Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Ethena’s USDe shed 24% of its supply in November, losing market share as fiat-backed stablecoins like USDT, USDC, PYUSD and RLUSD added billions.

Bitcoin traders are facing the most pressure of this cycle in terms of unrealized losses, but analysts argue that ETFs only accounted for a maximum of 3% the recent selling pressure.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

This partnership could accelerate institutional adoption of crypto by aligning staking services with traditional finance standards and security.

The post Deutsche Bank-backed Taurus partners with Everstake to enhance institutional crypto staking appeared first on Crypto Briefing.

Tokenization's potential to revolutionize financial systems could reshape market dynamics and investment strategies, impacting global asset management.

The post BlackRock CEO Larry Fink, Brian Armstrong to discuss tokenization at DealBook Summit appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Stay Ahead with Our Timely Insights of Today’s Next Crypto to Explode

Check out our Live Next Crypto to Explode Updates for December 3, 2025!

Crypto is so unthinkably huge at the moment, a nearly $4 trillion industry that’s aiming for world domination.

Recent headlines talk of Circle and Mastercard planning to add USDC to global payment systems, Ethereum and Bitcoin treasuries in the billions of dollars, and Google building its own blockchain.

Bitcoin has an all-time growth of over 180,000,000%, Dogecoin over 43,000%, and some of the newest presale coins often pump 10x, 100x, or even 1,000x on rare occasions.

Explosive potential is probably the single best description for what we’re seeing today in crypto.

Quick Picks for Coins with Explosive Potential

Bitcoin Hyper ($HYPER) - Real-Time Layer-2 Solution for Scaling Bitcoin

Launch:

May, 2025

Join Presale

Bitcoin Hyper ($HYPER) - Real-Time Layer-2 Solution for Scaling Bitcoin

Launch:

May, 2025

Join Presale

Maxi Doge ($MAXI) - High-Impact Meme Coin Built On Strength, Staking & Conviction

Launch:

July, 2025

Join Presale

Maxi Doge ($MAXI) - High-Impact Meme Coin Built On Strength, Staking & Conviction

Launch:

July, 2025

Join Presale

PepeNode ($PEPENODE) - A New, Gamified Way to Mine to Earn Meme Coin Rewards

Launch:

February, 2025

Join Presale

PepeNode ($PEPENODE) - A New, Gamified Way to Mine to Earn Meme Coin Rewards

Launch:

February, 2025

Join Presale

If you’re looking for the most recent insights on the next crypto to explode, stay tuned. We update this page frequently throughout the day, as we get the latest and greatest insider insights for chart sniffers and traders looking for the next coin to explode.

Disclaimer: Crypto is a high-risk investment, and you may lose your capital. Our content is informational only, and it does not constitute financial advice. We may earn affiliate commissions at no extra cost to you. As Bitcoin Eyes Six Figures, Bitcoin Hyper Quietly Lines Up as the Next Crypto to ExplodeDecember 3, 2025 • 10:00 UTC

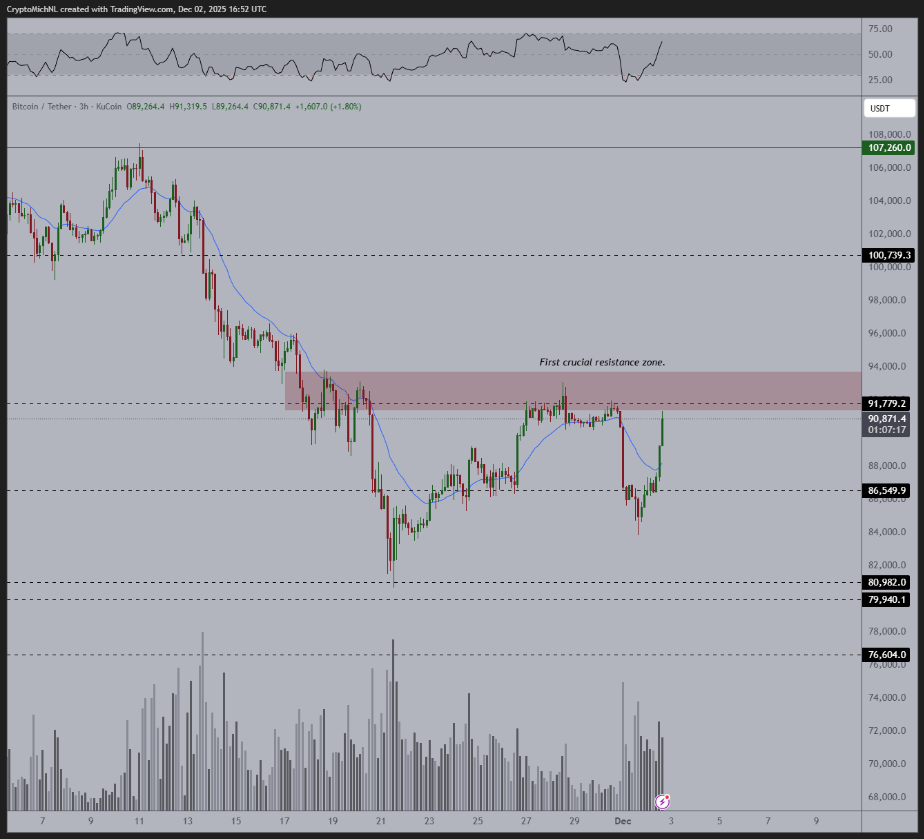

$BTC just bounced from a sharp flush down to $84,5k back to above $93k as analysts like Michael van de Poppe openly discuss a path to $100k over the next few months.

