Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

One of Argentina's longest‑running exchanges, Ripio, is betting on local currency stablecoins and tokenized bonds to drive a decade‑long boom in tokenized money across Latin America.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Rapid AI integration may outpace societal adaptation, necessitating collaborative retraining efforts to mitigate job displacement and unrest.

The post JPMorgan CEO Jamie Dimon warns AI adoption is happening faster than society can keep up appeared first on Crypto Briefing.

Binance's addition of RLUSD and XRP pairs could enhance Ripple's market presence, potentially boosting stablecoin adoption and crypto liquidity.

The post Binance to open trading for Ripple’s stablecoin and XRP pairs appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

XRP has once again traded directly into a price zone that a few traders have come to recognize as a liquidity pocket. This area has acted as a magnet for price since December 2024, causing repeated tests and reactions that stand out clearly on the price chart. In a recent technical breakdown shared on X, crypto analyst ChartNerd highlighted how XRP has repeatedly made contact with this liquidity pocket over the past year and the cryptocurrency might be approaching a relief bounce.

Liquidity Pocket: Support Or Springboard?

Technical analysis of XRP’s price action shows that the cryptocurrency is now trading within a liquidity zone that has acted as a support range since December 2024. This liquidity zone, which spans the range from $1.90 to $1.75, has acted as a price magnet for many months. Even after reaching its all-time high of $3.65 in July 2025, XRP entered into a multi-month correction that eventually found support at this liquidity zone.

According to the analysis, nearly every prior visit to this zone was followed by some form of relief, especially when momentum indicators aligned. The last time XRP returned to this level, it slowed down its decline and eventually bounced back above $2.4 in early January.

However, the most recent push downwards played out as a 20% decline after a rejection at the $2.40 zone in early January, which has essentially pushed the XRP price action back to trading within this liquidity range and has started to show tentative stabilization.

To bring further confirmation to the setup, the analyst included the daily Stochastic RSI below the price chart. This momentum indicator, which measures relative strength and conditions of overbought or oversold pressure, is currently sitting in deeply oversold territory according to the chart. These oversold conditions in the Stoch RSI aligned with rebounds off this same liquidity pocket.

XRP Price Chart. Source: @ChartNerdTA On X

What Happens Next?

If history repeats itself, the repeated tests of this liquidity pocket and accompanying oversold signals might be clearing the road for a bounce. If XRP was underneath this pocket and rejecting at this level, that would be bearish. Holding it as support for a long duration points to a strong support strength in this area.

That said, there is another possibility that the reverse could happen. Should XRP break decisively below this zone with strong selling pressure, the technical setup would shift from supportive to bearish and leave the price action trending downwards.

Trading activity hints that recent buyers may be in a tough spot, because the mix of holders now resembles the early 2022 structure when price pressure was high. That means many participants may be below their breakeven cost basis, and this can build selling pressure over time if prices fail to move higher.

Strategy continues to dominate as the largest Bitcoin treasury company. This time, the company has expanded its holdings, crossing 700,0000 BTC in the process, and currently holds over 3% of the total Bitcoin supply.

Strategy Now Holds 3.4% Of Bitcoin Supply As Holdings Top 700,000 BTC

Michael Saylor’s Strategy now holds approximately 3.4% of the total Bitcoin supply as the company increased its holdings to over 700,000. In a press release, the company revealed that it acquired 22,305 BTC for $2.13 billion at an average price of $95,284 per Bitcoin last week. It now holds 709,715 BTC, which it acquired for $53.92 billion at an average price of $75,979.

This purchase was Strategy’s largest weekly announcement since November 2024 and its fifth-largest announcement ever. It also came just a week after the company announced it had acquired 13,627 BTC for $1.25 billion. Meanwhile, this latest purchase has come amid a decline in BTC’s price.

Bitcoin dropped below $90,000 yesterday for the first time since the start of the year, dragging the Strategy stock with it. MSTR dropped as much as 8% yesterday, falling to around $160. The stock is still up over 3% year-to-date (YTD). However, it is worth noting that Saylor and his company continue to dilute MSTR shares to buy more Bitcoin. The company sold 10.4 million MSTR shares last week to fund most of this latest purchase.

Reactions To The Latest BTC Purchase

Market analyst Rob noted that Strategy no longer highlights BTC yield as a flagship metric. He further stated that even after buying over 35,000 BTC in the first few weeks of this year, the BTC yield achieved is 0.4%, which amounts to an annualized rate of about 6% to 10%. The analyst also remarked that the law of diminishing Bitcoin yield means the ability to deliver a yield decreases as the BTC stack grows.

With Strategy now holding over 700,000 BTC, Rob explained that it is harder to generate a return. According to him, this means that going forward, the play is more about squeezing the Bitcoin price itself higher rather than increasing the BTC per share. He added that this also explains why MSTR’s mNAV has collapsed to just over 1x.

