macro and micro developments.

The Federal Reserve formally ended quantitative tightening (QT) on Dec. 1, coinciding with the New York Fed conducting approximately $25 billion in morning repo operations and another $13.5 billion overnight, the largest such injections since 2020.

The liquidity pump eased funding stress and propelled BTC higher as traders responded to the abrupt shift in monetary plumbing.

The combination of QT’s termination and direct liquidity provision typically supports high-beta assets by reducing borrowing costs and expanding the dollar supply in the financial system.

Rate-cut probabilities shifted back in Bitcoin’s favor after weak US manufacturing data reinforced the case for an economic slowdown.

The ISM manufacturing PMI printed at 48.2, marking a ninth consecutive month of contraction and pushing CME FedWatch odds for a 25 basis point cut at the Dec. 10 FOMC meeting into the high-80% range.

As a result of rising odds of a rate cut, risk assets stabilized following the Dec. 1 selloff, which traders attributed to speculation about the Bank of Japan tightening and shallow crypto liquidity.

Distribution catalyst meets flow reversal

Vanguard, managing roughly $9 trillion to $10 trillion in assets, opened its brokerage platform to third-party crypto ETFs and mutual funds tied to BTC, ETH, XRP, and SOL for the first time, creating immediate demand pressure.

Bloomberg senior ETF analyst Eric Balchunas described a “Vanguard effect,” noting Bitcoin rose about 6% around the US market open on the first day clients could access these products, with BlackRock’s IBIT alone recording approximately $1 billion in volume during the first 30 minutes of trading.

That distribution milestone arrived as US spot Bitcoin ETF flows turned modestly positive after four weeks of outflows totaling more than $4.3 billion.

Market structure amplified the rally after Bitcoin broke through the resistance level.

After November delivered the worst monthly performance in more than four years, and the 7.3% drop on Dec. 1 pushed BTC below $84,000, positioning skewed bearish, and sentiment gauges registered “extreme fear.”

Bitcoin remains down more than 30% from its October peak near $126,000, with November alone erasing roughly 17% amid over $3.5 billion in ETF redemptions and stress around large corporate holders like Strategy.

The rebound reflects macro-driven relief from QT by the Fed and liquidity injections, structural tailwinds from Vanguard’s platform opening and slowing ETF outflows, and short-covering off a closely watched support level rather than a reversal of the broader downtrend.

The post Bitcoin just ripped 11% after the Fed quietly restarted a $38 billion money printer mechanism appeared first on CryptoSlate.

The broader Solana memecoin economy is currently facing a liquidity crisis and collapsing volumes, but one asset has successfully decoupled from the sector-wide decline.

According to CryptoSlate data, PIPPIN, a token born from an AI experiment in early 2024, has emerged as one of the best-performing crypto tokens in the last 30 days, surging 556% to defy a market trend defined by capital flight and investor fatigue.

This divergence is stark. Across the Solana network, the “meme mania” that defined the early part of this year has largely evaporated, replaced by a harsh period of consolidation.

Yet, PIPPIN has moved in the opposite direction, propelled by a potent combination of derivatives leverage, surging open interest, and what on-chain forensic analysis suggests is a highly coordinated effort to corner the token’s supply.

PIPPIN’s derivative-fueled rally

To understand the anomaly in PIPPIN’s rally, one must first understand the surrounding wasteland.

The Solana speculative market has undergone a brutal contraction over the last six months.

Data from Blockworks Research indicates that meme assets now account for less than 10% of daily Solana decentralized exchange (DEX) volume, a precipitous drop from the dominance they commanded a year ago, when they accounted for more than 70% of activity.

The catalyst for this exodus has been a breakdown in trust.

A series of high-profile “rug pulls,” including the collapse of the LIBRA and TRUMP tokens, has decimated the appetite for new launches.

As a result, the number of active traders has plummeted as liquidity fragments, leaving the market with thinner spot depth and a wary participant base that is reluctant to take new inventory.

Against this backdrop of capitulation, PIPPIN has emerged as a magnet for the remaining speculative liquidity.

CoinGlass data shows that the token’s rise was not driven solely by spot buying but by a massive expansion in leverage.