The key $86k–$88k support zone has already survived around 60 tests without breaking, which shows how much smart money defends this range while ETF inflows and potential Fed cuts act as tailwinds.

If you already hold $BTC, the next step is usually finding higher-beta exposure to that same narrative rather than chasing random meme coins.

Bitcoin Hyper ($HYPER) fits that lane as a Bitcoin Layer-2 built on the Solana Virtual Machine, bringing Solana-style execution and dApp potential to Bitcoin. It achieves this via a canonical bridge that lets you move $BTC into DeFi, NFTs, and gaming for the first time.

With $28.8M raised so far at a $0.013365 token price, you tap into infrastructure that scales Bitcoin instead of just tracking it, giving you a more asymmetric angle on the next crypto to explode.

Read more about what Bitcoin Hyper is here.

Solana’s Rizzmas Revival Puts Meme Liquidity Back on the Map for Maxi Doge, a Potential Next Crypto to ExplodeDecember 3, 2025 • 10:00 UTC

Solana meme action just switched back on, with Rizzmas reappearing as $SOL posts double-digit daily gains and spot volumes flood into seasonal tokens again.

When meme coins start waking up on a high-throughput chain, it usually signals that traders feel comfortable rotating out along the risk curve, hunting for fresh narratives with stronger upside than the first wave. That dynamic favors meme plays that carry real mechanics, not just a logo and a dog.

Maxi Doge ($MAXI) leans into this shift by combining classic Doge culture with staking, trading contests, and future 1000x leverage tie-ins, which turn the community into a constant flow of competition and volume rather than passive holders.

With $4.25M already raised at a $0.000271 token price, you position yourself earlier than most meme rotations, while still tying into a project that has audits, fixed supply, and a clearly defined ecosystem.Find out more about Maxi Doge here.

Authored by Bogdan Patru, Bitcoinist — https://bitcoinist.com/next-crypto-to-explode-live-news-today-december-3-2025

Quick Facts:

The market puts the odds of another rate cut at 87% as the next Fed meeting is set for December 10, one week from now.

The market puts the odds of another rate cut at 87% as the next Fed meeting is set for December 10, one week from now. Another rate cut could turn investors to risk-based assets like Bitcoin, which would result in a crypto pump across the board.

Another rate cut could turn investors to risk-based assets like Bitcoin, which would result in a crypto pump across the board. Bitcoin Hyper introduces a Bitcoin Layer 2 with SVM integration, promising faster-than-Solana performance, ultra-low fees, and a Rust-based SDK for builders.

Bitcoin Hyper introduces a Bitcoin Layer 2 with SVM integration, promising faster-than-Solana performance, ultra-low fees, and a Rust-based SDK for builders. The $HYPER presale raised over $28.8M so far and targets a release date between Q4 2025 and Q1 2026.

The $HYPER presale raised over $28.8M so far and targets a release date between Q4 2025 and Q1 2026.

With markets now openly betting on Federal Reserve rate cuts and a softer dollar in 2025, crypto investors are back to asking the same question: how do you position for the next leg of Bitcoin’s cycle without simply stacking more spot $BTC and hoping for a 2x?

The next rate cut should come on December 10, with the market putting the odds of a favorable decision at 87% now. A successful cut would make crypto appealing to investors again, which could put an end to the current bear market.

Lower yields and fresh liquidity typically push capital out the risk curve.

Historically, Bitcoin leads that move, but the outsized returns tend to emerge in narratives that sit around $BTC rather than in $BTC itself – think exchanges in 2017, DeFi in 2020, or Ethereum scaling in 2021. This time, the infrastructure gap is obvious: Bitcoin is still slow, expensive, and hard to build on.That’s the opening Bitcoin Hyper ($HYPER) is trying to exploit.

Instead of asking you to rotate away from $BTC, it pitches a way to keep Bitcoin at the center of your thesis while getting leverage to a much higher growth curve. Its angle is simple: turn Bitcoin into a fast, smart-contract powerhouse and let the liquidity follow.

For you, that means a way to play the next Bitcoin uptrend with more upside than spot alone.

If the ‘Bitcoin Layer 2’ meme becomes the next dominant narrative, projects that actually make $BTC programmable at Solana-like speeds are positioned to capture significant attention, developer mindshare, and, ultimately, capital flows.

You can read more about what Bitcoin Hyper is right here.

Bitcoin Hyper Aims To Turn $BTC Into A High-Speed Smart-Contract Chain

Bitcoin Hyper ($HYPER) delivers a Bitcoin Layer 2 designed around speed, low-cost execution, and developer-friendly smart contracts, without abandoning Bitcoin as the settlement root.

Instead of just scaling payments, it focuses on giving you Solana-style performance while keeping $BTC at the center of value transfer and collateral.

At the core is SVM integration, letting developers deploy familiar Solana-style smart contracts while tapping into Bitcoin’s trust and brand. The result, in plain terms: sub-second transaction speed, negligible fees, and a user experience where swaps, lending, gaming, and NFTs in $BTC no longer feel clunky or dated.For users, that translates into high-speed payments in wrapped $BTC, low-fee DeFi, and NFT or gaming dApps that don’t grind to a halt when things get busy.

For builders, the Rust-based SDK and API aim to make it easy to spin up DeFi protocols, NFT marketplaces, and on-chain games where the base asset is Bitcoin, not an alt.

$HYPER is available today on the official presale page.

Can $HYPER Ride The Next Bitcoin Leg Higher?