Crypto commentator Ran Neuner warned that a company like Strategy buying and holding such a large concentration of a reserve asset is not healthy. He added that right now, Saylor and his company are the only ones really buying Bitcoin. Meanwhile, market expert Bit Paine said it is a market failure that Saylor is allowed to buy this much BTC at prices below $100,000.

At the time of writing, the BTC price is trading at around $90,000, down in the last 24 hours, according to data from CoinMarketCap.

https://cryptoslate.com/feed/

Bitcoin price surrendered the psychological $90,000 stronghold during early Asian trading hours on Jan. 21, marking a decisive breakdown that has effectively erased the asset's gains for the start of 2026.

According to CryptoSlate's data, the world’s largest digital asset plummeted to a session low of $87,282 over the last 24 hours.

This downturn was not an isolated event but part of a broader, market-wide sell-off that inflicted heavy damage across the digital asset ecosystem. Major alternative cryptocurrencies, including Ethereum, XRP, Cardano, and Solana, all posted significant losses, mirroring the leader's descent.

Meanwhile, the sharp reversal marks the culmination of a brutal two-day slide that has pushed the emerging industry back toward price levels last observed in late 2025 and shattered the bullish momentum that had characterized the opening weeks of the new year.

Leverage flushes and aggressive selling

While price corrections are standard in crypto markets, the velocity of this decline points to a toxic combination of derivatives liquidations and genuine supply shocks.

The speed of the move was most evident in the futures markets, where “liquidation cascades” (a scenario in which falling prices trigger forced sell orders, which in turn drive prices lower) accelerated the drop.

Data from CoinGlass reveals the extent of the damage. Traders holding long positions (betting on price increases) suffered more than $1.5 billion in losses over the last 48 hours.

This figure represents the capitulation of bulls who had positioned themselves for a breakout above $100,000 only to be caught offside as Bitcoin failed to sustain support near the upper $90,000s.

However, this price decline was not purely a flush of over-leveraged speculation. Unlike “scam wicks” that are quickly bought up, this move was supported by aggressive selling in the spot market, the actual exchange of assets.

CryptoQuant’s “Net Taker Volume,” a critical metric that gauges market aggression by tracking whether traders are buying or selling, printed a negative reading of -$319 million on Jan. 20.

This deeply negative figure indicated that motivated sellers were aggressively bidding to exit their positions, overwhelming the available liquidity.

Notably, this marks the second time the indicator has plunged below minus $300 million in recent days. The prior occurrence was on Jan. 16, when Bitcoin was still trading above $95,000.

Further compounding the bearish outlook is the behavior of “whale” investors.

CryptoQuant’s Whale Screener, which tracks deposits from over 100 active high-net-worth wallets, detected a surge in supply moving onto exchanges.

Whales deposited more than $400 million worth of Bitcoin into spot exchanges on Jan. 20, following a similar $500 million spike on Jan. 15.

Historically, large deposits into spot exchanges have reliably preceded selling pressure, or at least create a wall of ask liquidity that dampens any potential price recovery.

Moreover, the negative market sentiment was confirmed by the performance of spot Bitcoin ETFs over the last two days.

According to SoSo Value data, the 12 funds have seen outflows of nearly $900 million over the last two trading sessions, further exacerbating the current market downtrend.

The macro headwind and “Japanic” phenomenon

Beyond the internal mechanics of the crypto market, a complex and increasingly hostile macroeconomic backdrop is exerting severe downward pressure.

Market headlines have been dominated by a phenomenon analysts are dubbing “Japanic,” a contagion effect originating from the Japanese bond market that is destabilizing global risk assets.

Presto Research argued that the true epicenter of current market stress is Tokyo, not the United States.

According to the firm, a chaotic selloff in Japanese government bonds (JGBs) has spilled over into broader international markets, triggering a “Sell America” trade. In this environment, correlations have converged, leading equities, US Treasuries, the dollar, and Bitcoin to fall in tandem as liquidity is withdrawn from the system.

The catalyst for this volatility was a surprisingly weak auction for 20-year Japanese government bonds. The bid-to-cover ratio (a primary measure of demand) fell to 3.19 at Tuesday's auction, down significantly from 4.1 previously.

This signals softening demand for Japanese debt at a time when the market is already jittery about Japan's fiscal health.

The Kobeissi Letter provided further context on this capital flight, noting that Japanese insurers sold $5.2 billion of bonds with maturities of 10 years or more in December.

This marked the largest monthly sale since data collection began in 2004 and the fifth consecutive month of net sales.

As Japanese institutions (historically among the largest foreign holders of global debt) retreat to domestic safety, global liquidity tightens, leaving risk assets like Bitcoin vulnerable.

Analysts at Bitunix highlighted the duality of this moment for digital assets in a statement shared with CryptoSlate.

According to the firm, the sharp dislocation in sovereign bond markets once again highlights the fragility of traditional safe-haven assets. They noted that in the short term, simultaneous pressure on bonds and risk assets may dampen risk appetite in crypto markets.