On Dec. 1, PIPPIN derivatives recorded more than $3.19 billion in trading volume. This figure dwarfs the activity of many mid-cap utility tokens, such as Hyperliquid’s HYPE and SUI.

Simultaneously, the token’s open interest doubled to $160 million, signaling that traders were aggressively building exposure to the asset.

This creates a self-reinforcing loop in which, as the broader sector withers, the remaining capital concentrates in the few assets showing momentum.

However, unlike the broad-based rallies of the past, this move is narrow and brittle, supported almost entirely by the mechanics of the futures market rather than genuine grassroots adoption.

The great supply transfer

Meanwhile, the most critical aspect of the PIPPIN rally is on-chain, where a significant transfer of ownership has occurred.

The token is undergoing a “changing of the guard,” shifting from the hands of early, organic adopters to what appears to be a syndicated cluster of wallets managing a large share of the supply.

This transition was highlighted by the exit of a prominent early “whale.” On Dec. 1, blockchain analysis platform Lookonchain reported that a wallet labeled 2Gc2Xg, which had held the token for over a year, recently liquidated its entire 24.8 million PIPPIN position.

The trader, who originally spent just 450 SOL (roughly $90,000 at the time) to acquire the stake, exited at $3.74 million, locking in a 4,066% gain.

This represented a textbook organic trade of an early believer cashing out life-changing money.

However, the question is: who absorbed that supply?

On-chain forensics provided by Bubblemaps suggests the buyers were not scattered retail traders, but a highly organized entity.

The analysis firm identified a cluster of 50 connected wallets that purchased $19 million worth of PIPPIN.

These wallets exhibited distinct non-organic behaviors as they were funded by the HTX exchange within tight, synchronized time windows, received comparable amounts of SOL for gas fees, and had no prior on-chain activity.

Furthermore, Bubblemaps flagged 26 additional addresses that withdrew 44 percent of PIPPIN’s total supply from the Gate exchange over two months.

These withdrawals, valued at approximately $96 million, were clustered around specific dates, specifically between Oct. 24 and Nov. 23, suggesting a deliberate strategy to remove liquidity from centralized venues and reduce the circulating float.

When combined with the entry of aggressive new speculators, such as wallet BxNU5a, which bought 8.2 million PIPPIN and is currently sitting on unrealized gains of over $1.35 million, the picture becomes clear.

This means that the floating supply of PIPPIN is being rapidly consolidated.

So, as organic holders exit, they are being replaced by entities that appear to be coordinating their accumulation to tighten the market structure, making the price significantly more sensitive to the derivatives flows mentioned earlier.

What does PIPPIN rally teach the market?

This concentration of supply creates a precarious valuation paradox.

On paper, PIPPIN appears to be a unicorn, briefly touching valuations reminiscent of its peak when its creator, Yohei Nakajima, first endorsed the AI-generated concept.

However, the token’s fundamental landscape remains barren. There have been no new posts from the creator, no updated roadmap, and no technological developments to justify a quarter-billion-dollar resurgence.

As a result, this rally is a “ghost ship” momentum play, driven by market structure rather than product substance.

For the new whales and the coordinated wallet clusters, the danger lies in the exit.

While wallet BxNU5a may show $1.35 million in profit, realizing those gains in a market with thinning spot depth is a different challenge.

Moreover, if the coordinated wallets attempt to unwind their $96 million position, the liquidity mismatch could trigger a rapid price reversal.

Ultimately, PIPPIN functions as a mirror of the current state of the crypto economy, which has been skewed by leverage and dominated by sophisticated actors who can manipulate low-float assets.

Its price performance also indicates that outlier rallies remain possible. However, they are increasingly the domain of whales and syndicates rather than the everyday trader.

The post 50 secret wallets fueled PIPPIN’s 556% rally — and $3B in derivatives volume may explain why appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Can Qivalis scale fast enough to compete with Tether’s $185B head start?

Can Qivalis scale fast enough to compete with Tether’s $185B head start? Is Bitcoin's 'Santa rally' back, or will Japan spoil the party?

