Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Bitcoin hit a key BTC price target from the start of January, with other CME futures gaps now above price, but traders remained cautious.

The submissions add to mounting pressure on regulators as Coinbase CEO Brian Armstrong calls for compromise to pass market structure legislation.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Galaxy's hedge fund launch amid market volatility highlights confidence in digital assets and potential growth in regulatory and tech-driven sectors.

The post Galaxy plans to debut $100M hedge fund amid market pullback appeared first on Crypto Briefing.

The institutionalization of crypto by 2026 could revolutionize financial systems, enhancing liquidity, efficiency, and global settlement.

The post Ripple President Monica Long predicts half of Fortune 500 will adopt crypto strategies this year appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

After experiencing a slight upward push a few days ago, the price of XRP has pulled back as volatility slowly takes over the broader cryptocurrency market. However, on-chain data reveals an interesting story about investors, who appear to have entered an accumulation phase, scooping up the altcoin at a rapid rate that rivals past cycles.

A Cycle Déjà Vu For XRP

Buying activity is starting to heat up for XRP, but investors and traders seem to be entering a familiar phase. While these investors continue to accumulate the leading altcoin, their buying patterns on the network closely resemble those seen in the past.

Glassnode, a popular on-chain data analytics platform, disclosed this pattern after examining the XRP Realized Price by Age (7-day Moving Average) metric. Specifically, the XRP Realized Price by Age is a key metric that determines the average price at which various cohorts of holders, divided by the length of time they have owned their tokens and last moved them.

As the price of XRP fluctuates, the chart shows that short-term holders are steadily building positions. This type of silent accumulation has been seen in the past when conviction-driven capital absorbs supplies before wider market notice, making it a critical period for the altcoin.

According to the data analytics platform, the current market structure for XRP is showing a striking resemblance to that of February 2022. A clear look into the chart reveals that active investors over the weekly to monthly timeframe window are now accumulating strongly, suggesting that bullish sentiment is returning toward the token.

One interesting thing about this accumulation is that it is happening below the cost basis of wallet addresses holding the altcoin between 6 months and 12 months. In the meantime, top purchasers continue to face increased psychological strain as long as this structure remains in place.

Why You Should Be A Patient Holder Of The Asset

Should this accumulation persist, the action is likely to lay the groundwork for another push higher. However, some investors remain skeptical about another upward move, especially to a new all-time high.

Crypto expert Bird has outlined the potential for XRP to experience a rally to a new all-time high, attributing it to the token’s design and growing role in the financial sector. The analyst stated that XRP is emerging as the foundation of the new financial system, not just another speculative asset.

Currently, the token has become a means for liquidity, payments, tokenization, and real-world use. “You don’t accidentally end up with something like this. Ripple has created something special and world-changing,” the expert added.

Bird stated that these kinds of assets only occur once in a lifetime, while encouraging investors to seek more insights about the token. This is because most people only become aware of them after the shift has already taken place.

House of Doge, the Dogecoin Foundation’s official corporate arm, says it is building a new mobile app called “Such” that aims to make it easier for users to hold and spend DOGE while giving small merchants and independent sellers tools to accept it in day-to-day commerce.

In a post on X and a January 20 press release, House of Doge said Such is expected to launch in the first half of 2026 and will pair a self-custodial wallet with transaction tracking and a commerce feature branded “Hustles,” positioned as a simple on-ramp for people looking to sell products and services for DOGE.

Dogecoin Foundation Arm, Brag House Tease ‘Such’

House of Doge framed Such as its “first product,” with additional launches planned in the first half of 2026. The company described the app as an attempt to reduce friction on both sides of a DOGE transaction: helping holders spend more easily and helping sellers add Dogecoin payments in a way that fits routine retail activity.

Timothy Stebbing, CTO of House of Doge and a Dogecoin Foundation director, tied the product thesis directly to the DOGE community’s informal commerce culture. “I’ve seen so many people in the Dogecoin Community try to start something themselves. Be it an artist selling prints or a person offering lawn care services, everyone has a side hustle these days,” Stebbing said. “We want to enable anyone to start their hustle with Dogecoin through the Such app. We’re planning to enable anyone to start selling their hustle in as few clicks as possible.”

