Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Bitcoin fudged the breakout to $93,000 as global TradFi markets stumbled and BTC spot investors failed to provide the necessary volume.

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Institutional interest in Solana ETFs suggests a shift in crypto investment trends, potentially impacting Bitcoin's dominance in the market.

The post Cantor Fitzgerald reveals 58,000 share position in Volatility Shares Solana ETF appeared first on Crypto Briefing.

Vanguard will open its platform to crypto ETFs and funds, offering more than 50 million clients access to Bitcoin, Ether, XRP, and Solana.

The post Vanguard will open trading access to crypto ETFs and funds starting tomorrow appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Reports have disclosed that centralized crypto lending climbed to roughly $25 billion in outstanding loans in the third quarter, a figure that signals renewed activity among centralized platforms. Activity has picked up this year, and some firms that survived the recent shake-out are growing their loan books again.

CeFi Surges

According to Galaxy Research, the broader crypto lending market totaled about $36.5 billion as of Q4 2024, down from a high of $64.4 billion in Q4 2021. That drop reflects the fallout from earlier platform failures and bankruptcies that cut into both supply and demand.

The makeup of the market has shifted. Based on reports, the largest centralized lenders — including Tether, Galaxy and Ledn — now account for a large share of CeFi loans. Those three together held close to $10 billion of CeFi outstanding loans, equal to roughly 88.6% of that segment by the end of last year. Tether alone represented the biggest single slice.

DeFi Borrowing Sees A Strong Comeback

DeFi borrowing has recovered sharply from the lows of the 2022–2023 downturn. Open borrows on decentralized platforms climbed from about $1.8 billion in the trough to $19 billion by the end of 2024, an increase of 959% over the period. This shows many users moved back to on-chain solutions as centralized options contracted.

Market watchers say the new totals matter because they reveal where activity lives today: more on chain, and concentrated among fewer centralized players. Some lenders appear to be operating with higher collateral levels and clearer reporting than some of the failed firms of past years. That has calmed some investors. Still, the total lending market is far below its 2021 size.

The concentration of CeFi loans in a handful of firms raises questions about single-point stress. If one large lender faces trouble, contagion could spread. Price swings in major cryptocurrencies also leave loans vulnerable to rapid liquidations. Regulators are watching the sector closely, and policy changes could reshape where and how loans are made.

What To Watch NextObservers will be watching quarterly loan books, the pace of on-chain borrowing, and any signals of new capital flowing into lending desks. The market is rebuilding, but it is rebuilding in a changed form — smaller than the peak in 2021 and more split between centralized players and DeFi protocols.

Featured image from Unsplash, chart from TradingView

For most of 2025, the crypto price action felt out of sync with the rest of the risk complex. Equities, gold and even parts of the defense and AI trade found sustained bids, while Bitcoin repeatedly failed to hold breakouts and altcoins bled liquidity.

A widely circulated X post by pseudonymous macro commentator and crypto analyst “plur_daddy” offers one of the most coherent internal diagnoses of what went wrong. His argument is not about a single shock, but about structural supply, fading belief and a new kind of existential risk.

Why Crypto Truly Lagged In 2025

At the core is ownership concentration and the long-awaited six-figure exit ramp. Bitcoin, he argues, “never fully distributed out at lower prices.” Large OG balances accumulated over more than a decade remained tightly held, and 2025 finally offered them both price and liquidity. With spot ETFs, deep derivatives markets and institutional counterparties in place, there was “heavy liquidity available for exiting large bags at the mythical $100k price target,” in line with the long-running meme of “dumping on the suits.”

Around that price region, several narratives converged: the perceived apex of the four-year cycle, a shift in Bitcoin’s image “from being a cypherpunk beacon to a Wall St/Trump family vehicle,” and mounting unease about quantum computing. For holders with essentially their entire net worth in BTC, that mix changed the calculus.

He asks readers to imagine “someone who has massive bags that can’t be sold overnight, with 99.99% of their wealth tied up in a single asset.” Quantum is not cast as an imminent catastrophe, but as a persistent tail risk whose timeline “has been accelerating.” Technical fixes exist, but “they’re all difficult,” and he highlights “the political dysfunction within the Bitcoin dev community.”

Once that worry lodges, he says, “the mind-virus is hard to shake.” With an estimated “$200–250bn+ of OG holdings out there,” it becomes “totally rational to dump a meaningful part of the bag.” In his summary line, “BTC got to a price where the supply overwhelmed the demand in the market.”

