Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

In a new Bloomberg interview, former SEC Chair Gary Gensler reiterated that Bitcoin stands apart from thousands of other crypto tokens, which he describes as ‘highly speculative’ assets.

Cayman foundation registrations increase by 70% year-on-year as DAOs seek legal wrappers, with CARF rules set to arrive in 2026.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

This partnership could accelerate institutional adoption of crypto by aligning staking services with traditional finance standards and security.

The post Deutsche Bank-backed Taurus partners with Everstake to enhance institutional crypto staking appeared first on Crypto Briefing.

Tokenization's potential to revolutionize financial systems could reshape market dynamics and investment strategies, impacting global asset management.

The post BlackRock CEO Larry Fink, Brian Armstrong to discuss tokenization at DealBook Summit appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Oslabujúci dolár, očakávané zníženie úrokových sadzieb americkým Fedom a rastúca aktivita na spotových ETF fondoch formujú nové podmienky pre decembrový trh. Bitcoin sa opäť obchoduje nad úrovňou 92 000 $ a aj altcoiny naznačujú zmenu trhovej dynamiky. Je december vhodným časom na nákup?

Preskúmať top predpredaj 2025

Cena Bitcoinu stúpla o viac ako 6 % za posledný týždeň

Bitcoin sa dnes obchoduje za 92 981 $. V priebehu posledných 7 dní posilnil o 6,15 % a zotavil časť novembrových strát, ktoré patrili k najvýraznejším od roku 2021. Nárast objemov v spotových ETF, najmä po tom, čo Vanguard zrušil obmedzenie obchodovania s Bitcoin ETF, podporil nový prílev kapitálu do trhu.

Len samotný fond IBIT spoločnosti BlackRock dosiahol miliardové objemy už v prvých minútach obchodovania po otvorení amerického trhu.

Zdroj: coinmarketcap.com

Zdroj: coinmarketcap.com

Prelomenie hranice 93 000 dolárov by podľa analytikov Glassnode mohlo vyvolať krátkodobý short squeeze, ktorý by cenu vystrelil smerom k 95-100 tisíc $. Zároveň platí, že pokiaľ Bitcoin zostane nad úrovňou 80 tisíc $, trh si udrží býčí výhľad. Makro faktorom dominuje očakávanie, že Fed už budúci týždeň pristúpi k zníženiu sadzieb, ktoré tradične podporuje rizikové aktíva vrátane kryptomien.

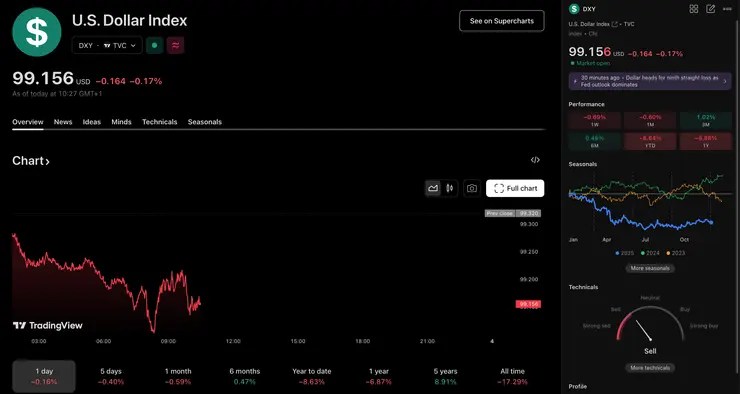

Euro posilňuje v očakávaní rozhodnutia americkej centrálnej banky. Dolár oslabil tento rok o takmer 7 %

Euro v úvode decembra posilňuje a prelomilo svoj 50-dňový kĺzavý priemer po tom, čo inflácia v eurozóne mierne prekonala očakávania. Spoločná mena sa aktuálne obchoduje pri úrovni 1,1640 dolára a smeruje k najlepšiemu ročnému výkonu od roku 2017. Trh tak reaguje na kombináciu priaznivých európskych makrodát a slabnúceho amerického dolára, ktorý v tomto roku stratil takmer 7 % hodnoty na indexe DXY.

Investori sa zároveň pripravujú na zasadnutie Federálneho rezervného systému, ktorý sa uskutoční už budúci týždeň. Podľa údajov platformy Polymarket vyskočila pravdepodobnosť, že Fed pristúpi k ďalšiemu zníženiu sadzieb až 93 %.

Práve toto očakávanie patrí medzi hlavné dôvody oslabenia dolára. Americká mena sa totiž stáva menej atraktívnou v prostredí, kde sa úrokový diferenciál medzi USA a ostatnými ekonomikami rýchlo zužuje. Odborníci upozorňujú, že aj malé náznaky holubičej rétoriky Fedu by mohli spôsobiť ďalší pokles dolára v druhej polovici decembra.

Zdroj: tradingview.com

Zdroj: tradingview.com

Naopak, Európska centrálna banka neplánuje bezprostredné znižovanie sadzieb a trhy započítavajú iba približne 25 % pravdepodobnosť uvoľnenia menovej politiky v roku 2026. Tento kontrast medzi Fedom a ECB hrá v prospech eura, ktoré zostáva podporované stabilnou politikou ECB a slabnúcou americkou menou.