The DOGE Foundation account echoed that positioning on X, describing Such as “coming in the first half of 2026” and highlighting a launch scope centered on self-custodial wallets, real-time transaction tracking, and merchant tools for selling goods and services.

The dev team at @DogecoinFdn and @Houseofdoge is proud to announce the Such app, coming in the first half of 2026. The Such app brings new ways to interact with and bring further utility to Dogecoin.

At launch Such will have: – Self-custodial Dogecoin wallets – Real-time…

— Dogecoin Foundation (@DogecoinFdn) January 20, 2026

According to the press release, Such is being developed by a team of twenty headquartered in Melbourne, Australia, led by Stebbing. House of Doge said development began in March 2025, using open-source technology developed by the Foundation, with an initial launch targeted for the first half of 2026.

House of Doge CEO Marco Margiotta argued the app is intended to be more than another on-ramp-plus-wallet bundle. “We’re planning to offer more by going beyond another wallet app that lets you buy Dogecoin. We have unique features we’re expecting to release, all with the quality and ease of use through the wealth of experience our development team brings,” Margiotta said. “We want to see Dogecoin become a widely used global decentralized currency. By building our own solution, we’re able to bring people on that journey together with our many strategic partnerships.”

The Such app account on X introduced a character named “Kubo” as a guide and leaned into the same pitch, saying Such is “more than just a wallet” and is designed to let users “start a side-hustle and sell your products and services for Dogecoin” by the time it launches.

The announcement also ties Such to Brag House Holdings Inc., described as House of Doge’s merger partner and identified in the release as Nasdaq-listed under ticker TBH. Brag House CEO Lavell Juan Malloy II positioned the app as a bridge from community engagement to monetization. “The Such app represents the next frontier for how communities connect, create, and transact in a digital-first economy,” he said. “This gives users the freedom to build, earn, and engage using Dogecoin, not as a concept, but as a real, usable currency. This is more than just innovation; it’s about democratizing access to opportunity for everyone through digital technology.”

At press time, DOGE traded at $0.12522.

https://cryptoslate.com/feed/

When the Ethereum Foundation dropped a thread on Jan. 19 claiming “Ethereum is the #1 choice for global financial institutions” and backing it with 35 cited examples, it moved past the standard protocol update or developer announcement.

It read like institutional marketing: a ranked claim, a curated evidence stack, and a call-to-action funnel pointing readers to an owned landing page where financial institutions can browse live metrics and click “Get In Touch.”

That shift in tone and structure matters because it signals something more strategic than routine developer communications.

The Foundation is documenting what's happening on Ethereum while also actively fighting for control of the narrative about which blockchain institutions will choose as their settlement layer.

And it's doing so at a moment when competing rails, particularly Solana, have been gaining mainstream credibility in institutional tokenization stories, while Ethereum itself has been painted as slowing down.

The question isn't whether the 35 stories are real. The question is why the Foundation chose this moment to package them into a public-facing narrative weapon, and what changed inside and outside the organization to make that move legible.

Is Ethereum comms centralized?

The clearest internal explanation is structural. In 2025, the Ethereum Foundation formalized “Comms & marketing” as an explicit management focus area, assigning it to Josh Stark as part of a broader effort to strengthen execution.

That's a shift from the Foundation's historically decentralized, developer-centric communications posture. Making narrative work someone's formal responsibility means the organization can now mount coordinated, institution-facing campaigns rather than relying on ad-hoc community evangelism.

The institutions portal, institutions.ethereum.org, wasn't thrown together for the January thread. It's a fully built funnel with a Data Hub that displays real-time network metrics, including ETH staked, stablecoin TVL, tokenized real-world assets, DeFi TVL, and layer-2 counts.

Additionally, the funnel includes a Library that explicitly references the Foundation's Enterprise Acceleration team's thought leadership and updates.

The Jan. 19 post functions as top-of-funnel distribution for an already-live institutional landing page, not as a standalone announcement. That's marketing infrastructure, not developer relations.

The story being told about Ethereum changed

Two external pressures made staying quiet costly.

First, competing institutional tokenization narratives have increasingly been attached to non-Ethereum rails. R3, the enterprise blockchain consortium whose clients include major banks, announced a collaboration with Solana in late 2024, framing it as bringing “big bank” tokenization efforts onto Solana's infrastructure.

