Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Trump hasn’t confirmed who he will have replace Fed Chair Jerome Powell with next year, but two recent hints, taken together, point to his crypto-friendly adviser.

Kevin O’Leary said he is not positioning his investments around expectations that the US Federal Reserve will cut rates in December.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Tokenization's potential to revolutionize financial systems could reshape market dynamics and investment strategies, impacting global asset management.

The post BlackRock CEO Larry Fink, Brian Armstrong to discuss tokenization at DealBook Summit appeared first on Crypto Briefing.

The surge in Bitcoin ETF trading volume underscores growing institutional adoption, potentially stabilizing and legitimizing the crypto market.

The post Bitcoin ETF trading volume hits $5.6B today appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Bitcoin has fallen back below the $90,000 level after another wave of selling pressure and leveraged long liquidations, signaling that the market remains firmly on the defensive. Each attempt to stabilize has failed, with sellers quickly overwhelming buyers and forcing price into lower ranges. Fear and uncertainty continue to dominate sentiment, and traders increasingly prepare for the possibility of a deeper continuation of the downtrend as volatility accelerates.

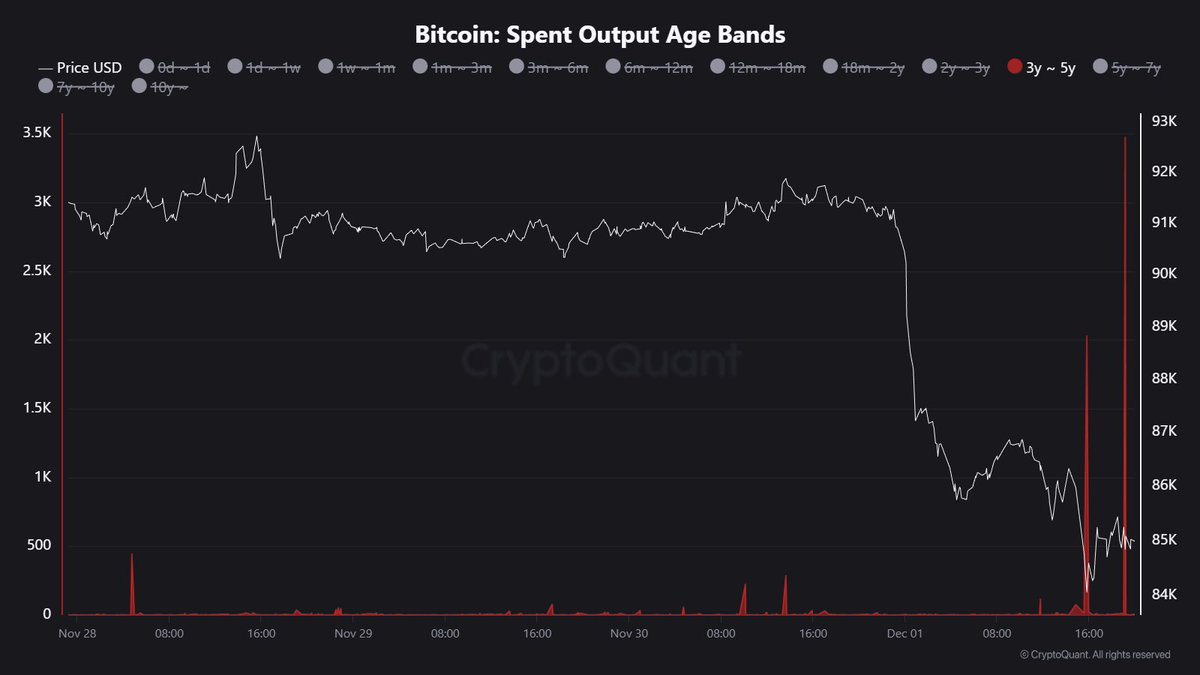

Amid this weakness, a new signal has started to attract the attention of analysts. According to Maartunn, one of the market’s most respected on-chain researchers, old coins are waking up again. Dormant Bitcoin—specifically coins held for 3 to 5 years—has begun to move on-chain in noticeable spikes. Historically, this type of activity often reflects structural shifts in holder behavior, appearing during periods of stress, capitulation, or preparation for major market pivots.

While the direction of these moves is not always immediately clear, rising activity among long-dormant coins adds another layer of complexity to an already fragile market. As Bitcoin continues to struggle below $90K, the behavior of these older coins could help determine whether the current decline deepens—or sets the stage for a larger transition ahead.