Is Bitcoin's 'Santa rally' back, or will Japan spoil the party? https://beincrypto.com/feed/

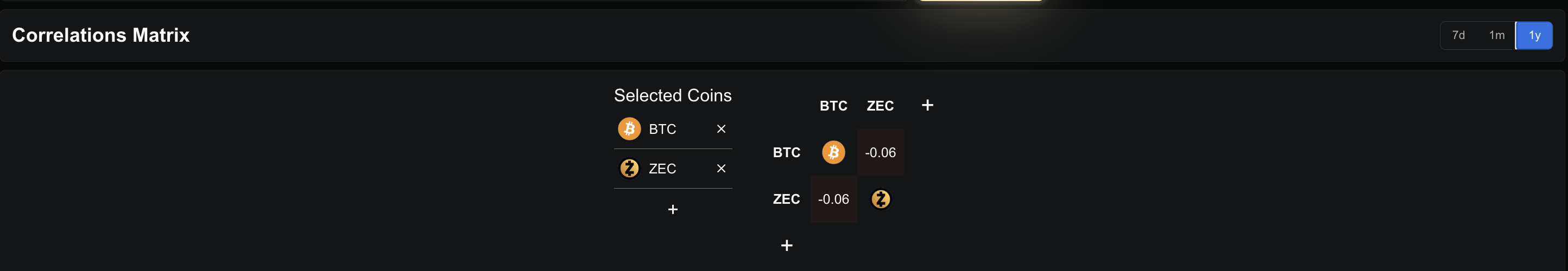

Zcash price has turned sharply lower even as the wider market rises more than 6% today. Bitcoin, Ethereum, and most large caps have bounced, but ZEC remains one of the biggest laggards, falling more than 4% in the last 24 hours and over 40% in the past week. This contrast raises a clear question: why is Zcash weakening when the rest of the market is recovering?

The answer begins with the same factor that helped Zcash outperform for months.

Zcash’s Biggest Strength Is Now Becoming Its Weakness

For most of the year, Zcash carried a negative correlation with Bitcoin. The one-year Pearson correlation coefficient, which measures how two assets move together or apart, sits near –0.06 for ZEC.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A negative value means ZEC often moves in the opposite direction of BTC. This was its biggest strength during late October and November, when Bitcoin struggled while ZEC surged more than 650% in the 3-month horizon.

Now that Bitcoin is rising, this same negative link is working against Zcash.

And the chart confirms the pressure.

The 20-day exponential moving average (EMA), which tracks short-term momentum by giving more weight to recent prices, is closing in on the 50-day EMA. If the 20-day crosses below the 50-day, it would confirm a loss of strength and could extend the Zcash decline beyond the current 40% weekly slide.

The trend that once protected ZEC during Bitcoin weakness has now flipped into a structural disadvantage.

Buying Pressure Collapses 97%, But Selling Pressure Begins to Ease

The biggest red flag appeared between December 1 and December 2. Exchange outflows — a proxy for buying demand — fell from $61.06 million to just $1.74 million.

When comparing the scale of outflows, this reflects roughly a 97% collapse in buying pressure within a single day. This drop signals that traders who had been accumulating aggressively through the October–November rally have suddenly stepped back.

But one element still keeps the chart from turning fully bearish.

Wyckoff volume colors show that selling pressure has begun to soften in the last two sessions. Yellow bars, which indicate sellers gaining control, have gradually weakened.

A similar pattern appeared between October 23 and 25. Soon after, buyers regained control with blue bars surfacing, and ZEC rallied more than 230%. So while buying pressure has collapsed, selling pressure is also reducing since yesterday, leaving the Zcash price at a conflicted but important turning point.

On the flipside, weakening buying and selling activity can eventually lead to a range-bound ZEC price movement.

Key Zcash Price Levels to Watch: Breakdown or Stabilization?

ZEC’s ability to avoid a deeper breakdown depends on holding a few major levels.

The first support sits near $299. Losing this zone would expose the next region around $210, where previous reactions formed a temporary base. A further slip could drag Zcash toward $124, a level seen during early-cycle resets.

For any recovery to develop, ZEC must reclaim $426, which would be a 34% bounce from current levels and mark the start of a reversal attempt. If buyers sustain momentum above that zone, the next major ceiling remains $736, a barrier ZEC has failed to break since early November.

Right now, Zcash price sits at a crossroads: its biggest historical strength — moving opposite to Bitcoin — has turned into a weight on its price, buying pressure has collapsed by 97%, and the bearish EMA setup is nearing. Only easing sell pressure and a reclaim of $426 keep the path to stabilization open.

