Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Strategy funded a new reserve from stock sales to cover at least 12 months of dividends as it boosts its Bitcoin stash to 650,000 coins amid market volatility.

Ether price held $2,800 support amid ETF inflows and undervalued signals, but $3,000 resistance and Bank of Japan rate hike fears stopped the recovery.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Strategy's continued Bitcoin accumulation amid market volatility underscores its commitment to digital assets as a long-term treasury strategy.

The post Strategy acquires 130 Bitcoin at $90K, holdings reach 650,000 BTC appeared first on Crypto Briefing.

Strategy's reserve move may enhance investor confidence, ensuring financial stability and potentially influencing corporate dividend strategies.

The post Strategy launches $1.4 billion reserve to support dividend payments appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

The leading Ethereum network is witnessing serious engagement even as its price struggles to undergo a major surge. After a massive wave of both new and old investors, the ETH mainnet utilization has increased drastically, reaching levels of adoption not seen since its inception.

Historic Lift-Off For Ethereum Mainnet Utilization

Ethereum is undergoing a shift in network adoption. In a significant landmark that cements its dominance, the Ethereum Maninnet usage has increased to the point where it feels more like a structural awakening than regular growth.

Leon Waidmann, the founder of On-Chain Foundation and market expert, reported that the ETH mainnet’s utilization is currently at an all-time high. This kind of spike in network traffic may indicate the return of activity from the periphery to the center of the chain, new applications, or even a resurgence of trust in the network’s long-term prospects.

Data shared by the market expert shows the network’s usage in the past 30 days rose to 1.97mags/s, marking its highest level in history. The chart reveals that the rise to a new peak represents a more than 57% increase in Year-Over-Year (YoY), indicating that ETH is moving with intent once again.

While weak network effects and parasitic Layer 2s are being debated within the community, Waidmann highlighted that the Ethereum Mainnet continues to display strong growth and strength. This robust growth is evidenced by the increase in activity, spiking gas fees, and the surge in the number of ETH being burned.

By combining these key factors about the network, Waidmann claims that ETH could attract more economic load. As a result, the leading altcoin may gradually shed its old skin and take on a more rigid financial function.

Waidmann has declared that ETH could become harder money and a settlement collateral. As a result, ETH is starting to resemble the foundation of a future financial structure rather than just a utility token.

ETH Layer 2s Dominates Network’s Transactions

In the midst of surging network activity and adoption, Ethereum layer 2s are now dominating in terms of transactions at a speed that makes the base layer feel nearly slow in contrast. While the center might still hold, the edges are undeniably where users’ action currently resides.

Last week, Waidmann noted that the total Transaction Per Second (TPS) across the Ethereum network reached over 358.21. Meanwhile, a more significant portion of these transactions was carried out on layer 2 networks. According to the data shared by the on-chain Foundation founder, layer 2s controlled over 95.2% of the overall throughput.

Such a development implies that execution has largely moved to the layer 2 chains. A major reason for this might be that users, liquidity, and developers are looking for quicker and less expensive channels to carry out transactions, transforming ETH’s scaling stack into the ecosystem’s actual heartbeat.

Quick Facts:

Solana meme coin volume falling to a two-year low suggests traders are moving away from pure degen churn and toward narratives with more durable engagement.

Solana meme coin volume falling to a two-year low suggests traders are moving away from pure degen churn and toward narratives with more durable engagement. Next‑cycle meme plays increasingly blend game mechanics, rewards, or social layers to keep communities active between major catalysts and exchange listings.

Next‑cycle meme plays increasingly blend game mechanics, rewards, or social layers to keep communities active between major catalysts and exchange listings. PEPENODE ($PEPENODE) targets this shift with a virtual mine‑to‑earn system, aiming to replace hardware mining complexity with gamified nodes and progressive in‑app rewards.

PEPENODE ($PEPENODE) targets this shift with a virtual mine‑to‑earn system, aiming to replace hardware mining complexity with gamified nodes and progressive in‑app rewards. $PEPENODE has raised $2.2M in presale so far and positions itself for a potential 513% ROI by end-2026.

$PEPENODE has raised $2.2M in presale so far and positions itself for a potential 513% ROI by end-2026.

Solana meme coin volume sliding to a two-year low is more than a blip on a chart.

$SOL itself is already down 7% in the market after a 31.45% dip over the past 30 days.

It’s a sign that traders are getting tired of pure degen rotations where tokens moon and then die within days. Liquidity is thinning on short-lived hype, and the market is quietly asking for something stickier than the next dog mascot.

You’re seeing it in sentiment: traders want meme coins that still deliver the dopamine hit, but with a storyline or mechanic that gives people a reason to come back tomorrow. Simple ‘buy, wait, pray for a CEX listing’ models feel dated when everyone has lived through multiple meme coin cycles already.