However, Bitunix analysts also pointed toward a potential long-term pivot inherent in this chaos. Over the medium term, if the politicization of bond markets and monetary intervention become persistent features, this dynamic could reinforce the allocation case for Bitcoin as a non-sovereign asset.

They concluded that over the longer horizon, sustained erosion in global interest rate and currency stability may ultimately lead to a repricing of crypto assets’ strategic weight within portfolio allocation.

This instability has fueled intense speculation regarding the Bank of Japan's next move ahead of the Feb. 8 snap election.

Presto Research outlines two binary outcomes: a “Liz Truss” moment, referencing the 2022 UK bond market revolt triggered by fiscal mismanagement, or a return to “fiscal dominance,” in which the central bank is forced to print money aggressively to cap yields.

Simultaneously, trade policy friction is adding another layer of uncertainty.

Matrixport notes that Bitcoin’s options market has seen a decisive shift in sentiment, with demand for “puts” (downside protection) outpacing “calls.”

The firm attributes this defensive positioning to President Donald Trump’s renewed threat of tariffs of 10% to 25% on European goods, which has prompted institutional investors to hedge against near-term macro volatility.

What's next for Bitcoin

Despite the pervasive gloom, not all indicators point to a prolonged bear market.

Glassnode’s weekly analysis characterizes the current setup as a “momentum slip,” a cooling of an overheated market that remains statistically “above neutral.”

However, the technical reality on the charts remains precarious.

CryptoQuant analyst Axel Adler Jr. has identified the $89,800-$90,000 range as the critical line of defense for bulls.

This price range is significant because it represents the “cost basis” (the average purchase price) for the freshest buyers in the market, specifically the Short-Term Holder cohorts who entered within the last day to the last month.

Adler warns that a sustained breakdown below this band pushes these cohorts underwater simultaneously. When short-term speculators hold unrealized losses, they become highly sensitive to price drops, raising the risk of panic selling that could accelerate the downtrend.

Meanwhile, the path upward is littered with resistance, even if Bitcoin manages to bounce. The 1-month to 3-month holder cohort has a cost basis of roughly $92,500.

Since these traders are currently nursing losses, they are likely to sell into any relief rallies to break even, creating natural sell pressure.

Furthermore, the aggregated realized price for all short-term holders stands at $99,300, essentially forming a formidable ceiling that must be breached to reignite bullish conviction.

For now, Bitcoin remains in a state of delicate balance. It is caught between aggressive liquidation flushes and a hostile macro environment, with the $90,000 level serving as the dividing line between consolidation and a deeper correction.

The post Bitcoin just erased all 2026 gains as a $1.5 billion liquidation trap catches every trader off guard appeared first on CryptoSlate.

Bermuda wants to become the world's first “fully on-chain national economy.”

The announcement, delivered jointly by the island's government, Circle, and Coinbase on Jan. 19, frames the initiative as the deployment of digital asset infrastructure across government agencies, local banks, insurers, small businesses, and consumers, with USDC positioned as the primary payment rail.

The pitch: fast, low-cost, dollar-denominated settlement replacing expensive legacy systems.

However, strip away the marketing gloss, and what's actually on the table is something narrower and more instructive: a pilot-driven modernization of payment rails in a small, high-cost economy where traditional card networks extract hefty fees and where experimentation carries limited systemic risk.

Bermuda isn't mandating that every resident transact on a blockchain, but it is testing whether stablecoins can function as an everyday settlement infrastructure without forcing consumers to change how they pay.

That distinction matters because the real story here isn't Bermuda's crypto ambitions. It's the quiet, grinding work of making dollars-on-chain a practical financial layer, and the gap between what that requires and what most “on-chain economy” headlines imply.

What “fully on-chain” actually describes

The official releases outline three concrete near-term actions: government agencies piloting stablecoin-based payments, financial institutions integrating tokenization tools, and residents participating in digital literacy programs.

The government characterizes this as a continuation of a multi-year arc that began with the Digital Asset Business Act in 2018, included a USDC airdrop at the Bermuda Digital Finance Forum in 2025, and will scale further at the 2026 forum in May.

But “fully on-chain” functions as a spectrum, not a binary.

At the low end, it's marketing with an announcement with minimal change to actual payment flows. At the high end, it's an integrated national infrastructure where banks, insurers, and government agencies have built stablecoin settlement into core systems, consumer wallets arecommon, and measurable cost and time savings appear in the data.

Bermuda's current position sits somewhere between allowing on-chain payments and making them a default settlement rail for key flows.

The language supports Level 1 to early Level 2: pilots exist, “multiple live examples” are claimed, but no adoption statistics, timelines, or mandates have been disclosed.