R3 followed up with plans for a Solana-native “Corda protocol” yield vault slated for the first half of 2026, adding more oxygen to the “institutions-on-Solana” storyline.

That's a direct challenge to Ethereum's positioning as the default institutional settlement layer.

Additionally, data from rwa.xyz shows that Ethereum grew by 3.72% in the tokenized real-world asset (RWA) market over the past 30 days. However, Solana, BNB Chain, and Stellar registered growth of 15.9%, 20.4%, and 35.3%, respectively, in the same period.

Although these three blockchains account for just 33% of Ethereum's total market share, the accelerated growth rate raises an alert.

Second, mainstream outlets began framing Ethereum as losing momentum. The Financial Times explicitly used “midlife crisis” language, contrasting Ethereum with faster, cheaper rivals and questioning whether the network could maintain its dominance amid intensifying competition.

That kind of framing, published in an outlet read by the exact institutional decision-makers Ethereum wants to attract, raises the reputational cost of silence.

Put together, the Foundation faced both competitive narrative pressure and reputational framing pressure. A proactive “here are the receipts” post becomes legible as a response to the story being told about Ethereum, not a reaction to any single new development.

What the 35 stories actually prove and why it matters now

Not all of the 35 items carry equal weight, and treating the thread as a truth table rather than a press release reveals useful nuance.

Several claims are verifiably live with measurable activity. Kraken launched xStocks on Ethereum. Fidelity issued its FDIT tokenized money market fund on the network. Amundi tokenized a share class of its CASH EUR money market fund.

JPMorgan issued its deposit token on Base, an Ethereum layer-2. Société Générale's SG-FORGE deployed its EURCV and USDCV stablecoins on DeFi protocols like Morpho and Uniswap. Stripe built stablecoin-based recurring billing into its payments stack.

These are real products with issuer announcements, on-chain contracts, and in some cases disclosed volume or assets under management.

The timing reflects a genuine shift in the competitive landscape for institutional adoption.

The global stablecoin market capitalization sits around $311 billion, with roughly $188 billion issued on the Ethereum ecosystem, whether on the mainnet or layer-2 blockchains.

Tokenized real-world assets tracked by RWA.xyz total roughly $21.66 billion in distributed value.

Those numbers are large enough that the “which chain wins institutions” question is no longer niche, but contested terrain with real economic stakes.

Ethereum retains structural advantages: the deepest liquidity, the most established DeFi protocols, the broadest developer ecosystem, and a multi-year head start in institutional experimentation.

However, advantages erode if the narrative shifts.

If decision-makers at banks, asset managers, and fintechs begin internalizing the story that Solana is faster, cheaper, and more aligned with institutional needs, those perceptions can become self-fulfilling as liquidity and developer attention migrate.

The same happens if these institutions believe that Ethereum is slowing down under its own weight.

The Foundation's response appears to contest that narrative directly by arguing that Ethereum already serves as the institutional liquidity layer, backed by a curated stack of proof points and a self-service portal where institutions can verify claims and make contact.

That's a deliberate attempt to win narrative share before the perception gap becomes an adoption gap.

The real signal

The Jan. 19 post isn't important because it reveals new institutional deals. It's important because it reveals that the Ethereum Foundation now treats narrative control as a formal organizational capability rather than a byproduct of developer evangelism.

The publication, the institutions' portal, the formalized comms structure, and the explicit funding of narrative-focused initiatives like Etherealize all point in the same direction: the Foundation has decided that winning the institutional adoption story requires more than building good infrastructure.

Tapping institutional interest also requires actively shaping how that infrastructure is perceived by the institutions it wants to attract.

Whether that strategy works depends less on the quality of the 35 stories than on whether the underlying claim, that Ethereum is the default institutional settlement layer, remains true as competitors build competing rails and mainstream outlets question Ethereum's momentum.

The Foundation is betting that proactive narrative work can prevent perception from drifting away from reality. The risk is that reality itself shifts while the Foundation is busy defending its story.

The post Ethereum is facing a brutal institutional “midlife crisis,” and the Foundation’s 35-point response reveals a shocking new reality appeared first on CryptoSlate.