Old Coins Start Moving as Macro Fear Collides With Policy Shifts

Maartunn highlights a notable rise in activity from 3–5 year-old Bitcoin, a cohort that typically remains dormant unless underlying conditions begin to shift. The Spent Output Age Bands show a sharp increase, jumping from 2,030 BTC earlier today to 3,475 BTC now. These spikes rarely happen randomly. Maartunn believes that “something’s stirring beneath the surface,” suggesting that long-term holders may be reacting to mounting market stress—or positioning ahead of a potential macro inflection.

This awakening of older coins comes at a moment filled with conflicting signals. Fear around Tether’s reserves has resurfaced, sparking concerns over liquidity stability across exchanges. At the same time, renewed headlines about a supposed China Bitcoin ban have circulated again, despite offering no new policy information. These narratives have added yet another layer of anxiety to an already fragile market.

Yet the macro backdrop also contains reasons for cautious optimism. The Federal Reserve is expected to bring its quantitative tightening (QT) program to an end, and markets are increasingly pricing in a potential interest rate cut this December. Such shifts historically improve liquidity conditions and support risk assets.

As long-term coins begin to move and macro forces pull in opposite directions, Bitcoin enters a complex environment—one that could precede either deeper volatility or the early stages of a larger transition.

Bitcoin Struggles to Recover as Daily Trend Remains Firmly Bearish

Bitcoin’s 1-day chart continues to reveal a market trapped in a strong downtrend, with price failing to reclaim the key moving averages that define higher-timeframe momentum. After breaking down from the $115,000 region, BTC plunged directly through the 50 SMA, 100 SMA, and 200 SMA, creating a steep momentum shift that sellers still control.

The current price action around $86,000–$88,000 shows hesitation and a lack of follow-through from bulls, even after several attempts to rebound.

The 50 and 100 SMAs both slope sharply downward, confirming a bearish trend structure. Meanwhile, the 200 SMA has flattened and now sits far above price, highlighting just how aggressive and extended the selloff has been. BTC continues to print lower highs and lower lows, a clear signal that the market has not yet found a stable bottom.

Volume spikes on major red candles suggest a mix of forced liquidations and panic-driven exits, while green candles remain smaller and less convincing. The lack of strong buy volume shows that investors remain cautious despite the magnitude of the correction.

If Bitcoin fails to break back above $92,000–$95,000, the market risks another leg lower. The next major supports sit between $80,000 and $78,000, levels that align with previous consolidation zones. For now, the bears still control the daily trend.

Featured image from ChatGPT, chart from TradingView.com

Kalshi has taken a major step in restructuring how prediction markets operate by moving its event contracts onto the Solana blockchain.

The transition brings U.S.-regulated prediction markets directly into decentralized finance, positioning the platform to compete more closely with its on-chain rival, Polymarket, while targeting deeper liquidity and broader user access.

Prediction Contracts Move On-Chain

Kalshi’s event markets now operate as Solana-based SPL tokens rather than entries on a centralized exchange. Through an integration with Solana protocols DFlow and Jupiter, users can trade “yes” and “no” positions via crypto wallets, tap automated liquidity, and settle outcomes through on-chain logic.

The shift enables contracts to be traded, borrowed, lent, or used as collateral within DeFi systems. Kalshi is supporting developer participation with a $2 million grants program and a new Builder Codes system that rewards teams for driving trading volume through custom applications.

Executives describe tokenization as the platform’s long-term strategy, arguing that on-chain access offers speed, transparency, and programmability while preserving Kalshi’s CFTC-regulated framework. The hybrid model links decentralized liquidity with an off-chain matching engine.

Will the Move Capture Liquidity and Challenge Polymarket?

Prediction-market activity has surged in 2025, with sector-wide volume nearing $28 billion by late October. November saw Kalshi record $5.8 billion in trading, while Polymarket handled $3.7 billion following rulings that reopened U.S. access.

Liqudity has become the core competitive factor. By issuing markets as standard Solana tokens, Kalshi expects automated market makers, trading bots, and cross-protocol liquidity systems to tighten spreads and improve pricing accuracy.

Enhanced privacy is another draw, with tokenized markets offering wallet-based trading rather than identity-verified accounts. Industry analysts note that the move puts Kalshi in direct competition with Polymarket’s fully on-chain model.