The second leg of the underperformance story is narrative. “There wasn’t anything to believe in,” he writes. The meme of financial nihilism may describe reality for some, but “does not captivate the interest of retail buyers.” At the same time, equity markets were selling far more compelling dreams around “AI, quantum, space, drones, nuclear, and defense.”

On the macro-hedge front, “the debasement story for BTC was real but gold simply beat it out.” Bitcoin faced adverse supply dynamics just as gold enjoyed “favorable demand dynamics (Central Bank buying),” weakening BTC’s claim as the superior monetary hedge.

Within crypto itself, there was also a vacuum. In late 2023 and early 2024, the ETFs and then Trump provided powerful, easy-to-grasp narratives. “In 2025,” he argues, “there also wasn’t a narrative around liquidity, or an overarching sense of hope and optimism around what crypto could achieve for the world.”

Liquidity still matters, but in his framing crypto is now “the tip of the spear for liquidity conditions,” a “blow-off valve for excess liquidity.” With conditions “without any doubt” the loosest in 2021 and “meaningfully more loose in 2024 over 2025,” price action simply tracked that tightening.

At the same time, the risk-reward stopped making sense for many participants. BTC “still had a lot of volatility and risk and traded like aids,” he writes, and that was acceptable when the upside was a 3–5x. As people “came to Jesus on the shift in potential upside,” and watched episodes such as the “$10bn seller in July,” they began to question whether trillion-dollar valuations and $500k–$1m BTC really “passed the smell test.”

The internal market structure did the rest. In a “liquidity deprived state,” the game turned increasingly “PvP,” with capital concentrating into sharps who then “offramp the money into other asset classes, helping to fuel them.” Severe altcoin weakness “ultimately became a drag on BTC as well,” because it pushed people to “fully offramp from the crypto ecosystem, instead of taking profits into BTC.”

Looking ahead, his base case is quietly bearish on narratives and quietly constructive on time. Bitcoin “most likely” needs “a period of re-accumulation.” OG selling and quantum awareness will remain overhangs, while “gold and silver are cleaner and simpler bets on debasement.” Liquidity “may improve a lot if Trump successfully takes over the Fed,” but that is “a complex process, and half a year away.”

As of the end of 2025, in his telling, crypto underperformance is not a glitch – it is the logical outcome of who owns the coins, what they fear, and what the rest of the world chose to believe in instead.

At press time, the total crypto market cap stood at $2.91 trillion.

https://cryptoslate.com/feed/

Cardano is entering a very important phase in its development, as its founding institutions are attempting to deliver the core infrastructure that every major blockchain already treats as standard.

On Nov. 27, a new proposal sought community approval to allocate 70 million ADA tokens (worth about $30 million) to onboard tier-one stablecoins, custody providers, cross-chain bridges, pricing oracles, and institutional analytics.

The effort is backed jointly by Input Output, EMURGO, the Cardano Foundation, Intersect, and the Midnight Foundation, an unusually coordinated coalition for a network often criticized for slow alignment and decentralized drift.

The central message behind this collaboration is unmistakable: Cardano wants to enter 2026 with the economic plumbing it has lacked for years.

Why the Cardano pivot matters

The integrations push arrives at a moment when Cardano’s economic base is still relatively shallow.

For context, DefiLlama data shows that the Charles Hoskinson-led network has about $248 million in TVL and roughly $40 million in stablecoins, as well as a limited pool for lending, liquidity provision, and RWA issuance compared with ecosystems that treat these assets as foundational utilities.

In comparison, Ethereum alone carries more than $170 billion in stablecoins, reflecting the scale gap Cardano is trying to close.

So, without deep stablecoin reserves, liquidity pathways, or institutional tooling, Cardano would continue to struggle to generate the network effects that make a blockchain economically relevant.

The network’s fragility came into focus earlier this month when it experienced a brief chain split.

While the disruption was resolved quickly, it intensified scrutiny on Cardano’s operational maturity, particularly its limited real-time analytics, monitoring, and other safeguards expected in institutional-grade environments.

The budget set up for the integration aims to systematize the onboarding of top-tier vendors, including milestones, audits, service-level agreements, and transparent delivery tracking.

So, instead of one-off deals or ad hoc negotiations, supporters say the fund would create a formal, accountable pipeline for onboarding the infrastructure Cardano has historically lacked. Tim Harrison, a director at Input Outputs, said:

“This is the kind of unity and focus that will accelerate growth across DeFi, DePIN and RWA.”

