Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Thailand’s SEC is planning new crypto ETF and futures trading regulations as the country looks to position itself as a regional crypto hub for institutions.

Saga’s US dollar-pegged stablecoin has dropped to $0.75, while the protocol's total value locked has fallen by around 55% over the past 24 hours.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Tokenizing ETF shares could revolutionize asset management by enhancing efficiency and adaptability while ensuring regulatory compliance.

The post F/m Investments seeks SEC permission to tokenize ETF shares appeared first on Crypto Briefing.

Strive's strategic focus on Bitcoin investment and debt reduction could enhance its market position and influence in the crypto sector.

The post Vivek Ramaswamy’s Strive plans to raise $150M in preferred stock sale to buy Bitcoin and repay debt appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

A new report from CoinGate shows Bitcoin took back the crown in cryptocurrency payments during 2025. Here’s how the rest of the rankings looked.

Bitcoin Was The Most Used Cryptocurrency On CoinGate In 2025

In a new thread on X, digital asset payments processor CoinGate has shared insights from its latest report about transactions that occurred on the platform in 2025. In total, CoinGate processed 1.42 million cryptocurrency payments during the year, bringing its total lifetime payments beyond 7 million.

As the below pie chart shows, Bitcoin accounted for the largest share of these payments.

Back in 2024, Tether’s USDT ranked the highest in payments on the platform, beating Bitcoin. With a share of 22.10% in 2025, however, the original cryptocurrency managed to reclaim the top spot over the stablecoin, which ended the year with a payments dominance of 16.60%.

The third position was occupied by Litecoin, which was involved in 14.40% of CoinGate payments. In Summer 2025, LTC even briefly became the second-best coin in the metric. Litecoin being preferred over some other popular assets could be due to the fact that its blockchain offers cheap and fast transactions as core features.

Ethereum and Tron, the fifth and sixth most used coins, both observed growth in payments dominance during 2025. “TRX payment share grew from 9.1% to 11.5% and ETH from 8.9% to 10.6%,” noted CoinGate.

In terms of networks, the Bitcoin blockchain, including the Lightning Network, was the most widely used on the platform in 2025, symmetrical with the token’s payments share itself.

As displayed above, the second and third largest networks on CoinGate were Tron and Ethereum, occupying shares of 19.6% and 15.1%, respectively. These blockchains being above Litecoin despite their native tokens accounting for lower payment shares is because they also facilitate stablecoin transactions.

The United States led in country rankings on the platform, with 24.37% of payments on the platform taking place in the nation. Germany and Netherlands rounded out the top three with shares of 6.83% and 5.16%, respectively.

Cryptocurrencies saw significant usage on the platform in terms of being a payment mode, but that’s not all they were used for. According to the report, merchants also increasingly chose to settle in digital assets.

More specifically, cryptocurrency settlements rose from 27% in 2024 to 37.5% in 2025. Stablecoins were the preferred option for merchants, being involved in 25.2% of all settlements, while Bitcoin occupied a smaller, but still notable, 9.7% share.

Merchants also used cryptocurrencies to pay vendors, affiliates, partners, and contractors. “The most popular payouts were in USDC, Bitcoin, and Ethereum,” said CoinGate. Stablecoins once again dominated here, occupying a payouts share of 87.8%.

BTC Price

At the time of writing, Bitcoin is trading around $88,300, down more than 9% over the last week.

Bitcoin has slipped below the $90,000 psychological level, and bulls are now trying to defend the $88,000 mark to prevent a deeper correction. After days of heavy volatility across crypto markets, BTC is trading in a fragile zone where short-term sentiment can shift quickly, especially as traders react to macro uncertainty and weakening momentum. With price hovering near key on-chain levels, the next move could define whether this drop becomes a brief shakeout or the start of another leg lower.

Analyst Axel Adler highlighted that Bitcoin is currently testing one of its most important short-term “defense lines.” His Bitcoin Support and Resistance chart compares spot price with the realized cost basis of different short-term holder (STH) cohorts, turning these levels into dynamic support and resistance zones.

According to the data, BTC is trading right around the cost basis of the two freshest buyer groups: STH 0D-1D at roughly $89,800 and STH 1W-1M near $90,000. In other words, investors who entered the market over the past few weeks are sitting at breakeven, making this area highly sensitive.

Above current levels, resistance appears stacked. The 1M-3M cohort sits near $92,500 and is already underwater, meaning it may sell into rebounds, while the aggregated STH realized price around $99,300 remains a major ceiling.

STH MVRV Near a Statistical Extreme

Adler adds that another key metric reinforcing this fragile setup is Short-Term Holder MVRV (STH MVRV), which measures the ratio between Bitcoin’s market price and the cost basis of short-term holders. In simple terms, when STH MVRV drops below 1.0, it signals that this cohort is, on average, holding unrealized losses and is increasingly vulnerable to panic-driven selling.

According to Adler, current STH MVRV stands at 0.897, meaning short-term holders are clearly underwater. More importantly, the metric is approaching the lower boundary of its 155-day statistical range, where the Mean minus one standard deviation sits near 0.875. With only around 2.5% remaining before reaching that statistical minimum, Bitcoin is entering a zone that historically aligns with market exhaustion and local bottom formation.