That’s why capital rotation away from hyperactive Solana meme coin churn matters.

In that context, PEPENODE ($PEPENODE) positions itself as a different way to play the next meme coin cycle: a mine-to-earn ERC‑20 token on Ethereum that wraps meme coin culture around a virtual mining game.

In that context, PEPENODE ($PEPENODE) positions itself as a different way to play the next meme coin cycle: a mine-to-earn ERC‑20 token on Ethereum that wraps meme coin culture around a virtual mining game.

Instead of needing ASICs or GPUs, users operate gamified mining nodes through a dashboard, turning what’s usually a back-end infrastructure process into front-end entertainment.

Visit the official $PEPENODE presale website for more project details.

Visit the official $PEPENODE presale website for more project details.

Why Meme Coin Capital Is Rotating Toward Mechanics, Not Just Mascots

The last two years of Solana meme coin mania have shown how quickly pure narrative trades can exhaust themselves. High-frequency launches, thin liquidity, and rapid rug cycles have trained traders to treat most new tokens as intraday lottery tickets, not communities to actually stick with beyond a few volatile sessions.

As that playbook gets crowded, there is growing interest in meme coin projects that bolt on real mechanics: gamification, social farming layers, NFT-based perks, or yield-style reward systems.

As that playbook gets crowded, there is growing interest in meme coin projects that bolt on real mechanics: gamification, social farming layers, NFT-based perks, or yield-style reward systems.

These don’t turn meme coins into blue-chip fundamentals, but they do offer repeatable actions and progression systems that survive beyond initial hype.

Competing efforts span across chains: gaming-infused memes on BNB Chain, social-fi memes on Base, and experimental ‘work-to-earn’ or ‘engage-to-earn’ designs on Ethereum and Solana.

In this mix, $PEPENODE is one of several projects that aims to capture rotating capital by making the meme coin itself the front end of a simplified mining and rewards economy, rather than just a ticker symbol.

Buy your $PEPENODE today.

Buy your $PEPENODE today.

Inside PEPENODE’s Virtual Mine-to-Earn Narrative

Where most mining-related projects lean into hardware jargon and hash power charts, PEPENODE ($PEPENODE) flips the script with a virtual mining system.

You’ll be able to buy and customize mining nodes, upgrade in‑game facilities to boost performance, and earn meme coin rewards like $PEPE and $FARTCOIN, all without using a single watt of real electricity or configuring actual rigs.

The project’s core pitch is solving recurring pain points at once: mining that feels boring or opaque and technical hurdles that keep non‑miners on the sidelines.

Early adopters in PEPENODE’s ecosystem can secure more powerful nodes with higher reward potential, effectively front‑loading upside for those willing to join before the full gameplay loop goes live.

On the token side, $PEPENODE runs as an ERC‑20 on Ethereum’s proof‑of‑stake network, with smart contracts handling staking logic, rewards, and governance hooks.

The presale has raised over $2.2M so far, with tokens currently priced at $0.0011731. As for staking, the $PEPENODE presale offers an impressive 578% APY.

The presale has raised over $2.2M so far, with tokens currently priced at $0.0011731. As for staking, the $PEPENODE presale offers an impressive 578% APY.

As is the nature of presales, though, the price will increase in stages, while staking APY will drop as more $PEPENODE holders join the staking pool.

That makes now the the perfect time to join the $PEPENODE presale. If you’re planning to do just that, take a look at our guide to buying $PEPENODE.

Our price prediction for $PEPENODE puts the token at a potential $0.0072 by end-2026 and $0.0244 or higher by 2030. In terms of ROI, these numbers translate to 513% and 1,979% respectively.

Ready to jump in? Join the $PEPENODE presale before the next price increase.

Ready to jump in? Join the $PEPENODE presale before the next price increase.

Disclaimer: This isn’t financial advice. Always do your own research before making any investment decision.

Authored by Bogdan Patru, Bitcoinist – https://bitcoinist.com/solana-meme-coin-volume-hits-2-year-low-investors-turn-to-pepenode

https://cryptoslate.com/feed/

Bitcoin price erased recent gains, shedding nearly 5% to below $87,000 in early Asian trading hours on Dec. 1.

This came as a surge in Japanese government bond yields triggered a broad risk-off sentiment, shattering a fragile, low-volume market structure.

According to CryptoSlate data, BTC fell from a consolidation range near $91,000, wiping out approximately $150 billion in total crypto market capitalization.