Why these integrations might not be sufficient for Cardano

The integrations push comes after Hoskinson had spoken about what truly limits Cardano’s DeFi growth.

Last month, the Cardano founder acknowledged the network’s DeFi gap but pushed back against the notion that landing USDC, USDT, or other fiat-backed stablecoins would “magically” transform adoption.

According to him:

“No one’s ever made the argument and explained how the existence of one of these larger stablecoins is magically going to make Cardano’s entire DeFi problem go away, make the price go up, massively improve our MAUs, our TVL, and all these other things.”

Instead, he points to a behavioral bottleneck by noting that millions of ADA holders participate in staking and governance, but few make the leap into DeFi. He also added that the network faces coordination and accountability challenges.

Hoskinson argued that this creates a classic chicken-and-egg problem, in which the network’s current low liquidity discourages integrations, and the lack of integrations keeps liquidity low.

Considering this, Hoskinson’s roadmap ties the network DeFi growth to Bitcoin interoperability and the Midnight privacy network. He believes these integrations could channel “billions” in volume into Cardano-native stablecoins and lending protocols if executed well.

That framing matters for the new budget.

If the challenge Cardano is facing is organizational, stemming from fragmented efforts, slow vendor onboarding, and the absence of a structured pathway for stablecoins and custody providers, then a community-mandated integrations program could provide the governance mechanism the ecosystem lacks.

However, even with a coordinated onboarding framework, the budget will only shift outcomes if it ultimately mobilizes passive ADA holders into active liquidity and attracts issuers with market makers willing to support real volume.

The 2026 stress test

Next year will test whether Cardano’s governance and new vendor pipeline can translate its integrations budget into measurable economic growth.

So, if even one major fiat-backed stablecoin arrives with market-maker depth, Cardano’s $40 million stablecoin base could plausibly expand into the low-hundreds-of-millions, a range consistent with early adoption phases on other L1s.

Moreover, Cardano’s $248 million DeFi TVL could reach $500 million if the network secures credible custody and analytics platforms. Notably, this is a level at which lending, RWAs, and liquidity routing begin to compound rather than stall.

Also, bridges, pricing oracles, and institutional wallets remain significant integrations necessary for the network’s growth.

Without them, liquidity will continue to circulate elsewhere. With them, Cardano enters 2026 with the minimum infrastructure required to compete for regulated DeFi pilots, RWA issuance, and BTC–ADA liquidity flows tied to its Bitcoin interoperability roadmap.

The post How Cardano plans to use $30M to bring real liquidity to the network appeared first on CryptoSlate.

Ripple’s RLUSD stablecoin is rapidly expanding on Ethereum rather than the company’s native XRP Ledger (XRPL).

According to CryptoSlate data, RLUSD’s total circulating supply has surged to $1.26 billion within 12 months of its launch. Of this, roughly $1.03 billion, or 82% of the total supply, resides on Ethereum, while the $235 million balance is on XRPL.

These numbers show that the market seems to favor the deep liquidity and composability of the Ethereum Virtual Machine over the more compliance-focused architecture of the XRPL.

Why RLUSD is growing on Ethereum

The primary driver of this disparity is the maturity of the underlying financial stack.

On Ethereum, RLUSD entered an environment where dollar liquidity is already entrenched. Data from DeFiLlama confirms that Ethereum continues to lead all chains in total value locked (TVL) and stablecoin supply, providing a turnkey ecosystem for new assets.

So, any new stablecoin that can plug into major DeFi protocols like Aave, Curve, and Uniswap immediately benefits from existing routing engines, collateral frameworks, and risk models.

RLUSD’s presence on Aave and Curve confirms this. The USDC/RLUSD pool on Curve now holds approximately $74 million in liquidity, ranking it among the larger stablecoin pools on the platform.

For institutional treasuries, market makers, and arbitrage desks, this depth is non-negotiable. It ensures low-slippage execution for trades in the tens of millions, facilitating basis trades and yield-farming strategies that drive modern crypto capital markets.

On the other hand, the XRPL is still in the nascent stages of building a DeFi foundation. Its protocol-level automated market maker (AMM) went live only in 2024. So all RLUSD-related pools on the ledger, such as the USD/RLUSD pair created in January 2025, still suffer from shallow depth and limited follow-through.

Moreover, the XRPL AMM design has not yet attracted the liquidity provider density seen in EVM ecosystems.

Consequently, a dollar of RLUSD placed on XRPL presently finds far fewer venues for swaps, leverage, or yield than the same dollar deployed on Ethereum.

