Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

The product gives retirement investors indirect Bitcoin exposure through a BlackRock index built on the company's spot Bitcoin ETF.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Trump Media sets February 2 2026 as the eligibility cutoff for a digital token airdrop to DJT shareholders using Crypto.com infrastructure.

The post Trump Media sets February 2 record date for digital token airdrop to DJT holders appeared first on Crypto Briefing.

The commitment to adding seized Bitcoin to reserves may influence global digital asset strategies and impact future crypto regulations.

The post Trump’s Treasury Secretary Bessent reiterates commitment to adding seized Bitcoin to strategic reserve appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

Rumors of a large-scale XRP purchase by the world’s largest asset manager, BlackRock, have captured the attention of the crypto world this week. Screenshots circulating on X suggest that the global investment company had invested over a billion dollars in the altcoin, sparking both bullish excitement and skepticism across the crypto community.

BlackRock’s Rumored $1.85 Billion XRP Bet

The frenzy began when several popular crypto influencers, including The Crypto Bull, shared a post and portfolio screenshot claiming that BlackRock had added $1.85 billion worth of XRP to its already substantial crypto holdings. Given BlackRock’s significant influence in the crypto space, the idea that the asset manager had invested in XRP seemed like a major signal for institutional adoption of the cryptocurrency.

The rumors triggered a wave of speculation about the token, with some market participants viewing the alleged purchase as extremely bullish. A closer examination of BlackRock’s actual portfolio, however, shows that the reports were unfounded and lacked any evidence to support them.

Data from Arkham Intelligence, a blockchain analytics company, revealed that, contrary to expectations, BlackRock holds just 5.267 XRP, valued at just $10.32—a far cry from the acclaimed $1.85 billion in holdings. The data also showed that the asset manager held the majority of its holdings in Bitcoin and Ethereum. BlackRock’s total crypto portfolio is estimated at $82.1 billion, including 784,424 BTC valued at $71.31 billion, 3.494 million ETH worth approximately $10.8 billion, and other assets.

Investigations also revealed that the original screenshots, which showed BlackRock owning 911.76 million XRP, had been edited to exaggerate the asset manager’s holdings. This misrepresentation created a temporary buzz, but did not reflect any real investment in the altcoin by the firm.

Despite the false alarm, the incident highlights how quickly misinformation can spread in the crypto space, especially when shared by crypto influencers with thousands of followers. The Crypto Bull’s post drew a variety of reactions from the community. Some questioned why XRP’s price had not moved if the reports were accurate, while others remained skeptical, and a few outrightly dismissed the claims.

Rise Of Misinformation In The Crypto Space

False rumors have become a recurrent theme in the crypto world, and the latest incident with XRP and BlackRock is just one example. This is alson’t the first time false claims have been made about the token. Earlier this month, rumours of a potential Ripple partnership with Amazon spread across the community, sparking speculation about how such a collaboration could positively impact XRP’s price.

Similarly, overly optimistic price forecasts can also contribute to misinformation. Some analysts have predicted that XRP could surge to $50,000, fueling unrealistic expectations for investors. In a market predominantly driven by speculation and volatility, it’s important for investors to verify sources and avoid making decisions based on unproven claims.

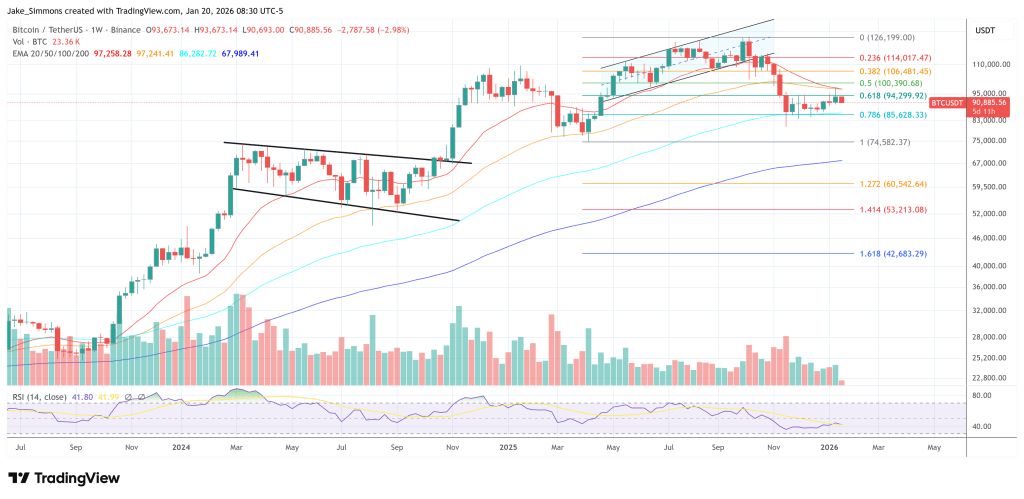

Bitcoin has slipped below the $92,000 level after a sharp decline that began on Sunday, signaling that downside pressure is still shaping market conditions. Despite the drop, bulls are trying to defend current levels and regain control, with many traders watching for a rebound that could restore confidence across the broader crypto market. The move comes at a sensitive moment, as risk appetite remains fragile and short-term volatility continues to shake out leveraged positioning.