The government hasn't published merchant counts, transaction volumes, cost comparisons, or wallet penetration rates, and these metrics distinguish experimentation from transformation.

| Level | Operational meaning | What you’d need to see | What Bermuda has actually disclosed |

|---|---|---|---|

| 0 | “On-chain economy” is primarily a branding line, with little to no change in real payment flows. | No meaningful new payment options in production; no measurable change in costs, settlement times, or adoption; no public roadmap beyond general ambition. | High-level ambition language + partnership framing; no KPIs, timelines, or adoption figures published. (Easy to over-interpret without data.) |

| 1 | On-chain payments are permitted and usable in pockets: early merchant acceptance and limited government/payment experiments. | Named payment categories in scope (e.g., specific fees/taxes); baseline counts (# merchants, # wallets); early volumes (monthly txn count/$$); basic user journeys (cash-in/out availability). | Releases describe pilots and claim “multiple live examples,” with USDC positioned centrally, plus education/onboarding plans — but provide no merchant counts, wallet penetration, volumes, or cost comps. |

| 2 | Stablecoins become a default (or common) settlement option for key flows, while legacy rails still exist. | Penetration rates by sector (% of merchant sales in stablecoins); cost delta vs cards/wires; settlement speed metrics; reliable on/off-ramps; named bank/insurer integrations with go-live dates; compliance framework in production. | Language supports “allowing on-chain payments” moving toward “default rails” in aspiration, but there’s no disclosed timetable, no named integrating institutions, and no measured adoption/cost outcomes yet. |

| 3 | On-chain is integrated into the national financial stack: government + financial institutions + broad consumer usage with measurable macro impact. | Government collections + disbursements materially on-chain (taxes/fees + benefits/payroll/rebates); broad merchant coverage; high wallet penetration; audited cost/time savings; resiliency/uptime stats; clear governance and success metrics. | Not established by the announcement: no mandate, no claim that “all GDP” settles on-chain, no replacement of fiat system, and no published success metrics showing system-level transformation. |

The island as a laboratory

Bermuda's small scale makes it an ideal testing ground. With a population of roughly 64,600 and a GDP of $9.23 billion, the economy is highly open and services-oriented.

Consumer spending hit $841 million in the second quarter of 2025, providing a useful anchor for estimating potential savings.

Traditional card networks charge merchants a blended fee of 2.5% to 3.5%. Stablecoin rails, depending on the on-ramp and compliance infrastructure, can reduce that to 0.5% 1.5%.

If 10% of Bermuda's consumer spending shifted to stablecoins, annual merchant savings could range from $3.4 million to $10.1 million. At 30% penetration, that climbs to $10.1 million to $30.3 million.

Those numbers are illustrative models that assume functional cash-in/cash-out infrastructure, merchant tooling, and regulatory clarity.

But they show why even modest adoption could be meaningful for a small economy.

The island has been experimenting with digital payments for years. In 2019, Circle announced Bermuda would accept USDC for tax payments. In 2020, the government partnered with Stablehouse on a “digital stimulus token” pilot for in-person merchant transactions.

The current initiative builds on that history, but it's still unclear which government payment categories, such as taxes, licenses, customs, benefits, or payroll, will be included in the pilots, or when.

The Visa proof point

The cleaner signal that stablecoins are becoming a practical settlement infrastructure doesn't come from Bermuda. It comes from Visa.

On Dec. 16, Visa announced USDC settlement for US issuer and acquirer partners, with initial banks including Cross River and Lead Bank.

Settlement runs over Solana, and broader US availability is planned through 2026. By late November, Visa's stablecoin settlement program had reached $3.5 billion in annualized volume.

By mid-January 2026, that figure had grown to $4.5 billion.

Visa's pitch mirrors Bermuda's: modernize the rails without changing the consumer experience. Cardholders swipe the same way, and merchants receive dollars the same way.

The difference is in backend settlement speed and cost. Yet, Visa's own crypto head acknowledged in January that stablecoins still lack “merchant acceptance at scale” for direct spending.

The $4.5 billion annualized run rate is real traction, but it's a rounding error next to Visa's $14.2 trillion in total payment volume.

That contrast of growing institutional adoption alongside limited consumer-facing utility defines stablecoins as payment infrastructure. They're effective as settlement rails inside existing networks. They're not yet replacing cards at checkout.

What the numbers hide

Stablecoin transaction volume headlines are misled by design.

Bloomberg reported $33 trillion in total stablecoin transaction value for 2025, a 72% year-over-year increase.

Meanwhile, Visa's on-chain analytics paint a different picture: $47 trillion in gross stablecoin volume, but only $10.4 trillion when adjusted for high-frequency trading, arbitrage, and non-payment activity.

That gap matters. It's the difference between treating stablecoins as speculative instruments cycling through wash trades and treating them as genuine payment infrastructure.

Bermuda's bet assumes the latter use case will dominate, but the data shows the former still drives most volume.

Circulating stablecoin supply now exceeds $310 billion, with USDT accounting for roughly $187 billion. That's real liquidity, but it doesn't automatically translate into grocery store checkouts or payroll disbursements.