RLUSD’s growing user base on Ethereum

Critics might argue that RLUSD’s Ethereum supply is merely “vanity metrics,” large sums minted but sitting idle.

However, a deeper analysis of on-chain transfer data refutes this. RLUSD is showing a genuine product-market fit with Ethereum, characterized by high velocity and recurring usage.

According to Token Terminal, weekly RLUSD transfer volume on Ethereum now averages approximately $1.0 billion, a dramatic increase from the $66 million average seen at the start of the year.

The data shows an apparent structural shift of a steady upward trend through the first half of 2025, followed by a “re-basing” to a significantly higher floor in the second half.

Crucially, recent weeks show activity clustering around this elevated level rather than spiking and reverting. In market structure terms, a rising baseline typically signals a transition from a distribution phase to a utility phase.

This implies that the token is being used in ongoing, recurring flows, such as institutional settlement and commercial payments, rather than isolated speculative events.

Transfer counts support this thesis. Weekly transactions on Ethereum now average 7,000, up from 240 in January.

The fact that transfer counts are rising in parallel with volume is a critical health indicator. If volume were rising while counts remained flat, it would suggest a market dominated by a few whales moving massive sums. Instead, the concurrent rise points to broader participation.

Furthermore, the holder data suggest a healthy dispersion of risk. According to data from Etherscan, Ripple’s RLUSD has attracted roughly 6,400 on-chain holders on Ethereum as of late November 2025, up from just 750 at the start of the year.

While the supply growth has been driven by “chunky” batch issuances rather than drip minting, the holder count has followed a smooth upward curve.

The friction between RLUSD and XRPL

The structural divergence between the two networks explains why the “permissionless” growth loop has favored Ethereum.

On Ethereum, RLUSD functions as a standard ERC-20 token. Wallets, custodians, accounting middleware, and DeFi aggregators are already optimized for this standard.

Once a protocol like Curve “wires in” a token, it becomes part of the standard dollar-pair universe alongside USDC and USDT, accessible to any address without prior authorization.

On the other hand, XRPL’s design choices, while technically robust, impose significantly higher friction on the user.

To hold RLUSD on the native ledger, users generally must maintain an XRP balance to satisfy reserve requirements and configure a specific trustline to the issuer. If the issuer enables the `RequireAuth` setting, which is a feature designed for strict compliance and granular control, accounts must be explicitly allow-listed before they can receive tokens.

So, while Ripple notes that these features appeal to banks that require explicit control, they act as a brake on organic adoption.

Essentially, the compliance tools that make XRPL attractive to regulated entities are the same features that slow down wallet-to-wallet distribution.

In a market where capital seeks the path of least resistance, the operational burden of trustlines renders XRPL less competitive for the high-frequency, automated flows that define DeFi.

RLUSD’s path to growth

Despite the ledger imbalance, the overall trajectory of RLUSD puts Ripple within striking distance of a major market tier.

Token Terminal has stated that Ripple would cement itself as the third-largest stablecoin issuer globally, behind only the incumbents Tether and Circle, if RLLUSD’s market cap were to grow 10x from current levels.

Considering this, RLUSD’s growth depends heavily on whether Ripple can leverage its Ethereum success to eventually jumpstart its native chain.

A base-case projection for the next six months sees RLUSD’s Ethereum supply climb from roughly $1.0 billion to a range of $1.4 billion to $1.7 billion. This assumes that Curve liquidity remains in the $60 million to $100 million band and that CEX and OTC demand continues to grow.

Under this path, XRPL would likely see its pools accumulate more liquidity over time but remain a small fraction of the aggregate issuance.

Meanwhile, a more aggressive “catch-up” scenario for XRPL would require deliberate market intervention. If Ripple or its partners commit to multi-month AMM reward programs and successfully mask trustline configurations behind single-click wallet interfaces, the native ledger could begin to erode Ethereum’s lead.

With these levers, XRPL liquidity could plausibly reach $500 million and claim up to 25% of the total supply.

However, the downside risk for the native ledger is real. If Ethereum cements its lead and the Curve USDC/RLUSD pool expands beyond $150 million, the network effects may become insurmountable. In that scenario, Ethereum could retain 80% to 90% of the supply indefinitely.

For now, Ripple finds itself in a paradoxical position: to succeed in its ambition to become a top-tier stablecoin issuer, it must rely on the infrastructure of its biggest rival.