Japan’s carry-trade repricing set the decline in motion, but trading volume data showed that the selloff worsened due to a market running on minimal liquidity

According to 10x Research, the crypto market had just delivered one of its lowest-volume weeks since July, leaving order books dangerously thin and unable to absorb institutional selling pressure.

So, Bitcoin’s decline wasn’t just a reaction to headlines but a structural failure at a key resistance level.

The volume vacuum

Beneath the surface of Bitcoin’s $3.1 trillion market cap, which rose 4% week-over-week, liquidity seems to have evaporated.

Data from 10x Research indicates that average weekly volumes have plummeted to $127 billion. Bitcoin volumes specifically were down 31% at $59.9 billion, while ETH volumes collapsed 43%.

This lack of participation turned what could have been a pretty standard technical correction into a liquidity event.

Timothy Misir, head of research at BRN, told CryptoSlate that this was “not a measured correction.” Instead, he painted it as a “liquidity event driven by positioning and macro repricing.”

He further observed that momentum “abruptly flipped” after a messy November, creating a deep gap lower that flushed leveraged longs. November was Bitcoin’s worst-performing month this year, losing nearly 18% of its value.

As a result, the shallow market depth meant that what might have been a 2% move during a high-volume week turned into a 5% rout during the illiquid weekend window.

A tale of two leverages

The current price decline has led to a significant number of liquidations, with nearly 220,000 crypto traders losing $636.69 million.

Still, the selloff also exposed a dangerous divergence in how traders are positioned across the two most significant crypto assets.

10x Research reported that Bitcoin traders have been de-risking, while ETH traders have been aggressively adding leverage. This has created a lopsided risk profile in the derivatives market.

According to the firm, Bitcoin futures open interest decreased by $1.1 billion to $29.7 billion leading up to the drop, with funding rates rising modestly to 4.3%, placing it in the 20th percentile of the last 12 months.

This suggests the Bitcoin market was relatively “cool” and that exposure was unwinding.

On the other hand, ETH is now flashing warning signals.

Despite network activity being essentially dormant, with gas fees sitting in the 5th percentile of usage, speculative fervor has overheated.

Funding rates surged to 20.4%, placing the cost of leverage in the 83rd percentile of the past year, while open interest climbed by $900 million.

This disconnect, where Ethereum is seeing “frothy” speculative demand despite a collapsing network utility, suggests the market is mispricing risk.

Macro triggers

While market structure provided the fuel, the spark arrived from Tokyo.

The 10-year Japanese government bond (JGB) yield climbed to 1.84%, a level unseen since April 2008, while the two-year yield breached 1% for the first time since the 2008 Global Financial Crisis.

These moves have repriced expectations for the Bank of Japan’s (BOJ) monetary policy, with markets increasingly pricing in a rate hike for mid-December. This threatens the “yen carry trade,” where investors borrow cheap yen to fund risk assets.

Arthur Hayes, co-founder of BitMEX, noted that the BOJ has “put a December rate hike in play,” strengthening the yen and raising the cost of capital for global speculators.

But the macro anxiety isn’t limited to Japan.

BRN’s Misir points to Gold’s continued rally to $4,250 as evidence that global traders are hedging against persistent inflation or rising fiscal risks. He noted:

“When macro liquidity tightens, crypto, a high-beta asset, often retests lower bands first.”

With US employment data and ISM prints due later in the week, the market faces a gauntlet of “event risk” that could further strain the already low liquidity.

Retail distress and on-chain reality

The fallout has damaged the technical picture for Bitcoin, pushing the price below the “short-term holder cost basis,” a critical level that often distinguishes between bull market dips and deeper corrections.

On-chain flows paint a picture of distribution from smart money to retail hands.

According to BRN analysis, accumulation by long-term holders and large wallets has decelerated. In their place, retail cohorts holding less than 1 BTC have been buying at “distressed levels.”

While this indicates some demand, the absence of whale accumulation suggests institutional investors are waiting for lower prices.

Misir said:

“The main takeaway is that supply has shifted closer to stronger hands, but supply-overhang remains above key resistance bands.”

However, there is quite a bit of “dry powder” on the sidelines. Stablecoin balances on exchanges have risen, signaling that traders have capital ready to deploy. But with Bitcoin futures traders unwinding and ETFs largely offline during the weekend drop, that capital has yet to step in aggressively.

Considering this, the market is now looking at the mid-$80,000s for structural support.

However, a failure to reclaim the low-$90,000s would signal that the weekend’s liquidity flush has further to run, potentially targeting the low-$80,000s as the unwinding of the yen carry trade ripples through the system.

The post $150B wiped: Bitcoin drops below $87k on Japan yield shock appeared first on CryptoSlate.