Adler notes that in many past observations, price stabilization occurred when the metric touched or approached this lower band, as buyers stepped in and selling pressure weakened. However, the market remains at a critical decision point. A clean break below 0.875 would signal extreme oversold conditions and raise the risk of short-term holder capitulation.

Together, both charts frame the same battlefield. The $89.8K–$90K region is the key defense zone for fresh buyers, while $92.5K now acts as resistance. With MVRV pressing toward a statistical extreme, Bitcoin is approaching a make-or-break moment between stabilization and deeper downside.

Bitcoin Bears Pressure Key Support Zones

Bitcoin (BTC) is facing renewed downside pressure after failing to reclaim the $90,000 region, with the latest pullback pushing price toward the $88,600 area. The 3-day chart shows BTC slipping back into the lower part of its recent range, reflecting a fragile market structure where rallies are being sold and buyers remain hesitant to step in aggressively.

From a trend perspective, BTC is trading below its key moving averages, with the faster lines curling downward and acting as dynamic resistance. The most notable barrier sits around the $100,000–$105,000 zone, where the broader trend indicators remain overhead and signal that the market is still in recovery mode rather than a confirmed uptrend. Even the recent bounce attempts have struggled to sustain momentum, highlighting that demand has not returned with enough force to absorb selling pressure.

At the same time, BTC continues to hold above the red long-term moving average, which is still rising and represents the broader bull market foundation. This keeps the larger structure intact, but the price action suggests that bulls must defend the $88,000–$90,000 area to prevent further weakness.

If BTC stabilizes and reclaims $90K, it could open the door for a push back into the mid-$90K range. However, if selling accelerates below $88K, the market risks revisiting deeper support levels from the late-2025 consolidation.

Featured image from ChatGPT, chart from TradingView.com

https://cryptoslate.com/feed/

European leaders facing a Greenland-linked dispute with Washington could treat U.S. Treasurys as a leverage point.

That would test not just the headline size of foreign holdings, but the market’s capacity to absorb speed, and how quickly higher yields would filter into the dollar, U.S. credit conditions, and crypto liquidity.

The Financial Times has framed Greenland as a plausible flashpoint for U.S.-Europe tensions and argued that Treasurys could sit on the menu of countermeasures.

That framing places the focus on execution mechanics and timing rather than a single “EU sells X” headline.

According to the U.S. Treasury’s Treasury International Capital (TIC) Table 5, foreign investors held $9.355 trillion in U.S. Treasurys at end-November 2025.

Of that total, $3.922 trillion was attributed to foreign official holders, a pool large enough that even partial portfolio shifts, especially if coordinated or fast, can register in rates.

The first constraint is measurement.

TIC country lines track securities reported by U.S.-based custodians and broker-dealers, and Treasury notes that holdings in overseas custody accounts “may not be attributed to the actual owners.”

That means the table “may not provide a precise accounting of individual country ownership,” a caveat that complicates any claim that “the EU” could dump a defined amount on command.

A portion of European beneficial ownership can appear in non-EU country lines, and European custody hubs can hold Treasurys for non-European owners. The practical implication is that “sell capacity” is not identical to “European-attributed holdings,” and policymakers have clearer influence over official portfolios than over private custody flows.

A defensible reference set exists inside the TIC data if it is described as custody attribution rather than EU ownership.

At end-November 2025, Treasurys attributed to Belgium ($481.0 billion), Luxembourg ($425.6 billion), France ($376.1 billion), Ireland ($340.3 billion), and Germany ($109.8 billion) totaled about $1.733 trillion.

Presented properly, that $1.73 trillion number is an upper-bound reference for identified major EU reporting and custody jurisdictions, not a verified EU-27 beneficial-owner total.

Custody data vs. “EU ownership” and why it matters

Official-sector positioning adds another layer because “official” can mean a classification in TIC reporting, while Fed custody data describes a location-based subset held in custody at Federal Reserve Banks.

The Federal Reserve’s international summary data show foreign official U.S. Treasury securities held in custody at Federal Reserve Banks at $2.74589 trillion in November 2025 (preliminary).

That location-based subset sits below the TIC “foreign official” total of $3.922 trillion at end-November.

How the Greenland dispute translates into selling would probably run through a sequence of policy signaling and portfolio mechanics rather than a single announcement of forced liquidation.

A preconditioning phase could unfold over weeks or months in which rhetoric hardens, and European policymakers discuss financial countermeasures in risk-management terms, consistent with the Financial Times framing that Treasurys could serve as leverage.

A second phase, spanning days to weeks, would center on a policy signal such as a coordinated call to shorten duration, reduce exposure, or adjust reserve-management guidelines.

Those steps can be executed without formally labeling the move as weaponization, and without requiring a centralized “EU” sale order.

The execution phase would then determine market impact, with two channels that can overlap.

One is official runoff through non-reinvestment at maturity, which can play out over quarters or years.

The other is active secondary-market sales by public and private holders, which can compress into weeks if hedging constraints, risk limits, or volatility targeting bind.

Even if the political intent is gradual diversification, volatility can turn it into a de facto flow shock if private hedgers and leveraged Treasury holders de-risk at the same time.

The liquidation timeline matters because research has linked month-scale changes in foreign official flows to rate moves.

