Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

The GENIUS Act promises safer, fully reserved dollar stablecoins and faster payments, but by steering issuers toward T-bills and cash, it may also hardwire a new demand engine for US debt.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Goldman's acquisition of Innovator Capital Management could significantly enhance its position in the rapidly expanding active ETF market.

The post Goldman Sachs to buy Innovator Capital Management in push to grow its ETF lineup appeared first on Crypto Briefing.

Strategy's continued Bitcoin accumulation amid market volatility underscores its commitment to digital assets as a long-term treasury strategy.

The post Strategy acquires 130 Bitcoin at $90K, holdings reach 650,000 BTC appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

The leading Ethereum network is witnessing serious engagement even as its price struggles to undergo a major surge. After a massive wave of both new and old investors, the ETH mainnet utilization has increased drastically, reaching levels of adoption not seen since its inception.

Historic Lift-Off For Ethereum Mainnet Utilization

Ethereum is undergoing a shift in network adoption. In a significant landmark that cements its dominance, the Ethereum Maninnet usage has increased to the point where it feels more like a structural awakening than regular growth.

Leon Waidmann, the founder of On-Chain Foundation and market expert, reported that the ETH mainnet’s utilization is currently at an all-time high. This kind of spike in network traffic may indicate the return of activity from the periphery to the center of the chain, new applications, or even a resurgence of trust in the network’s long-term prospects.

Data shared by the market expert shows the network’s usage in the past 30 days rose to 1.97mags/s, marking its highest level in history. The chart reveals that the rise to a new peak represents a more than 57% increase in Year-Over-Year (YoY), indicating that ETH is moving with intent once again.

While weak network effects and parasitic Layer 2s are being debated within the community, Waidmann highlighted that the Ethereum Mainnet continues to display strong growth and strength. This robust growth is evidenced by the increase in activity, spiking gas fees, and the surge in the number of ETH being burned.

By combining these key factors about the network, Waidmann claims that ETH could attract more economic load. As a result, the leading altcoin may gradually shed its old skin and take on a more rigid financial function.

Waidmann has declared that ETH could become harder money and a settlement collateral. As a result, ETH is starting to resemble the foundation of a future financial structure rather than just a utility token.

ETH Layer 2s Dominates Network’s Transactions

In the midst of surging network activity and adoption, Ethereum layer 2s are now dominating in terms of transactions at a speed that makes the base layer feel nearly slow in contrast. While the center might still hold, the edges are undeniably where users’ action currently resides.

Last week, Waidmann noted that the total Transaction Per Second (TPS) across the Ethereum network reached over 358.21. Meanwhile, a more significant portion of these transactions was carried out on layer 2 networks. According to the data shared by the on-chain Foundation founder, layer 2s controlled over 95.2% of the overall throughput.

Such a development implies that execution has largely moved to the layer 2 chains. A major reason for this might be that users, liquidity, and developers are looking for quicker and less expensive channels to carry out transactions, transforming ETH’s scaling stack into the ecosystem’s actual heartbeat.

Quick Facts:

Solana meme coin volume falling to a two-year low suggests traders are moving away from pure degen churn and toward narratives with more durable engagement.

Solana meme coin volume falling to a two-year low suggests traders are moving away from pure degen churn and toward narratives with more durable engagement. Next‑cycle meme plays increasingly blend game mechanics, rewards, or social layers to keep communities active between major catalysts and exchange listings.

Next‑cycle meme plays increasingly blend game mechanics, rewards, or social layers to keep communities active between major catalysts and exchange listings. PEPENODE ($PEPENODE) targets this shift with a virtual mine‑to‑earn system, aiming to replace hardware mining complexity with gamified nodes and progressive in‑app rewards.

PEPENODE ($PEPENODE) targets this shift with a virtual mine‑to‑earn system, aiming to replace hardware mining complexity with gamified nodes and progressive in‑app rewards. $PEPENODE has raised $2.2M in presale so far and positions itself for a potential 513% ROI by end-2026.

$PEPENODE has raised $2.2M in presale so far and positions itself for a potential 513% ROI by end-2026.

Solana meme coin volume sliding to a two-year low is more than a blip on a chart.

$SOL itself is already down 7% in the market after a 31.45% dip over the past 30 days.

It’s a sign that traders are getting tired of pure degen rotations where tokens moon and then die within days. Liquidity is thinning on short-lived hype, and the market is quietly asking for something stickier than the next dog mascot.

You’re seeing it in sentiment: traders want meme coins that still deliver the dopamine hit, but with a storyline or mechanic that gives people a reason to come back tomorrow. Simple ‘buy, wait, pray for a CEX listing’ models feel dated when everyone has lived through multiple meme coin cycles already.

That’s why capital rotation away from hyperactive Solana meme coin churn matters.