The post The Biggest Zcash Strength Is Now a Weakness as Buying Collapses 97% —Breakdown Next? appeared first on BeInCrypto.

December 2, 2025 — COCA, a leading stablecoin banking app, is introducing a special holiday promotion for its users. From December 5 to December 31, 2025, COCA Card holders can earn a 10% annual percentage yield (APY) on their stablecoin balances, an increase from the usual 6%.

Promotion Details: 10% APY on All Supported Stablecoins

During the promotional period, the 10% APY applies to all stablecoins supported on the COCA Card, including:

- USDC

- USDT

- EURC

- EURS

Users may hold a single stablecoin or a combination, and all balances remain fully liquid. There are no lockups, staking requirements, or tier upgrades necessary.

Eligibility Requirements

To qualify for the holiday APY boost, users must meet the following conditions:

- Minimum Balance: Maintain a COCA Card balance of $500 or more in stablecoins throughout December.

- Transaction Activity: Complete at least five eligible card transactions during the month. Transactions can include online purchases, in-store spending, travel bookings, or subscriptions.

The APY boost is automatically applied once these requirements are met.

Payout and Timing

- The holiday APY boost is calculated based on the minimum December card balance.

- Payouts will be credited directly to the COCA Card by January 10, 2026.

- Users may receive the boost in USDC or EURC, and funds remain fully liquid, available for spending, swapping, withdrawal, or saving immediately.

Purpose and Benefits of the Promotion

This promotion underscores COCA’s mission to unlock real-world utility for stablecoins. Beyond the APY boost, COCA users benefit from:

- Up to 8% cashback on everyday purchases

- 50% cashback on Netflix, Spotify, ChatGPT, and Amazon Prime subscriptions

- Up to 50% off global hotel bookings

- Zero-fee swaps across 15+ blockchains

- A globally accepted Visa card used by over 1 million people

The holiday APY boost provides users with an additional opportunity to grow their stablecoins while retaining full control and liquidity.

Campaign Dates

- Start: December 5, 2025

- End: December 31, 2025

Why Stablecoin Yield Matters

Stablecoins are increasingly integrated into everyday spending. With COCA, users’ funds are not just stored; they can:

- Grow with passive income

- Power daily purchases

- Unlock cashback rewards

- Remain fully under user control through MPC self-custody

The December APY boost further enhances the financial utility of stablecoins.

About COCA

COCA is a digital platform designed to provide practical utility for stablecoins. The COCA Card allows users to earn yield, access cashback and discounts, and conduct zero-fee swaps across multiple blockchains. The platform is used by a growing global user base, supporting secure, liquid, and fully controlled digital assets.

More Information

- X (Twitter): https://x.com/coca_wallet

- Telegram: https://t.me/coca_wallet

- LinkedIn: https://www.linkedin.com/company/cocawallet

- Discord: https://discord.com/invite/AVxksnCubn

- CoinMarketCap:https://coinmarketcap.com/currencies/coca/

The post COCA Announces 10% APY Holiday Boost on Stablecoins appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

What to Know:

- Even as Bitcoin holds around $93K, Bitcoin’s base layer remains secure but slow, with high fees and no native smart contract environment, limiting real on-chain activity for everyday users.

- As demand for scalable on-chain applications grows, the lack of a high-speed execution layer around Bitcoin creates a structural gap for DeFi, gaming, and payments.

- Bitcoin Hyper introduces the first Bitcoin Layer 2 with SVM integration, targeting faster-than-Solana performance while leveraging Bitcoin as the settlement backbone.

- By delivering extremely low-latency execution, fast smart contracts, and Rust-based tooling, Bitcoin Hyper aims to make wrapped $BTC usable across DeFi, NFTs, and gaming.

If you’re convinced Bitcoin is marching toward six figures, the bigger question is where the next asymmetric upside comes from. Right now, the world’s leading crypto is holding near $93K.

History suggests the highest multiples don’t usually come from the base asset itself, but from the infrastructure built on top of it; think ERC-20 DeFi blue chips riding Ethereum’s 2020 breakout.