Solana Expands Multi-Chain Prediction EconomyKalshi believes Solana is the first step toward a broader on-chain architecture. The company plans to add EVM-compatible networks and deeper integrations with DeFi protocols to build a multi-chain forecasting ecosystem.

Additional partnerships, including earlier collaborations with Zero Hash and stablecoin custody support from Coinbase, reflect an effort to streamline global accessibility.

With its valuation recently rising to $11 billion after a major funding round, the company is signaling confidence that tokenized prediction markets will become a standard format for forecasting and derivatives tied to real-world events.

As prediction markets evolve toward decentralized models, Kalshi’s Solana rollout marks a turning point in how regulated platforms interact with crypto liquidity and sets the stage for intensified competition across the sector.

Cover image from ChatGPT, SOLUSD chart from Tradingview

https://cryptoslate.com/feed/

Bitcoin was launched fifteen years ago. The industry has ballooned into a nearly $4 trillion ecosystem, yet Satoshi’s vision of everyday payments remains largely unfulfilled. The hope for peer-to-peer payments has shifted to stablecoins. But rather than replacing banks, stablecoins risk becoming bank-like infrastructure. Stronger regulation in the U.S. and Europe may push them toward centralized rails rather than open money.

Regulation turning stablecoins into regulated payment networks

In America, the GENIUS Act established a federal framework for payments with stablecoins—who can issue them, how to back them up, and how they’re regulated. In Europe, MiCA regulation (Markets in Crypto-Assets) became applicable in 2024 and set strict requirements for stablecoins under categories like “e-money tokens” and “asset-referenced tokens.”

These regulations foster legitimacy and safety, but at the same time push stablecoin issuers into the world of banks. When issuers need to comply with reserve, audit, KYC, and redemption requirements, the structure and essence of stablecoins shift. They become centralized gateways rather than peer-to-peer money. Over 60% of corporate stablecoin usage is cross-border settlement, not consumer payments. Stablecoins are becoming more institutional tools and fewer tokens for individuals.

The danger: becoming the next SWIFT

What does it mean to “become the next SWIFT”? It means evolving into the go-to rail for institutions; efficient yet opaque, centralized yet indispensable. SWIFT transformed global banking by enabling messaging between banks; it did not democratize banking access. If stablecoins mirror that evolution, they’ll deliver faster rails for existing players rather than empowering the unbanked.

Crypto’s promise was programmable money—cash that moves with logic, autonomy, and user control. But when transactions require issuer permission, compliance tagging, and monitored addresses, the architecture changes. The network becomes compliant infrastructure, not money. That subtle but profound shift may make stablecoins less radical and more reactionary.

A better path to open rails with compliance baked in

The challenge is not regulation; it’s design. To uphold the promise of stablecoins while adhering to regulatory demands, developers and policymakers should embed compliance in the protocol layer, maintain composability across jurisdictions, and preserve non-custodial access. Back in the real world, initiatives like the Blockchain Payments Consortium provide a glimpse of hope that standardizing cross-chain payments is possible without sacrificing openness.

Stablecoins must work for individuals, not just institutions. If they serve only large players and regulated flows, they won’t disrupt—they’ll conform. The design must allow true peer-to-peer movement, selective privacy, and interoperability. Otherwise, the rails will lock us into old hierarchies, just faster.

Stablecoins still hold the potential to rewrite money. But if we allow them to become institutionalized rails built for banks rather than people, we will have replaced one central system with another. The question isn’t whether we regulate—stablecoins will be regulated. It’s whether we design for inclusion and autonomy, or lock in yesterday’s system behind digital wrappers. The future of money depends on which path we choose.

The following is a guest post and opinion from Joël Valenzuela, Director of Marketing and Business Development at Dash.

The post Stablecoins were built to replace banks but on course to becoming one appeared first on CryptoSlate.

XRP spot ETFs have posted one of the most consistent inflow streaks of this quarter, attracting roughly $756 million across eleven consecutive trading sessions since their Nov. 13 launch.

Yet the strength in the ETF demand contrasts with XRP’s price performance.

According to CryptoSlate’s data, the token has fallen about 20% over the same period and currently trades near $2.03.

This divergence has prompted CryptoSlate to examine how XRP’s ownership structure is shifting beneath the surface.