The connectors, such as on-ramps, off-ramps, merchant tooling, and compliance frameworks, remain the hard part.

What Bermuda's announcement doesn't establish

The official releases don't mandate that residents or merchants use stablecoins. They don't claim that all GDP will settle on public blockchains. They don't replace Bermuda's fiat system with a sovereign token.

More importantly, they don't solve the banking problem: stablecoins still need the same connectors that enable traditional payments.

Bermuda's Digital Asset Business Act, passed in 2018, established a licensing regime for private-sector digital asset businesses and explicitly states it “shall not apply to any entity owned by the Bermuda Government.”

That means the government's move on-chain doesn't automatically subject it to the same regulatory framework as Circle or Coinbase.

The announcement also leaves critical questions unanswered. Which agencies will pilot stablecoin payments, and for which services? Which banks and insurers have integrated tokenization tools? What percentage of merchants accept USDC today, and what's the average transaction size?

Officials claim “multiple live examples” but provide no metrics. That's the gap between rhetoric and reality.

The real stakes

The question isn't whether Bermuda will wake up tomorrow with every transaction on a blockchain. It won't.

The question is whether a small, high-cost economy can build enough on-chain infrastructure to make stablecoins a default option for a meaningful share of economic activity.

If it works, Bermuda becomes a reference case for other jurisdictions evaluating stablecoin adoption. If it doesn't, the island joins the long list of crypto-friendly jurisdictions that announced ambitious plans but struggled with execution.

The outcome depends less on blockchain technology than on operational discipline: onboarding merchants, training consumers, integrating compliance, and ensuring the cost savings are real and measurable.

The post One country is moving its economy “fully on-chain” with USDC, but the data reveals a massive hidden catch appeared first on CryptoSlate.

https://ambcrypto.com/feed/

If anything, they've made this the perfect entry point.

If anything, they've made this the perfect entry point. Trade tensions and yields: A key Bitcoin signal.

Trade tensions and yields: A key Bitcoin signal.https://beincrypto.com/feed/

dYdX has announced two updates to its affiliate program in early 2026: the launch of the first Affiliate Booster Program of the year and the rollout of a new sliding commission structure following the v9.4 software upgrade.

Affiliate Booster Program (January–February 2026)

The new Affiliate Booster Program will run from January 19 to February 16, 2026, with a total rewards pool of $100,000 USDC. Unlike previous leaderboard-based campaigns, this iteration introduces a proportionate rewards model, where affiliates earn a share of the pool based on the trading volume they refer.

To qualify, participants must:

- Refer at least $100,000 in eligible trading volume (BTC excluded), and

- Onboard at least five new users.

Registration is required, and affiliates can join at any point during the campaign period. Interested participants can register via the official form.

Sliding Affiliate Fee Structure Now Live

Following the community-approved v9.4 upgrade, dYdX has introduced a new sliding, volume-based commission model for affiliates. The previous static VIP tier system has been replaced with a structure that adjusts commissions automatically based on performance.

Under the new model:

- Affiliates earn a baseline 30% commission on taker fees from referred volume, up from 15%.

- Commission rates scale up to 50% based on referred trading volume over a trailing 30-day period:

| 30-Day Referred Volume | Commission Rate |

| Up to $1,000,000 | 30% |

| $1,000,001 – $10,000,000 | 40% |

| Above $10,000,000 | 50% |

Rates adjust dynamically as referred volume changes, creating a performance-based incentive model.

Interested affiliates can unlock their custom affiliate list here.

Program Access and Participation

Affiliates must comply with applicable terms and conditions and note that the program is not available in the U.S., UK, Canada, sanctioned countries, or to restricted persons. Eligible affiliates can register for the Booster Program and access the updated affiliate tools via dYdX’s official channels.

The post dYdX Announces New Affiliate Booster Program and Upgraded Commission Structure appeared first on BeInCrypto.