$HYPER already raised over $28.88M in presale, following sustained investor participation and growing confidence in Bitcoin Hyper’s value proposition.

Based on the current trend, we expect the token to experience a post-launch boom, followed by a period of stabilization before the next leg-up.

Our price prediction for $HYPER suggests a potential target of $0.20 in 2026 and a $1.50 one for 2030, once the project reaches its developmental milestones. In terms of profit, think ROIs of 1,396% and 11,123% respectively.This type of performance would recommend $HYPER as the best crypto to buy today, given the presale price of $0.013365.

If you believe the next liquidity wave will reward infrastructure that makes Bitcoin faster, cheaper, and more programmable, Bitcoin Hyper is a pure-play bet on that thesis rather than a vague ecosystem token.

You’re not just betting on $BTC going up; you’re betting on $BTC finally becoming usable as DeFi collateral, gaming currency, and high-speed payment rail.

If that isn’t incentive enough, maybe $HYPER’s long-term market potential is and the earlier you buy, the higher the potential gains. Which, given the presale’s projected end date between Q4 2025 and Q1 2026, adds a strong flavor or urgency.Go to the presale page and buy your $HYPER today.

This isn’t financial advice. DYOR before investing.

Authored by Bogdan Patru, Bitcoinist: https://bitcoinist.com/best-crypto-to-buy-before-fed-rate-cuts

https://cryptoslate.com/feed/

Bitcoin was launched fifteen years ago. The industry has ballooned into a nearly $4 trillion ecosystem, yet Satoshi’s vision of everyday payments remains largely unfulfilled. The hope for peer-to-peer payments has shifted to stablecoins. But rather than replacing banks, stablecoins risk becoming bank-like infrastructure. Stronger regulation in the U.S. and Europe may push them toward centralized rails rather than open money.

Regulation turning stablecoins into regulated payment networks

In America, the GENIUS Act established a federal framework for payments with stablecoins—who can issue them, how to back them up, and how they’re regulated. In Europe, MiCA regulation (Markets in Crypto-Assets) became applicable in 2024 and set strict requirements for stablecoins under categories like “e-money tokens” and “asset-referenced tokens.”

These regulations foster legitimacy and safety, but at the same time push stablecoin issuers into the world of banks. When issuers need to comply with reserve, audit, KYC, and redemption requirements, the structure and essence of stablecoins shift. They become centralized gateways rather than peer-to-peer money. Over 60% of corporate stablecoin usage is cross-border settlement, not consumer payments. Stablecoins are becoming more institutional tools and fewer tokens for individuals.

The danger: becoming the next SWIFT

What does it mean to “become the next SWIFT”? It means evolving into the go-to rail for institutions; efficient yet opaque, centralized yet indispensable. SWIFT transformed global banking by enabling messaging between banks; it did not democratize banking access. If stablecoins mirror that evolution, they’ll deliver faster rails for existing players rather than empowering the unbanked.

Crypto’s promise was programmable money—cash that moves with logic, autonomy, and user control. But when transactions require issuer permission, compliance tagging, and monitored addresses, the architecture changes. The network becomes compliant infrastructure, not money. That subtle but profound shift may make stablecoins less radical and more reactionary.

A better path to open rails with compliance baked in

The challenge is not regulation; it’s design. To uphold the promise of stablecoins while adhering to regulatory demands, developers and policymakers should embed compliance in the protocol layer, maintain composability across jurisdictions, and preserve non-custodial access. Back in the real world, initiatives like the Blockchain Payments Consortium provide a glimpse of hope that standardizing cross-chain payments is possible without sacrificing openness.

Stablecoins must work for individuals, not just institutions. If they serve only large players and regulated flows, they won’t disrupt—they’ll conform. The design must allow true peer-to-peer movement, selective privacy, and interoperability. Otherwise, the rails will lock us into old hierarchies, just faster.

Stablecoins still hold the potential to rewrite money. But if we allow them to become institutionalized rails built for banks rather than people, we will have replaced one central system with another. The question isn’t whether we regulate—stablecoins will be regulated. It’s whether we design for inclusion and autonomy, or lock in yesterday’s system behind digital wrappers. The future of money depends on which path we choose.

The following is a guest post and opinion from Joël Valenzuela, Director of Marketing and Business Development at Dash.

The post Stablecoins were built to replace banks but on course to becoming one appeared first on CryptoSlate.

XRP spot ETFs have posted one of the most consistent inflow streaks of this quarter, attracting roughly $756 million across eleven consecutive trading sessions since their Nov. 13 launch.

Yet the strength in the ETF demand contrasts with XRP’s price performance.

According to CryptoSlate’s data, the token has fallen about 20% over the same period and currently trades near $2.03.

This divergence has prompted CryptoSlate to examine how XRP’s ownership structure is shifting beneath the surface.

The strong ETF inflows alongside falling prices point to a market absorbing two opposing forces of steady institutional allocation on one side and a broader risk reduction on the other.

Essentially, this pattern reflects a more complex process in which new, regulated demand is entering the ecosystem as existing holders adjust their exposure.

XRP dominates crypto ETFs flow

The inflow profile of XRP products is statistically remarkable, particularly against a backdrop of net redemptions elsewhere.

During the reporting period, Bitcoin ETFs saw over $2 billion in outflows, and Ethereum products recorded nearly $1 billion in withdrawals.

Even high-flying competitors like Solana have managed only about $200 million in cumulative inflows. At the same time, other altcoin ETFs have drawn smaller totals, with Dogecoin, Litecoin, and Hedera products each holding between $2 million and $10 million.