The post RLUSD supply hit $1.26B, and 82% of it now sits on Ethereum, not XRPL appeared first on CryptoSlate.

https://ambcrypto.com/feed/

![Pudgy Penguins [PENGU] tanks 12% overnight: Is a full breakdown next?](https://ambcrypto.com/wp-content/uploads/2025/12/Abdul-6-3.webp) PENGU has attracted more seekers than buyers.

PENGU has attracted more seekers than buyers. The markets turn fragile when liquidity runs out.

The markets turn fragile when liquidity runs out.https://beincrypto.com/feed/

Vanguard, the $8 trillion US asset manager, will allow crypto-focused ETFs and mutual funds to trade on its platform from December 2, ending its long-standing refusal to support digital asset products.

The decision marks a major shift for the world’s second-largest asset manager and opens regulated crypto access to more than 50 million brokerage customers.

Vanguard Abandons Its Anti-Crypto Policy

The firm confirmed it will support products that hold Bitcoin, Ether, XRP, Solana, and other regulated cryptocurrencies.

However, it will continue to block funds tied to meme coins and will not launch its own digital asset products.

Vanguard spent years resisting crypto exposure and repeatedly framed Bitcoin and other digital assets as speculative.

The company rejected spot Bitcoin ETFs after their January 2024 debut and even restricted customer purchases of competing funds.

For years, Vanguard executives argued that crypto lacked intrinsic value, produced no cash flows, and did not fit long-term retirement strategies.

However, persistent demand pressured the firm to rethink its stance. Bitcoin ETFs became one of the fastest-growing product categories in US fund history, with BlackRock’s IBIT alone gathering tens of billions in assets.

This scale, combined with a steady shift in investor preferences, weakened the rationale for exclusion.

Leadership Changes Helped Clear the Path

The policy shift follows more than a year of internal debate. Vanguard’s former CEO, Tim Buckley, was widely seen as the main opponent of crypto adoption.

His departure and the appointment of Salim Ramji — a former BlackRock executive with experience in blockchain initiatives — signaled a potential pivot.

Ramji did not push the firm toward issuing its own crypto funds but supported granting customers access to regulated products.

That move aligns crypto with Vanguard’s treatment of other non-core assets, such as gold ETFs.

Market Conditions Did Not Stop the Move

The reversal comes during a deep crypto drawdown and heavy ETF outflows since early October. Bitcoin’s market value has fallen sharply, and leveraged positions have suffered heavy losses.

Yet Vanguard said digital asset ETFs have continued to operate smoothly and maintain liquidity through volatile periods.

The firm noted that operational processes for servicing crypto products have matured since 2024. It added that its clients increasingly expect access to a wide range of asset classes through a single brokerage platform.

What the Decision Means for Investors

Starting Tuesday, Vanguard customers can buy and sell most regulated crypto ETFs and crypto-focused mutual funds. The company will still screen products for compliance and will exclude any vehicle tied to SEC-defined memecoins.

Vanguard stressed that it has no plans to build proprietary crypto offerings.

Instead, it aims to accommodate diverse risk profiles while maintaining its conservative product philosophy.

The move is likely to strengthen digital asset legitimacy across traditional finance. It also marks a symbolic turning point for a firm long considered crypto’s most persistent holdout.

The post Vanguard Reverses Years-Long Crypto Ban With New Trading Features From Tomorrow appeared first on BeInCrypto.

Since its inception in 2009, Bitcoin has shown a consistent four-year cycle. It’s driven by massive moves centered around Bitcoin’s halving, peaking with a blow-off top the next year.

Since the 2024 halving, Bitcoin prices have trended higher, but none of the signs of a speculative blow-off top have occurred in 2025, at least within the timeframe consistent with the four-year cycle.

Without that blow-off top, the rest of the crypto market has stalled out, since soaring Bitcoin prices tend to kick off altcoin season.

End of the Famous Bitcoin Cycle?

With Bitcoin prices down 30% from their early October highs, it’s clear that the four-year price cycle has lost its validity.

This is a sensible development, since BTC is rapidly maturing as an asset class. Rising institutional interest also means that Bitcoin’s cycles will more likely center around economic cycles.

One area where investors have noted a strong correlation with Bitcoin is with global liquidity:

While there has been a strong correlation since the start of 2024, even that trend has broken in recent months.

Should that trend establish itself, Bitcoin could jump higher – and even kick off an altcoin season.

Michael Saylor recently called out the four-year cycle as “dead.” Saylor sees a massive repricing soon, which may explain his rush this year to acquire as much Bitcoin as possible.

However, liquidity isn’t the only factor.