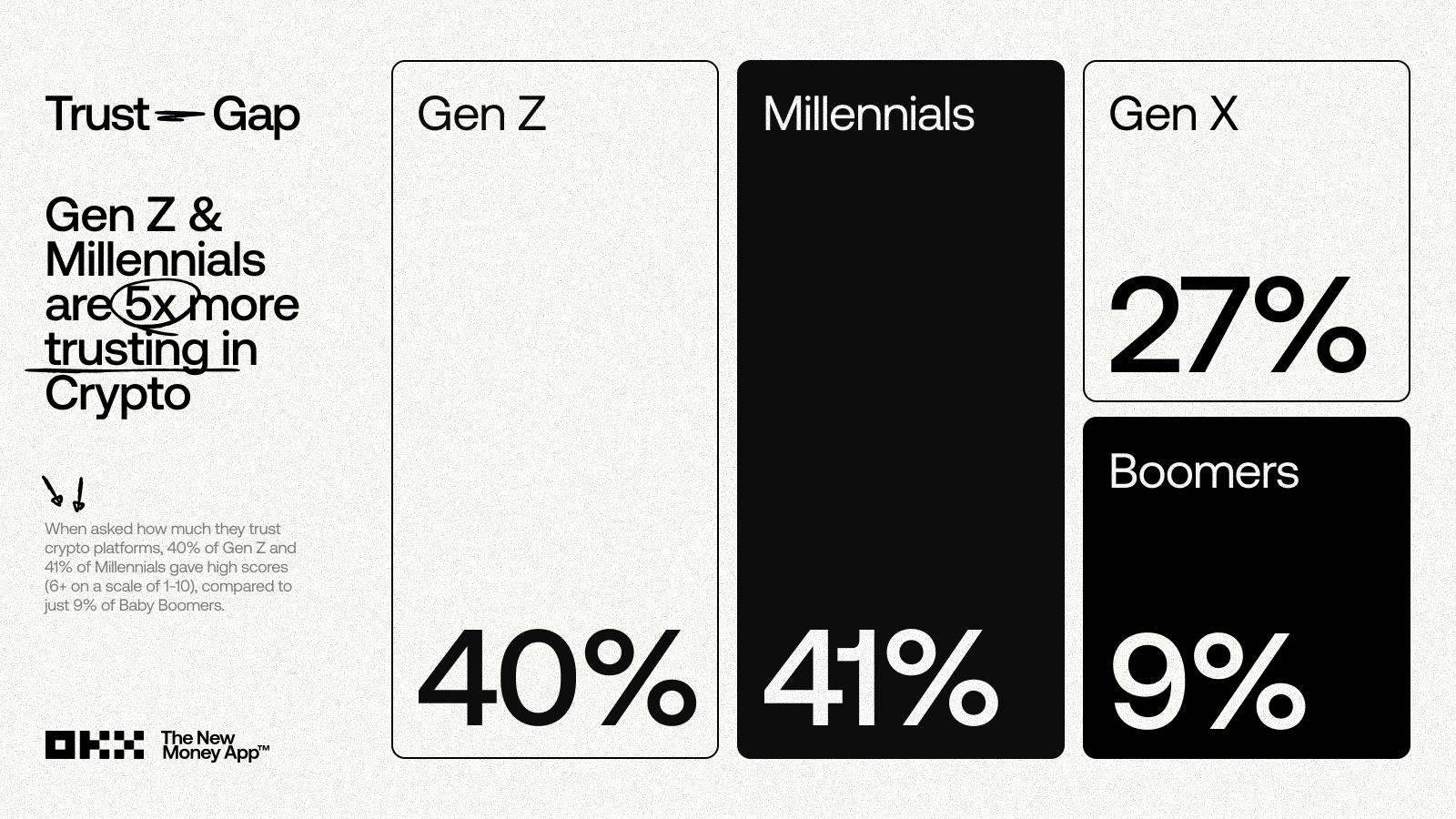

Younger Americans place far greater trust in crypto platforms than older generations, with Gen Z and Millennials nearly five times more trusting than Baby Boomers, according to a new OKX survey.

The survey, conducted in January 2026 among 1,000 US respondents, highlights a deepening generational divide in attitudes toward digital assets and traditional finance.

Crypto Trust Rises Among Gen Z as Boomers Remain Cautious

OKX’s survey found that 40% of Gen Z and 41% of Millennials reported high trust in crypto platforms, with scores of 6 or higher on a 10-point scale. By contrast, only 9% of Boomers expressed similar confidence.

This divide becomes even clearer when compared with trust in traditional banks. About 74% of Boomers assign high trust scores to legacy financial institutions, a level roughly eight times higher than the trust they place in crypto.

Among younger respondents, skepticism toward banks is more pronounced. Around 22% of Gen Z and 21% of Millennials reported low trust in traditional banking institutions.

“To younger people, the traditional financial system feels like a relic from their parents’ generation. Gen Z and younger Millennials grew up in a digital world. It’s natural for them to be more comfortable with the digital asset economy,” Haider Rafique, Global Managing Partner, OKX, told BeInCrypto.

The data suggests that confidence among younger users is not only higher, but also growing. Compared with January 2025, 36% of Gen Z and 34% of Millennials said their trust in crypto platforms increased over the past year.

Among Boomers, sentiment was more subdued. Only 6% reported growing confidence. Moreover, 49% said their trust levels had remained unchanged.

But what is driving this trust? Is it shaped more by first-hand experience or by community influence, such as social media, peers, and content creators? Rafique said both factors play a role, but their impact differs for younger users.

He explained that for younger generations, social media is the most natural entry point for information, whether for customer support, user experiences, or assessing credibility. They turn to social platforms first when they encounter a problem, want to learn something new, or see what trusted voices are saying online.

“That said, real trust only builds through direct experience. This is part of a bigger change in Gen Z behavior: They verify it themselves through repeated personal use. In digital assets, especially, loyalty comes one smooth transaction at a time,” he added.