Makro pohyby na devízových trhoch tak vytvárajú prostredie priaznivé pre rizikové aktíva vrátane kryptomien. Slabší dolár totiž historicky podporuje dopyt po Bitcoine, altcoinoch a ďalších volatilnejších aktívach.

Altcoiny naznačujú budúci rast. Ethereum si polepšilo o 9 %

Popri Bitcoine sa nálada zlepšuje aj v segmente altcoinov. Celková trhová kapitalizácia kryptomien stúpla na 3,14 bilióna dolárov, čo predstavuje 6,84 % denný nárast. A práve altcoiny ťahajú značnú časť tohto impulzu. Ethereum (ETH) vzrástlo za posledných 24 hodín o 8,80 % a jeho cena sa drží nad 3 052 dolármi. Rast podporuje návrat likvidity na trh a klesajúca dominancia Bitcoinu, ktorá vytvára priestor pre širšiu altcoinovú rally.

Zdroj: coinmarketcap.com

Zdroj: coinmarketcap.com

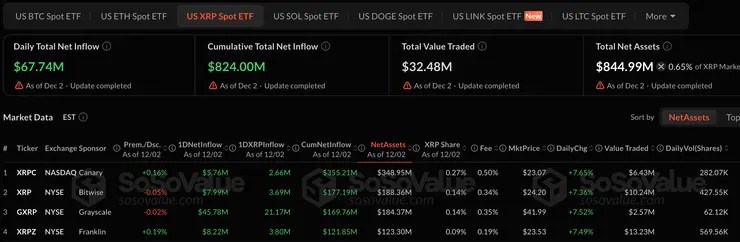

XRP taktiež potvrdzuje posilnenie sentimentu. S 8,27 % denným nárastom patrí medzi najvýkonnejšie veľké altcoiny, pričom jeho trhová kapitalizácia presiahla už 131,6 miliardy dolárov. Súčasne rastie aj dopyt po XRP ETF fondoch, ktoré pritiahli tento týždeň už viac ako 157 miliónov dolárov.

Súčasne, natívna kryptomena populárneho blockchainu pre meme coiny Solana (SOL), si pripísala za posledný deň 12 %. Celkovo si tak polepšila o takmer 4 % za týždeň. Záujem investorov podporuje vysoká aktivita v DeFi a rastúce množstvo nových aplikácií v jej ekosystéme.

Zdroj: sosovalue.com

Zdroj: sosovalue.com

Stablecoin Tether (USDT) zostáva najväčším zdrojom likvidity na trhu, čo je viditeľné z vysokého 24-hodinového objemu 128,2 miliardy dolárov Ide o jasný signál, že obchodníci aktívne rotujú kapitál medzi hlavnými altcoinmi. Súčasné trhové ukazovatele vytvárajú konzistentný obraz prostredia, v ktorom sa altcoiny presadzujú čoraz výraznejšie.

Rastový impulz v segmente altcoinov zároveň vytvára priaznivé podmienky pre nové kryptomeny, ktoré práve v tomto období vstupujú na trh. Investori po mesiacoch opatrnosti opäť rozširujú expozíciu voči projektom s vyšším potenciálom, čo zvyšuje záujem o kvalitné predpredaje. V tejto skupine aktuálne dominuje projekt Bitcoin Hyper, ktorý počas prebiehajúceho predpredaja už získal viac než 28 miliónov dolárov.

Layer 2 architektúra Bitcoin Hyper prináša pre BTC novú úroveň využitia

Základom projektu Bitcoin Hyper (HYPER) je snaha prepojiť vysokú bezpečnosť Bitcoinovej siete s výkonnosťou moderných blockchainových architektúr. HyperChain používa Solana Virtual Machine (SVM) ako výpočtovú vrstvu, no finálne osadenie transakcií sa rieši na Bitcoinovom Layer 1.

V praxi to znamená, že DeFi aplikácie môžu využívať nízke poplatky a vysoké TPS, kým Bitcoin zostáva konečnou autoritou pre zúčtovanie. Súčasťou riešenia je aj mechanizmus canonical bridge, v ktorom sa BTC uzamkne na základnej vrstve a jeho zabalená verzia sa následne používa v prostredí Bitcoin Hyper. Tým sa otvára priestor pre reálne ekonomické aktivity, ktoré Bitcoin doteraz nepodporoval.

Zdroj: bitcoinhyper.com

Zdroj: bitcoinhyper.com

Natívny token HYPER zohráva v ekosystéme ústrednú úlohu. Držitelia ho využijú ako:

- platidlo na úhradu transakčných poplatkov

- zdroj pasívnych príjmov za staking (aktuálne ponúka 40 % APY)

- hlasovacie právo pri rozhodovaní o budúcom vývoji ekosystému v rámci DAO

- investičný nástroj na zhodnotenie kapitálu v trhovom prostredí

Aktuálna cena kryptomeny HYPER v predpredaji je 0,013365 $, pričom do uzavretia predpredaja zostáva už len niekoľko dní. Silný záujem retailových investorov dopĺňajú aj výrazné kapitálové vstupy zo strany veľrýb, čo zvyšuje dôveru v dlhodobejšiu víziu projektu.