Economic Activity

Some investors today are turning to the relationship between Bitcoin’s price and the US Purchasing Managers’ Index (PMI).

The PMI measures manufacturing sector health and serves as an economic leading indicator.

When PMI is above 50, it suggests expansion; below 50 indicates contraction.

In theory, a strong PMI signals economic growth, which could influence Bitcoin through several channels:

- Strong PMI → robust economy → risk-on sentiment → higher appetite for speculative assets like Bitcoin

- Weak PMI → economic concerns → potential Fed easing → more liquidity → potentially supportive for Bitcoin

However, even tools like PMI fail to work as a one-stop indicator for Bitcoin and the crypto cycle.

Sometimes, Bitcoin trades as a “risk-on” asset (correlating positively with stocks and economic strength).

Other times, it trades as a “risk-off” hedge (like digital gold during uncertainty), and it will even move independently based on crypto-specific factors.

Data also shows that the correlations between Bitcoin and PMI are unstable and vary across different time periods.

Bitcoin often responds more strongly to monetary policy signals (Fed decisions, liquidity conditions) than to real economy indicators like PMI.

When PMI does seem to matter, it’s typically through the broader risk sentiment channel rather than a direct mechanistic relationship.

If you’re looking to use PMI as a Bitcoin trading signal, you’d likely find it less reliable than monitoring Fed policy, liquidity conditions, or crypto-native metrics. But a growing economy likely won’t hurt – as sometimes that can push Bitcoin higher even when monetary conditions are tightening.

Sentiment – The Factor that Can Drive Extremes

Cryptocurrencies, particularly Bitcoin, lack traditional valuation anchors like earnings, dividends, or cash flows.

Without these fundamental metrics, price discovery relies heavily on what people believe the asset should be worth.

This creates space for sentiment to be the primary driver.

Studies of crypto market behavior consistently show that social media activity, search trends, and news sentiment have measurable predictive power for short-term price movements in ways that exceed their impact on traditional assets.

The crypto market also has structural features that amplify sentiment, including high retail participation (which leads to more emotional trading), 24/7 trading (with no circuit breakers to cool emotions), high leverage availability, and rapid information dissemination through crypto-native social channels.

Fear and greed cycles can become self-reinforcing quickly.

Here’s where it gets complicated: what looks like “pure sentiment” often includes assessments of fundamental factors.

When investors get excited about institutional adoption news, is that sentiment or recognition of changing supply/demand fundamentals?

When macro concerns drive people toward Bitcoin as a hedge, sentiment is the transmission mechanism for macro factors.

During stable periods, you might see something like: 40% macro conditions (Fed policy, inflation, dollar strength), 30% supply/demand fundamentals (adoption metrics, on-chain activity, halving cycles), and 30% pure sentiment/speculation.

During euphoric bull runs or panic crashes, sentiment could dominate at 60-70%+, temporarily overriding both fundamentals and macro logic.

These are the periods where asset prices detach most dramatically from any rational valuation model. Investors who can recognize when sentiment is in control are best positioned to profit from those conditions.

Academic studies attempting to decompose crypto returns generally find that sentiment indicators explain 20-40% of price variance in normal conditions, but this can spike much higher during extreme market phases.

Notably, crypto markets show much stronger “momentum” and “herding” effects than traditional markets, which are often hallmarks of sentiment-driven trading.

The cryptocurrency market is probably best understood as fundamentally sentiment-driven in the short to medium term, with macro and supply/demand factors providing boundaries and direction over longer timeframes.

Bringing It Together

Clearly, there’s no one signal or trend for investors to look at to determine Bitcoin’s cycles.

An expanding economy should be bullish for Bitcoin prices. A contracting one shouldn’t be – unless there’s a massive infusion of liquidity in the system.

Individual indicators like global liquidity, credit market conditions, business conditions and market sentiment will all play a role.

Beyond Bitcoin, individual crypto projects working on real-world problems will rise or fall with their prospects.

Meme coins will rise and fall much faster – driven by the short-lived magic of memes themselves.

But bear in mind, even with Bitcoin moving beyond its four-year, retail-driven cycle, the fundamental concept remains intact.

As Bitwise CIO Matt Houghton recently noted:

“The reason bitcoin’s price is up ~28,000% over the last ten years is that more and more people want the ability to store digital wealth in a way that isn’t intermediated by a company or a government.”

And when Bitcoin takes off again, the altcoins will follow.

The post Bitcoin’s Famous 4-Year Cycle Is Breaking Down — What Now? appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Similar to major assets in the cryptosphere, Dogecoin (DOGE) is facing renewed selling pressure as broader crypto market weakness intensifies, pushing the memecoin below several key technical levels.