In that context, PEPENODE ($PEPENODE) positions itself as a different way to play the next meme coin cycle: a mine-to-earn ERC‑20 token on Ethereum that wraps meme coin culture around a virtual mining game.

In that context, PEPENODE ($PEPENODE) positions itself as a different way to play the next meme coin cycle: a mine-to-earn ERC‑20 token on Ethereum that wraps meme coin culture around a virtual mining game.

Instead of needing ASICs or GPUs, users operate gamified mining nodes through a dashboard, turning what’s usually a back-end infrastructure process into front-end entertainment.

Visit the official $PEPENODE presale website for more project details.

Visit the official $PEPENODE presale website for more project details.

Why Meme Coin Capital Is Rotating Toward Mechanics, Not Just Mascots

The last two years of Solana meme coin mania have shown how quickly pure narrative trades can exhaust themselves. High-frequency launches, thin liquidity, and rapid rug cycles have trained traders to treat most new tokens as intraday lottery tickets, not communities to actually stick with beyond a few volatile sessions.

As that playbook gets crowded, there is growing interest in meme coin projects that bolt on real mechanics: gamification, social farming layers, NFT-based perks, or yield-style reward systems.

As that playbook gets crowded, there is growing interest in meme coin projects that bolt on real mechanics: gamification, social farming layers, NFT-based perks, or yield-style reward systems.

These don’t turn meme coins into blue-chip fundamentals, but they do offer repeatable actions and progression systems that survive beyond initial hype.

Competing efforts span across chains: gaming-infused memes on BNB Chain, social-fi memes on Base, and experimental ‘work-to-earn’ or ‘engage-to-earn’ designs on Ethereum and Solana.

In this mix, $PEPENODE is one of several projects that aims to capture rotating capital by making the meme coin itself the front end of a simplified mining and rewards economy, rather than just a ticker symbol.

Buy your $PEPENODE today.

Buy your $PEPENODE today.

Inside PEPENODE’s Virtual Mine-to-Earn Narrative

Where most mining-related projects lean into hardware jargon and hash power charts, PEPENODE ($PEPENODE) flips the script with a virtual mining system.

You’ll be able to buy and customize mining nodes, upgrade in‑game facilities to boost performance, and earn meme coin rewards like $PEPE and $FARTCOIN, all without using a single watt of real electricity or configuring actual rigs.

The project’s core pitch is solving recurring pain points at once: mining that feels boring or opaque and technical hurdles that keep non‑miners on the sidelines.

Early adopters in PEPENODE’s ecosystem can secure more powerful nodes with higher reward potential, effectively front‑loading upside for those willing to join before the full gameplay loop goes live.

On the token side, $PEPENODE runs as an ERC‑20 on Ethereum’s proof‑of‑stake network, with smart contracts handling staking logic, rewards, and governance hooks.

The presale has raised over $2.2M so far, with tokens currently priced at $0.0011731. As for staking, the $PEPENODE presale offers an impressive 578% APY.

The presale has raised over $2.2M so far, with tokens currently priced at $0.0011731. As for staking, the $PEPENODE presale offers an impressive 578% APY.

As is the nature of presales, though, the price will increase in stages, while staking APY will drop as more $PEPENODE holders join the staking pool.

That makes now the the perfect time to join the $PEPENODE presale. If you’re planning to do just that, take a look at our guide to buying $PEPENODE.

Our price prediction for $PEPENODE puts the token at a potential $0.0072 by end-2026 and $0.0244 or higher by 2030. In terms of ROI, these numbers translate to 513% and 1,979% respectively.

Ready to jump in? Join the $PEPENODE presale before the next price increase.

Ready to jump in? Join the $PEPENODE presale before the next price increase.

Disclaimer: This isn’t financial advice. Always do your own research before making any investment decision.

Authored by Bogdan Patru, Bitcoinist – https://bitcoinist.com/solana-meme-coin-volume-hits-2-year-low-investors-turn-to-pepenode

https://cryptoslate.com/feed/

US-listed Bitcoin ETFs capped their second-heaviest month of redemptions with a rare late-month shift back into positive flows.

According to SoSo Value data, the 12 US-listed spot Bitcoin funds recorded net creation of roughly $70 million in the final days of November, after four weeks of relentless selling pressure that totalled more than $4.3 billion in net outflows.

Despite the modest nominal reversal, the timing of this brief respite from outflows suggests a critical exhaustion of seller momentum.

Considering this, the market enters December in a fragile equilibrium, caught between a constructive supply shock and a disjointed macroeconomic calendar that threatens to leave policymakers and traders flying blind.

Bitcoin ETFs and their poor November

November served as an actual structural stress test for the mature ETF complex, confirming what the market has long believed: these products are now the unequivocal price-setters for the asset class.

Last month, Bitcoin ETFs recorded $3.48 billion in net outflows, the deepest negative print since February.