Pre mnohých investorov predstavuje Bitcoin Hyper riešenie, ktoré môže Bitcoinu priniesť funkcionalitu, aká mu doteraz chýbala. Nová Layer-2 vrstva umožňuje obchodníkom aj vývojárom využívať BTC v moderných decentralizovaných aplikáciách, pokročilých DeFi riešeniach, ekosystémoch založených na meme tokenoch či v rámci smart kontraktov.

Tvorcovia projektu zároveň stavili na výraznú vizuálnu identitu, ktorá pracuje s hravým a virálnym potenciálom značky. Novú sieť reprezentuje postava Hyper, využívaná v meme formáte s estetikou superhrdinu, ktorá sprevádza jednotlivé fázy vývoja projektu.

Markets move fast. Hyper stays ready.

https://t.co/VNG0P4GuDo pic.twitter.com/5YVWN3TnQ1

— Bitcoin Hyper (@BTC_Hyper2) December 3, 2025

Tento prístup podporuje aktívnu a angažovanú komunitu, uľahčuje odlíšenie od ostatných projektov a prispieva k rýchlemu budovaniu povedomia ešte pred uvedením tokenu na trh.

Token nájdete na domovskej stránke projektu a tiež priamo v aplikácii kryptopeňaženky Best Wallet. Nákupný widget akceptuje kryptomeny ETH, BNB, USDT a tiež platbu kartou.

Navštíviť predpredaj Bitcoin Hyper

Michael Burry has escalated his long-running war on Bitcoin, calling it “the tulip bulb of our time” and insisting it is “not worth anything.” Speaking on Michael Lewis’ “Against the Rules: The Big Short Companion” podcast released on December 2, Burry recoiled at how normalized such valuations have become in financial media.

Burry Revives Tulip Bubble Comparison For Bitcoin

“I think that Bitcoin at $100,000 is the most ridiculous thing,” he said. “Sane people are sitting on TV talking about Bitcoin, they’re just casually, ‘it’s 100,000, it’s down now, it’s 98,000.’ It’s not worth anything. Everybody’s accepted it. It’s the tulip bulb of our time.” He then pushed the analogy further: “It’s worse than a tulip bulb because this has enabled so much criminal activity to go deep under.”

The exchange was triggered when Lewis asked whether Burry’s “institutional pessimism” nudged him toward refuges like “Bitcoin or gold or one of these refuges that people” talk about. Burry rejected Bitcoin outright and drew a sharp contrast with his own positioning: “I have had gold since 2005.” In his framework, Bitcoin is not “digital gold” but a speculative token whose perceived value rests on social consensus and leverage, while simultaneously, in his view, providing a powerful channel for illicit flows rather than productive capital formation.

Burry’s critique is consistent with his broader view that markets are again trapped in a cross-asset bubble driven by narrative and cheap money rather than fundamentals. But he does not present himself as a crypto macro-trader looking to time Bitcoin’s next leg lower. Instead, Bitcoin appears in the interview as a kind of exhibit A in a system that, he argues, has once more stopped asking what anything is intrinsically worth and simply extrapolates price action and stories.

Burry’s Critique Is Not New

The podcast marks the latest chapter in a Bitcoin skepticism that Burry has been voicing since the last cycle. In late February 2021, with BTC near its then-record zone, he tweeted that “BTC is a speculative bubble that poses more risk than opportunity despite most of the proponents being correct in their arguments for why it is relevant at this point in history,” adding a warning on hidden leverage: “If you do not know how much leverage is involved in the run-up, you may not know enough to own it.”

By June 2021, as meme stocks and crypto surged together, Burry widened the lens. He described the environment as the “greatest speculative bubble of all time in all things. By two orders of magnitude,” and cautioned that “all hype/speculation is doing is drawing in retail before the mother of all crashes,” explicitly including cryptocurrencies in that warning.

Today’s “tulip bulb” broadside on Lewis’ podcast does not represent a new stance so much as the culmination of that trajectory: from calling Bitcoin a leveraged “speculative bubble” in early 2021 to declaring in 2025 that, at the kinds of levels now discussed on television, it is simply “not worth anything” at all.

At press time, BTC traded at $93,226.

https://cryptoslate.com/feed/

The broader Solana memecoin economy is currently facing a liquidity crisis and collapsing volumes, but one asset has successfully decoupled from the sector-wide decline.

According to CryptoSlate data, PIPPIN, a token born from an AI experiment in early 2024, has emerged as one of the best-performing crypto tokens in the last 30 days, surging 556% to defy a market trend defined by capital flight and investor fatigue.

This divergence is stark. Across the Solana network, the “meme mania” that defined the early part of this year has largely evaporated, replaced by a harsh period of consolidation.