Related Reading: $300 Million Crypto Bet: Kazakhstan’s Central Bank Gears Up

The decline occurs amid outflows, a weakening market structure, and fading speculative interest, raising questions about whether a deeper correction may be underway.

Dogecoin Breaks Key Supports as Selling Pressure Mounts

Dogecoin slipped below important support areas after breaking a bullish trend line on the hourly chart, continuing a multi-day downtrend. The price now trades below the 100-hour simple moving average, near $0.13, with MACD momentum strengthening in the bearish zone and the RSI remaining below 50.

The coin declined more than 8% in 24 hours, falling through multiple Fibonacci retracement zones and failing to regain footing above the 23.6% level of the latest swing move.

Analysts note that immediate resistance lies near the 50% retracement of the recent decline. A close above that threshold is needed to ease short-term downside pressure.

Failure to break above these resistance areas has kept momentum tilted toward sellers, with a retest of recent lows likely if the market does not stabilize.

Weak Flows and Derivatives Contraction Deepen Market Strain

Spot market flows show persistent distribution. Recent data revealed a $5.7 million outflow, extending the multi-month trend of reduced accumulation from large holders. Earlier inflows that supported rallies toward $0.30 have given way to steady red prints, reflecting waning confidence among major players.

Derivatives markets reinforce the weakening structure. Open interest has dropped more than 9% as traders unwind positions rather than add exposure during declines.

Long-short ratios show a mild long bias, but price action has repeatedly invalidated those positions, triggering waves of long-side liquidations whenever DOGE attempts to rise above short-term moving averages.

These repeated failed rallies have kept Dogecoin locked beneath declining EMAs between $0.154 and $0.202, a structure analysts say remains firmly bearish.

DOGE ETF Disappointment and Market Rotation Add Further PressureDogecoin’s recently launched ETFs have not provided support. Combined inflows from major issuers barely surpassed $2 million, far below expectations and significantly weaker than the debut flows seen in Bitcoin or Ethereum funds.

The soft demand has signaled limited institutional appetite for the memecoin, contributing to negative sentiment.

Related Reading: XRP Hit By Violent 59% Leverage Flush As Speculators Slam The Brakes

Meanwhile, market rotation is moving toward utility-focused assets and payment-driven networks. Declining volume and low whale activity suggest traders may be shifting away from meme assets in favor of projects showing faster adoption and real-world use cases.

Cover image from ChatGPT, DOGEUSD chart from Tradingview

Bitcoin is fighting to reclaim the $90,000 level after a sharp drop earlier today, adding fuel to growing fears of a deeper downtrend. Market sentiment has weakened noticeably, with selling pressure intensifying across spot and derivatives markets.

Traders remain cautious as liquidity thins and volatility increases, creating an environment where even minor inflows can trigger outsized price reactions. The recent rejection below $90K highlights the fragility of the current structure and raises questions about whether Bitcoin is entering a more prolonged corrective phase.