The composition of the exit suggests a broad-based tactical retreat rather than a fundamental capitulation.

BlackRock’s IBIT, which is typically the sector’s liquidity vacuum, led the outflows, shedding $2.34 billion. This marks a significant rotation for a fund that has dominated inflows for most of the year.

Fidelity’s FBTC saw $412.5 million in redemptions, while Grayscale’s GBTC continued its slow bleed with $333 million in outflows. Ark Invest’s ARKB and VanEck’s HODL also saw capital flight, recording exits of $205.8 million and $121.9 million, respectively.

Yet, the bearish impulse revealed a silver lining regarding market depth.

Despite a nearly $3.5 billion monthly exit, Bitcoin price action defended the mid-$80,000s, refusing to break market structure to the downside. This resilience implies that while tactical capital retreated to lock in year-to-date gains, underlying demand remained sticky.

Still, the cumulative net inflows for spot Bitcoin ETFs since January 2024 sit at a robust $57.71 billion, and the funds collectively hold approximately $120 billion in assets.

The multiplier effect

The significance of the late-November stabilization is best understood through the mechanics of network issuance, which gives ETFs outsized leverage in price discovery.

Following the 2024 Bitcoin halving, the network’s block subsidy dropped to 3.125 BTC per block, capping daily coin issuance at roughly 450.

At current valuations, this equates to roughly $38 million to $40 million in daily new sell pressure from miners. In this supply-constrained environment, even a “trickle” of ETF inflows can act as a powerful lever.

So, net creations in the $50 million to $100 million daily range are sufficient to absorb the entire daily issuance multiple times over. This means that when flows turn positive, market makers are forced to bid up spot inventory to satisfy creation units, as there is no structural surplus of new coins to dampen the demand.

Conversely, this leverage works against the price during periods of liquidation. The sustained $100 million-plus daily outflows seen throughout November forced issuers to return Bitcoin to the market, requiring liquidity providers to absorb not only the 450 new coins minted daily but also thousands of coins from unwinding ETF baskets.

If the $70 million net inflow seen last week continues, the supply-demand dynamics shift back in favor of price support, removing the artificial supply overhang that defined November.

December’s macro visibility gap

While the internal market structure appears to be healing, the external macro environment presents a unique risk for December.

Bitcoin investors are preparing for an unusual disconnect in the economic calendar as the Federal Reserve’s Federal Open Market Committee (FOMC) meets on Dec. 9–10.

Still, the next Consumer Price Index (CPI) reading will not be released until Dec. 18, following the shutdown-related cancellation of October’s data collection.

This sequence creates a “blind flight” scenario. The Federal Reserve will be forced to set the tone for interest rates and update its economic projections without the most critical data point markets use to anchor inflation expectations.

This is a dangerous ambiguity for Bitcoin, which remains highly correlated to global liquidity conditions and real rates.

Market participants will be forced to extrapolate policy intent from guidance rather than hard numbers. A hawkish tilt from Chair Jerome Powell could rapidly tighten financial conditions, especially if it is delivered without the counter-narrative of inflation data.

In a scenario where the Fed signals “higher for longer” to hedge against the missing data, the conditions that drove November’s drawdown could quickly re-emerge, punishing risk assets before the CPI print can validate or refute the central bank’s stance.

Meanwhile, the macro disconnect is further complicated by seasonality.

December liquidity typically thins significantly as hedge funds and institutional desks lock in annual performance and reduce gross exposure heading into the holiday season. In a thin market, order books become shallower, meaning smaller flow numbers can trigger outsized price moves.

Bitcoin ETFs flow equation

Considering the above, market participants are increasingly framing December through flow bands rather than directional price targets, reflecting how tightly ETF activity now anchors Bitcoin’s trading range.

If net creations hold in the $50 million to $100 million band, the complex would absorb roughly 11,500 BTC for every $1 billion in inflows at an $86,800 reference price, equivalent to 25 to 50 times daily issuance.

| Flow Band (Daily Net Flows) | Monthly Impact | BTC Absorption (per $1B inflows at $86,800/BTC) | Issuance Multiple | Market Implication |

|---|---|---|---|---|

| +$150M to +$200M | +$3B to +$4B | ~11,500 BTC per $1B | 25x–50x | Strong upward pressure; liquidity tightens across venues |

| +$50M to +$100M | +$1B to +$2B | ~11,500 BTC per $1B | 25x–50x | Structural support; ETFs absorb multiples of daily issuance |

| –$50M to –$150M | –$1B to –$3B | N/A (net selling) | N/A | Recreates November’s dynamic; market makers forced to source BTC; elevated volatility |

| 0 to +$50M | Flat to +$1B | Modest absorption | Slightly > issuance | Neutral to mildly supportive; stability depends on macro tone |

| Below –$150M | Worse than –$3B | N/A | N/A | Severe liquidity stress; accelerates downside in thin year-end markets |

However, a move back into outflows within the $50 million to $150 million zone would recreate November’s pressure, but in a market contending with even thinner year-end liquidity.