A 2012 Federal Reserve International Finance Discussion Papers study estimated that if foreign official inflows into Treasurys drop by $100 billion in a month, 5-year Treasury rates rise about 40–60 basis points in the short run.

It also estimated long-run effects near 20 basis points after private investors respond.

The paper is dated, so the figures function as order-of-magnitude bounds for speed risk rather than a point estimate for today’s market structure.

Even so, the core implication remains: a faster “dump” (or a faster stop in marginal buying) has a different rate profile than a maturity runoff.

Important: The table below lays out editorial scenario constructs using an execution-speed lens. Sale sizes are illustrative except the $1.73 trillion line, which is a TIC custody-attribution reference for major EU reporting and custody jurisdictions and explicitly not a verified EU beneficial-owner amount. The rate language is framed as regime risk (orderly vs disorderly) rather than a linear “bps per $X” extrapolation.

| Scenario (sale amount) | One-month execution (flow shock framing) | One-quarter execution (absorption window) | 1–3 years (runoff framing) |

|---|---|---|---|

| $250B | Heuristic short-run +100–150 bps on 5-year rates if concentrated in a month; long-run effects nearer +50 bps after private response (2012 elasticity) | Lower peak move if distributed, with repricing tied to hedging and risk appetite | Often resembles reduced reinvestment, with term-premium drift more than a single shock |

| $500B | Heuristic short-run +200–300 bps; long-run effects nearer +100 bps (2012 elasticity) | Greater chance of persistent term-premium repricing if sustained alongside wider “sell America” flows | Functions as diversification, with market impact spread across cycles |

| $1.0T | Tail-risk short-run +400–600 bps; long-run effects nearer +200 bps (2012 elasticity) | Would test dealer balance sheets and risk-bearing capacity even with time to adjust | Hard to distinguish from structural reallocation without clearer attribution data |

| $1.73T (TIC custody-attribution reference) | Tail-risk framing if treated as a one-shot sale, while noting the $1.73T is not EU beneficial ownership | Could transmit as a multi-quarter tightening impulse if sales coincide with heavier hedging demand | Resembles a multi-year reserve and portfolio shift if done mainly through runoff |

Execution speed, yield shock risk, and broader market spillovers

Any sustained yield backup would land on a U.S. economy carrying a large debt stock.

U.S. gross national debt stands at $38.6 trillion as of press time.

That scale increases sensitivity to marginal funding-cost shifts even when refinancing occurs over time.

Higher Treasury yields typically tighten financial conditions through benchmark effects on mortgages, investment-grade issuance, and leveraged credit.

Equity valuations can also re-rate as the risk-free discount rate changes, channels that become more acute if the term premium reprices rather than only the policy path.

The spillover is broader than Treasurys because foreign investors hold a large footprint across U.S. markets.

The Treasury’s annual survey reported $31.288 trillion in foreign holdings of U.S. securities, including $12.982 trillion in long-term debt and $16.988 trillion in equities.

In crypto-adjacent markets, stablecoin issuers are also material Treasury buyers; see CryptoSlate’s breakdown of stablecoin issuers’ Treasury demand.

Dollar outcomes split into two regimes that can coexist across horizons.

In acute stress, a geopolitical shock can push investors toward dollar liquidity and U.S. collateral even as one bloc sells, a setup where yields move higher while the dollar holds up, or even strengthens.

Over longer horizons, sustained politicization can pull the other direction if allies treat U.S. government paper as a policy variable, nudging incremental diversification in official portfolios and gradually weakening structural dollar demand.

The International Monetary Fund’s COFER data show the dollar at 56.92% of disclosed global reserves in Q3 2025, with the euro at 20.33%.

That structure tends to change in steps rather than a single break.

The IMF has also described prior quarterly moves as sometimes valuation-driven, noting that the Q2 2025 decline in the dollar share was “largely valuation-driven” through exchange-rate effects.

That dynamic can blur interpretation of quarter-to-quarter shifts during volatility.

Crypto transmission: liquidity, discount rates, and narrative reflexivity

For crypto markets, the near-term linkage would run through rates and dollar liquidity rather than reserve shares alone.

A fast Treasury liquidation that lifts intermediate yields would raise the global discount rate and can tighten leverage conditions that feed into BTC and ETH positioning.

A slower runoff would transmit more through term-premium drift and portfolio rebalancing across equities and credit.

The narrative channel can cut the other way.

A high-profile episode where allied blocs discuss Treasurys as a policy tool can reinforce the “neutral settlement” framing that parts of the market apply to crypto, even if the first-order move is risk reduction under higher yields.

Tokenized Treasury products sit at the intersection of TradFi collateral and crypto rails; see CryptoSlate’s coverage as tokenized U.S. Treasurys reached a $7.45 billion all-time high.

What traders and policymakers would watch for is not a single “EU sells X” headline, because custody-based data can misstate beneficial ownership.

Instead, they would likely track a sequence of observable proxies, including shifts in foreign official custody holdings at the Fed and changes in TIC-reported totals over subsequent months.

If Greenland becomes the trigger for sustained U.S.-EU financial brinkmanship, the market variable that matters first is whether any Treasury reduction is executed as a one-month flow shock or a multi-year runoff.