Top analyst Darkfost highlighted that the market is now 109 days removed from Bitcoin’s last all-time high, placing the current drawdown into a wider cycle context. In previous major corrections, Bitcoin spent far longer in recovery mode, including 236 days between March 2024 and November, followed by another 154-day correction window between December 2024 and May 2025. Compared to those periods, the current pullback may still be early in its timeline, even if price action already feels aggressive.

What makes this correction stand out is the intensity of the pain across the market. Realized losses have stacked up, capitulation has been more visible, and short-term holders appear increasingly stressed, creating the sense that this decline is heavier than past resets. Even so, history suggests Bitcoin can remain in a choppy recovery phase for months without breaking the broader cycle structure.

Capitulation Builds, But the Cycle May Still Be Intact

Bitcoin’s recent decline has not been a “clean” pullback. Realized losses have stacked up, capitulation has looked aggressive, and short-term holders remain under heavy pressure as the market punishes late entries and weak conviction. Liquidation data has also shown how leverage has amplified the downside, with forced selling accelerating drops that might have otherwise played out more gradually. That backdrop is exactly why the correction feels so violent, even compared to past drawdowns.

However, Darkfost argues this phase still fits within the broader rhythm of Bitcoin’s cycle. His key point is that extended corrections are not unusual, even when they feel unusually painful in real time. From that perspective, the market could easily spend more months digesting losses and rebuilding positioning without signaling a full structural breakdown.

Where this cycle becomes more complex is the macro timing. Unlike previous cycles, Bitcoin’s post-bear all-time high and the halving narrative have overlapped with a new variable: ETF-driven demand. That shift changes how drawdowns develop, because deeper pools of institutional capital can absorb supply differently than retail-led rallies. If this institutional trend continues, Bitcoin may be transitioning into a structurally different market regime, with longer consolidations and less predictable “four-year cycle” behavior.

Bitcoin Slips Below Key Averages as Bulls Defend $90K Support

Bitcoin is back under pressure after failing to hold above the $92,000 zone, with the chart showing price sliding toward $91,300 as selling accelerates. The move keeps BTC trapped below major moving averages, reinforcing the idea that this rebound is still fragile and highly reactive to headline-driven volatility. After the January recovery attempt, the rejection near the descending resistance structure highlights that sellers remain active on rallies, limiting bullish follow-through.

Technically, the market continues to trade beneath the 50-day and 100-day trend lines, while the longer-term averages remain overhead, acting as dynamic resistance. This structure suggests BTC is still in a corrective phase rather than a confirmed trend reversal, despite short-term optimism earlier this month. Volume also shows a lack of sustained demand expansion, supporting the view that buyers are defending levels, but not fully regaining control.

The $90,000–$88,000 range now stands out as a critical support area, as it has acted as a base during recent consolidation. A clean breakdown below it could reopen downside risk toward the December lows, while a hold could keep the market building a recovery structure. For bulls, the first step is stabilizing above $92,000 again, then reclaiming the mid-$90,000s to shift momentum back in their favor.

Featured image from ChatGPT, chart from TradingView.com

https://cryptoslate.com/feed/

NYSE said it is developing a platform for trading and on-chain settlement of tokenized securities, and will seek regulatory approvals for a proposed new NYSE venue powered by that infrastructure.

According to the owners, ICE, the system is designed to support 24/7 operations, instant settlement, orders sized in dollar amounts, and stablecoin-based funding. It combines NYSE’s Pillar matching engine with blockchain-based post-trade systems that have the capability to support multiple chains for settlement and custody.

ICE did not name which blockchains would be used. The company also framed the venue and its features as contingent on regulatory approvals.

The scope ICE described is U.S.-listed equities and ETFs, including fractional share trading. It said tokenized shares could be fungible with traditionally issued securities or natively issued as digital securities.

ICE said tokenized shareholders would retain traditional dividends and governance rights. It also said distribution is intended to follow “non-discriminatory access” for qualified broker-dealers.