In that setting, policy uncertainty and reduced market depth tend to amplify volatility, leaving ETF flows as the dominant force shaping Bitcoin’s direction into the new year.

The post Bitcoin ETFs end brutal November with a late $70M inflow appeared first on CryptoSlate.

Bitcoin price erased recent gains, shedding nearly 5% to below $87,000 in early Asian trading hours on Dec. 1.

This came as a surge in Japanese government bond yields triggered a broad risk-off sentiment, shattering a fragile, low-volume market structure.

According to CryptoSlate data, BTC fell from a consolidation range near $91,000, wiping out approximately $150 billion in total crypto market capitalization.

Japan’s carry-trade repricing set the decline in motion, but trading volume data showed that the selloff worsened due to a market running on minimal liquidity

According to 10x Research, the crypto market had just delivered one of its lowest-volume weeks since July, leaving order books dangerously thin and unable to absorb institutional selling pressure.

So, Bitcoin’s decline wasn’t just a reaction to headlines but a structural failure at a key resistance level.

The volume vacuum

Beneath the surface of Bitcoin’s $3.1 trillion market cap, which rose 4% week-over-week, liquidity seems to have evaporated.

Data from 10x Research indicates that average weekly volumes have plummeted to $127 billion. Bitcoin volumes specifically were down 31% at $59.9 billion, while ETH volumes collapsed 43%.

This lack of participation turned what could have been a pretty standard technical correction into a liquidity event.

Timothy Misir, head of research at BRN, told CryptoSlate that this was “not a measured correction.” Instead, he painted it as a “liquidity event driven by positioning and macro repricing.”

He further observed that momentum “abruptly flipped” after a messy November, creating a deep gap lower that flushed leveraged longs. November was Bitcoin’s worst-performing month this year, losing nearly 18% of its value.

As a result, the shallow market depth meant that what might have been a 2% move during a high-volume week turned into a 5% rout during the illiquid weekend window.

A tale of two leverages

The current price decline has led to a significant number of liquidations, with nearly 220,000 crypto traders losing $636.69 million.

Still, the selloff also exposed a dangerous divergence in how traders are positioned across the two most significant crypto assets.

10x Research reported that Bitcoin traders have been de-risking, while ETH traders have been aggressively adding leverage. This has created a lopsided risk profile in the derivatives market.

According to the firm, Bitcoin futures open interest decreased by $1.1 billion to $29.7 billion leading up to the drop, with funding rates rising modestly to 4.3%, placing it in the 20th percentile of the last 12 months.

This suggests the Bitcoin market was relatively “cool” and that exposure was unwinding.

On the other hand, ETH is now flashing warning signals.

Despite network activity being essentially dormant, with gas fees sitting in the 5th percentile of usage, speculative fervor has overheated.

Funding rates surged to 20.4%, placing the cost of leverage in the 83rd percentile of the past year, while open interest climbed by $900 million.

This disconnect, where Ethereum is seeing “frothy” speculative demand despite a collapsing network utility, suggests the market is mispricing risk.

Macro triggers

While market structure provided the fuel, the spark arrived from Tokyo.

The 10-year Japanese government bond (JGB) yield climbed to 1.84%, a level unseen since April 2008, while the two-year yield breached 1% for the first time since the 2008 Global Financial Crisis.

These moves have repriced expectations for the Bank of Japan’s (BOJ) monetary policy, with markets increasingly pricing in a rate hike for mid-December. This threatens the “yen carry trade,” where investors borrow cheap yen to fund risk assets.

Arthur Hayes, co-founder of BitMEX, noted that the BOJ has “put a December rate hike in play,” strengthening the yen and raising the cost of capital for global speculators.

But the macro anxiety isn’t limited to Japan.

BRN’s Misir points to Gold’s continued rally to $4,250 as evidence that global traders are hedging against persistent inflation or rising fiscal risks. He noted:

“When macro liquidity tightens, crypto, a high-beta asset, often retests lower bands first.”

With US employment data and ISM prints due later in the week, the market faces a gauntlet of “event risk” that could further strain the already low liquidity.

Retail distress and on-chain reality

The fallout has damaged the technical picture for Bitcoin, pushing the price below the “short-term holder cost basis,” a critical level that often distinguishes between bull market dips and deeper corrections.

On-chain flows paint a picture of distribution from smart money to retail hands.

According to BRN analysis, accumulation by long-term holders and large wallets has decelerated. In their place, retail cohorts holding less than 1 BTC have been buying at “distressed levels.”

While this indicates some demand, the absence of whale accumulation suggests institutional investors are waiting for lower prices.