In this context, XRP stands alone for its consistent accumulation, with the four products now holding about 0.6% of the token’s total market capitalization.

Considering this, market participants attribute the demand to the ETF’s operational efficiency. The four XRP funds offer institutional allocators a compliant, low-friction path into the asset, bypassing the custody headaches and exchange risks associated with direct token handling.

However, the fact that these inflows have not translated into upward price pressure suggests that other market segments may be reducing exposure or managing risk amid elevated macro and crypto-specific uncertainty.

This phenomenon is not unprecedented in crypto, but the scale here is distinct.

The selling pressure is likely originating from a combination of early adopters cashing out after years of volatility and potential treasury movements. The ETF boom has essentially created a liquidity bridge, allowing large-scale entities to offload positions without crashing the order book instantly.

Consolidation or centralization risk?

Meanwhile, the ownership data below the surface reinforces the view that the asset is undergoing a radical centralization.

Data from blockchain analysis firm Santiment indicates that the number of “whale” and “shark” wallets holding at least 100 million XRP has plummeted by 20.6% over the past eight weeks.

This pattern of fewer large wallets with more combined assets can be interpreted in different ways.

Some market observers have framed this as “consolidation,” arguing that supply is moving into “stronger hands.”

However, a risk-adjusted view suggests rising centralization risk.

With nearly half of the available supply concentrated in a shrinking cohort of entities, the market’s liquidity profile is becoming increasingly fragile.

This centralization of supply means that future price action is heavily dependent on the decisions of fewer than a few dozen entities. If this group decides to distribute, the resulting liquidity shock could be severe.

Simultaneously, spot exchange balances are thinning as tokens move into the regulated custody solutions required by ETF issuers.

While this theoretically reduces the “float” available for retail trading, it hasn’t triggered a supply shock. Instead, the transfer from exchange to custodian appears to be a one-way street for now, soaking up circulating supply sold by the shrinking whale cohort.

The benchmark race

The inflow streak has renewed discussion about which asset could emerge as the benchmark altcoin for institutional portfolios.

Historically, regulated crypto exposure has centered almost exclusively on Bitcoin and Ethereum, with other assets attracting minimal attention. XRP’s recent flow profile, which has significantly exceeded the cumulative inflows of other altcoin ETFs, has temporarily shifted that dynamic.

Part of the interest stems from developments around Ripple. The firm’s licensing expansion in Singapore and the significant adoption of RLUSD, its dollar-backed stablecoin, give institutions a broader ecosystem to evaluate.

At the same time, Ripple’s acquisitions across custody, brokerage, and treasury management have created a vertically integrated framework that resembles components of traditional financial infrastructure, offering a foundation for regulated participation.

Still, analysts caution that a short inflow streak does not establish a new long-term benchmark.

XRP will need to sustain demand across multiple market phases to maintain its position relative to peers such as Solana, which has gained attention for its growing tokenization activity, and to assets that may attract larger flows once new ETFs launch.

For now, XRP’s performance within the ETF complex reflects early momentum rather than structural dominance.

The flows highlight genuine institutional interest, but the asset’s price behavior reflects the broader challenges large-cap cryptocurrencies face amid macroeconomic uncertainty.

The post How XRP became the top crypto ETF trade despite price slides toward $2 appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Is Bitcoin's 'Santa rally' back, or will Japan spoil the party?

Is Bitcoin's 'Santa rally' back, or will Japan spoil the party?  Post-upgrade demand will determine if an ETH rally will follow.

Post-upgrade demand will determine if an ETH rally will follow.https://beincrypto.com/feed/