The strong ETF inflows alongside falling prices point to a market absorbing two opposing forces of steady institutional allocation on one side and a broader risk reduction on the other.

Essentially, this pattern reflects a more complex process in which new, regulated demand is entering the ecosystem as existing holders adjust their exposure.

XRP dominates crypto ETFs flow

The inflow profile of XRP products is statistically remarkable, particularly against a backdrop of net redemptions elsewhere.

During the reporting period, Bitcoin ETFs saw over $2 billion in outflows, and Ethereum products recorded nearly $1 billion in withdrawals.

Even high-flying competitors like Solana have managed only about $200 million in cumulative inflows. At the same time, other altcoin ETFs have drawn smaller totals, with Dogecoin, Litecoin, and Hedera products each holding between $2 million and $10 million.

In this context, XRP stands alone for its consistent accumulation, with the four products now holding about 0.6% of the token’s total market capitalization.

Considering this, market participants attribute the demand to the ETF’s operational efficiency. The four XRP funds offer institutional allocators a compliant, low-friction path into the asset, bypassing the custody headaches and exchange risks associated with direct token handling.

However, the fact that these inflows have not translated into upward price pressure suggests that other market segments may be reducing exposure or managing risk amid elevated macro and crypto-specific uncertainty.

This phenomenon is not unprecedented in crypto, but the scale here is distinct.

The selling pressure is likely originating from a combination of early adopters cashing out after years of volatility and potential treasury movements. The ETF boom has essentially created a liquidity bridge, allowing large-scale entities to offload positions without crashing the order book instantly.

Consolidation or centralization risk?

Meanwhile, the ownership data below the surface reinforces the view that the asset is undergoing a radical centralization.

Data from blockchain analysis firm Santiment indicates that the number of “whale” and “shark” wallets holding at least 100 million XRP has plummeted by 20.6% over the past eight weeks.

This pattern of fewer large wallets with more combined assets can be interpreted in different ways.

Some market observers have framed this as “consolidation,” arguing that supply is moving into “stronger hands.”

However, a risk-adjusted view suggests rising centralization risk.

With nearly half of the available supply concentrated in a shrinking cohort of entities, the market’s liquidity profile is becoming increasingly fragile.

This centralization of supply means that future price action is heavily dependent on the decisions of fewer than a few dozen entities. If this group decides to distribute, the resulting liquidity shock could be severe.

Simultaneously, spot exchange balances are thinning as tokens move into the regulated custody solutions required by ETF issuers.

While this theoretically reduces the “float” available for retail trading, it hasn’t triggered a supply shock. Instead, the transfer from exchange to custodian appears to be a one-way street for now, soaking up circulating supply sold by the shrinking whale cohort.

The benchmark race

The inflow streak has renewed discussion about which asset could emerge as the benchmark altcoin for institutional portfolios.

Historically, regulated crypto exposure has centered almost exclusively on Bitcoin and Ethereum, with other assets attracting minimal attention. XRP’s recent flow profile, which has significantly exceeded the cumulative inflows of other altcoin ETFs, has temporarily shifted that dynamic.

Part of the interest stems from developments around Ripple. The firm’s licensing expansion in Singapore and the significant adoption of RLUSD, its dollar-backed stablecoin, give institutions a broader ecosystem to evaluate.

At the same time, Ripple’s acquisitions across custody, brokerage, and treasury management have created a vertically integrated framework that resembles components of traditional financial infrastructure, offering a foundation for regulated participation.

Still, analysts caution that a short inflow streak does not establish a new long-term benchmark.

XRP will need to sustain demand across multiple market phases to maintain its position relative to peers such as Solana, which has gained attention for its growing tokenization activity, and to assets that may attract larger flows once new ETFs launch.

For now, XRP’s performance within the ETF complex reflects early momentum rather than structural dominance.

The flows highlight genuine institutional interest, but the asset’s price behavior reflects the broader challenges large-cap cryptocurrencies face amid macroeconomic uncertainty.

The post How XRP became the top crypto ETF trade despite price slides toward $2 appeared first on CryptoSlate.

https://ambcrypto.com/feed/

![Monero [XMR] faces first real test since November breakout: What's next?](https://ambcrypto.com/wp-content/uploads/2025/12/Monero-Featured.webp) XMR's technical indicators showed steady buying pressure, justifying bullish expectations.