Yet, PIPPIN has moved in the opposite direction, propelled by a potent combination of derivatives leverage, surging open interest, and what on-chain forensic analysis suggests is a highly coordinated effort to corner the token’s supply.

PIPPIN’s derivative-fueled rally

To understand the anomaly in PIPPIN’s rally, one must first understand the surrounding wasteland.

The Solana speculative market has undergone a brutal contraction over the last six months.

Data from Blockworks Research indicates that meme assets now account for less than 10% of daily Solana decentralized exchange (DEX) volume, a precipitous drop from the dominance they commanded a year ago, when they accounted for more than 70% of activity.

The catalyst for this exodus has been a breakdown in trust.

A series of high-profile “rug pulls,” including the collapse of the LIBRA and TRUMP tokens, has decimated the appetite for new launches.

As a result, the number of active traders has plummeted as liquidity fragments, leaving the market with thinner spot depth and a wary participant base that is reluctant to take new inventory.

Against this backdrop of capitulation, PIPPIN has emerged as a magnet for the remaining speculative liquidity.

CoinGlass data shows that the token’s rise was not driven solely by spot buying but by a massive expansion in leverage.

On Dec. 1, PIPPIN derivatives recorded more than $3.19 billion in trading volume. This figure dwarfs the activity of many mid-cap utility tokens, such as Hyperliquid’s HYPE and SUI.

Simultaneously, the token’s open interest doubled to $160 million, signaling that traders were aggressively building exposure to the asset.

This creates a self-reinforcing loop in which, as the broader sector withers, the remaining capital concentrates in the few assets showing momentum.

However, unlike the broad-based rallies of the past, this move is narrow and brittle, supported almost entirely by the mechanics of the futures market rather than genuine grassroots adoption.

The great supply transfer

Meanwhile, the most critical aspect of the PIPPIN rally is on-chain, where a significant transfer of ownership has occurred.

The token is undergoing a “changing of the guard,” shifting from the hands of early, organic adopters to what appears to be a syndicated cluster of wallets managing a large share of the supply.

This transition was highlighted by the exit of a prominent early “whale.” On Dec. 1, blockchain analysis platform Lookonchain reported that a wallet labeled 2Gc2Xg, which had held the token for over a year, recently liquidated its entire 24.8 million PIPPIN position.

The trader, who originally spent just 450 SOL (roughly $90,000 at the time) to acquire the stake, exited at $3.74 million, locking in a 4,066% gain.

This represented a textbook organic trade of an early believer cashing out life-changing money.

However, the question is: who absorbed that supply?

On-chain forensics provided by Bubblemaps suggests the buyers were not scattered retail traders, but a highly organized entity.

The analysis firm identified a cluster of 50 connected wallets that purchased $19 million worth of PIPPIN.

These wallets exhibited distinct non-organic behaviors as they were funded by the HTX exchange within tight, synchronized time windows, received comparable amounts of SOL for gas fees, and had no prior on-chain activity.

Furthermore, Bubblemaps flagged 26 additional addresses that withdrew 44 percent of PIPPIN’s total supply from the Gate exchange over two months.

These withdrawals, valued at approximately $96 million, were clustered around specific dates, specifically between Oct. 24 and Nov. 23, suggesting a deliberate strategy to remove liquidity from centralized venues and reduce the circulating float.

When combined with the entry of aggressive new speculators, such as wallet BxNU5a, which bought 8.2 million PIPPIN and is currently sitting on unrealized gains of over $1.35 million, the picture becomes clear.

This means that the floating supply of PIPPIN is being rapidly consolidated.

So, as organic holders exit, they are being replaced by entities that appear to be coordinating their accumulation to tighten the market structure, making the price significantly more sensitive to the derivatives flows mentioned earlier.

What does PIPPIN rally teach the market?

This concentration of supply creates a precarious valuation paradox.

On paper, PIPPIN appears to be a unicorn, briefly touching valuations reminiscent of its peak when its creator, Yohei Nakajima, first endorsed the AI-generated concept.

However, the token’s fundamental landscape remains barren. There have been no new posts from the creator, no updated roadmap, and no technological developments to justify a quarter-billion-dollar resurgence.

As a result, this rally is a “ghost ship” momentum play, driven by market structure rather than product substance.

For the new whales and the coordinated wallet clusters, the danger lies in the exit.

While wallet BxNU5a may show $1.35 million in profit, realizing those gains in a market with thinning spot depth is a different challenge.

Moreover, if the coordinated wallets attempt to unwind their $96 million position, the liquidity mismatch could trigger a rapid price reversal.

Ultimately, PIPPIN functions as a mirror of the current state of the crypto economy, which has been skewed by leverage and dominated by sophisticated actors who can manipulate low-float assets.

Its price performance also indicates that outlier rallies remain possible. However, they are increasingly the domain of whales and syndicates rather than the everyday trader.

The post 50 secret wallets fueled PIPPIN’s 556% rally — and $3B in derivatives volume may explain why appeared first on CryptoSlate.