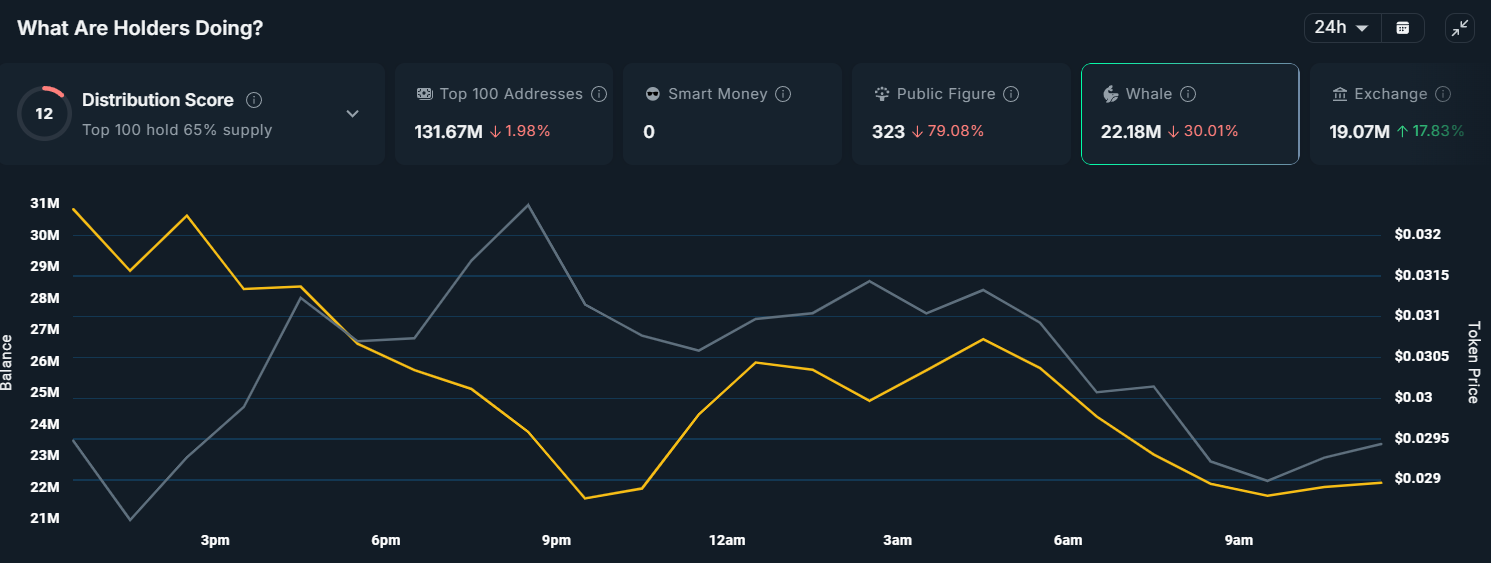

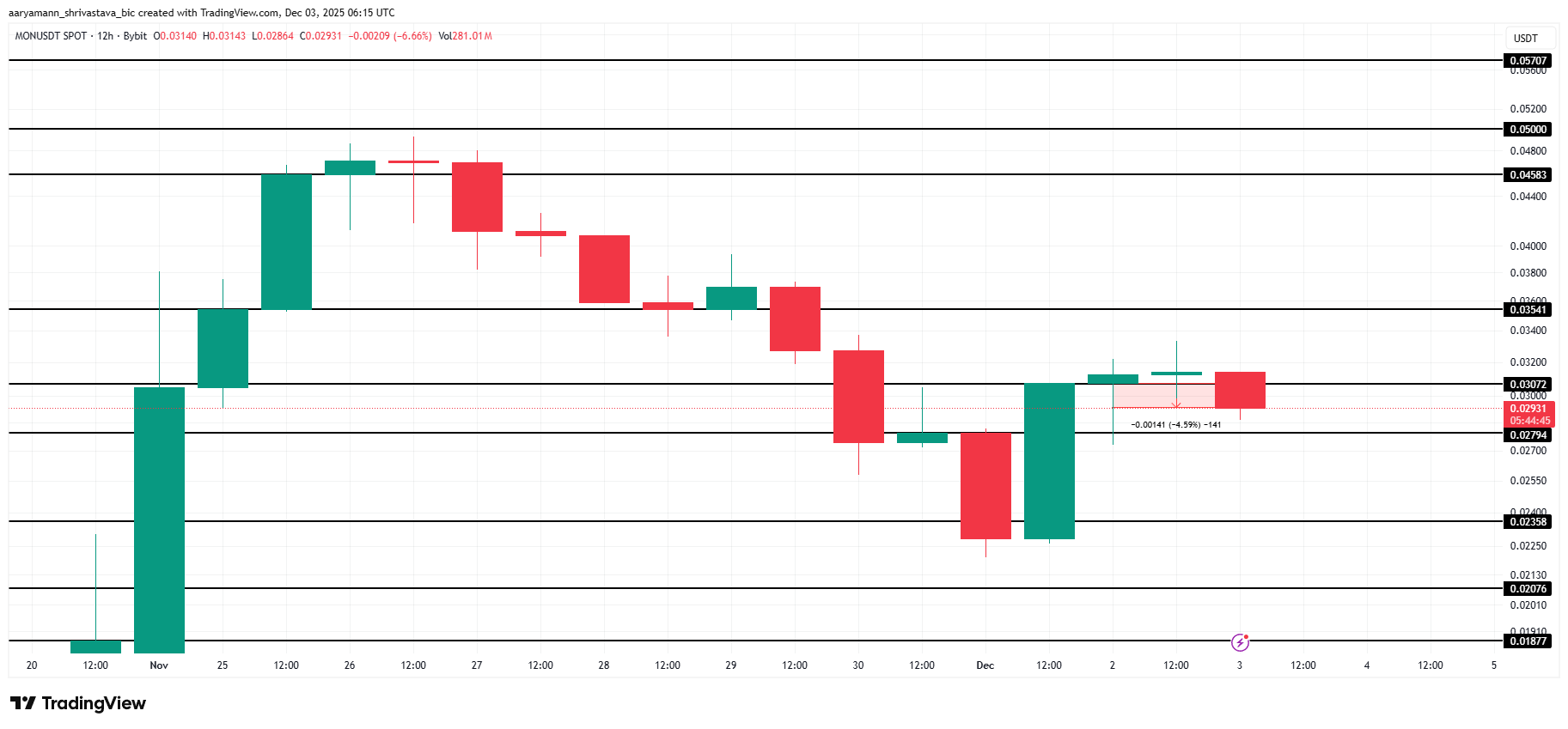

Monad is facing renewed pressure after a sharp dip in price triggered by broader market weakness led by Bitcoin. The pullback has shaken investor confidence, resulting in notable selling activity across key cohorts.

As sentiment shifts, the question now is whether MONAD can stabilize or whether deeper losses are ahead.

Monad Whales Turn To Selling

Whale activity has become a major concern for MONAD holders this week. On-chain data shows that large wallets holding more than $1 million worth of MONAD — excluding exchanges — sold over 8 million tokens in just 24 hours. This scale of distribution signals a clear decline in confidence among influential holders, who often drive major price movements.

Their exit from the asset could create additional downward pressure if the trend accelerates.