Bitcoin’s problem is that it never had its own native DeFi and application stack to the same extent.Slow confirmation times, high fees during peak cycles, and the absence of native smart contracts have kept most real on-chain activity on other networks, even as Bitcoin dominates as a store of value and brand.

That’s the gap Bitcoin Hyper ($HYPER) is going after: a high-speed Bitcoin Layer 2 that brings Solana-style throughput directly to $BTC’s settlement layer.

Instead of asking you to rotate out of Bitcoin into a ‘fast L1,’ Bitcoin Hyper is betting the next 1000x upside comes from plugging DeFi, gaming, and payments into Bitcoin’s existing liquidity.

With a presale already into eight figures and early whales circling, Bitcoin Hyper is positioning itself as a bet not against Bitcoin, but on Bitcoin finally getting the performance layer it has been missing.For $BTC holders who want more than passive ‘number go up,’ that’s a compelling narrative to examine seriously.

Bitcoin Hyper Turns BTC Into a High-Speed Application Layer

Bitcoin Hyper is built for one simple outcome: letting you use Bitcoin like a modern, high-throughput network without abandoning Bitcoin’s security and brand.

It introduces a dedicated Layer 2 that runs smart contracts using the Solana Virtual Machine (SVM) tooling, tuned to deliver faster performance than Solana itself for real-world transactions.For users, this translates into sub-second confirmation experiences and low fees on wrapped $BTC transfers, swaps, and dApps, rather than waiting on congested Bitcoin blocks.

DeFi traders can move into pools, lending markets, and staking strategies at speed, while still ultimately settling back to Bitcoin as the base layer they trust via a Canonical Bridge. If you’re considering getting exposure, here’s a guide on how to buy Bitcoin Hyper.

Developers get a Rust-based SDK and API to ship NFT platforms, gaming dApps, and high-frequency applications without fighting Bitcoin’s base-layer limitations.

Bitcoin Hyper explicitly targets Solana-level speed while anchoring to Bitcoin, aiming to keep latency low enough for gaming and real-time apps.The presale has already pulled in $28.8M, a clear signal of early conviction behind the project’s thesis

You can explore the Bitcoin Hyper presale now.

Can $HYPER Be a 1000x for Bitcoin Maxis?

If Bitcoin Hyper captures even a small portion of the broader Bitcoin DeFi and Layer 2 narrative market, our prediction suggests that $HYPER could reach $0.08625, delivering roughly 545% returns from the current presale price of $0.013365.

That kind of upside depends on real usage, but the thesis is clear: bring Solana-like performance to where the Bitcoin liquidity already sits. You can read a Bitcoin Hyper price prediction breakdown for more scenario modeling.

Momentum is already building around that idea. Whale buys include $500K, $379K, and $274K, all feeding into the $HYPER momentum.If Bitcoin does grind toward six figures over the next cycle, the infrastructure that lets $BTC behave like a modern programmable asset stands to benefit most.

What is Bitcoin Hyper? The execution layer for crypto’s flagship: fast, cheap, and plugged directly into the world’s best-known crypto brand.

The core opportunity here is simple: Bitcoin retains its role as pristine collateral and base money, while Bitcoin Hyper turns that collateral into something you can actually deploy across DeFi, gaming, and payments at high speed.If the market agrees that the next 1000x comes from building on Bitcoin rather than competing with it, $HYPER sits directly in that slipstream.

Join the $HYPER presale now.

This article is informational only and does not constitute financial, investment, or trading advice; always do your own research.

Authored by Aaron Walker for NewsBTC — https://www.newsbtc.com/bitcoin-hyper-presale-next-1000x-bitcoin-layer-2

What to Know:

- Vanguard’s embrace of spot Bitcoin ETFs adds another giant gatekeeper to the BTC on-ramp, channeling retirement and retail capital into the asset.

- As Bitcoin becomes an ETF-friendly macro asset, traders seeking more upside are rotating toward higher-risk ecosystem plays and infrastructure tokens.

- Bitcoin Hyper targets Bitcoin’s limitations on speed, fees, and programmability by integrating SVM on a modular Layer 2 anchored to $BTC settlement.

- The Bitcoin Layer 2 race is intensifying as projects compete to capture DeFi, gaming, and payments flows that the base Bitcoin network cannot natively support.