The post US Treasurys face a $1.7 trillion EU “dump” over Greenland, forcing shift to Bitcoin if dollar safety vanishes appeared first on CryptoSlate.

Binance, the largest crypto exchange by trading volume, has listed Ripple's RLUSD stablecoin on its platform.

On Jan. 21, the exchange announced that it would open spot trading pairs, including RLUSD/USDT, RLUSD/U, and XRP/RLUSD, on Jan. 22 by 8 AM UTC.

Critically, Binance will initiate trading on the RLUSD/USDT and RLUSD/U pairs with zero fees until further notice.

To a casual trader, this reads like a straightforward listing announcement. However, industry experts noted that the move could fundamentally alter the market hierarchy and cement RLUSD's rapid growth over the past year.

The logic here is not that Binance magically creates value, but that the exchange can change how the market routes value. If that routing translates into sustained net issuance, RLUSD could plausibly jump into the top three stablecoins in a rapidly expanding market.

Engineering a liquidity event

The specific mechanics of the Binance listing suggest a push for dominance rather than mere participation.

By waiving fees, Binance is not merely adding trading pairs; it is subsidizing adoption. Zero-fee stablecoin pairs have a history of changing market share on centralized exchanges by redirecting where trades clear.

Kaiko’s analysis of stablecoin dynamics on Binance offers a precedent for disrupting these numbers. After the exchange re-listed USDC in March 2023, the token’s market share on centralized exchanges reportedly surged from roughly 60% to above 90%.

This shift did not necessarily mean USDC instantly became the superior asset. It meant Binance made it the cheapest and most convenient rail, and the market followed the incentives.

Kaiko has also documented how zero-fee regimes can dominate exchange volume and reshape market structure.

This presents both a promise and a warning for Ripple’s stablecoin. Incentives can create deep liquidity quickly, but they can also inflate activity that evaporates when the subsidy ends.

For RLUSD to move toward the top three, two distinct “flywheels” must spin in sequence.

The first is routing adoption. Zero fees encourage market makers and high-frequency desks to quote tighter spreads and push more flows through RLUSD pairs.

This improves the experience for all participants by deepening the order book, reducing slippage, and ensuring more reliable execution. In stablecoin markets, where product differentiation is often thin, the preferred asset is frequently the one that trades most efficiently.

The second flywheel is balance-sheet adoption. Market cap grows only when RLUSD is actually held, whether as exchange collateral, in DeFi lending markets, or in treasury allocations.

Binance creates the environment for this by expanding RLUSD utility. The listing announcement confirmed that portfolio margin eligibility will be added, increasing the token’s utility in leveraged trading strategies.

Furthermore, inclusion in Binance Earn is planned. This would give users yield-bearing incentives to hold the asset rather than simply trade it.

The math behind the climb

Despite this strategic setup, the numerical gap RLUSD must close to reach the top three is substantial.

Data from CryptoSlate shows that RLUSD has a circulating supply of around $1.4 billion. This places it among the top 10-largest stablecoins by market cap but significantly behind market leaders Tether's USDT and Circle's USDC.

To breach the “top 3 stablecoin,” RLUSD would need roughly $5.1 billion in new circulation to displace Ethena’s USDe, whose supply sits around $6.47 billion.

Over a 12-month period, reaching that benchmark would require approximately $424 million in net new RLUSD issuance per month

These are large numbers that would require RLUSD to grow four to seven times from its current base within a relatively tight window.

However, macro tailwinds may assist this ascent.

The US Treasury has publicly argued that the stablecoin market, currently valued at around $300 billion, could grow tenfold by the end of the decade. That would imply that the market could reach $3 trillion by 2030.

Meanwhile, US banking giant JPMorgan is more optimistic, projecting that stablecoins could reach $2 trillion within two years under a bullish adoption scenario.

If those trajectories materialize, RLUSD reaching the top three will not only be about stealing market share from incumbents but also about riding a rising tide.

Institutional plumbing over retail hype

While the Binance listing provides the liquidity spark, Ripple’s best case for the top three relies on institutional plumbing.

Over the past two years, Ripple has assembled a stack that resembles that of a payments and capital markets infrastructure provider more than that of a typical crypto issuer.

The foundation of any potential growth is a regulatory posture that has resulted in RLUSD being issued under a New York DFS Limited Purpose Trust Company Charter. At the same time, Ripple has received conditional approval for an OCC charter.

This dual layer of state and federal oversight sets a bar for transparency and compliance that few other issuers can claim.

For corporate treasurers and bank compliance officers, this regulatory perimeter often matters more than brand recognition.

Perhaps the most direct catalyst for sticky institutional adoption is that Ripple has quietly positioned itself at the center of the global payment network as a platform that settles, secures, and moves digital money.

Last year, Ripple had a $4 billion acquisition spree that included the purchase of prime broker Hidden Road, custody firm Palisade, treasury-management platform GTreasury, and stablecoin payments provider Rail.

These firms form the foundation of a vertically integrated enterprise spanning trading, custody, payments, and liquidity management.

This move essentially expands RLUSD’s growth runway beyond crypto exchange wallets. It moves the asset into multi-asset margin and financing workflows where stablecoin balances can scale rapidly.

A stress test

The risk remains that while trading volume can be manufactured, adoption cannot.