Such aggressive whale selling typically reflects expectations of further decline or a desire to reduce exposure during periods of volatility. Since these wallets hold a significant supply, their collective moves can sway price direction sharply.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

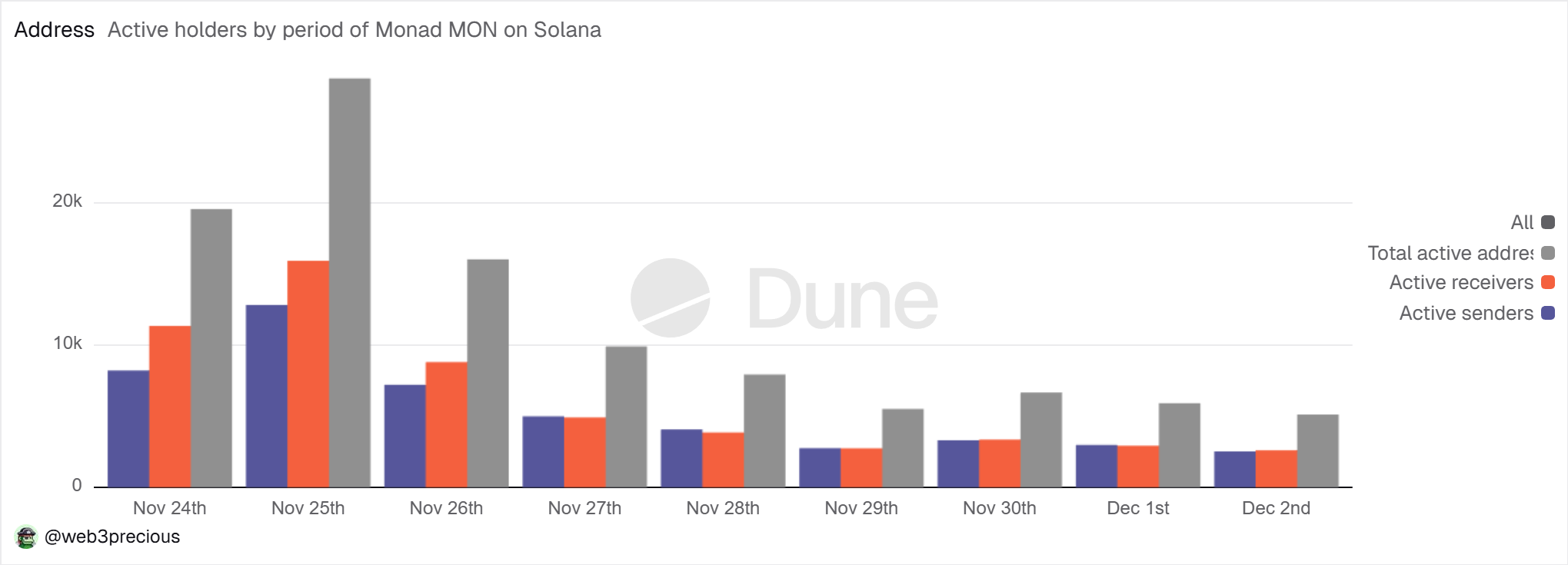

The broader activity on the Monad network also paints a cautious picture. Active addresses have been steadily falling over the past week, with activity nearly flatlining in the last few days. Active addresses represent users interacting with the chain, whether through sending, receiving, or executing transactions.

This drop in activity reflects uncertainty among MONAD holders. As long as market conditions remain unfavorable, user engagement may stay muted, limiting the organic demand needed to support price recovery. A revival in active addresses is essential for regaining momentum.

MONAD Price Might See Decline

Monad’s price is down 5% in the past 24 hours, trading at $0.029 at the time of writing. The altcoin is attempting to establish short-term support within the $0.027 to $0.030 range as it searches for stability.

However, the pressures highlighted above suggest further downside risk. If whale selling continues and network participation weakens further, MONAD could fall toward the key support at $0.023, deepening losses for holders.

On the positive side, if bullish momentum returns and whales pause their distribution, MONAD could recover. A bounce from $0.030 would allow the token to target $0.035, with a potential extension to $0.045. A move into this zone would invalidate the bearish outlook and restore investor confidence.

The post 8 Million MONAD Sold By Whales In 24 Hours, Could Price Suffer? appeared first on BeInCrypto.