Misir said:

“The main takeaway is that supply has shifted closer to stronger hands, but supply-overhang remains above key resistance bands.”

However, there is quite a bit of “dry powder” on the sidelines. Stablecoin balances on exchanges have risen, signaling that traders have capital ready to deploy. But with Bitcoin futures traders unwinding and ETFs largely offline during the weekend drop, that capital has yet to step in aggressively.

Considering this, the market is now looking at the mid-$80,000s for structural support.

However, a failure to reclaim the low-$90,000s would signal that the weekend’s liquidity flush has further to run, potentially targeting the low-$80,000s as the unwinding of the yen carry trade ripples through the system.

The post $150B wiped: Bitcoin drops below $87k on Japan yield shock appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Is the Chainlink ETF hype enough to reverse the 60% odds of a red December?

Is the Chainlink ETF hype enough to reverse the 60% odds of a red December? Meet the Top 1% in Web3. From industry leaders, visionaries, and innovators of the Blockchain […]

Meet the Top 1% in Web3. From industry leaders, visionaries, and innovators of the Blockchain […]https://beincrypto.com/feed/

Market sentiment shifted into extreme fear on December 1. Short positions are dominating the derivatives market. Several major altcoins are exhibiting severe imbalances in their liquidation maps, which could trigger a new record in liquidations.

The following analysis highlights the underlying factors that could cause the market to deviate from short-term expectations in the first week of December.

1. Ethereum (ETH)

ETH’s 7-day liquidation map shows that cumulative liquidation volume from short positions significantly outweighs that of long positions. This indicates that traders are aggressively shorting ETH.

If ETH rebounds to $3,150 this week, cumulative short liquidations could exceed $4 billion.

What risks should short sellers consider? On-chain data on ETH exchange balances may be an important signal.

CryptoQuant data shows that ETH supply on exchanges has dropped to an all-time low of 16.6 million ETH. The trend of withdrawing ETH from exchanges has accelerated over the past month, despite ETH’s price decline.

“With ETH exchange reserves hitting record lows… I believe Ethereum will lead the next market leg up,” investor Momin predicted.

Although many analyses suggest further downside, the ongoing accumulation, reflected in falling exchange supply, could soon amplify scarcity as selling pressure weakens. This could trigger a sudden recovery in ETH.

2. Solana (SOL)

Similar to ETH, SOL shows a clear imbalance in its liquidation map. Traders have been actively shorting SOL in early December.

If SOL rebounds to $145 this week, cumulative short liquidations could surpass $1 billion.

Is there a basis for SOL to recover this week? On-chain indicators are reflecting positive signals. Nansen reported that Solana continued to lead in transaction count during the week.

On prediction markets, many investors still expect a price range of $150–$200 in December. Additionally, US-based SOL ETFs have experienced five consecutive weeks of inflows.

Recently, BitMEX co-founder Arthur Hayes also stated that only Ethereum and Solana have the institutional use cases necessary for long-term survival.

3. XRP

XRP’s 7-day liquidation map indicates that short activity is dominant. If XRP rebounds above $2.30 this week, cumulative short liquidations could exceed $500 million.

Short sellers should consider several factors.

- Ripple has received a series of positive developments. At the end of November, Ripple announced that RLUSD had been added to the green list by Abu Dhabi’s FSRA. Additionally, the Monetary Authority of Singapore (MAS) approved an expansion of the Major Payment Institution (MPI) license for Ripple Markets APAC.

- Moreover, similar to SOL, the XRP ETFs recorded $643 million in net inflows during their first month, indicating strong demand for XRP despite its stagnant price.

With these drivers, many analysts predict that XRP could reach $2.6 this month. Such a move would severely impact short sellers.

Rising Stablecoin Supply Signals a Possible Market Rebound

Another factor worth considering is the renewed expansion in stablecoin supply.

Coinglass data shows that the combined market cap of USDT, USDC, DAI, and FDUSD reached a new high of $267.5 billion at the start of December.

The rising stablecoin supply suggests that market liquidity may increase this month. Analyst Ted noted that this uptrend ends a four-week decline in stablecoin market cap.

“Stablecoin MCap is going up again. It went down for 4 consecutive weeks, which also explains the reason behind the dump. If this goes up from here, fresh liquidity will enter the crypto market, which is good for BTC and alts,” Ted said.

The three major altcoins mentioned above account for a combined $5.5 billion in potential liquidation volume if the market rebounds unexpectedly.

If a genuine recovery occurs, a new record for liquidation may be set. Investors may need to consider all these factors to minimize risks to their positions.

The post 3 Altcoins That Could Trigger a Liquidation Record in the First Week of December appeared first on BeInCrypto.