The forward-looking market-structure implication sits less in the token wrapper and more in the decision to pair continuous trading with immediate settlement.

Under that design, the binding constraint shifts from matching orders during a session to moving money and collateral across time zones and outside banking hours (inference based on settlement and operating-hour constraints described by regulators and ICE).

U.S. markets only fairly recently completed the move from T+2 to T+1 settlement, effective May 28, 2024, a project the SEC tied to updated rules for clearing agencies and broker-dealers. FINRA has also issued reminders that even a one-day compression requires coordinated changes in trade reporting and post-trade workflows.

Always-on trading raises settlement and funding demands

Pressure for longer trading windows is also building in listed equities, with Nasdaq publicly described as seeking SEC approval for a 23-hour, five-day trading schedule. ICE’s proposal extends the concept by pairing always-available trading with a settlement posture it labeled “instant.”

That approach would require market participants to pre-position cash, credit lines, or eligible on-chain funding at all times (inference grounded in the “instant settlement” and 24/7 features, and the post-trade funding constraints reflected in the T+1 migration).

For broader context on how quickly tokenization is spreading in finance, see CryptoSlate’s coverage of tokenized assets.

ICE made the funding and collateral angle explicit, describing the tokenized securities platform as one component of a broader digital strategy. That strategy also includes preparing clearing infrastructure for 24/7 trading and potential integration of tokenized collateral.

ICE said it is working with banks including BNY and Citi to support tokenized deposits across ICE’s clearinghouses. It said the goal is to help clearing members transfer and manage money outside traditional banking hours, meet margin obligations, and accommodate funding requirements across jurisdictions and time zones.

That framing aligns with DTCC’s push around tokenized collateral. DTCC has described collateral mobility as the “killer app” for institutional blockchain use, according to its announcement of a tokenized real-time collateral management platform.

A near-term data point for how quickly tokenized cash-equivalents can scale sits in tokenized U.S. Treasuries. RWA.xyz displays the total value of $9.33 billion as of press time.

ICE’s emphasis on tokenized deposits and collateral integration creates a path where similar assets become operational inputs for brokerage margin and clearinghouse workflows. That scenario is an inference grounded in ICE’s stated clearing strategy and DTCC’s collateral thesis, including the focus on mobility.

| Plumbing shift | Metric | Value | Source |

|---|---|---|---|

| U.S. equities settlement cycle | Compliance date | May 28, 2024 (T+1) | SEC, FINRA |

| Tokenized Treasuries | Total value (displayed) | $8.86B (as of 01/06/2026) | RWA.xyz |

Stablecoins, tokenized deposits, and collateral mobility

For crypto markets, the bridge is the settlement asset and the collateral workflow. ICE explicitly referenced stablecoin-based funding for orders and separately referenced tokenized bank deposits for clearinghouse money movement.

One base-case scenario is a settlement-asset race where stablecoins and bank-issued tokenized deposits compete for acceptance in brokerage and clearing operations. That could push more institutional treasury activity into on-chain rails while keeping the compliance perimeter centered on broker-dealers and clearing members.

A second scenario is collateral mobility spillover, where tokenized collateral becomes a primary tool for intraday and overnight margining in a 24/7 environment. That shift could increase demand for tokenized cash-equivalents such as Treasury tokens that can move in real time under defined eligibility rules.

In that design, the operational question becomes which chains, custody arrangements, and permissioning models satisfy broker-dealer requirements. ICE said only that the post-trade system has the capability to support multiple chains and did not identify any specific network.

A third scenario reaches Bitcoin through cross-asset liquidity. Always-available equities and ETFs, paired with faster settlement expectations, could compress the boundary between “market hours” and “crypto hours,” making funding conditions a more continuous input into BTC positioning (scenario inference anchored to ICE’s 24/7 equities and ETF scope and the mechanics of TradFi access via ETF wrappers).

Farside data shows large daily net flows into U.S. spot Bitcoin ETFs on several early-January sessions, including +$697.2 million on Jan. 5, 2026, +$753.8 million on Jan. 13, 2026, and +$840.6 million on Jan. 14, 2026.

That channel transmits equity-like allocation decisions into BTC exposure, alongside other flow drivers covered in CryptoSlate’s ETF inflows reporting.

Why macro and regulation will shape the rollout

Macro conditions set the incentive gradient for these plumbing changes because collateral efficiency matters more when rate policy and balance-sheet costs shift. The OECD’s baseline projects the federal funds rate will remain unchanged through 2025 and then be lowered to 3.25–3.5% by the end of 2026.