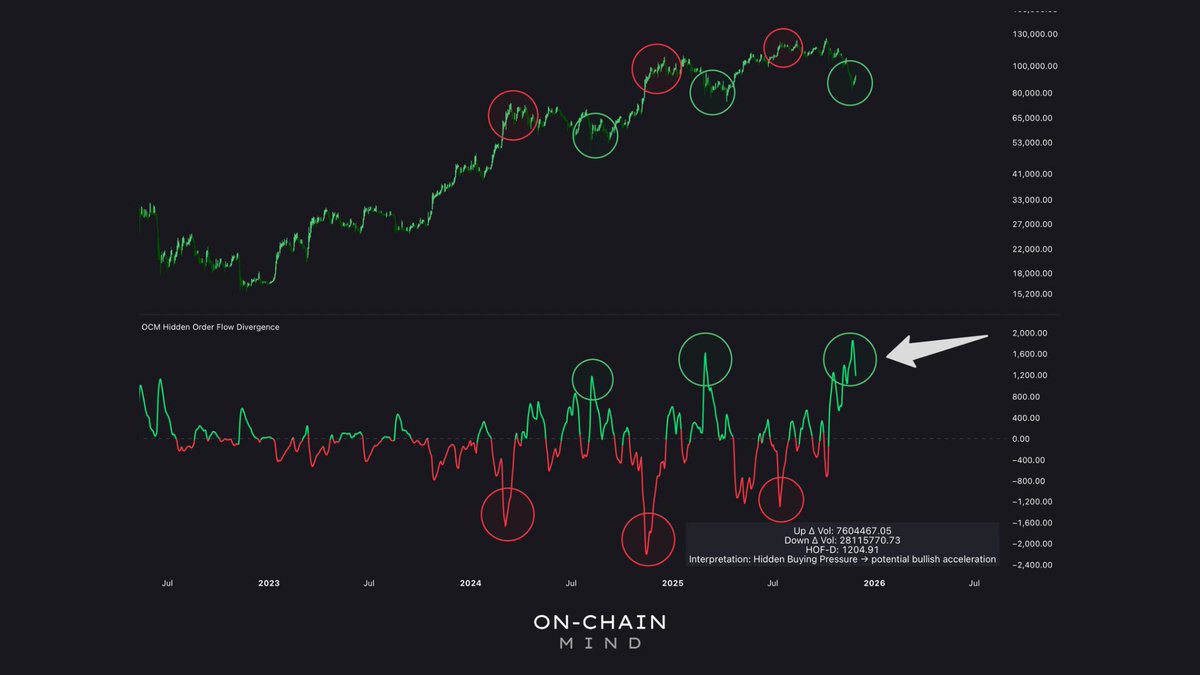

However, beneath the surface, on-chain data reveals a striking counter-signal. According to On-Chain Mind, Bitcoin is currently printing the largest hidden-buying spike of the entire cycle. Order flow analysis tracks the relationship between actual buy/sell pressure and the corresponding price movement. When the two do not align, hidden divergences emerge: positive divergences indicate aggressive buying despite muted price action, while negative ones reflect stealth selling.

The size of this hidden-buying spike suggests a major imbalance in favor of buyers—an early sign that large players may be quietly accumulating while the broader market focuses on the decline. Whether this hidden demand can offset the prevailing sell pressure will determine Bitcoin’s next decisive move.

Hidden Buying Supports Reversal Narrative Despite Macro Fear

According to On-Chain Mind, the persistent hidden-buying spike remains one of the strongest signals favoring a future upside reversal. Even after Bitcoin’s most recent drop, the imbalance between real buying pressure and price action suggests that large players are still absorbing supply.

While this type of signal does not guarantee an immediate rebound—and may take several weeks to fully materialize—it indicates that buyers have not exhausted their resources. Historically, such divergences appear near cyclical inflection points, when sentiment is weakest, but accumulation quietly strengthens beneath the surface.

This constructive signal emerges at a time when fear in the market is amplified by external narratives. Renewed headlines about a China Bitcoin ban, despite being recycled and lacking substantive policy updates, have resurfaced across social media, contributing to confusion and short-term panic. Similarly, fresh waves of Tether FUD—focused on reserve transparency and regulatory scrutiny—have pressured liquidity conditions and fueled risk-off behavior.

Together, these storylines have exaggerated bearish sentiment, overshadowing the more nuanced on-chain developments. While retail reacts to alarming headlines, order flow data suggests that sophisticated investors are taking the opposite stance. If hidden accumulation continues, this correction may ultimately resolve with a stronger recovery than current sentiment implies.

Related Reading: Bitcoin STH Loss Transfers Fall 80% From Peak – What Comes Next?

Bitcoin Attempts to Stabilize After Sharp Breakdown, but Trend Remains Fragile

Bitcoin’s 1-day chart reflects a market still under heavy corrective pressure following the steep decline from the $110,000 region. The breakdown sliced through the 50 SMA and 100 SMA with little resistance, signaling a decisive shift in momentum. Price is now hovering below both moving averages, which have begun to curl downward—an early sign that the medium-term trend has weakened. The 200 SMA around the $109,000 zone sits far above the current price, underscoring how aggressive the correction has been.

After reaching a local low near $83,000, BTC has attempted to rebound, but the reaction remains modest. The latest bounce failed to reclaim $90,000 convincingly, forming a lower high that aligns with bearish continuation.

Volume spikes during sell-offs reinforce the dominance of sellers, while buying activity remains comparatively muted. Until BTC can flip the 50 and 100 SMAs back into support—now clustered around $101,000–$108,000—bulls will struggle to regain control.

The chart also shows increasing distance between price and the 200 SMA, a condition that often precedes temporary relief rallies. However, unless Bitcoin closes back above the $95,000–$98,000 region, downside risks persist. For now, BTC is attempting to stabilize, but the broader trend continues to favor caution.

Featured image from ChatGPT, chart from TradingView.com