NYSE said it is developing a platform for trading and on-chain settlement of tokenized securities, and will seek regulatory approvals for a proposed new NYSE venue powered by that infrastructure.

According to the owners, ICE, the system is designed to support 24/7 operations, instant settlement, orders sized in dollar amounts, and stablecoin-based funding. It combines NYSE’s Pillar matching engine with blockchain-based post-trade systems that have the capability to support multiple chains for settlement and custody.

ICE did not name which blockchains would be used. The company also framed the venue and its features as contingent on regulatory approvals.

The scope ICE described is U.S.-listed equities and ETFs, including fractional share trading. It said tokenized shares could be fungible with traditionally issued securities or natively issued as digital securities.

ICE said tokenized shareholders would retain traditional dividends and governance rights. It also said distribution is intended to follow “non-discriminatory access” for qualified broker-dealers.

The forward-looking market-structure implication sits less in the token wrapper and more in the decision to pair continuous trading with immediate settlement.

Under that design, the binding constraint shifts from matching orders during a session to moving money and collateral across time zones and outside banking hours (inference based on settlement and operating-hour constraints described by regulators and ICE).

U.S. markets only fairly recently completed the move from T+2 to T+1 settlement, effective May 28, 2024, a project the SEC tied to updated rules for clearing agencies and broker-dealers. FINRA has also issued reminders that even a one-day compression requires coordinated changes in trade reporting and post-trade workflows.

Always-on trading raises settlement and funding demands

Pressure for longer trading windows is also building in listed equities, with Nasdaq publicly described as seeking SEC approval for a 23-hour, five-day trading schedule. ICE’s proposal extends the concept by pairing always-available trading with a settlement posture it labeled “instant.”

That approach would require market participants to pre-position cash, credit lines, or eligible on-chain funding at all times (inference grounded in the “instant settlement” and 24/7 features, and the post-trade funding constraints reflected in the T+1 migration).

For broader context on how quickly tokenization is spreading in finance, see CryptoSlate’s coverage of tokenized assets.

ICE made the funding and collateral angle explicit, describing the tokenized securities platform as one component of a broader digital strategy. That strategy also includes preparing clearing infrastructure for 24/7 trading and potential integration of tokenized collateral.

ICE said it is working with banks including BNY and Citi to support tokenized deposits across ICE’s clearinghouses. It said the goal is to help clearing members transfer and manage money outside traditional banking hours, meet margin obligations, and accommodate funding requirements across jurisdictions and time zones.

That framing aligns with DTCC’s push around tokenized collateral. DTCC has described collateral mobility as the “killer app” for institutional blockchain use, according to its announcement of a tokenized real-time collateral management platform.

A near-term data point for how quickly tokenized cash-equivalents can scale sits in tokenized U.S. Treasuries. RWA.xyz displays the total value of $9.33 billion as of press time.

ICE’s emphasis on tokenized deposits and collateral integration creates a path where similar assets become operational inputs for brokerage margin and clearinghouse workflows. That scenario is an inference grounded in ICE’s stated clearing strategy and DTCC’s collateral thesis, including the focus on mobility.

| Plumbing shift | Metric | Value | Source |

|---|---|---|---|

| U.S. equities settlement cycle | Compliance date | May 28, 2024 (T+1) | SEC, FINRA |

| Tokenized Treasuries | Total value (displayed) | $8.86B (as of 01/06/2026) | RWA.xyz |

Stablecoins, tokenized deposits, and collateral mobility

For crypto markets, the bridge is the settlement asset and the collateral workflow. ICE explicitly referenced stablecoin-based funding for orders and separately referenced tokenized bank deposits for clearinghouse money movement.

One base-case scenario is a settlement-asset race where stablecoins and bank-issued tokenized deposits compete for acceptance in brokerage and clearing operations. That could push more institutional treasury activity into on-chain rails while keeping the compliance perimeter centered on broker-dealers and clearing members.

A second scenario is collateral mobility spillover, where tokenized collateral becomes a primary tool for intraday and overnight margining in a 24/7 environment. That shift could increase demand for tokenized cash-equivalents such as Treasury tokens that can move in real time under defined eligibility rules.