The digital asset landscape has matured significantly over the past several years. Simple spot holding is no longer the only viable strategy for generating substantial returns. Today’s market rewards precision, algorithmic discipline, and above all else, liquidity.

For skilled traders, the barrier to entry is rarely knowledge. Instead, it is capitalization. A trader may possess a strategy with a high Sharpe ratio and disciplined risk management, yet find their growth stunted by a personal account size that renders the math irrelevant.

This disconnect between skill and capital has given rise to a sophisticated ecosystem of crypto proprietary trading. The concept extends far beyond simply borrowing funds. It represents access to institutional-grade infrastructure that bridges the gap between retail speculation and professional execution.

The Capital Efficiency Paradox

Why do profitable traders fail to scale?

The answer often lies in mathematics rather than market movement. A trader operating with a 5,000 USDT personal account must take outsized risks to generate a livable income. This frequently leads to over-leveraging positions to the point of ruin. In contrast, a trader managing a funded account of 200,000 USDT can target conservative, low-variance moves and still generate substantial returns.

This dynamic creates what we might call the efficiency paradox: having more capital allows a trader to take less risk while making more money. By utilizing a proprietary firm’s resources, the focus shifts from desperate account flipping to sustainable wealth generation. The pressure to hit “home runs” evaporates entirely, replaced by the professional pursuit of consistent base hits.

Psychological Detachment as an Edge

When personal savings are on the line, emotional attachment distorts decision-making in profound ways. The fear of loss triggers the amygdala, causing traders to cut winners early. Even worse, it often leads to revenge trading after a loss. Proprietary trading constructs a firewall between the trader’s lifestyle and their trading capital, fundamentally changing the psychological equation.

In a funded environment, the downside is capped at a defined level. A trader might face a drawdown limit, but they are not risking their mortgage payment or emergency savings. This psychological freedom allows for the execution of strategies with cold, calculated precision. When the risk is systemic rather than personal, the trader can finally operate with the objectivity required to extract value from volatile markets.

Evaluating the Execution Environment

Not all funding models are created equal, and the differences matter significantly. In the early days of prop trading, firms were largely focused on Forex. They treated crypto as an afterthought, offering poor spreads and artificial slippage. The modern crypto trader requires a specialized environment built specifically for digital assets. If the underlying technology does not mirror live exchange conditions, the strategy is doomed to fail regardless of its theoretical merit.

A robust trading infrastructure must offer direct access to order books without intermediaries. Whether a trader is scalping Bitcoin perpetuals or navigating complex options strategies, the execution must be instantaneous.

This is where the distinction between a simulation and a career-building platform becomes evident. Identifying the best crypto prop trading firm requires careful examination of the execution model. The key is looking for firms like HyroTrader that route through major liquidity providers like ByBit or Binance rather than internal dealing desks that trade against their clients.

The Importance of True Market Data

A chart is only as good as its data feed, and this principle cannot be overstated. Artificial “wicks” designed to stop out retail traders are a hallmark of inferior platforms that prioritize their own profit over trader success. Professional prop firms utilize real-time data streams that ensure what a trader sees on the chart matches the global order book with complete accuracy.

For algorithmic traders and those utilizing automated bots, this transparency is non-negotiable. Strategies that rely on technical levels or high-frequency inputs cannot function properly if the price feed is manipulated or delayed. The ability to integrate tools like TradingView or connect via API directly to the exchange liquidity is what separates a gamified experience from a professional trading operation.

Meet HyroTrader

Founded in 2022 and based in Prague, HyroTrader is a proprietary trading firm specializing in cryptocurrency for traders. The company offers funded accounts of up to 200,000 USDT, which can be scaled to 1 million USDT with consistent performance.

Traders utilize real-time data to trade on ByBit or Binance through CLEO, ensuring authentic trading conditions. Profit sharing begins at 70% and can increase to 90%, with payouts made in USDT or USDC within 12-24 hours after earning $100 in profit.

Unlike many competitors, HyroTrader provides unlimited evaluation periods and refunds the challenge fee after the first payout, lowering entry costs. With over $2 million paid out and a global community, it offers a legitimate opportunity for skilled crypto traders to access institutional capital without risking personal funds.

Navigating Risk and Drawdown Constraints

The primary critique of proprietary trading is often the strictness of risk rules. However, these constraints are actually the training wheels of professionalism when viewed through the right lens. A 5% daily drawdown limit or a 10% maximum loss ceiling is not a trap designed to fail traders. It is a standard institutional risk parameter used by professionals worldwide. No hedge fund manager in the world is permitted to lose 20% of a portfolio in a single afternoon, and for good reason.