Binance’s own spot market has cooled recently, with CoinDesk Data reporting spot volume fell to $367 billion in December 2025, the lowest since September 2024.

Yet even at these reduced levels, Binance remains large enough that a fee subsidy can reshape liquidity routing.

So, the ultimate danger in this move is that RLUSD could become a “cheap rail” but not a “held asset.”

If trading volume explodes but circulating supply barely grows, the market will have its answer: Binance can create liquidity, but not necessarily durable adoption.

For RLUSD to credibly challenge for the top three, the story must evolve from “listed and traded” to “used and held.”

The post Ripple’s RLUSD just got Binance’s strongest growth lever, can that catapult it into a top 3 asset? appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Ripple is expanding its reach as RLUSD stablecoin is officially listed on Binance.

Ripple is expanding its reach as RLUSD stablecoin is officially listed on Binance.![Story [IP] price prediction - Is a move towards $4 next for the altcoin?](https://ambcrypto.com/wp-content/uploads/2026/01/Kelvin-2026-01-21T170912.629.webp) IP's price action may be set to go in an interesting direction soon.

IP's price action may be set to go in an interesting direction soon. https://beincrypto.com/feed/

BitGo has officially opened the crypto IPO calendar for 2026, with a debut on the New York Stock Exchange (NYSE) as one of the year’s first major digital asset listings.

It signals a renewed, though selective, return of institutional appetite for the sector.

BitGo Opens Crypto’s 2026 IPO Window with a Custody-First Bet

The Palo Alto–based digital asset infrastructure firm priced its initial public offering at $18 per share. This is above the marketed range of $15 to $17, implying a valuation of roughly $2.1 billion.

The above-range pricing is a notable signal in a still-cautious market environment. Trading begins on January 22 under the ticker BTGO, following pricing a day earlier.

The offering raised approximately $213 million, with a mix of primary shares issued by the company and secondary shares sold by existing shareholders.

Unlike previous crypto listings dominated by trading platforms and retail-driven volatility, BitGo’s pitch to public market investors is centered on custody, compliance, and infrastructure.

Founded in 2013, the company operates as a qualified custodian serving institutional clients. It offers services that span digital asset custody, wallets, lending, staking, liquidity, and infrastructure-as-a-service for stablecoins and crypto applications.

As of September 30, 2025, BitGo reported serving more than 4,900 clients and 1.1 million users across over 100 countries. It also reported supporting more than 1,550 digital assets and managing roughly $104 billion in assets on the platform.

Its client base includes financial institutions, corporations, technology platforms, government agencies, and high-net-worth individuals. This is an audience increasingly prioritizing security, regulatory clarity, and balance-sheet resilience.

That positioning appears well aligned with current market forces. After a turbulent 2024 and uneven recovery in 2025, investors have gravitated toward what analysts describe as a “flight to quality” within crypto. This means favoring regulated, revenue-diversified firms over speculative trading-led models.

BitGo’s IPO was led by Goldman Sachs and Citigroup, alongside a broad syndicate of global banks, suggesting institutional backing.

Why BitGo’s IPO Is Being Read as a Test for Crypto’s Next Public-Market Cycle

Financially, BitGo’s topline figures require careful interpretation. While the company reported billions in gross revenue driven by transaction volumes, net revenue after costs is far slimmer.

This is a common accounting feature among crypto infrastructure firms. Still, investors have pointed to encouraging trends beneath the surface. This includes 56% year-on-year growth in subscriptions and services revenue, which rose to $120.7 million last year.

The IPO also comes amid broader expectations of a gradual reopening of public markets in 2026, particularly for fintech and crypto-adjacent companies.

Firms such as Kraken, Revolut, and others are widely seen as potential candidates should market conditions stabilize. In that context, BitGo’s successful debut may serve as an early litmus test for how much risk equity investors are willing to absorb, and under what terms.

Elsewhere, venture firm Pantera Capital predicts 2026 as the biggest crypto IPO year ever. This forecast is based on 2025 already setting a strong foundation with significant momentum in public markets.

That traction validated crypto businesses, with the VC citing several accelerating factors pointing to even greater scale in 2026.

The post BitGo Prices IPO at $18 Per Share In NYSE Debut as First Major Crypto Listing of 2026 appeared first on BeInCrypto.

Cardano is trying to stabilize after a rough stretch. ADA is up about 1.8% over the past 24 hours, but the broader picture remains weak. The token is still down nearly 9% over the past seven days, and the Cardano price continues to trade below key short-term trend levels.

At first glance, the move looks like a simple bearish continuation. But when participation, holder behavior, and derivatives positioning are viewed together, the story becomes less straightforward. The sell-off may have a more layered story to tell.

Cardano Loses Its Trend as Spot Interest Collapses

The weakness started with participation, not just price.