That path can reduce carry costs while leaving institutions focused on liquidity buffers and margin funding as trading windows lengthen (analysis tied to OECD rates and ICE’s 24/7 clearing focus). Under a 24/7 regime with instant settlement as a design goal, margin operations can become more continuous.

That dynamic can pull attention toward programmable cash movement, tokenized deposits, and tokenized collateral as tools for meeting obligations outside bank cutoffs.

For more on one of the key collateral-like building blocks, see CryptoSlate’s deep dive on tokenized Treasuries.

For crypto-native venues, the nearer-term implication is less about NYSE listing tokens and more about whether regulated intermediaries normalize on-chain cash legs for funding and collateral management. That can affect demand for stablecoin liquidity and short-duration tokenized instruments even if the trading venue remains permissioned (scenario inference based on ICE’s stated objectives).

DTCC’s positioning of collateral mobility as an institutional blockchain use case offers a parallel track where post-trade modernization proceeds through constrained implementations rather than open-access markets. That approach can shape where on-chain liquidity forms and which standards become acceptable for settlement and custody.

ICE did not provide a timeline, did not specify eligible stablecoins, and did not identify which chains would be used. The next concrete milestones are likely to center on filings, approval processes, and published eligibility criteria for funding and custody.

NYSE said it will seek regulatory approvals for the platform and the proposed venue.

The post Wall Street’s secret blockchain platform is coming for your dividends and it’s using stablecoins to do it appeared first on CryptoSlate.

Strategy (formerly MicroStrategy) acquired an additional 22,305 Bitcoin for approximately $2.13 billion between Jan. 12 and Jan. 19, continuing an aggressive accumulation campaign that has absorbed 3.38% of the top crypto's total supply.

That works out to 3.55% of the circulating supply of 19.97 million coins.

The purchases were executed at an average price of $95,284 per bitcoin, according to a Jan. 20 8-K filing with the Securities and Exchange Commission (SEC).

The latest acquisition brings Strategy’s total Bitcoin holdings to 709,715 BTC, a hoard worth roughly $64 billion. The company’s cost basis for the total stack is approximately $53.92 billion, or an average of $75,979 per bitcoin, implying around $10.5 billion in paper gains at current prices.

How Strategy is funding its Bitcoin purchases

While the headline number highlights the company’s relentless buying, the mechanics behind the purchase reveal a significant shift in how Strategy funds its operations.

These latest acquisitions were funded using proceeds from the firm's at-the-market sales of its Class A common stock (MSTR), its perpetual Stretch preferred stock (STRC), and the Series A Perpetual Strike Preferred Stock (STRK).

According to the SEC filing, the Michael Saylor-led Strategy sold 10,399,650 MSTR shares for approximately $1.8 billion last week. It still has about $8.4 billion worth of shares to fund future BTC purchases.

According to the SEC filing, the Michael Saylor-led Strategy sold 10,399,650 MSTR shares for approximately $1.8 billion last week. It still has about $8.4 billion worth of shares to fund future BTC purchases.

However, the preferred channel is seeing increased activity.

The filing showed Strategy sold 2,945,371 STRC shares for around $294.3 million (with $3.6 billion shares remaining) and 38,796 STRK shares for $3.4 million (with $20.3 billion shares remaining).

This increased bet shows that the company's attempt to turn its bitcoin treasury strategy into a repeatable “yield SKU” that can sit quietly in brokerage accounts and income portfolios is yielding significant interest.

Notably, this financial engineering has produced four distinct exposure tiers that trade on the Nasdaq exchange. This means investors do not need any BTC know-how to invest, as they can simply buy them through a regular brokerage account.

The product lineup is segmented by risk appetite, offering four distinct ways to play the Strategy trade.

The headline act is the Variable Rate Series A Perpetual Stretch Preferred Stock, or STRC. Marketed explicitly as “short duration high yield credit,” this security currently pays an 11.00% annual dividend in monthly cash installments.

Unlike a standard bond where market forces dictate the yield, STRC is an issuer-managed product. Strategy retains the policy power to adjust the dividend rate to ensure the stock trades near its $100 par value.

Data from STRC.live shows that the firm has accumulated 27,000 BTC from the STRC fundraiser.

Below STRC sits a tiered structure of fixed-rate perpetuals.

For the investor who wants a piece of the equity upside, there is STRK (“Strike”). It pays an 8% annual dividend and is non-cumulative (meaning missed payments are lost forever).

However, it functions as a hybrid, offering convertibility to stock that captures about 40% of the gains if Strategy’s common shares rally.