Bitcoin was launched fifteen years ago. The industry has ballooned into a nearly $4 trillion ecosystem, yet Satoshi’s vision of everyday payments remains largely unfulfilled. The hope for peer-to-peer payments has shifted to stablecoins. But rather than replacing banks, stablecoins risk becoming bank-like infrastructure. Stronger regulation in the U.S. and Europe may push them toward centralized rails rather than open money.

Regulation turning stablecoins into regulated payment networks

In America, the GENIUS Act established a federal framework for payments with stablecoins—who can issue them, how to back them up, and how they’re regulated. In Europe, MiCA regulation (Markets in Crypto-Assets) became applicable in 2024 and set strict requirements for stablecoins under categories like “e-money tokens” and “asset-referenced tokens.”

These regulations foster legitimacy and safety, but at the same time push stablecoin issuers into the world of banks. When issuers need to comply with reserve, audit, KYC, and redemption requirements, the structure and essence of stablecoins shift. They become centralized gateways rather than peer-to-peer money. Over 60% of corporate stablecoin usage is cross-border settlement, not consumer payments. Stablecoins are becoming more institutional tools and fewer tokens for individuals.

The danger: becoming the next SWIFT

What does it mean to “become the next SWIFT”? It means evolving into the go-to rail for institutions; efficient yet opaque, centralized yet indispensable. SWIFT transformed global banking by enabling messaging between banks; it did not democratize banking access. If stablecoins mirror that evolution, they’ll deliver faster rails for existing players rather than empowering the unbanked.

Crypto’s promise was programmable money—cash that moves with logic, autonomy, and user control. But when transactions require issuer permission, compliance tagging, and monitored addresses, the architecture changes. The network becomes compliant infrastructure, not money. That subtle but profound shift may make stablecoins less radical and more reactionary.

A better path to open rails with compliance baked in

The challenge is not regulation; it’s design. To uphold the promise of stablecoins while adhering to regulatory demands, developers and policymakers should embed compliance in the protocol layer, maintain composability across jurisdictions, and preserve non-custodial access. Back in the real world, initiatives like the Blockchain Payments Consortium provide a glimpse of hope that standardizing cross-chain payments is possible without sacrificing openness.

Stablecoins must work for individuals, not just institutions. If they serve only large players and regulated flows, they won’t disrupt—they’ll conform. The design must allow true peer-to-peer movement, selective privacy, and interoperability. Otherwise, the rails will lock us into old hierarchies, just faster.

Stablecoins still hold the potential to rewrite money. But if we allow them to become institutionalized rails built for banks rather than people, we will have replaced one central system with another. The question isn’t whether we regulate—stablecoins will be regulated. It’s whether we design for inclusion and autonomy, or lock in yesterday’s system behind digital wrappers. The future of money depends on which path we choose.

The following is a guest post and opinion from Joël Valenzuela, Director of Marketing and Business Development at Dash.

The post Stablecoins were built to replace banks but on course to becoming one appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Can Qivalis scale fast enough to compete with Tether’s $185B head start?

Can Qivalis scale fast enough to compete with Tether’s $185B head start? Is Bitcoin's 'Santa rally' back, or will Japan spoil the party?

Is Bitcoin's 'Santa rally' back, or will Japan spoil the party? https://beincrypto.com/feed/

The crypto market has entered December with a sharp momentum shift, as altcoins rebound in a clean V-shape pattern, Bitcoin flashes a historically rare bullish signal, and the Federal Reserve injects $13.5 billion in liquidity, the second-largest such operation since the COVID-19 pandemic.

Traders now want to know whether this cluster of catalysts marks the start of a full market reversal.

Altcoins Erase Losses in V-Shape Recovery As Bitcoin Flashes a Rare Parabolic Signal

Altcoins are driving the December turnaround after one of the strongest 24-hour recoveries in months.

“Alts just printed a sharp V-shape recovery, erasing all the downside. In 24 hours, they’ve surged into the Warming Up quadrant, where rallies and breakouts ignite. But there’s one condition: BTC must stabilize and reclaim $93,500,” cautioned Altcoin Vector in a post.

The V-shape pattern historically appears ahead of broader trend reversals, but only if Bitcoin confirms the macro direction.

Several analysts believe a confirmation signal may already be forming. According to Gert van Lagen, Bitcoin’s monthly Bollinger Band Width has dipped below 100, a rare technical event that preceded every major Bitcoin parabolic leg in the past decade.

If history repeats itself, Bitcoin may be preparing for its next major expansion phase, provided it can retake the $93,500 resistance level.

Institutions Step Back In: Vanguard, BoA, Tether

Social data from Santiment indicates a sharp increase in institutionally driven narratives across cryptocurrency platforms. Vanguard, managing $11 trillion, reversed its anti-crypto stance and opened Bitcoin, Ethereum, XRP, and Solana ETF trading to more than 50 million clients.

Bank of America followed by allowing advisers to recommend a 1%–4% crypto allocation starting January 2026.

“… [these developments] signal growing institutional acceptance and mainstream adoption of cryptocurrency,” Santiment noted.