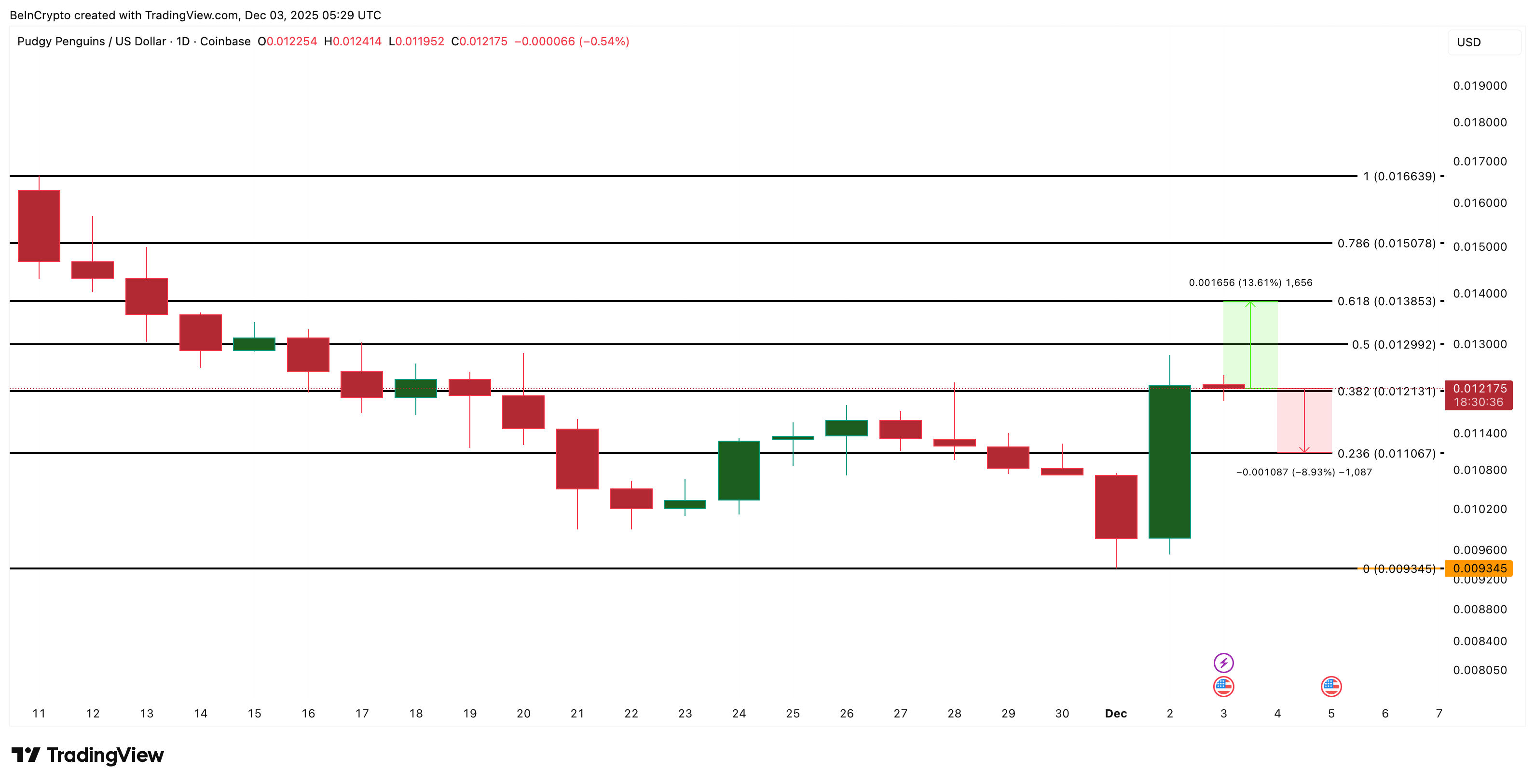

PENGU price jumped almost 37% between December 1 and December 2, making it one of the strongest movers in the memecoin group. The move pushed the price back above short-term levels and helped PENGU retain about 26% of its 24-hour gains even after a small dip.

But this early December burst may not continue without resistance. A few key signals now indicate the rally is at risk of slowing due to a “bear attack.”

Rally Risks Cooling as Momentum Weakens and Traders Turn Cautious

PENGU has been one of the meme coins to watch this month because its recent setup was bullish. That early December bounce confirmed that buyers were active again.

But the chart shows the first warning sign.

RSI (Relative Strength Index), which measures momentum on a 0–100 scale, made a higher high between November 10 and December 1, while the PENGU price made a lower high. This is a hidden bearish divergence. It usually means buyers are pushing hard, but the price is not reacting with equal strength.

That type of mismatch can slow rallies during broader downtrends, and PENGU is still down almost 25% over the past month.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

On-chain positioning supports this risk.

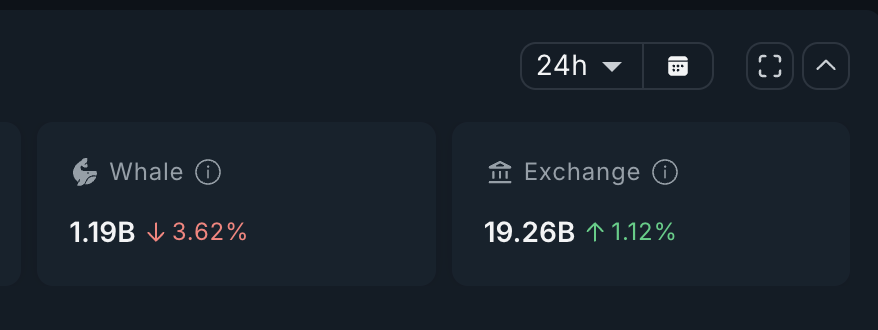

Whales on spot have reduced their holdings by 3.62%, now holding about 1.19 billion PENGU. That reduction is worth roughly 43 million PENGU, showing that large holders used the bounce to trim exposure by possibly profit booking. This hints at weaker conviction.

Perpetual traders are not helping the trend either.

Top 100 addresses (mega whales) have shifted heavily toward shorts, cutting long exposure by more than 17% in 24 hours. Even though consistent PERP winners slightly increased long activity, the entire group still leans net-short. That means they expect the prices to go down.

Together, the momentum mismatch and the shift in bearish behavior show why the rally now faces its first real test.

PENGU Price Levels: Where the Supposed Pullback Might Stop?

PENGU trades near $0.0121 and faces a ceiling at $0.0129, under which its latest rally attempt stalled.

To regain strength, the chart needs a break above $0.0129 first, followed by $0.0138. But the hidden bearish divergence does not get invalidated until PENGU crosses $0.0166, which marks the early November peak.

If today’s minor pullback extends, the first level to watch is $0.0110. A daily close below that could open a deeper move toward $0.0093, which was the previous reaction area before the December rebound.