For the risk-averse income seeker, the company offers STRF (“Strife”). This 10% perpetual preferred cannot be converted to stock, but it sits higher in the capital structure.

It is cumulative, meaning the company must make up any missed dividend payments later. With $1.6 billion remaining in capacity, it represents the most conservative tier.

There is also the STRD (“Stride”) instrument, which matches the 10% yield of STRF but removes the safety net. It is non-cumulative and non-convertible.

If Strategy skips a payment, the investor has no recourse, giving STRD the sharpest risk-reward profile among the fixed-rate options. It has $1.4 billion remaining.

Meanwhile, the company has even opened a European front. Last November, Strategy introduced the Series A Perpetual Stream Preferred (STRE), a euro-denominated security that carries a 10% annual dividend paid quarterly.

This instrument carries sharp teeth regarding non-payment. The dividend is cumulative and increases by 100 basis points per missed period, up to a maximum of 18%.

Institutional investors turn to Strategy's preferred

Strategy's financial engineering product list has successfully courted a demographic that typically shuns crypto: the income tourist.

Data from several institutional filings show that high-income and preferred-focused funds are populating the STRC holders list. The roster includes the Fidelity Capital & Income Fund (FAGIX), Fidelity Advisor Floating Rate High Income (FFRAX), and the Virtus InfraCap U.S. Preferred Stock ETF (PFFA).

Meanwhile, the most striking validation comes from BlackRock. The BlackRock iShares Preferred and Income Securities ETF (PFF) is a massive fund that tracks an index usually dominated by sleepy bank and utility preferreds.

As of Jan. 16, the fund held $14.25 billion in net assets. Inside that conservative portfolio, Strategy’s Bitcoin-linked paper has established a beachhead.

The ETF disclosed a position of approximately $210 million in Strategy’s STRC. It holds another ~$260 million across STRF, STRK, and STRD. In total, BlackRock’s ETF exposure to Strategy preferreds sits at roughly $470 million (or 3.3% of the total fund).

Valentin Kosanovic, a deputy director at Capital B, views this as a watershed moment for digital credit.

According to him:

“This is another clear, factual, unquestionable demonstration of the materialization of the wave of institutionalized legacy BTC-pegged financial products.”

Risks?

The machinery required to sustain these dividends creates a unique set of risks. Strategy is not paying these yields from operating profits in the traditional sense. It is funding them through the capital markets.

The company’s prospectus for STRC states that cash dividends are expected to be funded primarily through additional capital raising, including at-the-market stock offerings.

This creates a circular dependency: Strategy sells securities to buy Bitcoin and then pays dividends on those securities.

Considering this, Michael Fanelli, a partner at RSM US, highlighted several risks associated with this model, including Bitcoin price crashes, the lack of insurance coverage, and the fact that the products are unproven in recessions. He also noted that the perpetual products have no maturity date.

However, Bitcoin analyst Adam Livingston countered that the products are a “mind-bender” for traditional analysts. He argued that “STRC is quietly turning Strategy into a private central bank for the yield-starved world.”

According to him:

“STRC is a coupon-bearing ‘credit rail’ that can absorb fixed-income demand, convert it into BTC at scale, then feed the equity premium that makes the next raise easier, cheaper, and faster. That is a flywheel with a bid inside it.”

The post Strategy just crossed 700k BTC but its “circular” Bitcoin funding loop risks a massive high-yield credit disaster appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Bitcoin demand continues to build, supported by clear signs of underlying momentum rather than speculative excess.

Bitcoin demand continues to build, supported by clear signs of underlying momentum rather than speculative excess. BitMine has staked nearly $6 billion worth of ETH as staking demand hits a record high.

BitMine has staked nearly $6 billion worth of ETH as staking demand hits a record high.https://beincrypto.com/feed/

Global markets turned risk-off on Tuesday after US Treasury Secretary Scott Bessent openly reaffirmed the Trump administration’s willingness to use tariffs as a primary geopolitical weapon. His statements reignited fears of trade-driven inflation just as crypto markets were showing signs of stabilization.

Bitcoin fell back below $90,000, while Ethereum slipped under $3,000, as investors reassessed macro risks following Bessent’s remarks at the World Economic Forum in Davos.

Tariffs Framed as Leverage, Not a Last Resort

Speaking at Davos, Bessent made clear that tariffs remain central to US foreign-policy strategy. He described them as an effective tool rather than a temporary measure.

“Sit back, take a deep breath, do not retaliate. The president will be here tomorrow and he will get his message across,” Bessent said, responding to European backlash over tariff threats tied to Greenland.