In that design, the operational question becomes which chains, custody arrangements, and permissioning models satisfy broker-dealer requirements. ICE said only that the post-trade system has the capability to support multiple chains and did not identify any specific network.

A third scenario reaches Bitcoin through cross-asset liquidity. Always-available equities and ETFs, paired with faster settlement expectations, could compress the boundary between “market hours” and “crypto hours,” making funding conditions a more continuous input into BTC positioning (scenario inference anchored to ICE’s 24/7 equities and ETF scope and the mechanics of TradFi access via ETF wrappers).

Farside data shows large daily net flows into U.S. spot Bitcoin ETFs on several early-January sessions, including +$697.2 million on Jan. 5, 2026, +$753.8 million on Jan. 13, 2026, and +$840.6 million on Jan. 14, 2026.

That channel transmits equity-like allocation decisions into BTC exposure, alongside other flow drivers covered in CryptoSlate’s ETF inflows reporting.

Why macro and regulation will shape the rollout

Macro conditions set the incentive gradient for these plumbing changes because collateral efficiency matters more when rate policy and balance-sheet costs shift. The OECD’s baseline projects the federal funds rate will remain unchanged through 2025 and then be lowered to 3.25–3.5% by the end of 2026.

That path can reduce carry costs while leaving institutions focused on liquidity buffers and margin funding as trading windows lengthen (analysis tied to OECD rates and ICE’s 24/7 clearing focus). Under a 24/7 regime with instant settlement as a design goal, margin operations can become more continuous.

That dynamic can pull attention toward programmable cash movement, tokenized deposits, and tokenized collateral as tools for meeting obligations outside bank cutoffs.

For more on one of the key collateral-like building blocks, see CryptoSlate’s deep dive on tokenized Treasuries.

For crypto-native venues, the nearer-term implication is less about NYSE listing tokens and more about whether regulated intermediaries normalize on-chain cash legs for funding and collateral management. That can affect demand for stablecoin liquidity and short-duration tokenized instruments even if the trading venue remains permissioned (scenario inference based on ICE’s stated objectives).

DTCC’s positioning of collateral mobility as an institutional blockchain use case offers a parallel track where post-trade modernization proceeds through constrained implementations rather than open-access markets. That approach can shape where on-chain liquidity forms and which standards become acceptable for settlement and custody.

ICE did not provide a timeline, did not specify eligible stablecoins, and did not identify which chains would be used. The next concrete milestones are likely to center on filings, approval processes, and published eligibility criteria for funding and custody.

NYSE said it will seek regulatory approvals for the platform and the proposed venue.

The post Why Wall Street is overhauling stock dividends through tokenization powered by stablecoins appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Memecoins tend to sit in an odd place in crypto. They aren’t built around complex […]

Memecoins tend to sit in an odd place in crypto. They aren’t built around complex […] A Uniswap whale bought back 757,684 UNI for $3.66 million, after panic selling 798,734 UNI for $4.26 million.

A Uniswap whale bought back 757,684 UNI for $3.66 million, after panic selling 798,734 UNI for $4.26 million.https://beincrypto.com/feed/

Ethereum price slipped nearly 6% over the past 24 hours and almost 13% in two days, extending a choppy January pullback. Price briefly dipped below key levels, raising fresh doubts about whether buyers can regain control.

Yet beneath the surface, large holders stepped in aggressively. Roughly $360 million worth of ETH was accumulated by whales near the dip. The rebound case looks tempting, but Smart money (informed traders) is not fully convinced yet.

Triangle Pattern And Bullish Divergence Face Off Against Heavy Supply Cluster

Ethereum is trading inside a symmetrical triangle on the daily chart. Sellers rejected the price near the upper trendline earlier, around January 14. Now price is testing the lower boundary. But can buyers save the breakdown now?

Momentum throws an important hint. Between November 4 and January 20, Ethereum printed a lower low while RSI formed a higher low. RSI measures momentum by comparing recent gains and losses. This bullish divergence suggests selling pressure is weakening, even as the price tests support.

This kind of signal mattered before. In early January, a bearish RSI divergence preceded the recent drop. Now the opposite setup is forming, hinting at a potential reversal rather than continuation.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The possible bounce, however, faces a clear obstacle. Cost basis data shows a dense supply cluster between roughly $3,146 and $3,164. About 3.44 million ETH was accumulated in this zone.