XMR's technical indicators showed steady buying pressure, justifying bullish expectations. XRP wallets with 100 million token shrink but their holdings hit a 7 year high of 48 billion tokens.

XRP wallets with 100 million token shrink but their holdings hit a 7 year high of 48 billion tokens.https://beincrypto.com/feed/

Shares of American Bitcoin Corp., the mining company tied to the family of US President Donald Trump, experienced a sharp decline on Tuesday, despite a broader recovery in the cryptocurrency market.

The company faces continued challenges following a significant decrease in stock value over recent months.

American Bitcoin Corp. Faces Losses

As crypto markets rejoiced amid Bitcoin’s recent price recovery, American Bitcoin Corp. continued to see its shares slide.

Google Finance reports that the Bitcoin mining company’s stock has dropped 37% in the last 24 hours, priced at $2.22 at the time of writing. Over the past six months, this decline has reached almost 60%.

The mining venture’s poor performance recently isn’t good news for the Trump family. The creation of American Bitcoin Corp. occurred a couple of months after Trump assumed office, as a spin-off from Hut 8 Corp.

Under the arrangement, Hut 8 supplied the majority of the mining infrastructure and retained an 80% stake in the project. At the same time, American Bitcoin Corp. became the platform through which Trump’s sons, Eric and Donald Trump Jr., control approximately 20%.

As a result, the mining company’s poor stock performance is directly tied to its profitability, affecting the Trump family’s financial interests.

What is striking about today’s events is that, despite Bitcoin’s price rebound, the company’s shares saw the opposite effect, continuing their decline.

Bitcoin’s Struggles Continue Despite Price Recovery

Bitcoin’s price has performed poorly over the past two months. Since peaking at $126,000 in October, its price has sharply declined. Less than two weeks ago, it fell to $82,800, the lowest since April.

Bitcoin regained its $90,000 level on Tuesday, improving market sentiment. However, this shift wasn’t enough to lift the stock price of Bitcoin-based companies like American Bitcoin Corp.

The inverted reaction suggests that a short-term price recovery alone may not suffice to improve the company’s performance. Given the broader context of the crypto industry, this conclusion is not surprising.

The uncertainty is compounded by MicroStrategy’s potential decision to sell its Bitcoin holdings if its stock remains below the value of its Bitcoin reserves. This could erode confidence in the asset.

Ethereum has underperformed more than Bitcoin, further indicating market weaknesses.

Key economic factors also fuel the volatility. The Federal Reserve’s stance on interest rates and the Bank of Japan’s monetary policy have particularly added further uncertainty.

The post Why Trump-Backed Mining Company Struggles Despite Bitcoin’s Recovery appeared first on BeInCrypto.

XRP spot ETFs have recorded inflows for 11 consecutive trading days, pushing cumulative inflows to $756.26 million as of December 1, according to SoSoValue data.

The products added another $89.65 million on Monday alone, marking one of their strongest sessions since launch.

Strong Momentum Across All Issuers

The latest inflows lifted total net assets across the four US funds to $723.05 million, equal to 0.60% of XRP’s market capitalization.

The trend places the category within reach of the $1 billion asset milestone, a level analysts view as a key threshold for long-term institutional adoption.

All four XRP ETFs—Canary, Bitwise, Grayscale, and Franklin Templeton—finished the day in positive territory. Their market prices rose between 8.30% and 8.54%, reflecting a broad rebound in XRP after last week’s decline.

Monday’s inflow was led by Franklin’s XRPZ, followed by Grayscale. The consistent demand has also pushed cumulative inflows sharply higher.

Over the past two weeks, the category saw multiple high-volume days, including $243.05 million on November 14 and $164.04 million on November 24.

XRP price also reflected the positive ETF performance. The altcoin rallied nearly 9% today, after dropping to $2 earlier in the week.

$1 Billion Is Now in Sight

At the current pace, analysts expect XRP ETFs to cross $1 billion in assets within days. The category added more than $500 million in the past week alone, reflecting accelerating participation from large buyers.

If inflows remain positive this week, XRP would become one of the fastest-growing altcoin ETF markets launched in 2025. The surge also signals expanding demand for non-Bitcoin digital asset products under the new regulatory framework.

The run of 11 consecutive green days highlights rising appetite for XRP exposures through ETFs. With cumulative inflows nearing the $1 billion level and net assets climbing steadily, the products have quickly become a significant part of XRP’s market structure.