[Dubai, UAE – Dec. 1, 2025] The fifth edition of Cosmoverse, the flagship conference for the sovereign Cosmos blockchain ecosystem and interoperable finance, concluded last month in Split, Croatia. Held from October 30 to November 1, 2025, the event brought together a global audience of builders, institutional leaders, regulators, investors, and developers, reflecting a growing convergence between sovereign blockchain systems and traditional finance.

This year’s edition marked a strategic inflection point for Web3. Over three days, more than 60 sessions explored the technical, regulatory, and societal evolution of Web3 across curated tracks such as AI, Bitcoin, Tokenization, Policy, EVM, and Stablecoins. From Cosmos-native chains to multinational fintech platforms, the conference offered a comprehensive view into the decentralized future of finance and infrastructure.

Headline sessions included “Digital Euro in the Age of On-Chain Finance”, with representatives from the European Central Bank, Croatian National Bank, Cosmos Labs, and Bloomberg Adria. This session marked a first for multiple European central banks participating in a Web3 conference, engaging in open dialogue on the future of monetary systems. Jürgen Schaaf (European Central Bank) and Linardo Martinečević (Croatian National Bank) provided key insights into the Digital Euro, covering its institutional design, strategic objectives, and rollout roadmap, with implementation currently projected for 2029.

Followed by a fireside conversation with Revolut; and an AI mobility panel featuring Bosch, highlighting the rise of autonomous systems and decentralized infrastructure. Throughout the program, sessions showcased how traditional enterprises and frontier technologies are converging through sovereign blockchain frameworks.

Global voices from Visa, Bybit, Electrocoin, InterCapital, Boston Consulting Group (BCG), Informal Systems and the Forbes Technology Council joined on-stage sessions exploring how on-chain infrastructure can support public-private innovation. Visa’s Onur Özdemir revealed a pilot for a stablecoin liquidity and funding model with global banks. Meanwhile, Cosmos Labs led four keynotes outlining the Cosmos vision, the Cosmos Stack, the Cosmos EVM, and the Cosmos Hub (ATOM), presenting the roadmap and expanding role in institutional finance.

During his opening keynote, Maghnus Mareneck, Co-CEO of Cosmos Labs, announced a strategic push to expand adoption of the Cosmos Stack across governments and international banking systems. He confirmed that Cosmos Labs is actively developing two central bank digital currencies (CBDCs) in Latin America.

Additional initiatives include collaborations with Fortune 500 companies preparing to launch Cosmos-powered chains across sectors including banking, gaming with billion-dollar IPs, government-grade CBDCs, and asset management, with more details to be revealed beginning Q1 2026.

Cosmos Labs also confirmed that the Cosmos Hub (ATOM) will play a central role in this emerging vision, acting as foundational infrastructure for new institutional and enterprise deployments. The team outlined new services being explored for customers adopting the Cosmos Stack, including asset issuance, RPC and infrastructure services, and neutral interoperability services, among others.

Cosmoverse 2025 also hosted the Hackmos x DoraHacks hackathon, featuring 100 emerging builders from across Europe and beyond, and the CosmosVentures Pitching Competition, giving exposure to high-potential startups building within the ecosystem. VALT, founded by Zac Wickstrom, was named the winner of the Cosmoverse 2025 Pitching Competition. VALT’s mission is enabling users to access, secure, and monetize their personal data.

And as part of a tailored experience for decision-makers, the Cosmoverse Executive Lounge hosted curated activations that brought together industry leaders, enabling meaningful conversations and deal-making throughout the event.

At the closing ceremony, the Cosmoverse team officially unveiled its next destination: Cosmoverse 2026 will take place in Hong Kong, marking the conference’s expansion into Asia and reinforcing its role as the leading global platform for sovereign blockchain innovation and interoperable finance.

For a complete overview of the conference, including session highlights, key announcements, and insights, see the Cosmoverse 2025 Event Report.

About Cosmoverse

Cosmoverse is the Flagship Cosmos Conference and the World’s Leading Summit for Purpose-Built Blockchain Infrastructure. It connects builders, founders, investors, and institutions around shared values of sovereignty, modularity, and interoperability – empowering the development of a user-owned internet.

Website: cosmoverse.orgContact:contact@cosmoverse.org

The post Cosmoverse 2025 Set a New Standard for Web3 Conferences as Sovereign Chains, Central Banks & Cosmos Converged in Split appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

Large Dogecoin holders have sharply reduced their on-chain activity, with whale transactions falling to their lowest level in more than two months, according to fresh network data shared by on-chain analyst Ali Martinez.

Posting a Santiment chart on X, Martinez stated that “whale activity on the Dogecoin network has dropped to the lowest level in the past two months.” The chart tracks DOGE’s price against the number of transactions larger than $1 million. It shows frequent, tall spikes in high-value transfers in early October 2025, when price was oscillating near the upper end near $0.27.