Strong stablecoin inflows, including Tether’s $1 billion mint on Tron, and anticipation of Ethereum’s Fusaka upgrade are further supporting the early December rebound.

$13.5 Billion Fed Liquidity Shock Reprices Markets

The most unexpected catalyst emerged on December 1, when the Federal Reserve injected $13.5 billion via an overnight repo. The move, which signaled tightening pressure within the financial system, was one of the largest liquidity injections since the COVID-19 pandemic.

The general sentiment is that this move could prevent further downside or boost short-term risk appetite” ahead of the December rate decision. Analyst Tracy Jin believes Bitcoin’s rebound was a direct response to the liquidity signal.

“In risk markets, ‘not tightening further’ is often enough to shift positioning,” she stated.

However, analyst Brett warned against assuming this is the start of quantitative easing, suggesting that it is a warning light inside the financial system.

The market now hinges on whether Bitcoin can reclaim the critical $93,500 level. If BTC stabilizes and confirms the rare Bollinger Band signal, the early December V-shape bounce could evolve into a full reversal supported by liquidity, institutional flows, and seasonal strength.

If not, volatility may return as macro and liquidity conditions continue to shift.

The post V-Shape Bounce, Rare Bitcoin Signal, $13 Billion Fed Shock: What’s Coming? appeared first on BeInCrypto.

Hedera (HBAR) has gained more than 13% in the last 24 hours, reversing most of its weekly losses and turning sentiment slightly positive again. The HBAR price is still down about 18% over the past month, but the current bounce shows much stronger conviction than earlier attempts.

The question now is whether this rebound can mature into a real rally. One level decides everything.

Buyer Strength Builds, but Momentum Still Shows a Small Warning

The HBAR price is trading inside a triangle pattern, where buyers and sellers narrow into a tight range. Breakouts from triangles usually decide the next lasting move, and two key indicators explain why this one matters.

The first is CMF, or Chaikin Money Flow, a metric that tracks whether large wallets are increasing or decreasing their exposure. CMF recently broke above its downward trend line (showing strength) and now sits near 0.03. If it climbs toward 0.07, CMF would form a higher high even without the price needing to retest the old swing high near $0.198. That would signal rising spot demand and give the rebound real support.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The second indicator is RSI, the Relative Strength Index, which measures momentum on a 0–100 scale. Between November 23 and December 3, RSI made a higher high while the HBAR price made a lower high. This is a hidden bearish divergence, and it often suggests a mild pullback during broader downtrends.

But the divergence has a clear defeat point: RSI loses its bearish signal if HBAR closes above $0.155. That level removes the mismatch between price and momentum and confirms buyers are strong enough to push past the ceiling of the triangle.

Together, CMF strength and the RSI warning explain why HBAR is pressing inside the pattern but still hasn’t fully broken out. The big-money support keeps the structure stable, but the hidden bearish divergence shows buyers still lack the momentum needed to push past the upper trend line, which is why the triangle pattern continues to hold.

HBAR Price Levels: The One Break That Turns the Rebound Into a Rally

HBAR trades around $0.149, but the entire setup revolves around a single barrier at $0.155. A daily close above $0.155 gets the HBAR price close to the top of the triangle. It also defeats the RSI divergence and confirms that buyer demand is strong enough to shift the trend upward. If that break happens, the chart opens space for a move toward $0.180, if supported by improving CMF.

If the HBAR price stalls, the nearest key support sits around $0.142. This level has acted strong during the recent sessions. A drop below that level weakens the rebound and puts $0.130 back on the table if the broader market softens.

For now, HBAR holds a rare mix. Big money flow strengthening, momentum mixed but fixable, and one hurdle ($0.155) that decides whether this rebound becomes a full rally or slows again.

The post HBAR Price Rebound Finds Big Money Support, But One Hurdle to a Rally Still Remains appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

What to Know:

- Coinbase and Bithumb are expanding altcoin listings into a recovering stablecoin market.

- This signals returning risk appetite, bolstering the case for curated presale exposure.

- Bitcoin Hyper brings SVM execution and extremely low-latency processing to a Bitcoin Layer 2, targeting wrapped $BTC payments, DeFi, NFTs, and gaming.

- Maxi Doge and Pumpd offer higher‑beta meme exposure, the former around leverage‑trader culture, the latter around automated burns and AI market tooling.

Altcoin risk appetite is quietly returning.

Coinbase’s latest roadmap additions and Bithumb’s fresh KRW pairs show that big, regulated venues are finally widening the funnel again, just as spot volumes and stablecoin float start to recover from 2024’s drawdown.

When top-tier exchanges expand listings to improve liquidity, it’s usually not about chasing memes; it’s about preparing inventory for the next rotation. Historically, periods like this have front‑run broad alt seasons as sidelined capital migrates from $BTC and stablecoins into higher‑beta narratives.

You’re also seeing a structural shift under the surface. Stablecoin market caps are ticking higher, basis trades are back on, and derivatives funding is no longer screaming fear.