Learning to navigate these parameters is what refines a gambler into a genuine risk manager. The best environments offer unlimited time for evaluation, recognizing that quality trading cannot be rushed. The artificial pressure of a “30-day challenge” often forces traders to violate their own risk management rules just to beat the clock. Removing the time limit allows the trader to wait patiently for the highest probability setups, aligning their activity with market conditions rather than an arbitrary calendar deadline.

Scaling: The Path to Seven Figures

The trajectory for a crypto prop trader should not end at the initial funding stage. The true goal is scalability over time. A static account size eventually limits potential regardless of skill level, whereas a dynamic scaling plan rewards consistency and discipline.

Consider a roadmap that begins at 200,000 USDT. Through consistent performance, avoiding significant drawdowns, and hitting modest profit targets, a trader can see their allocation grow to 1,000,000 USDT. At this level, a profit split of 80% or 90% becomes genuinely life-changing, transforming trading from a side pursuit into a legitimate wealth-building vehicle.

The Cash Flow Advantage

Liquidity is king in any trading endeavor. In traditional finance, waiting 30 days for a wire transfer is standard practice. In the crypto ecosystem, money moves at the speed of the blockchain itself. Traders who live off their market returns require agility. They need the ability to request a withdrawal on a Sunday and receive USDT or USDC within hours rather than weeks.

This fluidity turns trading from a speculative venture into a reliable business operation with predictable cash flows. When profits can be realized and withdrawn immediately upon hitting a threshold, the feedback loop of success is powerfully reinforced. It allows the trader to compound their personal net worth steadily while leaving the firm’s capital at work in the markets.

The Future of Decentralized Opportunity

The convergence of cryptocurrency volatility and proprietary capital offers a unique moment in financial history. It allows individuals with skills to act as institutional players, regardless of their geographic location or personal net worth. The playing field has never been more level for talented traders seeking meaningful opportunities.

Whether employing high-frequency trading bots, executing manual price-action strategies, or hedging with options, the vehicle matters as much as the driver. By leveraging significant capital without personal risk, utilizing direct exchange execution, and operating within professional risk parameters, traders can unlock the full potential of the crypto markets. The era of the undercapitalized retail trader is ending. The era of the funded professional has arrived.

Disclaimer: This is a sponsored post. CryptoSlate does not endorse any of the projects mentioned in this article. Investors are encouraged to perform necessary due diligence.

The post Why Pro Traders Choose Crypto Prop Firms appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Meet the Top 1% in Web3. From industry leaders, visionaries, and innovators of the Blockchain […]

Meet the Top 1% in Web3. From industry leaders, visionaries, and innovators of the Blockchain […] All the gains that Solana made have been wiped out, and the price is testing the same $120 demand zone once more.

All the gains that Solana made have been wiped out, and the price is testing the same $120 demand zone once more.https://beincrypto.com/feed/

Market sentiment shifted into extreme fear on December 1. Short positions are dominating the derivatives market. Several major altcoins are exhibiting severe imbalances in their liquidation maps, which could trigger a new record in liquidations.

The following analysis highlights the underlying factors that could cause the market to deviate from short-term expectations in the first week of December.

1. Ethereum (ETH)

ETH’s 7-day liquidation map shows that cumulative liquidation volume from short positions significantly outweighs that of long positions. This indicates that traders are aggressively shorting ETH.

If ETH rebounds to $3,150 this week, cumulative short liquidations could exceed $4 billion.

What risks should short sellers consider? On-chain data on ETH exchange balances may be an important signal.

CryptoQuant data shows that ETH supply on exchanges has dropped to an all-time low of 16.6 million ETH. The trend of withdrawing ETH from exchanges has accelerated over the past month, despite ETH’s price decline.

“With ETH exchange reserves hitting record lows… I believe Ethereum will lead the next market leg up,” investor Momin predicted.

Although many analyses suggest further downside, the ongoing accumulation, reflected in falling exchange supply, could soon amplify scarcity as selling pressure weakens. This could trigger a sudden recovery in ETH.

2. Solana (SOL)

Similar to ETH, SOL shows a clear imbalance in its liquidation map. Traders have been actively shorting SOL in early December.

If SOL rebounds to $145 this week, cumulative short liquidations could surpass $1 billion.

Is there a basis for SOL to recover this week? On-chain indicators are reflecting positive signals. Nansen reported that Solana continued to lead in transaction count during the week.

On prediction markets, many investors still expect a price range of $150–$200 in December. Additionally, US-based SOL ETFs have experienced five consecutive weeks of inflows.

Recently, BitMEX co-founder Arthur Hayes also stated that only Ethereum and Solana have the institutional use cases necessary for long-term survival.

3. XRP

XRP’s 7-day liquidation map indicates that short activity is dominant. If XRP rebounds above $2.30 this week, cumulative short liquidations could exceed $500 million.