Many holders are near breakeven. That often turns the area into strong resistance. Any rebound must clear this cluster to prove strength and turn into a reversal, as the RSI hints.

Whales Buy the Dip, but Smart Money Waits

Whales are acting with conviction. As Ethereum fell from around 13% (between January 19 and January 21), whale holdings rose from roughly 103.42 million ETH to about 103.71 million ETH. That increase represents close to $360 million in accumulation near current prices. This is not new behavior.

Similar whale buying appeared around January 14, shortly before a sharp bounce. Plus, the Ethereum whales started picking up supply again over the past few hours.

This steady accumulation signals confidence that the downside is limited near current levels. Whales are willing to absorb supply during weakness.

Smart money tells a different story.

The smart money index, which tracks informed positioning, remains below its signal line. Smart money typically moves early and aggressively before sustained rallies. In December, when this indicator surged above the signal line, Ethereum rallied about 26% in ten days. A similar move at the end of December preceded a 16% advance into mid-January.

That kind of confirmation is missing now. Smart money appears to be waiting for proof that resistance is cleared. The heavy cost basis cluster above the ETH price likely explains the hesitation. Until supply is absorbed, patience makes sense.

Ethereum Price Levels Reveal The Key Zone

Everything now funnels into a narrow range of levels.

The first level to reclaim is $3,050. Ethereum lost this multi-touchpoint support during the latest selloff. A daily close back above it would signal initial stabilization.

Above that, all eyes turn to the $3,160 area. This level has multiple touchpoints and aligns with the cost basis supply cluster. A clean daily close above it would represent roughly a 6% move from current prices. More importantly, it would break heavy resistance and could invite smart money back in. Post that, the reversal setup can take form.

If that happens, momentum could accelerate quickly. A confirmed breakout opens the path toward $3,390, where a broader bullish reversal would take shape.

On the downside, losing the lower triangle support near $2,910 weakens the rebound thesis. A sustained break there exposes $2,610 as the next major support.

Ethereum’s sellers may have won the recent battle, but the war is still on. Whales are already positioning for a bounce. Smart money is waiting for proof. If Ethereum can clear the $3,160 supply wall, hesitation may turn into momentum fast.

The post Ethereum’s 13% Dip Draws $360 Million in Whale Buying — But Why Is Smart Money Hesitating? appeared first on BeInCrypto.

Bitget, the world’s largest Universal Exchange (UEX), has released its latest research whitepaper, Bitget Universal Exchange (UEX): Blueprint for Financial Technologies in Crypto, Stocks, Commodities, and Emerging Markets, setting out a clear vision for how exchanges are evolving beyond crypto-only platforms into unified, multi-asset financial systems.

Authored by Ryan Lee, Chief Analyst at Bitget Research, and co-authored by Gracy Chen, CEO of Bitget, the paper introduces the Universal Exchange concept as a practical response to the long-standing trade-offs between user experience, asset access, and security. Rather than treating centralized finance, decentralized finance, and traditional markets as separate worlds, the UEX framework brings them together under a single account, supported by AI-driven execution and a unified risk and security layer.

The whitepaper arrives at a moment when exchanges are rapidly adding Web3 wallets, AI tools, and new asset classes, but often as disconnected features. Bitget’s research argues that the next phase of competition will not be about adding more products, but about how deeply those products are integrated at the architectural level. UEX positions Bitget at the forefront of that shift, with live support for on-chain assets, tokenized stock exposure, AI-assisted trading through GetAgent, and a security framework anchored by proof of reserves and a $700 million protection fund.

“Every exchange talks about innovation, but real progress comes when systems start making sense to and for users,” said Gracy Chen.

“The UEX is about making markets work together. One account, one experience, and a level of transparency and protection that users can actually trust.”

The paper also places Bitget’s approach in a broader industry context, comparing how leading platforms are progressing across seven dimensions of UEX readiness, from unified accounts to AI execution and on-chain risk controls. While many exchanges have taken steps toward convergence, the research highlights that full universality requires foundational design choices that are difficult to retrofit later.

According to Ryan Lee, the goal of the whitepaper is to move the conversation away from surface-level features.