Dogecoin Whales Plummets Sharply

On the day of the October 10 crash, the largest peak occurred when more than 280 Dogecoin whales made a transaction. This was followed by a progressive decline through late October and November. By November 29, the whale-transaction bar fell to 3 even as price trades around $0.15.

The drop has sparked debate about what it signals for market structure and liquidity. Responding to Martinez, analyst account CryptoGames3D argued that “whale activity dropping on Dogecoin could mean one of two things: either whales are holding tight and waiting, or they’re stepping out of the game; both cases bring risk. With low liquidity from big holders, even modest selling could hit prices hard.” The comment underlines concerns that thinner participation from large entities can make order books more fragile if conditions turn.

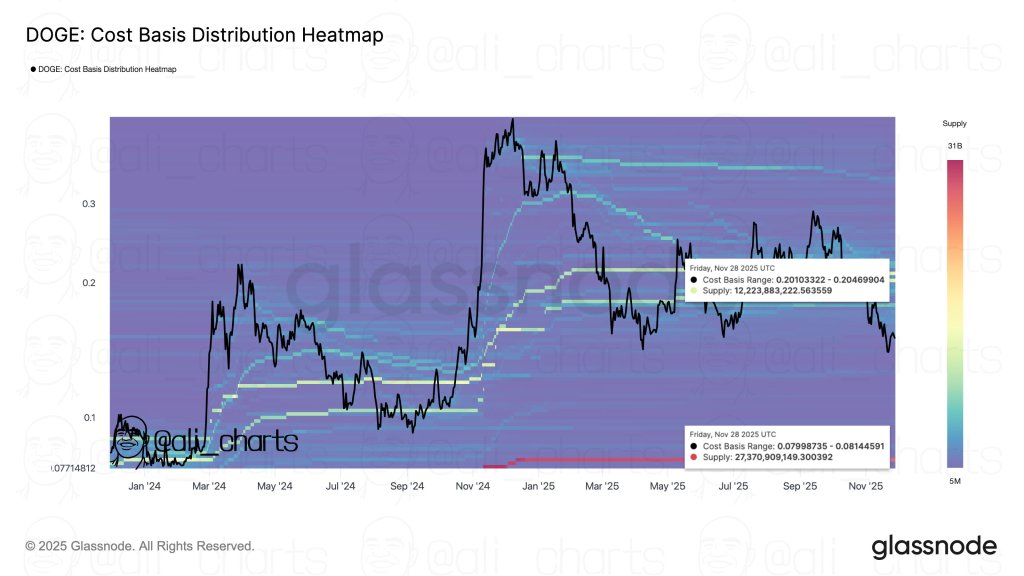

In a separate post on November 29, Martinez outlined what he called “key levels for Dogecoin DOGE,” citing “support at $0.08” and “resistance at $0.20.” Those levels are mirrored in a Glassnode cost-basis distribution heatmap he shared, which maps DOGE’s price since early 2024 against realized price bands where supply last moved.

The heatmap reveals a dense cluster of supply around $0.08. A highlighted range between roughly $0.07999 and $0.08145 contains about 27.37 billion DOGE, marking it as a major realized-price support zone. Higher up, a second but thinner band between approximately $0.20103 and $0.20470 holds around 12.22 billion DOGE, forming a significant resistance cohort. The color scale, running from about 5 million to 31 billion DOGE, emphasizes how pronounced the lower cluster is relative to other price areas.

Taken together, the datasets present a tightly framed picture. DOGE is currently trading between a heavy long-term holder cost basis near $0.08 and a resistance pocket around $0.20, while the count of $1 million-plus transfers has compressed to a multi-month low.

At press time, DOGE traded at $0.137.

What to Know:

- A 5% Bitcoin pullback and more than $500M in liquidations show how quickly overleveraged long positions unwind when volatility returns.

- Volatility spikes often drive traders out of crowded perpetual futures trades and into emerging Bitcoin-adjacent themes such as Layer-2 infrastructure and smart contract ecosystems.

- Bitcoin Hyper ($HYPER) is designed to close Bitcoin’s throughput and programmability gaps with an SVM-backed Layer-2 offering sub-second execution anchored to the Bitcoin base layer.

- Rising interest in Bitcoin-native DeFi and high-speed payment rails indicates that Bitcoin Layer-2 narratives may become increasingly influential in the next market cycle.

Bitcoin’s latest Sunday Slam was a sharp 5% intraday drop with over $500M in liquidations, a reminder of how brutal leverage can be when volatility snaps back.

Longs that looked safe on Saturday night were wiped out by Sunday afternoon, as cascading liquidations hit major derivatives venues.

As a trader or longer-term holder, this kind of move is less about the exact candle and more about the narrative rotation it triggers. Every sharp drawdown tends to shake confidence in crowded trades and push capital toward new Bitcoin-adjacent themes that promise outsized upside relative to spot $BTC.