Short sellers should consider several factors.

- Ripple has received a series of positive developments. At the end of November, Ripple announced that RLUSD had been added to the green list by Abu Dhabi’s FSRA. Additionally, the Monetary Authority of Singapore (MAS) approved an expansion of the Major Payment Institution (MPI) license for Ripple Markets APAC.

- Moreover, similar to SOL, the XRP ETFs recorded $643 million in net inflows during their first month, indicating strong demand for XRP despite its stagnant price.

With these drivers, many analysts predict that XRP could reach $2.6 this month. Such a move would severely impact short sellers.

Rising Stablecoin Supply Signals a Possible Market Rebound

Another factor worth considering is the renewed expansion in stablecoin supply.

Coinglass data shows that the combined market cap of USDT, USDC, DAI, and FDUSD reached a new high of $267.5 billion at the start of December.

The rising stablecoin supply suggests that market liquidity may increase this month. Analyst Ted noted that this uptrend ends a four-week decline in stablecoin market cap.

“Stablecoin MCap is going up again. It went down for 4 consecutive weeks, which also explains the reason behind the dump. If this goes up from here, fresh liquidity will enter the crypto market, which is good for BTC and alts,” Ted said.

The three major altcoins mentioned above account for a combined $5.5 billion in potential liquidation volume if the market rebounds unexpectedly.

If a genuine recovery occurs, a new record for liquidation may be set. Investors may need to consider all these factors to minimize risks to their positions.

The post 3 Altcoins That Could Trigger a Liquidation Record in the First Week of December appeared first on BeInCrypto.

[Dubai, UAE – Dec. 1, 2025] The fifth edition of Cosmoverse, the flagship conference for the sovereign Cosmos blockchain ecosystem and interoperable finance, concluded last month in Split, Croatia. Held from October 30 to November 1, 2025, the event brought together a global audience of builders, institutional leaders, regulators, investors, and developers, reflecting a growing convergence between sovereign blockchain systems and traditional finance.

This year’s edition marked a strategic inflection point for Web3. Over three days, more than 60 sessions explored the technical, regulatory, and societal evolution of Web3 across curated tracks such as AI, Bitcoin, Tokenization, Policy, EVM, and Stablecoins. From Cosmos-native chains to multinational fintech platforms, the conference offered a comprehensive view into the decentralized future of finance and infrastructure.

Headline sessions included “Digital Euro in the Age of On-Chain Finance”, with representatives from the European Central Bank, Croatian National Bank, Cosmos Labs, and Bloomberg Adria. This session marked a first for multiple European central banks participating in a Web3 conference, engaging in open dialogue on the future of monetary systems. Jürgen Schaaf (European Central Bank) and Linardo Martinečević (Croatian National Bank) provided key insights into the Digital Euro, covering its institutional design, strategic objectives, and rollout roadmap, with implementation currently projected for 2029.

Followed by a fireside conversation with Revolut; and an AI mobility panel featuring Bosch, highlighting the rise of autonomous systems and decentralized infrastructure. Throughout the program, sessions showcased how traditional enterprises and frontier technologies are converging through sovereign blockchain frameworks.

Global voices from Visa, Bybit, Electrocoin, InterCapital, Boston Consulting Group (BCG), Informal Systems and the Forbes Technology Council joined on-stage sessions exploring how on-chain infrastructure can support public-private innovation. Visa’s Onur Özdemir revealed a pilot for a stablecoin liquidity and funding model with global banks. Meanwhile, Cosmos Labs led four keynotes outlining the Cosmos vision, the Cosmos Stack, the Cosmos EVM, and the Cosmos Hub (ATOM), presenting the roadmap and expanding role in institutional finance.

During his opening keynote, Maghnus Mareneck, Co-CEO of Cosmos Labs, announced a strategic push to expand adoption of the Cosmos Stack across governments and international banking systems. He confirmed that Cosmos Labs is actively developing two central bank digital currencies (CBDCs) in Latin America.

Additional initiatives include collaborations with Fortune 500 companies preparing to launch Cosmos-powered chains across sectors including banking, gaming with billion-dollar IPs, government-grade CBDCs, and asset management, with more details to be revealed beginning Q1 2026.

Cosmos Labs also confirmed that the Cosmos Hub (ATOM) will play a central role in this emerging vision, acting as foundational infrastructure for new institutional and enterprise deployments. The team outlined new services being explored for customers adopting the Cosmos Stack, including asset issuance, RPC and infrastructure services, and neutral interoperability services, among others.