For now, the early December PENGU price rally is not broken, but it is at risk.

RSI warns of slowing momentum, whales are reducing their stake, and PERP traders are positioning against the move. To keep the Pudgy Penguins’ party alive, the price must hold above $0.0110 and push cleanly through $0.0138.

The post Bears To Crash the PENGU’in Party? The Early December Rally Now Risks a Pullback appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Bitcoin jumped back above key levels on Wednesday, with prices climbing past $93,000 after dipping to $84,400 earlier this month.

The move followed a sharp sell-off that removed about $8,000 from the price late over the weekend, and traders pushed the coin to a 24-hour peak of $93,910 on Coingecko.

Bitcoin Climbs Above Key Levels

According to MN Fund founder Michaël van de Poppe, regaining ground above $93,000 is important for momentum. He said that if the price holds and breaks higher, a run toward $100,000 becomes more likely.

Other analysts echoed the call: Nick Ruck of LVRG Research pointed to macro factors and fresh ETF flows as drivers that could help Bitcoin test six figures in the coming months.

This is what you’d want to see. $BTC coming back up again, after a weird move down on the 1st of this month.

Now, again, breaking the $92K area is crucial.

If that breaks, then I’m sure we’ll start to see a new all-time high and a test at $100K.

A great day on the markets. pic.twitter.com/uy6WPabnQ8

— Michaël van de Poppe (@CryptoMichNL) December 2, 2025

ETF Activity And Market Moves

Reports have disclosed that ETF-related trading helped lift the market. BlackRock’s IBIT recorded over $1.8 billion in volume within two hours after Vanguard reversed a previous stance, and total spot Bitcoin ETF volume topped $5.1 billion on the day.

Market stats showed the broader crypto capitalization rose close to 7% to $3.13 trillion, with BTC dominance climbing to nearly 60%. Bitcoin itself jumped by about 8% after the US market opened, giving larger markets a clear lift.

Analysts had been watching the $86,000 to $88,000 band as a critical area of support. Based on reports from active market watchers, that range had been tested dozens of times in recent months and holding above it signaled reduced selling pressure. One analyst argued that a break below would likely lead some big players to change tack, moving from buying to selling behavior.

Liquidations And Net Inflows Changed The DayOther market observers reported heavy turnover in derivatives and spot markets: over $360 billion in short positions were liquidated, while more than $160 billion was reportedly added back into crypto markets within a 24-hour span. Those figures, if accurate, helped explain the speed of the rebound and the large single-day gains.

What Comes Next For Prices

What Comes Next For Prices

Short-term traders will watch how Bitcoin behaves around $92,000 and whether it can hold above the $86,000–$88,000 floor. Some commentators warned that sudden ETF-driven demand can cause sharp spikes that may not last.

Others pointed to possible policy shifts, such as renewed talk of US interest-rate cuts, as reasons why money might flow into major crypto assets in the months ahead.

For now, prices sit a little above $92,700 at the time of writing. The market is clearly volatile. Investors and traders will likely need to balance the bullish signs against the risk that a fresh round of selling could wipe gains quickly.

Featured image from Gemini, chart from TradingView

Ethereum fell more than 2% within 24 hours, sliding below $3,000 after losing its $2,900 support level. The drop triggered widespread liquidations, with around $500 million in long positions wiped out. Data shows that $79 million of the $106 million in ETH-focused contracts liquidated were long bets.

Trading activity spiked sharply during the decline, with daily volume rising 200% to $33.2 billion. The broader crypto market also contracted, falling nearly 1.2% and erasing an estimated $1100 billion in value within hours. Bitcoin, SOL, XRP, and DOGE followed similar downward moves.

Despite the volatility, some firms accumulated ETH during the downturn. BitMine Immersion Technologies increased its holdings by 96,798 ETH, diverging from the trend of companies reducing risk exposure.

Fusaka Upgrade Goes Live, Aiming to Boost Scalability

On December 3, Ethereum is set to activate its Fusaka upgrade, the network’s second major 2025 update. The upgrade aligns execution- and consensus-layer changes, introducing features that aim to improve Layer 2 and reduce costs.

A key component is PeerDAS, a data-sampling mechanism designed to reduce the bandwidth validators need to verify Layer 2 data. This system aims to cut validator bandwidth requirements by up to 85% and expand blob data capacity, potentially lowering Layer 2 transaction fees by 40–60%.

Fusaka also raises Ethereum’s block gas limit to 60 million, enabling more transactions per block, and introduces updates to the Ethereum Virtual Machine that streamline smart contract execution. These combined changes are expected to enhance the network’s transaction capacity.

Industry interest had been rising ahead of the upgrade. Major financial players, including Amundi and Fidelity, recently announced moves into tokenized products built on Ethereum, reflecting broader institutional activity across the network.

Can Ethereum (ETH) Recover From Oversold Levels?Ethereum (ETH) last traded at around $2,807, with technical indicators indicating continued bearish momentum. The MACD remains in negative territory, while the Relative Strength Index sits at 32, signaling oversold conditions.

Key support levels are at $2,700 and $2,500. A failure to hold these zones may deepen the downtrend, while a rebound could push ETH back toward $2,900–$3,000. Open Interest rose 4.3% after the decline, suggesting traders are reopening positions and preparing for higher volatility.

Whether the Fusaka upgrade can shift market sentiment remains uncertain, but its long-term scaling impact may play a role in Ethereum’s broader recovery.

Cover image from ChatGPT, ETHUSD chart from Tradingview