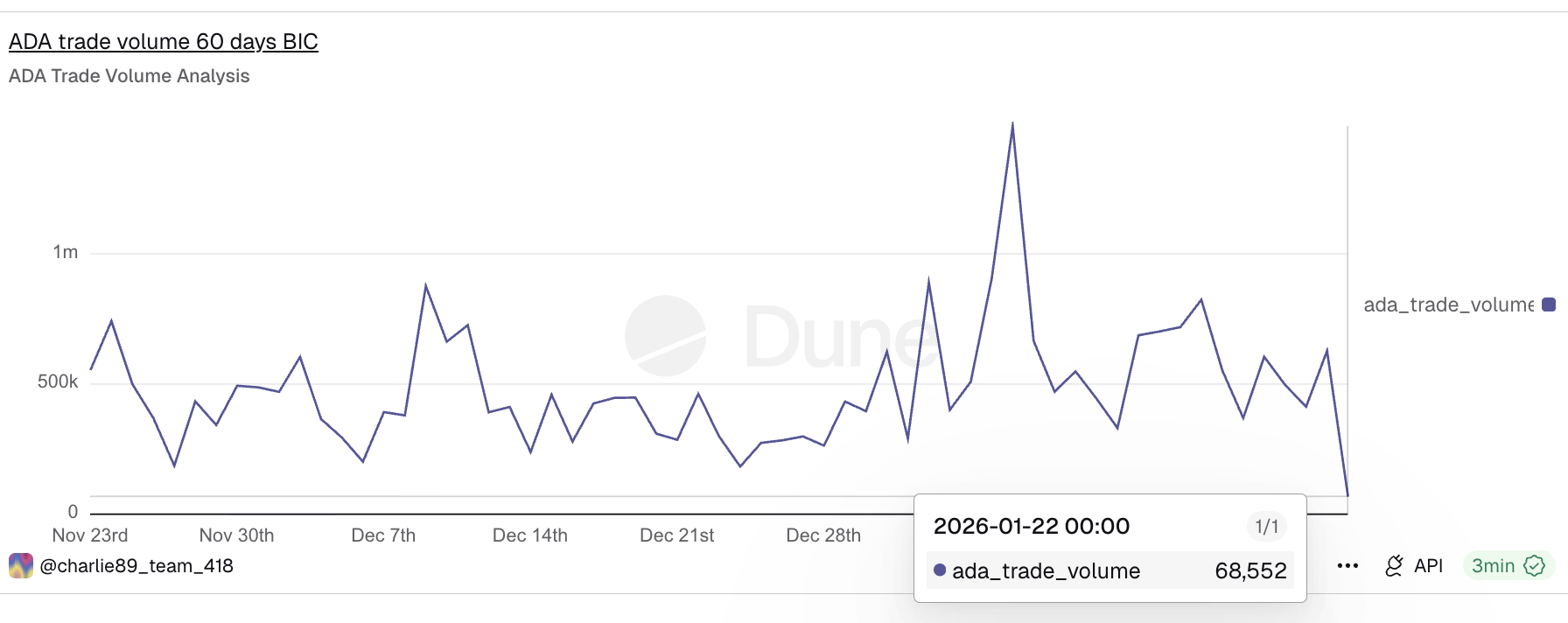

On January 6, Cardano’s spot trading volume on decentralized exchanges peaked near $1.49 million as identified by BeInCrypto analysts. That same day, ADA also printed its highest price of 2026 so far. From that point, both price and activity rolled over together.

By January 22, spot trading volume had collapsed to roughly $68,552 (still incomplete), a drop of more than 95% in just over two weeks. This data reflects spot trades only, meaning real buying and selling (swaps), not leveraged bets. When spot volume falls this sharply, it usually signals that retail participation has stepped away.

Note: DEX spot volume reflects organic token demand, as trades are settled on-chain primarily without leverage, forced liquidations, or market-maker buffering.

That drop in activity lined up cleanly with a technical shift.

Cardano lost its 20-day exponential moving average (EMA) in mid-January. An EMA gives more weight to recent prices and is often used to track short-term trend direction. Losing it typically signals that momentum has shifted from buyers to sellers.

This pattern has mattered for ADA before.

In early October, losing the 20-day EMA preceded a 55% decline into December. A similar loss between December 11 and December 31 led to a 25% correction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This time, once ADA fell below the 20-day EMA, spot participation did not stabilize. It worsened. With fewer spot buyers stepping in, the price slid more easily, setting the stage for aggressive bearish positioning.

That is where the second layer of the story begins.

Whales Add Into Weakness as Shorts Crowd the Market

While spot traders were exiting, large holders were not.

Addresses holding more than 1 billion ADA began accumulating around January 14, even as Cardano’s price continued to slide. This cohort increased its combined holdings from 1.92 billion ADA to 2.93 billion ADA, adding roughly 1.01 billion ADA during the correction. At current prices, that translates to approximately $360–$380 million accumulated while price momentum was still negative. Most importantly, they keep holding the stash despite breakdown (s).

A second whale group followed shortly after. Wallets holding between 10 million and 100 million ADA started adding on January 17, the same day Cardano fully lost its 20-day exponential moving average (EMA). Their holdings rose from 13.61 billion ADA to 13.64 billion ADA, an addition of roughly 30 million ADA, or about $11 million at current prices.

The timing matters. These whales were not buying into strength. Both groups stepped in after the trend break, after the spot interest collapsed, and after the bearish structure became obvious. That behavior suggests positioning during visible weakness, not momentum chasing.

Meanwhile, derivatives traders moved the other way.