The language signaled that the White House expects resistance from allies and is prepared to escalate if necessary. Markets interpreted this as confirmation that trade friction risks are rising again, particularly between the US and Europe.

Bessent also revealed a concrete timeline, noting that President Trump could impose a 10% tariff as early as February 1 if Denmark and allied countries refuse to cooperate on Greenland.

Inflation Risk Returns to the Macro Narrative

Beyond geopolitics, Bessent defended tariffs as economically effective and dismissed concerns that they would backfire domestically.

“It’s very unlikely that the Supreme Court is going to strike down a president’s signature economic policy,” he said, adding that tariffs have already generated “hundreds of millions of dollars” in revenue.

However, this stance clashes with recent research showing that US consumers absorb the vast majority of tariff costs.

New data from European and US economists indicates that tariffs act more like a hidden consumption tax, tightening household liquidity over time.

That dynamic matters for crypto. Reduced discretionary spending and higher price pressures directly weaken speculative capital flows, particularly into high-volatility assets.

Markets react as rate Volatility Resurfaces

Bessent attempted to downplay the bond-market reaction following his remarks, arguing that rising yields were driven by turmoil in Japan rather than US policy.

“Japan over the past two days has had a six standard deviation move in their bond market,” he said, calling it difficult to isolate US-specific factors.

Still, traders focused on the bigger picture: renewed tariff threats, geopolitical escalation, and higher rate volatility—a combination that historically pressures crypto markets.

Bitcoin’s failure to hold above $90,000 and Ethereum’s drop below $3,000 reflected this reassessment. Altcoins fell harder, consistent with leverage unwinds and risk reduction.

A Familiar Pattern for Crypto Markets

The sell-off mirrors earlier episodes where tariff announcements drained liquidity without immediately triggering broader economic contraction.

Tariffs are one of the key reasons crypto remained range-bound after October’s liquidation shock, even as institutional interest quietly grew. Davos brought that risk back to the forefront.

While Bessent emphasized US economic strength and accelerating private-sector growth, markets reacted less to optimism and more to policy direction.

Tariffs framed as leverage, rather than contingency, signal persistent uncertainty—and crypto remains one of the first assets to price that in.

For now, the message from Davos is clear: trade-war inflation risk is back on the table, and crypto markets are adjusting accordingly.

The post US Treasury Secretary Revives Trade-War Inflation Risk at Davos as Crypto Sinks appeared first on BeInCrypto.

Strategy (formerly MicroStrategy) made its most substantial Bitcoin purchase since November 2024, just a day before Bitcoin’s price dropped below the $90,000 threshold.

Despite the company’s consistent commitment to its aggressive accumulation playbook, Strategy’s shares dropped by over 7%.

Strategy’s Biggest Bitcoin Buy Since 2024

On Tuesday, Strategy announced the acquisition of 22,305 Bitcoin for approximately $2.13 billion, bringing its total Bitcoin holdings to 709,715.

The transaction, which was carried out on Monday, marked Strategy’s largest Bitcoin purchase since November 2024. It also followed two additional acquisitions completed earlier in January, reaffirming the company’s continued commitment to expanding its Bitcoin treasury.

Despite the scale of the latest purchase, market reaction remained muted. Similar to the acquisition announced last Monday, the move failed to bolster investor confidence in Strategy’s long-term outlook.

Over the past 24 hours, the company’s shares declined 7.39%, with MSTR trading at $160.87 at the time of writing.

The company’s approach to timing its Bitcoin purchases has also drawn scrutiny.

Bitcoin Accumulation Continues Despite Market Weakness

According to Monday’s disclosure, Strategy paid an average price of $95,284 per Bitcoin. Yet on the same day, Bitcoin was trading near $92,500 and briefly fell below $90,000 the following day.

The timing highlighted a recurring pattern in which Strategy has failed to capitalize on short-term price declines.

In December, BeInCrypto reported that the company spent nearly $1 billion to acquire 10,624 Bitcoin. Although Bitcoin had dropped to around $86,000 at the time, Strategy executed the purchase after the price rebounded to approximately $90,615.

This approach has raised ongoing questions about the firm’s entry-point strategy and its apparent willingness to accumulate Bitcoin at elevated price levels rather than during market pullbacks.

It has also done little to ease shareholder concerns about its broader capital allocation decisions.

Despite a modest recovery over the past month, Bitcoin has been unable to reclaim the $100,000 level. At the same time, growing analyst concerns about a potential bear market have heightened uncertainty about the asset’s near-term price outlook.

Against this backdrop, Strategy has continued to press ahead with its accumulation plan.