“The industry has reached a point where adding another wallet or another AI tool is not enough,” Lee said.

“What matters is whether these systems actually talk to each other. UEX is our way of showing how that integration can work at scale, across crypto and traditional markets.”

Beyond outlining Bitget’s own implementation, the whitepaper frames UEX as a broader blueprint for the industry, one that exchanges, fintech firms, and even traditional institutions can adapt as tokenized assets and AI-driven trading become more mainstream. With global estimates projecting tokenized assets to reach trillions of dollars by the end of the decade, the research positions universal exchanges as a natural foundation for that growth.

The Bitget Universal Exchange (UEX) Whitepaper is now available and is intended for traders, institutions, developers, and policymakers seeking a clearer view of where digital and traditional finance are converging next.

For the full UEX Whitepaper, visit here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

The post Bitget Releases Universal Exchange (UEX) Whitepaper, Outlining the Next Phase of Global Trading appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Fundstrat’s Tom Lee reiterated his $250,000 Bitcoin target while cautioning that 2026 could be a “jagged” year for crypto adoption and a turbulent one for broader risk assets, framing any major pullback as a buying window rather than a signal to de-risk.

Speaking on The Master Investor Podcast with Wilfred Frost in an interview released Jan. 20, Lee said he expects 2026 to ultimately “look like a continuation of the bull market that started in 2022,” but argued markets must first digest several transitions that could deliver a drawdown large enough to “feel like a bear market.”

$250,000 Bitcoin Call Comes With A 2026 Warning

Lee pointed to what he described as a “new Fed” dynamic, arguing markets tend to “test” a new chair and that the sequencing of identification, confirmation, and reaction can catalyze a correction. He also warned that the White House could become “more deliberate in picking winners and losers,” expanding the set of sectors, industries, and even countries “in the bullseye,” which he said is already visible in gold’s strength.

A third friction point, in his telling, is AI positioning: the market is still calibrating “how much is priced into AI,” from energy needs to data-center capacity, and that uncertainty could linger until other narratives take the baton.

Pressed on magnitude, Lee said with regards to the S&P 500, the drawdown “could be 10%,” but also “could be 15% or 20%,” potentially producing a “round trip from the start of the year,” before finishing 2026 strong. He added that his institutional clients did not appear aggressively positioned yet, and flagged leverage as a tell: margin debt is at an all-time high, he said, but up 39% year-over-year—below the 60% pace he associates with local market peaks.

For crypto, Lee leaned on a market-structure explanation for why gold outperformed: he said crypto tracked gold until Oct. 10, when the market suffered what he called “the single largest deleveraging event in the history of crypto,” “bigger than what happened in November 2022 around FTX.”

After that, he said, Bitcoin fell more than 35% and Ethereum almost 50%, breaking the linkage. “Crypto has periodic deleveraging events,” Lee said. “It really impairs the market makers and the market makers are essentially the central bank of crypto. So many of the market makers I would say maybe half got wiped out on October 10th.”

That fragility, he argued, doesn’t negate the “digital gold” framing so much as it limits who treats it that way today. “Bitcoin is digital gold,” Lee said, but added that the set of investors who buy that thesis “is not the same universe that owns gold.”

Over time, Lee expects the ownership base to broaden, though not smoothly. “Crypto still has a, I think, future adoption curve that’s higher than gold because more people own gold than own crypto,” he said. “But the path to getting that adoption rate higher is going to be very jagged. And I think 2026 will be a really important test because if Bitcoin makes a new all-time high, we know that that deleveraging event is behind us.”

Within that framework, Lee reiterated his high-conviction upside call: “We think Bitcoin will make a new high this year,” he said, confirming a $250,000 target. He tied the thesis to rising “usefulness” of crypto, banks recognizing blockchain settlement and finality, and the emergence of natively crypto-scaled financial models.

Lee cited Tether as a proof point, claiming it is expected to generate nearly $20 billion in 2026 earnings with roughly 300 employees, and argued that the profit profile illustrates why blockchain-based finance can look structurally different from legacy banking.

Lee closed with advice that intentionally cuts against short-horizon reflexes. “Trying to time the market makes you an enemy of your future performance,” he said. “As much as I’m warning about 2026 and the possibility of a lot of turbulence, they should view the pullback as a chance to buy, not the pullback as a chance to sell.”