For years, Vanguard stood out as the big asset manager that wanted nothing to do with spot Bitcoin ETFs.

That stance quietly shifted, and the pivot matters. When a $9+ trillion retirement giant opens the door to $BTC exposure, it adds another massive gatekeeper to the on-ramp for mainstream capital. It saw $BTC rally on Tuesday, jumping back up to the $92K mark from a recent dip below the $86K region.

You now have BlackRock, Fidelity, and Vanguard funneling retirement portfolios, 401(k)s, and brokerage accounts into spot Bitcoin. That flow doesn’t just push up $BTC’s market cap; it changes how traditional investors think about crypto risk. Bitcoin starts to look like ‘digital gold core holding,’ not a speculative side bet.

The knock-on effect is obvious for traders: if Bitcoin becomes the safe, ETF-wrapped asset, the search for higher-octane upside moves further out on the risk curve. That’s where ecosystem plays, infrastructure tokens, and early-stage presales come in.

Bitcoin Hyper ($HYPER) is positioning itself exactly in that lane, pitching itself as a Bitcoin-native Layer 2 with Solana-grade performance.

As capital crowds into spot BTC via TradFi rails, the question for more aggressive crypto traders isn’t ‘Should I own Bitcoin?’ anymore. It’s ‘Where can I get leveraged exposure to the Bitcoin network’s growth without using actual leverage?’

For some, that answer increasingly looks like ecosystem bets such as Bitcoin Hyper (HYPER) and other high-throughput Bitcoin Layer 2s.Why Wall Street’s Bitcoin Obsession Pushes Attention To Layer 2

Wall Street’s ETF embrace solves one thing: easy Bitcoin exposure inside familiar accounts. It doesn’t solve Bitcoin’s technical pain points. The base layer still processes roughly 7 transactions per second, with confirmation times measured in minutes and fees that spike into double digits when mempools clog.

That limitation is a feature for store-of-value purists, but a brick wall for anyone wanting DeFi, gaming, or consumer apps atop Bitcoin.

So you’re seeing a rush of infrastructure projects racing to bolt smart contracts and high throughput onto $BTC without compromising its settlement assurances.

Competing visions include Ordinals-centric tooling, sidechains like Rootstock, and experimental rollup frameworks.

In that crowded field, Bitcoin Hyper ($HYPER) is pitching itself as a unique contender, differentiating through Solana Virtual Machine (SVM) compatibility. It has an explicit focus on traders and DeFi power users looking to amplify Bitcoin’s upside rather than just hold ETF shares.

You can buy $HYPER for $0.013365 while it’s still in its presale, and take advantage of 40% staking rewards.Bitcoin Hyper’s Bet: Solana Performance, Bitcoin Settlement

Zooming in, Bitcoin Hyper ($HYPER) markets itself as ‘the first ever Bitcoin Layer 2 with SVM integration,’ aiming to deliver performance that can exceed Solana’s own execution speeds.

Anchored by a canonical bridge that links Bitcoin’s security to high-speed execution, Bitcoin Hyper’s modular architecture combines the best of both worlds. The system relies on Bitcoin L1 for settlement while offloading processing to a real-time SVM Layer 2, where a single sequencer commits state roots on-chain.

This bridge allows you to escape L1 congestion and access an ecosystem of instant, low-cost wrapped $BTC payments, NFTs, and DeFi. With support for Rust SDKs and Solana-style APIs, Bitcoin Hyper brings high-performance gaming and complex smart contracts to Bitcoin. If you want more info, check out our ‘What is Bitcoin Hyper’ guide.

The market seems to be paying attention as the Bitcoin Hyper presale has raised over $28.8M so far. And smart money is moving. High-net-worth wallets have been making purchases as large as $500K.

Our experts see a potential end-of-2026 high of $0.08625, which, if you bought at today’s price, would see you with a potential ROI of over 545%.

If you believe Vanguard and its peers will keep funneling conservative capital into spot Bitcoin, Layer 2s like $HYPER offer a different angle: upside tied not just to $BTC’s price, but to whether Bitcoin can finally host high-throughput applications at scale.

Join the $HYPER presale.Remember, this isn’t intended as financial advice, and you should always do your own research before investing.

Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/vanguard-etf-pivot-causes-fomo-as-hyper-rides-the-wave