While the approach is intended to signal confidence in Bitcoin’s long-term prospects, it has so far done little to alleviate investors’ short-term concerns.

The post MicroStrategy’s Largest Bitcoin Purchase in a Year Shakes Stock Market Confidence appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

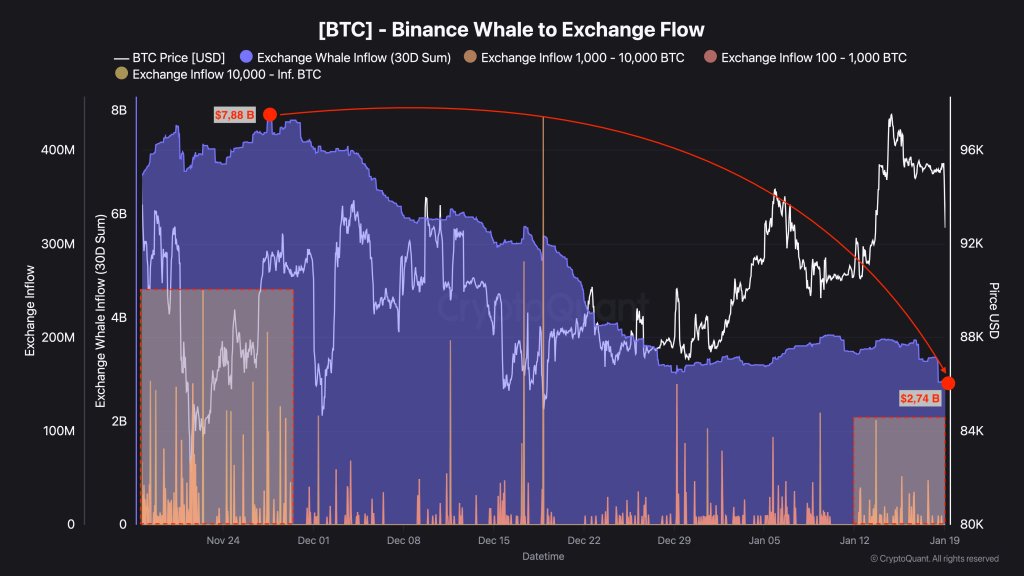

Bitcoin’s exchange-side supply signal is flashing a notable change: whale-sized transfers into Binance have dropped sharply from late-November panic levels, suggesting large holders are no longer leaning on the sell button with the same urgency.

Selling Pressure From Bitcoin Whales Fade

CryptoQuant contributor Darkfost said current data shows a “clear decline in whale transactions,” specifically BTC inflows to exchanges, meaning “large holders are sending significantly less BTC to trading platforms than before.”

In the post, the chart focus was Binance inflows segmented by transaction size, spanning transfers from 100 BTC up to the largest prints above 10,000 BTC, flows that are commonly interpreted as potential sell-side positioning when they hit an exchange.

The key backdrop in Darkfost’s thread is how quickly whale behavior shifted around the market’s late-2025 drawdown. “December has been particularly challenging, even for these investors,” the analyst wrote, adding that whales are typically “more cautious” and “less sensitive to market movements than retail participants,” often acting with “greater discipline and patience.”

That discipline appeared to crack as Bitcoin rolled over from its latest all-time high near $126,000. Darkfost described a surge in whale inflows to Binance at the end of November as BTC “continued its correction,” with the “average monthly total” reaching “nearly $8 billion” during a period when BTC “fell back below the $90,000 level.”

“This phase clearly triggered a panic-driven move,” the post said. “Transactions ranging between 100 and 10,000 BTC increased significantly, especially as price broke below the $85,000 level. This behavior reflects real stress among certain whales, who chose to sell quickly in order to limit losses, thereby reinforcing selling pressure on the market.”

The crux is what changed since that cluster. “Today, the situation looks very different,” Darkfost wrote. Those Binance inflows “have been divided by three and now stand at around $2.74 billion,” with “daily movements” becoming “far less frequent than during the cluster observed at the end of November.”

The analyst framed the drop as an observable behavioral pivot rather than a single-day anomaly. “This shift in dynamics suggests that whales have changed their behavior,” Darkfost wrote. “They are no longer selling aggressively and now appear to favor waiting.”