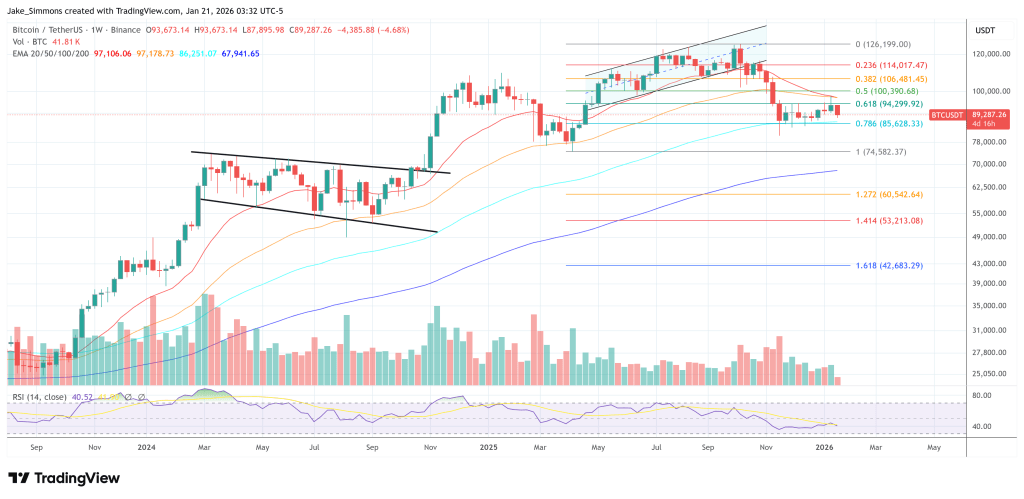

At press time, Bitcoin traded at $89,287.

Trove Markets’ new token collapsed almost immediately after trading began, wiping out the vast majority of early gains and leaving many backers angry and confused. The drop was brutal. Traders who bought early watched their holdings shrink by about 95% in a matter of hours.

Token Price Plunges After Launch

Initial prices implied a market value near $20 million. Based on reports, the token fell to roughly $0.0008 per unit, trimming the market cap to below $1–2 million.

Some wallets unloaded huge chunks of coins right after the token generation event. That selling pressure coincided with a flood of posts on social platforms calling the launch a rug pull.

Trove Had Raised Millions Before The Fall

According to reports, the project raised roughly $11.5 million in its public sale. The Trove team announced it would keep about $9.4 million to fund further work and pay for a switch of blockchains.

Refunds totaling about $2.44 million were returned to some investors, and another $100,000 was earmarked for additional reimbursements. The numbers left many buyers feeling shortchanged and asking why a large share of the money stayed with the team.

Team Keeps Majority Of FundsOn-chain analysts and tracing tools flagged unusual transfers tied to a handful of new accounts. Reports note that a meaningful slice of the token supply moved into one cluster of wallets, and some transfers were routed through services like ChangeHero.

That activity raised questions about whether all token allocations were handled openly. Legal calls and demands for public audits followed soon after.

Investors reacted quickly. Some demanded full refunds. Others threatened legal steps. Community moderators and influencers amplified complaints and demanded clear timelines for fixes.

We’re pivoting Trove to Solana.

After recent sentiment around Trove, the liquidity partner that had been supporting our Hyperliquid path chose to unwind their 500k $HYPE position. That was their decision and we fully respect it.

This changes our constraints: we’re no longer…

— unwise (@unwisecap) January 18, 2026

Trove posted updates, saying a partner had pulled out and that the pivot to Solana was necessary to keep the project alive.

The team promised to continue building and to be more open about their choices, while pledging to deliver a working platform that might justify holding the funds.

Trust Hinges On Delivery And Transparencyhttps://t.co/sc8b59sjYE

— TROVE (@TroveMarkets) January 19, 2026

What happens next will matter more than the words now being exchanged. If the team can show tangible progress on the exchange and create real trading depth, some anger may fade.

If not, the episode could be used as a warning: token sales that change terms late in the process can trigger swift market punishment and reputational damage. Regulatory scrutiny could also increase if large sums are held after a collapse like this.

Featured image from Unsplash, chart from TradingView