Cosmoverse 2025 also hosted the Hackmos x DoraHacks hackathon, featuring 100 emerging builders from across Europe and beyond, and the CosmosVentures Pitching Competition, giving exposure to high-potential startups building within the ecosystem. VALT, founded by Zac Wickstrom, was named the winner of the Cosmoverse 2025 Pitching Competition. VALT’s mission is enabling users to access, secure, and monetize their personal data.

And as part of a tailored experience for decision-makers, the Cosmoverse Executive Lounge hosted curated activations that brought together industry leaders, enabling meaningful conversations and deal-making throughout the event.

At the closing ceremony, the Cosmoverse team officially unveiled its next destination: Cosmoverse 2026 will take place in Hong Kong, marking the conference’s expansion into Asia and reinforcing its role as the leading global platform for sovereign blockchain innovation and interoperable finance.

For a complete overview of the conference, including session highlights, key announcements, and insights, see the Cosmoverse 2025 Event Report.

About Cosmoverse

Cosmoverse is the Flagship Cosmos Conference and the World’s Leading Summit for Purpose-Built Blockchain Infrastructure. It connects builders, founders, investors, and institutions around shared values of sovereignty, modularity, and interoperability – empowering the development of a user-owned internet.

Website: cosmoverse.orgContact:contact@cosmoverse.org

The post Cosmoverse 2025 Set a New Standard for Web3 Conferences as Sovereign Chains, Central Banks & Cosmos Converged in Split appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

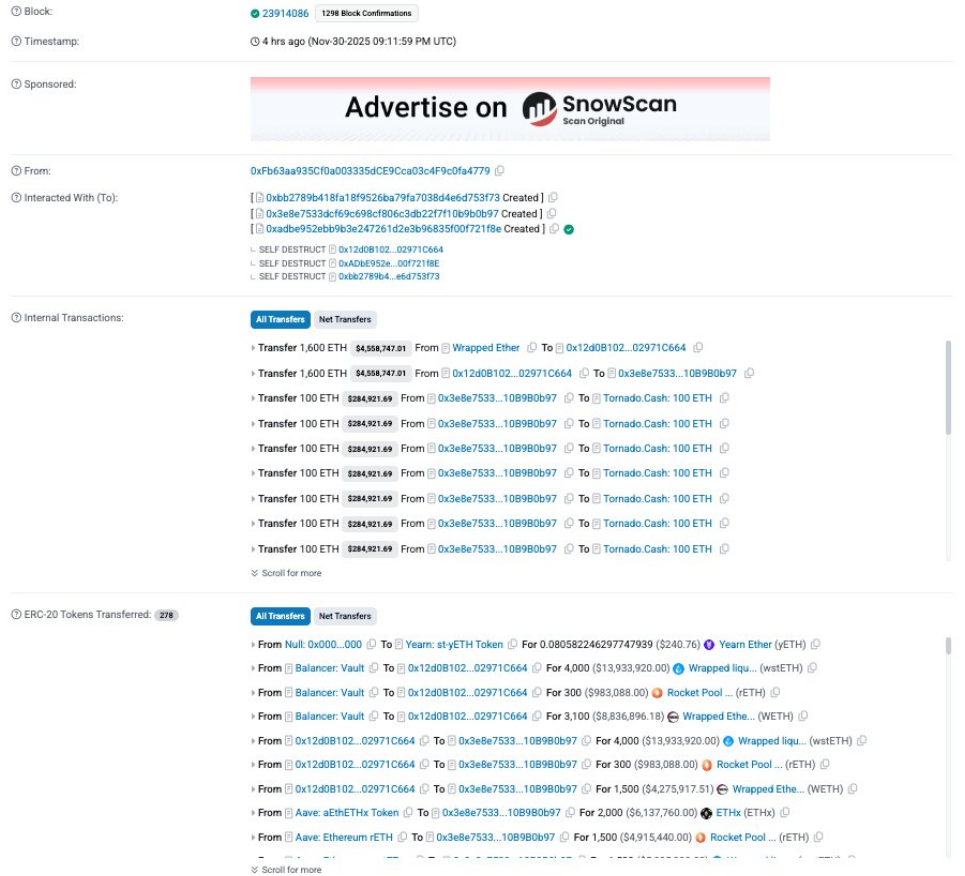

Yearn Finance reported that a legacy yETH product was hit by an exploit that allowed an attacker to mint a massive amount of fake tokens and swap them for real assets.

According to on-chain alerts and protocol statements, the attacker created a near-infinite supply of yETH in a single transaction, then used those tokens to pull ETH and liquid-staking derivatives from liquidity pools.

The incident was first flagged on November 30, 2025, and the total impact has been reported at roughly $9 million.

#PeckShieldAlert Yearn Finance @yearnfi suffered an attack resulting in a total loss of ~$9M.