However, continued momentum will depend on broader market conditions and how institutional investors respond to price volatility in the weeks ahead.

The post XRP ETFs Extend 11-Day Inflow Streak as $1 Billion Mark Nears appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

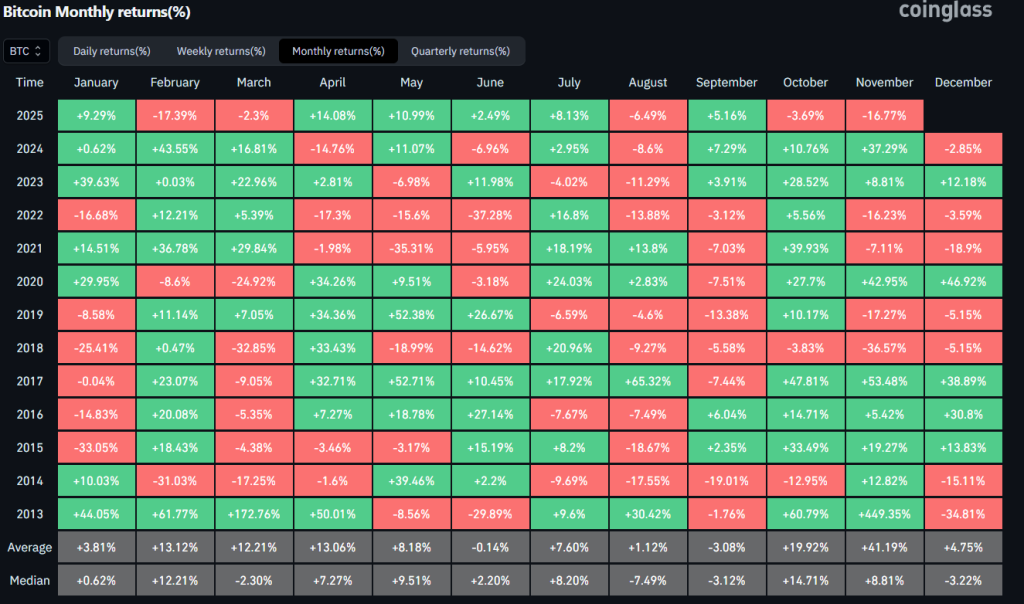

Bitcoin has opened December 2025 on the back foot, and market structure around the new monthly candle is already drawing close scrutiny from traders.

How Will Bitcoin Perform In December?

Sharing a year-to-date chart on X, trader Daan Crypto Trades highlighted a recurring pattern in 2025: Bitcoin often sets its monthly extreme early. “We know by now that the first move does often create the monthly high or low within the first ~12 days,” he wrote. “This happens about 80% of the months.” His chart marks how February’s low, March’s high, April’s low, May’s low, July’s inflection, and the key October and November pivots all occurred within that window, with June and August flagged as exceptions.

December, so far, is conforming in form if not yet in outcome. “Price has taken a quick dive straight from the candle open so far in December, leaving no wick above either,” Daan noted. “This doesn’t make for the strongest high.” That kind of immediate one-sided move, he argues, is often revisited: “Good to watch closely in the 1–2 weeks ahead. Often these instant moves from the open, do end getting retested. October was a good example of that recently.”

Zooming in, Daan’s second chart sets out the key levels. After bottoming near $80,714 on November 21, Bitcoin staged roughly a +15% relief rally into a thick prior support-turned-resistance zone in the low-$93,000s. That first test failed, with price rejected and rolling back over.

“BTC rejecting from the previous support & resistance area,” he wrote. “Not something you want to see as a bull. Price saw a decent +15% relief rally but has lost steam again after a week already.” On that same chart he plots a short-term Fibonacci retracement from the $93,175 local high down to the $80,714 low. The 0.786 retracement level sits around $83,381, close to spot at the time of posting.

“It is early in the week/month,” he added, “and we do often see sharp moves straight from that new monthly candle. These often aren’t the strongest highs/lows set straight at the start of a new month. So good to watch in the days ahead. (You guys also know I love my .786 fib retests so watching closely around this area).”

That leaves a clear tactical map: immediate downside levels around the 0.786 retrace and the prior low, with upside conviction only returning if price can re-enter and reclaim the mid-to-high-$80,000s former support zone.