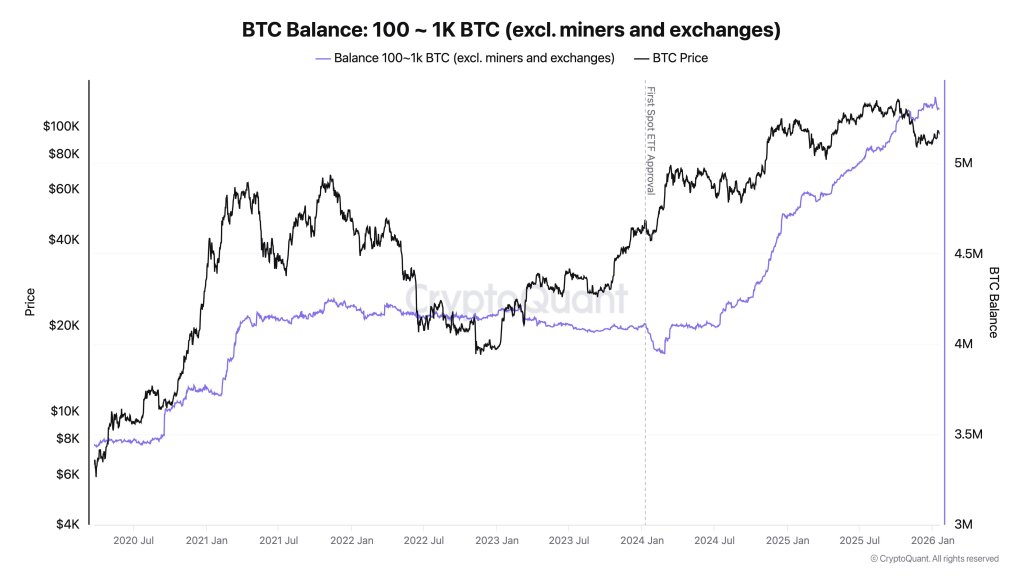

Institutional Demand Side Remains Robust

While Darkfost’s post focuses on whale-associated inflows as a proxy for potential sell pressure, CryptoQuant CEO Ki Young Ju pointed investors to the other side of the ledger: institutional accumulation.

“Institutional demand for Bitcoin remains strong,” Ki wrote on X. “US custody wallets typically hold 100–1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.”

Ki added that “577K BTC ($53B) [was] added over the past year, and still flowing in,” characterizing the trend as ongoing rather than a completed wave.

At press time, Bitcoin traded at $90,885.

The recent price movements of Bitcoin are unfolding in a notably quiet environment and are largely absent from retail participation. Unlike past rallies that were fueled by viral speculation and surging search interest, the current advance appears to be driven by a different class of buyers.

How Retail Activity Remains Muted Despite Price Movement

Bitcoin is not being driven by retail emotion. An analyst known as the Master of Crypto highlighted on X that after President Donald Trump’s latest news hit the headlines, the market stayed flat for more than a day, despite BTC trading nonstop. The real move only began when Asian institutional flows entered the market, and gold followed the same pattern.

This suggests that most breaking news explanations are written after the price has already been decided. The most concerning is that retail traders continue to pile into leverage even with clear warnings. Meanwhile, this was the third tariff-related headline from Trump, and BTC has reacted negatively to every single one.

Any company that is capitalized entirely in a single fiat currency is exposed to catastrophic loss if that currency fails. Ben Werkman has pointed out that history shows that this risk repeatedly occurred with outright collapse, just like the Iranian rial, Argentine peso, Venezuelan bolívar, Zimbabwe dollar, and Lebanese pound, which have experienced severe breakdowns in purchasing power. Meanwhile, currencies like the Turkish lira and Sri Lankan rupee have undergone major devaluation cycles.

When a monetary regime breaks, unhedged corporate balance sheets tend to break with it. Werkman argues that Bitcoin introduces an unprecedented hedge in this context. As a non-sovereign, globally liquid asset, BTC cannot be devalued overnight by a single policy decision or local political crisis. Companies may want to accumulate some BTC on their balance sheet, just in case these real-world events continue to happen.

Key Levels That Will Define the Next Expansion Phase

According to Creptosolutions, Bitcoin is now centered around the key zone of $90,000 and $92,000, an area that previously acted as strong support, after topping near $126,000. If the bullish market structure remains valid, this level must continue to hold.

The price action here is not random. After a major rally, BTC is now compressing, suggesting that the market is building energy for the next direction. As long as the price remains above $90,000, buyers retain structural control, and another move up remains possible. If BTC sustained a break back above $103,000, it would continue surging higher.

On the downside, a weekly close below $90,000 would turn the momentum negative, with a deeper drop toward the $85,000 to $80,000 zone. Currently, BTC is still moving in a narrow range and has not yet chosen a direction. This kind of behaviour usually leads to a strong move. The weekly close is more important than short-term price swings. How price behaves around the $90,000 level will provide the clearest signal of the next major move.