The exploit involved minting a near-infinite number of yETH tokens, depleting the pool in a single transaction.

~1K $ETH (worth ~$3M) was sent to #TornadoCash, while the exploiter’s… pic.twitter.com/IXNygpwoWa

— PeckShieldAlert (@PeckShieldAlert) December 1, 2025

How The Exploit Worked

Based on reports, the attacker took advantage of a flaw in the yETH minting logic and produced tokens on the order of 235 trillion in one go.

Those worthless tokens were then swapped for real assets from Balancer and Curve pools tied to the product, emptying liquidity in minutes. Chain monitors and security researchers showed the mint and subsequent swaps unfolding very quickly on the blockchain.

At 21:11 UTC on Nov 30, an incident occurred involving the yETH stableswap pool that resulted in the minting of a large amount of yETH. The contract impacted is a custom version of popular stableswap code, unrelated to other Yearn products. Yearn V2/V3 vaults are not at risk.

— yearn (@yearnfi) December 1, 2025

What Assets Were Taken

Reports have disclosed that roughly $8 million was pulled from the main yETH stable-swap pool, while about $0.9 million was taken from a yETH–WETH pool.

In addition, roughly 1,000 ETH—valued at about $3 million at the time of movement—was sent to Tornado Cash in attempts to obscure the trail. The attacker converted fake yETH into a mix of ETH and liquid staking tokens before attempting to launder funds.

According to Yearn officials and follow-up coverage, the breach was limited to an older, legacy implementation of the yETH product and did not affect Yearn’s main V2 and V3 vaults.

Deposits into the affected pool were isolated while the team and outside experts began an investigation. This isolation is said to have kept the bulk of user funds in active vaults from being touched.

Market Reaction And Wider ConcernsCrypto markets saw selling pressure as the news spread, with traders weighing the risk that comes from combining liquid staking tokens with custom swap code.

Yearn Finance said it is working with outside security teams to run a post-mortem and to patch the vulnerability. Based on reports, teams named in coverage include external auditors and blockchain investigators who are tracking the stolen funds and advising on recovery options.

The protocol’s notice warned users about the affected legacy product and urged caution while the review continues.

Featured image from Unsplash, chart from TradingView

A crypto analyst has issued one of the most dramatic market calls of the year, predicting that the Bitcoin price could crash below $50,000 by 2026. However, he claims that this drop could set the stage for a historic wealth transfer. He says 2026 could become the best year for investors who stay calm and prepare for a major market reset. His reasons are closely tied to the growing economic imbalances and to key US macroeconomic indicators, which continue to tilt deeper into negative territory.

Analyst Predicts Bitcoin Price Crash And 2026 Market Reset

A crypto market analyst who goes by the name ‘NoLimit’ on X has shared a dramatic forecast, claiming that 2026 may be the “best year” ever and could see the biggest wealth-transfer event in more than a decade. He anticipates significant volatility in digital assets during this period and predicts that the price of Bitcoin could slip below $50,000, representing a more than 42% decline from its present price above $86,000.

The analyst outlined several reasons why he believes that 2026 could become the most defining year for investors. As Bitcoin’s price declines to projected lows, NoLimit predicts the broader market will undergo a deep structural reset, which could drive declines across several economic indicators and financial assets.

In his chart, the analyst referenced the widening gap between US assets and liabilities, arguing that the expanding spread is an early signal of structural weakness. That chart highlights a consistent rise in US liabilities from the roughly $30 trillion range in 2016 to above $60 trillion in 2025, while US assets climb more slowly. This gap pushes the net position further into negative territory, which the analyst indicates could trigger a broader correction in traditional markets.

During the projected market reset in 2026, NoLimit anticipates a dramatic decline in US equities, warning that the S&P 500 could lose as much as 40% of its value. He believes that the correction will hit individual companies even harder. In the most extreme cases, he expects some stocks to fall by 50% to 98%, echoing the collapse of many technology firms during the dot-com crash in 2001.

Gold Expected To Surge As Banks Collapse

NoLimit has indicated that his projected decline in Bitcoin’s price is expected to contribute to his proposed wealth-transfer event in 2026. While BTC drops below $50,000, the analyst forecasts that gold will skyrocket to $6,500, reflecting a more than 53.6% increase from its current price of around $4,233.

He also warns that several banks may collapse in 2026. He believes that the recessionary pressure building beneath the surface is far worse than most expect, pointing to sky-high debt, governments and corporations burdened by cheap loans, and the $1.2 trillion commercial real estate loans set to mature between 2025 and 2026.

NoLimit has indicated that these projected shifts in both economic indicators and investment assets will strain overextended investors and reward those who preserve liquidity and position themselves during the lowest point of the cycle.