A separate post from Daan situates this setup within December’s broader historical profile. Sharing a Coinglass table of Bitcoin’s monthly returns from 2013 onward, he described December as “pretty mixed but [one that] has seen some big outliers with a lot of volatility.”

The data support that: past Decembers range from large gains above 30–40% to deep drawdowns exceeding -30%. The average December return sits in modest positive territory (+4.75%), while the median is slightly negative (-3.22%), underscoring that there is no simple “Santa rally” effect; instead, dispersion and volatility dominate.

For Daan, part of that behaviour is structural. “Don’t be surprised if you see some weird flows at the end and start of the year,” he warned. “Generally this is a period where large holders/funds and such rebalance their books. We might also see the effect of tax loss harvesting at some point.” Those portfolio adjustments and tax-driven trades can magnify moves in both directions, particularly in an asset that still trades with pockets of thin liquidity.

His practical takeaway is deliberately conservative: “Good to just be allocated in a way that feels comfortable for you. Whatever the end of 2025 and start of 2026 will bring.”

At press time, BTC traded at $87,323.

Ethereum has fallen below the $2,800 mark after a sharp and sudden decline, deepening panic across the market and reinforcing the sense that bulls have lost control. The recent drop has pushed investors into defensive mode, with some analysts now openly discussing the possibility of a broader bear market emerging. Selling pressure has intensified across spot and derivatives markets, and volatility continues to rise as traders struggle to identify a reliable support zone.

A new CryptoQuant report by Darkfost highlights one of the most alarming developments: Ethereum’s open interest on Binance has been steadily collapsing for more than three months. After reaching an all-time high of $12.6 billion on August 22, open interest has now been cut in half. Nearly $6.4 billion in derivative positions have evaporated, bringing ETH’s open interest down to $6.2 billion, a steep 51% decline.

While this appears to be an extraordinary contraction, Darkfost notes that open interest has only just slipped below the previous all-time high of $7.7 billion. This underscores how speculative and overstretched the 2025 derivatives market had become — and suggests that Ethereum may be undergoing a much deeper structural reset than most expected.

Speculation Unwinds Across Exchanges as Ethereum Enters Deep Reset Phase

Darkfost emphasizes that 2025 has been the most speculative phase in Ethereum’s history, fueled by aggressive leverage, rapid inflows, and a market structure that proved far less solid — and far less sustainable — than it appeared during the rally. The collapse in open interest on Binance is only part of the story.

The same pattern is unfolding across major derivatives platforms, revealing a broader structural unwind rather than an exchange-specific phenomenon.

On Gate.io, ETH open interest has fallen from $5.2 billion to $3.5 billion. On Bybit, the drop is even more severe, plunging from $6.1 billion to $2.3 billion. This synchronized contraction shows how aggressively speculative positions have been flushed out. Meanwhile, the ongoing correction has dragged Ethereum’s price from $4,830 to $2,800, marking a steep 43% decline from the highs.

This widespread reduction in leverage suggests the market is undergoing a deeper reset than typical corrections. Investors are not rushing to re-enter positions, especially as liquidations continue to stack up across exchanges.

While shrinking open interest weighs on short-term momentum and sentiment, Darkfost notes that such aggressive deleveraging may ultimately help rebuild a healthier market foundation — one capable of supporting a durable bottom for ETH.

ETH Loses Key Trend Support as 3-Day Structure Turns Fully Bearish

Ethereum’s 3-day chart shows a decisive breakdown in structure, with price now firmly below the 50 SMA, 100 SMA, and 200 SMA for the first time since late 2024. The rejection from the $3,600–$3,800 region triggered a strong impulse to the downside, sending ETH directly through all major moving averages and confirming a shift toward a higher-timeframe downtrend. The current trading zone around $2,800 reflects a critical test of former support, but momentum remains weak.

The 50 SMA has now crossed below the 100 SMA, while both are beginning to converge downward toward the 200 SMA — a configuration that typically precedes sustained corrections. Volume has increased on red candles, showing that sellers remain dominant, and there is little evidence of aggressive dip-buying. The most recent candle wick toward $2,700 highlights vulnerability rather than strength, suggesting buyers are hesitant to defend this level with conviction.

ETH is also forming a series of lower highs and lower lows, further confirming bearish market structure. If $2,750 breaks cleanly, the next significant liquidity zones sit near $2,550 and $2,300, where prior consolidations developed earlier in the cycle.

Featured image from ChatGPT, chart from TradingView.com