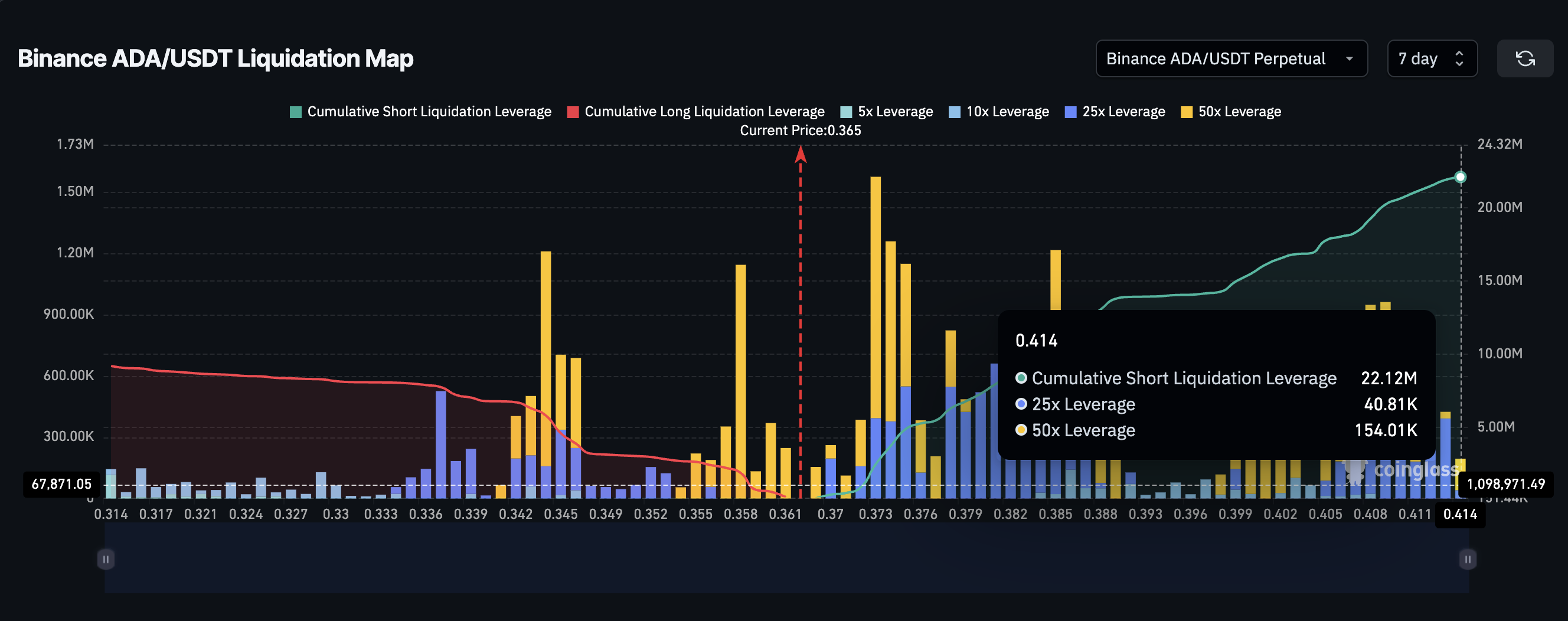

The loss of trend support and collapsing spot volume made the bearish case look clear. Short positions piled in across perpetual futures, $22.12 million in short leverage. On Binance, ADA is now heavily short-biased, with short liquidation exposure roughly 2.5 times larger than long exposure.

This imbalance matters.

When spot traders leave and shorts crowd in, the price can move sharply even on modest buying. Whales accumulating during that phase are often positioning for either a quick trend reclaim or a forced move higher driven by liquidations.

That brings the focus to structure and levels.

Cardano Price Levels That Decide Whether Bears Get Trapped

On the 12-hour chart, Cardano did break down from a head-and-shoulders structure around January 20. That breakdown likely triggered the final wave of spot selling and encouraged the surge in short positions.

But momentum is no longer confirming continued downside.

The Money Flow Index (MFI) has started rising while the price holds near recent lows. MFI tracks buying and selling pressure using both price and volume. When it rises as price stabilizes, it often signals dip buying rather than panic selling. That could mean the return of spot buyers as MFI breaks above the descending trendline, leaving only short positions at risk.

Short liquidation pressure begins building near $0.37. A move above that level would start forcing short positions to close. Above $0.39, liquidation pressure increases meaningfully. A push toward $0.42 would place most near-term short exposure at risk.

The bearish case regains full control only if ADA breaks and holds below $0.34. A sustained move under that level would invalidate the stabilization thesis and reopen downside risk toward prior lows.

Until then, Cardano remains caught between fading retail participation and growing whale conviction. Spot traders may have stepped away, but the positioning underneath suggests the move may not be finished yet.

The post Cardano’s Spot Market Just Collapsed 95% — Here’s Why Whales Bought The Breakdown appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Data shows the Bitcoin market sentiment has seen a sharp turnaround recently as the Fear & Greed Index has swung to extreme fear.

Bitcoin Fear & Greed Index Is Back In Extreme Fear Zone

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the average sentiment present among traders in the Bitcoin and wider cryptocurrency markets.

The index uses the data of the following five factors to determine the investor mentality: market cap dominance, trading volume, volatility, Google Trends, and social media sentiment. To represent the sentiment, it uses a numerical scale running from zero to hundred.