That combination tends to favor early‑stage bets: investors look for presales that marry strong narratives with credible tech and clear token utility.

Against that backdrop, three of the best crypto presales stand out across very different corners of the market: Bitcoin Hyper ($HYPER) as a high‑throughput Bitcoin Layer 2, Maxi Doge ($MAXI) as a hyper‑speculative trading culture play, and Pumpd ($PUMPD) as an experiment in algorithmic meme tokenomics and AI tooling.Bitcoin Hyper ($HYPER): The High-Performance Layer 2 for the Bitcoin Economy

Bitcoin established the foundation of digital finance as the ultimate store of value. But to power the next generation of Web3, the network needs speed and utility without sacrificing security. Introducing Bitcoin Hyper ($HYPER), a revolutionary Layer 2 scaling solution engineered to take Bitcoin further.

Bitcoin Hyper differentiates itself by integrating the high-performance Solana Virtual Machine (SVM) directly atop Bitcoin’s security anchor.

This unique architecture leverages the SVM’s parallel processing capabilities to deliver sub-second finality and negligible gas fees, making high-frequency trading and complex DeFi finally viable on Bitcoin.

Furthermore, onboarding assets is secure and seamless via its robust canonical bridge. This trust-minimized gateway ensures that native $BTC can be safely ported onto the Bitcoin Hyper network without relying on centralized intermediaries.

Want a bit more project info? We’ve got you covered in our ‘What is Bitcoin Hyper’ guide.

The native $HYPER token fuels this rapidly expanding ecosystem, serving as the essential currency for network transaction fees and decentralized governance. Bitcoin Hyper isn’t just faster money; it is the sophisticated infrastructure needed for a decentralized future built on the bedrock of Bitcoin.

$HYPER’s already flying high, having raised over $28.8M in its presale. It currently offers you 40% staking rewards, and there have been some hefty whale purchases, one of $500K, showing that smart money sees it as a viable play.

Buy your $HYPER today for $0.013365.2. Maxi Doge ($MAXI): Meme Token for Leverage Degens

Maxi Doge ($MAXI) leans unapologetically into the leverage culture that still defines much of crypto trading. Branded as a 240‑lb canine juggernaut, it’s less about utility primitives and more about capturing the 1000x mentality through community competition, and the ‘never skip leg-day, never skip a pump’ attitude.

The core pitch is ‘Leverage King Culture’: a meme asset that personifies the high‑risk, high‑reward ethos of perpetual traders while avoiding actual 1000x leverage on platforms that blow up accounts.

Holder‑only trading competitions, performance leaderboards, and reward campaigns in the future will turn speculative behavior itself into content and community glue. Already sold on the vibe? Check out our ‘How to Buy Maxi Doge’ guide to see how to get in on the action.

On the numbers side, the Maxi Doge presale has raised over $4.2M so far, with tokens currently at $0.000271. That’s a meaningful war chest for marketing, liquidity provisioning, and partnerships through its Maxi Fund treasury, which is earmarked to support listings and ecosystem collaborations as conditions improve.

Staking comes with a dynamic APY model currently offering 72% rewards, which can flex based on treasury performance and market conditions. If you believe meme liquidity roars back whenever alt seasons kick off, Maxi Doge offers a focused bet on that behavior.

Buy Maxi Doge in its presale now.3. Pumpd ($PUMPD): Daily-Pump Meme Coin With AI Trading Tools

Pumpd ($PUMPD) pushes meme tokenomics into more programmatic territory.

It’s a meme‑driven project whose smart contract encodes daily price increase mechanics, an automated burn schedule tied to market triggers, and AI‑powered analytics tools designed to help holders trade more intelligently across the broader market.

The token includes a ‘daily pump’ parameter baked into the contract, effectively engineering a persistent upward bias in the quoted presale price while supply gets reduced via automatic burns.

Those burns are triggered by specific market conditions, removing tokens from circulation without relying on manual team actions or discretionary treasury moves.

On top of that, Pumpd is building AI systems that scan markets, whale wallets, and social sentiment for trading signals, with the goal of turning raw volatility into structured alerts and dashboards for the community. It’s still firmly a meme coin, but one that tries to justify attention with data‑driven tools rather than vibes alone.

The project remains in an active presale phase, with guaranteed daily price steps and a growing set of launchpad and AI integrations.

As an emerging meme play with a more advanced technical stack, Pumpd fits investors who want speculative upside plus a narrative around automation and on‑chain intelligence rather than pure branding.

Get your $PUMPD for $0.000412.Recap: With big exchanges expanding altcoin listings into a recovering liquidity backdrop, the best crypto presales like Bitcoin Hyper, Maxi Doge, and Pumpd offer very different ways to position for the next cycle.

Remember, this isn’t intended as financial advice, and you should always do your own research before investing.

Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/best-crypto-presales-as-coinbase-and-bithumb-add-new-altcoins

Macro strategist Alex Krüger is tying Bitcoin’s next macro chapter directly to the coming reshuffle at the Federal Reserve, warning that investors are underpricing how far US rates could fall under a Trump-aligned central bank.