Half of Gen Z and Millennials See Crypto as the Future

This rising confidence is translating into action. This year, 40% of Gen Z and 36% of Millennials plan to increase their crypto trading activity. Just 11% of Boomers said the same, making younger respondents nearly four times more bullish than their older counterparts.

The differences in trust appear closely tied to what each generation values most. For Gen Z, Millennials, and Gen X, platform security is the leading factor cited by 59%, 50%, and 54% respectively.

Nonetheless, Boomers place the greatest emphasis on regulation and legal protection, with 65% identifying it as their top concern.

Among younger users who remain skeptical of crypto, complexity stands out as the primary point of resistance, according to Rafique.

“Gen Z grew up with fintech apps that feel effortless. Crypto often still feels like handing someone a set of power tools and saying figure it out — confusing navigation, hidden costs, jargon everywhere. Irreversible mistakes that can cost real money,” he noted.

Meanwhile, the broader generational difference extends to long-term expectations about the future of finance. 52% of Gen Z and 50% of Millennial respondents believe crypto will eventually rival or surpass traditional finance as a dominant force.

Among Boomers, only 28% share that view. Moreover, 71% remain confident that banks will continue to underpin the financial system for years to come.

“Younger generations clearly see crypto as a pathway to greater opportunities and a hedge against limitations in traditional wealth-building paths,” the report read.

Views on crypto’s usefulness further separate the generations. Nearly half of Boomers said crypto does not solve any problems better than traditional finance. Among Gen Z, only 6% agreed. According to the findings,

“Younger participants consistently point to practical strengths that resonate deeply in a digital-first world, such as true 24/7 accessibility, borderless transfers, and the kind of flexibility that rigid legacy infrastructure simply cannot replicate. These perceived advantages fuel not just adoption but a sense of empowerment among those who have come of age expecting instant, always-on financial tools.”

The data suggests younger users increasingly perceive crypto as secure, innovative, and inevitable. Older generations, by contrast, are more likely to associate digital assets with risk and uncertainty.

Rather than acting as a constraint, this trust gap serves as a signal of where crypto’s momentum lies. Adoption and growth are driven by the generations that place the greatest confidence in the technology.

“Remember when Facebook was difficult for older generations to understand? Now, the entire platform is Boomers. We’ll see a similar pattern with the digital asset economy,” Rafique stated.

Overall, the findings point to a clear generational shift in financial trust. As younger users grow more confident through hands-on experience and digital-native channels, they are increasingly shaping crypto’s adoption trajectory, while older generations remain anchored to traditional banking models.

The post Younger Americans Trust Crypto 5x More Than Baby Boomers, OKX Survey Shows appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Delphi Digital is betting that Solana’s next major upgrade cycle will reposition the network as an “exchange grade” environment capable of supporting onchain order books that can realistically contend with centralized venues on latency, liquidity depth, and market structure. In a Jan. 20 post on X titled “2026 is the Year of Solana”, the research firm argued Solana’s 2026 roadmap is its “most aggressive upgrade cycle” yet, one that “overhaul[s] everything from consensus to infrastructure to become the decentralized Nasdaq.”

Why Delphi Digital Calls 2026 “The Year Of Solana”

Delphi framed the roadmap less as a grab bag of performance enhancements and more as a capital-markets push: “Solana’s roadmap is about transforming it into an exchange grade environment where a native onchain CLOB can viably compete with CEX latency, liquidity depth, and fairness. Here are all the upgrades making this possible.” In that view, shaving milliseconds matters only insofar as it produces predictable, enforceable execution outcomes for applications like high-frequency trading and central limit order books.

The centerpiece, Delphi wrote, is Alpenglow, a consensus redesign it called “the most significant protocol level change in Solana’s history.” The firm said Alpenglow introduces a new architecture built around Votor and Rotor, with Votor changing how validators reach agreement. Rather than “chaining multiple voting rounds together,” validators would aggregate votes offchain and “commit to finality in one or two rounds,” producing “theoretical finality in the 100-150 millisecond range, down from the original 12.8 seconds.”

Delphi emphasized Votor’s parallel finalization paths as a resilience feature, not just a speed play. If a block gets “overwhelming support (80%+ stake)” it finalizes immediately; if support is between 60% and 80%, a second round triggers, and finality follows if that also clears 60%. The goal, Delphi argued, is to preserve finality even with unresponsive segments of the network.

Alpenglow also introduces what Delphi called a “20+20” resilience model: safety holds as long as no more than 20% of stake is malicious, while liveness persists even if another 20% is offline, “tolerat[ing] up to 40% of the network being either malicious or inactive while still maintaining finality.” Under this design, Proof of History is “effectively deprecated,” replaced by deterministic slot scheduling and local timers. Delphi said the upgrade is expected to roll out in early to mid 2026.