When the value of the Fear & Greed Index is greater than 53, it means a sentiment of greed is shared by the majority of traders. On the other hand, the indicator being below 47 implies the dominance of fear. All values lying between these two cutoffs correspond to a net neutral mentality.

Besides these three core regions, there are also two ‘extreme’ zones, known as the extreme fear (occurring at 25 and under) and extreme greed (above 75). At present, the market sentiment is in one of these zones, as the Fear & Greed Index’s latest value suggests.

As displayed above, the Bitcoin market sentiment is just inside the extreme fear territory right now, with the Fear & Greed Index sitting at 24. This level of despair among traders is a new development, as just earlier mood was much better.

On January 15th, the index had a value of 61, putting the sentiment of the average investor firmly inside the greed territory. Only six days later, the situation has completely flipped.

The reason behind this shift lies in the bearish price action that the cryptocurrency has faced since US President Donald Trump announced tariffs on several European countries over Greenland.

The earlier greed sentiment also came after trader mentality saw a sharp swing. In fact, the shift was even faster back then, as the Fear & Greed Index went from a near-extreme fear level of 26 to the greedy value of 61 over just two days as Bitcoin witnessed a price surge beyond $97,000.

The latest drop back into the extreme zone may not entirely be a negative development for the cryptocurrency, though, if history is anything to refer to. Often, digital asset markets have tended to move in the direction that goes contrary to the expectations of the majority.

Since extreme fear is where a bearish mentality is the strongest, bottoms can be likely to occur in the zone. Similarly, extreme greed can lead to tops instead. With the sentiment currently in the former zone, it now remains to be seen how long it will take for Bitcoin to find back its footing.

BTC Price

Bitcoin dropped under $88,000 earlier in the day, but the coin has since bounced back to $90,200.

Bitcoin has slipped below the $90,000 level as markets react to rising macroeconomic tension between the United States and the European Union, with fresh concerns tied to geopolitical friction around Greenland. The renewed risk-off tone pressured equities and crypto alike, reinforcing Bitcoin’s sensitivity to global headlines when uncertainty spikes and investors reduce exposure across high-beta assets.

Beyond price action, on-chain data suggests a deeper shift is taking place inside the Bitcoin market. A report by analyst MorenoDV highlights that, for the first time in history, “new whales” now account for a larger share of Bitcoin’s Realized Cap than long-term “OG” whales. Realized Cap tracks the aggregate cost basis of coins based on their last on-chain movement, meaning this change signals that a substantial portion of BTC supply has recently changed hands at higher prices.

This transfer of influence matters because it reshapes short-term supply dynamics. When newer large holders dominate realized capital, market behavior can become more reactive, with marginal supply increasingly controlled by investors who entered later in the cycle and may be more sensitive to volatility. As Bitcoin battles to reclaim $90,000, this evolving whale structure may help explain why rebounds feel less stable and why selling pressure can reappear quickly during macro-driven pullbacks.

New Whales Now Dictate Bitcoin’s Short-Term Direction

Realized Cap measures Bitcoin’s aggregate cost basis by valuing coins at the price of their last on-chain movement. When this metric shifts toward new whales—short-term holder whales holding more than 1,000 BTC with UTXO age below 155 days—it signals that a meaningful share of supply has recently changed hands at elevated prices. In other words, market control is moving away from experienced, cycle-tested holders and toward capital that arrived late in the trend.

This transition helps explain Bitcoin’s current behavior. The realized price of new whales sits near $98,000, while spot price continues trading below that level. As a result, this cohort is estimated to be carrying roughly $6 billion in unrealized losses. These losses are not just paper drawdowns—they shape decision-making and increase sensitivity to volatility, especially during sharp corrections.

On-chain realized PnL data suggests that since the market peak, new whales have driven the bulk of realized losses. During the recent drawdown, they repeatedly sold into weakness and used brief rebounds to exit positions. Reflecting risk management rather than conviction.

Old whales tell the opposite story. With a realized price around $40,000, long-term whales remain deeply profitable. Their activity has been limited relative to the flows coming from new whales. For now, Bitcoin’s direction is being dictated by this newer, more fragile whale cohort.

Bitcoin Breaks Below Key Support

Bitcoin is showing renewed weakness after losing the $90,000 psychological level, with price now trading near $88,300 on the daily chart. The structure reflects a clear downtrend from the late-2025 highs, followed by a failed attempt to recover. After a sharp drop in November, BTC stabilized and built a short consolidation base, but the rebound into early January lacked follow-through and quickly turned into another rejection.

From a technical perspective, BTC remains trapped below its major moving averages, which are now acting as dynamic resistance. The shorter-term average has rolled over sharply, while the broader trend line above continues to slope downward. Signaling that momentum remains capped, and sellers are still in control on rallies. The recent bounce toward the mid-$90K region was rejected aggressively, confirming that overhead supply remains heavy and buyers are not yet strong enough to flip the trend.

Volume patterns support this narrative. The biggest spikes occurred during the selloff leg, showing forced activity and distribution. While the most recent recovery attempts have been met with weaker participation. As long as Bitcoin stays below the $90K–$92K zone, price action suggests the market is still searching for a stable bottom. The downside risk remains elevated if fear accelerates across the broader crypto market.

Featured image from ChatGPT, chart from TradingView.com