In a long X post titled “2026: The Year of the Fed’s Regime Change,” he argues that “the Federal Reserve as we know it ends in 2026” and that the most important driver of asset returns will be a new, much more dovish Fed led by Kevin Hassett. His base case is that this shift becomes a key driver for risk assets broadly and Bitcoin in particular in 2026, even if crypto markets are currently trading as if nothing fundamental has changed.

Why The Federal Reserve Will Dramatically Change

Krüger’s scenario is anchored in personnel. He notes that prediction platform Kalshi put the odds of Hassett becoming chair at 70% as of 2 December, and describes him as a supply-side loyalist who “champions a ‘growth-first’ philosophy, arguing that with the inflation war largely won, maintaining high real rates is an act of political obstinacy rather than economic prudence.”

A few hours after Krüger’s thread, Trump himself added fuel, telling reporters at the White House that he would announce his Fed pick “early next year” and explicitly teasing National Economic Council Director Kevin Hassett as a possible choice, after saying the search had been narrowed down to one candidate.

To explain how this would translate into policy, Krüger reconstructs Hassett’s stance from his own 2024 comments. On 21 November, Hassett said “the only way to explain a Fed decision not to cut in December would be due to anti-Trump partisanship.” Earlier he argued, “If I’m at the FOMC, I’m more likely to move to cut rates, while Powell is less likely,” adding, “I agree with Trump that rates can be a lot lower.” Across the year he endorsed expected rate cuts as merely “a start,” called for the Fed to “keep cutting rates aggressively,” and supported “much lower rates,” leading Krüger to place him at 2 on a 1–10 dove–hawk scale, with 1 being the most dovish.

Institutionally, Krüger maps a concrete path: Hassett would first be nominated as a Fed governor to replace Stephen Miran when his short term expires in January, then elevated to chair when Powell’s term ends in May 2026. Powell, he assumes, follows precedent by resigning his remaining Board seat after pre-announcing his departure, opening a slot for Kevin Warsh, whom Krüger treats not as a rival but as a like-minded ally who has been “campaigning” for a structural overhaul and arguing that an AI-driven productivity boom is inherently disinflationary. In that configuration, Hassett, Warsh, Christopher Waller and Michelle Bowman form a solidly dovish core, with six other officials seen as movable votes and only two clear hawks on the committee.

The main institutional tail risk, in Krüger’s view, is that Powell does not resign his governor seat. He warns that this would be “extremely bearish,” because it would prevent Warsh’s appointment and leave Powell as a “shadow chair,” a rival focal point for FOMC loyalty outside Hassett’s inner circle. He also stresses that the Fed chair has no formal tie-breaking vote; repeated 7–5 splits on 50-basis-point cuts would look “institutionally corrosive,” while a 6–6 tie or a 4–8 vote against cuts “would be a catastrophe,” turning the publication of FOMC minutes into an even more potent market event.

On rates, Krüger argues that both the official dot plot and market pricing understate how far policy could be pushed lower. The September median projection of 3.4% for December 2026 is, he says, “a mirage,” because it includes non-voting hawks; by re-labeling dots based on public statements, he estimates the true voters’ median closer to 3.1%. Substituting Hassett and Warsh for Powell and Miran, and using Miran and Waller as proxies for an aggressive-cuts stance, he finds a bimodal distribution with a dovish cluster around 2.6%, where he “anchors” the new leadership, while noting that Miran’s preferred “appropriate rate” of 2.0%–2.5% suggests an even lower bias.

As of 2 December, Krüger notes, futures price December 2026 fed funds at about 3.02%, implying roughly 40 basis points of additional downside if his path is realized. If Hassett’s supply-side view is right and AI-driven productivity pushes inflation below consensus forecasts, Krüger expects pressure for deeper cuts to avoid “passive tightening” as real rates rise. He frames the likely outcome as a “reflationary steepening”: front-end yields collapsing as aggressive easing is priced in, while the long end stays elevated on higher nominal growth and lingering inflation risk.

What This Means For Bitcoin

That mix, he argues, is explosive for risk assets like Bitcoin. Hassett “would crush the real discount rate,” fueling a multiple-expansion “melt-up” in growth equities, at the cost of a possible bond-market revolt if long yields spike in protest. A politically aligned Fed that explicitly prioritizes growth over inflation targeting is, in Krüger’s words, textbook bullish for hard assets such as gold, which he expects to outperform Treasuries as investors hedge the risk of a 1970s-style policy error.

Bitcoin, in Krüger’s telling, should be the cleanest expression of this shift but is currently trapped in its own psychology. Since what he calls the “10/10 shock,” he says Bitcoin has developed “a brutal downside skew,” fading macro rallies and crashing on bad news amid “4-year cycle” top fears and an “identity crisis.” Even so, he concludes that the combination of a Hassett-led Fed and Trump’s deregulation agenda would “override the dominant self-fulfilling bearish psychology, in 2026” — a macro repricing he insists “markets aren’t ready” for yet.

At press time, Bitcoin traded at $92,862