Delphi also pointed to Firedancer, Jump’s C++ validator client, as a structural upgrade aimed at reducing a long-standing operational risk. Solana has historically relied on a single client, now known as Agave, and Delphi described that “monoculture” as a central weakness because client-level faults can cascade into broader network halts.

Firedancer’s objective, Delphi said, is a deterministic, high-throughput engine that can process “millions of TPS with minimal latency variance.” Ahead of full readiness, Delphi highlighted “Frankendancer,” a transitional build that combines Firedancer’s networking and block production modules with Agave’s runtime and consensus components, as a bridge to “substantially” increased client diversity.

On infrastructure, Delphi spotlighted DoubleZero as a private fiber overlay for validators, likening its transmission profile to traditional exchange connectivity: “the same infrastructure traditional exchanges like Nasdaq and CME rely on for microsecond level transmission.” The argument is that as validator sets expand, propagation variance becomes the enemy of tight finality windows. By routing messages along “optimal paths” and supporting multicast delivery, Delphi said DoubleZero can narrow latency gaps across validators—an enabler for both Votor’s quorum formation and Rotor’s propagation design.

Delphi also framed Solana’s block-building roadmap as a market-structure project. It described Jito’s BAM (Block Assembly Marketplace) as separating ordering from execution via a marketplace and privacy layer, with transactions ingested into TEEs so “neither validators nor builders can see raw transaction content before ordering takes effect,” reducing pre-execution behavior like frontrunning.

Harmonic, meanwhile, targets builder competition by introducing an open aggregation layer so validators can accept proposals from “multiple competing builders in real time,” with Delphi summarizing: “Think of Harmonic as a meta-market and BAM as a micro-market.”

Raiku rounds out the thesis by adding deterministic latency and programmable execution guarantees adjacent to Solana’s validator set, using Ahead-of-Time (AOT) transactions for pre-committed workflows and Just-in-Time (JIT) transactions for real-time needs—without modifying L1 consensus.

Delphi ultimately tied the technical roadmap to market demand: Solana’s spot trading gravity, the consolidation of onchain perps toward a handful of venues, and the need to reach performance parity with centralized platforms. It cited expectations for “new Solana native perps like Bulk Trade coming early next year,” and pointed to products like xStocks bringing “onchain equities directly to Solana,” arguing that liquidity and attention are consolidating toward a chain with faster settlement, better UX, and denser capital.

At press time, SOL traded at $127.

Although the XRP price has remained in a downtrend and largely range-bound since falling below its 2025 peak, a crypto analyst believes it could still surge to $10 in 2026. The analyst has shared a detailed roadmap supporting this bullish outlook, outlining how XRP’s price could play out this year and the key factors that could influence its movements.

A Roadmap To XRP $10 Price Surge

In a YouTube video released on January 20, crypto market analyst Zach Rector laid out his honest expectations for XRP’s outlook in 2026, offering insights into how it could get to $10 and the catalysts that could fuel this rally. According to the analyst, the XRP market is currently dominated by Fear, Uncertainty, and Doubt (FUD), along with signs of capitulation, which have pushed the price down and negatively impacted the sentiment and confidence of newer investors.

Rector revealed that long-term XRP holders are also becoming increasingly frustrated with the prolonged downtrend, with many wishing they had taken profits during last year’s rally, particularly when XRP rose to a peak around $3.6. He added that there has also been discontent and negative sentiment regarding XRP’s slow adoption, delay in industry regulation, and more.

However, from both a technical and investment standpoint, the analyst said he remains excited and optimistic about XRP’s price prospects in 2026. He explained that the market is already entering a renewed liquidity cycle, a shift that typically leads to an expansion in the broader business cycle. According to him, this stage has always correlated with powerful bull runs during an altcoin season.

Rector mentioned that although many investors and analysts expected an altcoin season in 2025, it never came. He believes that market conditions could still align for an altcoin season this year, with XRP positioned for significant gains during that period. He further acknowledged that he does not expect XRP to skyrocket to $50 or $100 in 2026, calling those price targets highly ambitious.

For his more realistic projection, Rector said he believes XRP could rise to between $5 and $10 in 2026. He noted that a significant sell wall exists around this range, as many investors are likely to take profits amid potential price volatility. Despite this, the analyst said that XRP still brings a strong ROI opportunity for investors. He pointed to factors that could drive the market, including US interest rate cuts, the implementation of the CLARITY Act, and billions of dollars expected from the Fed’s QE programs.

XRP Could Double ROI Faster Than Gold And Silver

In his video, Rector compared XRP’s long-term profitability potential to that of gold and silver. He noted that both precious metals performed exceptionally during this cycle, reaching new all-time highs. Silver, in particular, exceeded expectations, breaking past $95 in the last 24 hours after experiencing a years-long downtrend.

Rector believes that the chances of silver doubling to $200 or gold reaching $9,000-$10,000 per ounce this year are low. However, he says XRP has much stronger upside potential, forecasting a surge to $4 and beyond. If this happens, long-term investors who bought at or below $2 could effectively double their ROI.