That’s why we’re suddenly seeing more attention on Bitcoin Layer-2 infrastructure, especially projects that claim to unlock real programmability and throughput without abandoning Bitcoin’s base-layer security.

That’s why we’re suddenly seeing more attention on Bitcoin Layer-2 infrastructure, especially projects that claim to unlock real programmability and throughput without abandoning Bitcoin’s base-layer security.

Instead of chasing another overleveraged bounce, some dip-buyers are rotating into early-stage infrastructure plays that could outperform if the next leg up is driven by Bitcoin-native DeFi and smart contracts.

Bitcoin Hyper ($HYPER) is beginning to surface as one of the more aggressive bets: a Bitcoin Layer-2 built around the Solana Virtual Machine (SVM), pitching sub-second execution and high-throughput smart contracts settled back to Bitcoin.

As interest grows, we’re here to explain what Bitcoin Hyper is and why it’s dominating the narrative for traders hunting the next high-beta Bitcoin play.

As interest grows, we’re here to explain what Bitcoin Hyper is and why it’s dominating the narrative for traders hunting the next high-beta Bitcoin play.

Why Volatile Drawdowns Push Capital Toward Bitcoin Layer-2s

This 5% flush and half-billion in liquidations underlined how fragile overleveraged Bitcoin longs are whenever funding gets crowded.

When volatility returns, it’s the perp traders – not long-term holders – who eat the first loss. And that shock often sends sidelined capital searching for cleaner, earlier-stage narratives tied to Bitcoin’s upside.

Layer-2 projects have become a natural outlet for that rotation. They all promise to make Bitcoin more usable for payments, DeFi, or tokens, but each often makes trade-offs around trust, speed, or composability. Competing efforts are racing to offer low fees, programmable environments, and better user experience while still anchoring to Bitcoin’s settlement layer.

In that landscape, Bitcoin Hyper is positioning itself as one of several emerging options, but with a very different tack: instead of building a minimalist scripting layer, it’s importing the Solana Virtual Machine model directly into a Bitcoin-secured Layer-2.

In that landscape, Bitcoin Hyper is positioning itself as one of several emerging options, but with a very different tack: instead of building a minimalist scripting layer, it’s importing the Solana Virtual Machine model directly into a Bitcoin-secured Layer-2.

For traders, that ties a familiar high-throughput smart contract stack to the oldest and most battle-tested base layer in crypto.

Bitcoin Hyper Bets on SVM Speed Anchored to Bitcoin Security

Where most Bitcoin scaling efforts focus on payments or simple scripting, Bitcoin Hyper is pitching something bolder: delivering Bitcoin’s reliability and Solana’s execution.

The design uses Bitcoin’s Layer-1 for settlement and a real-time SVM Layer-2 for execution, targeting sub-second finality and low fees for complex dApps.

The design uses Bitcoin’s Layer-1 for settlement and a real-time SVM Layer-2 for execution, targeting sub-second finality and low fees for complex dApps.

On the execution layer, Bitcoin Hyper runs SVM-based smart contracts, meaning developers used to Solana’s tooling and Rust-based workflows can port or build DeFi, NFT, and gaming applications with minimal friction.

SPL-compatible tokens are modified for this Layer-2 environment, while a decentralized canonical bridge is intended to move $BTC into wrapped representations for use in swaps, lending, and high-speed payments.

That combination of throughput and familiarity appears to be resonating with early participants. The presale has already raised over $28.8M, suggesting meaningful demand for a Bitcoin-secured, SVM-powered environment.

That combination of throughput and familiarity appears to be resonating with early participants. The presale has already raised over $28.8M, suggesting meaningful demand for a Bitcoin-secured, SVM-powered environment.

Smart money is moving, too. Whale buys include major purchases of $502.6K and $397K. Right now, $HYPER costs $0.013355 per token, and staking is at 40% APY. The next price increase, however, is just a few hours away.

Check out our guide to buying $HYPER to join the presale now.

Check out our guide to buying $HYPER to join the presale now.

For dip-buyers who just watched overleveraged longs get wiped out, reallocating into an early Bitcoin Layer-2 narrative like $HYPER is one way to seek higher upside without simply reloading perps.

If you believe the next Bitcoin cycle will be driven less by passive holding and more by on-chain activity, then a programmable, SVM-based Layer-2 becomes a clear speculative venue.

Ready to jump in? Buy Bitcoin Hyper ($HYPER) today.

Ready to jump in? Buy Bitcoin Hyper ($HYPER) today.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or trading advice. Always do your own research and never invest more than you can afford to lose.

Authored by Aaron Walker for NewsBTC – https://www.newsbtc.com/news/bitcoin-dips-5-percent-liquidations-surge-bitcoin-hyper-booms